It is really an easy task to fill out the 14653 irs form empty lines. Our editor can make it almost effortless to work with any kind of form. Below are the only four steps you'll want to consider:

Step 1: The first thing will be to hit the orange "Get Form Now" button.

Step 2: Once you've got entered the editing page 14653 irs form, you'll be able to find every one of the functions intended for your document at the top menu.

For every single area, fill in the information requested by the platform.

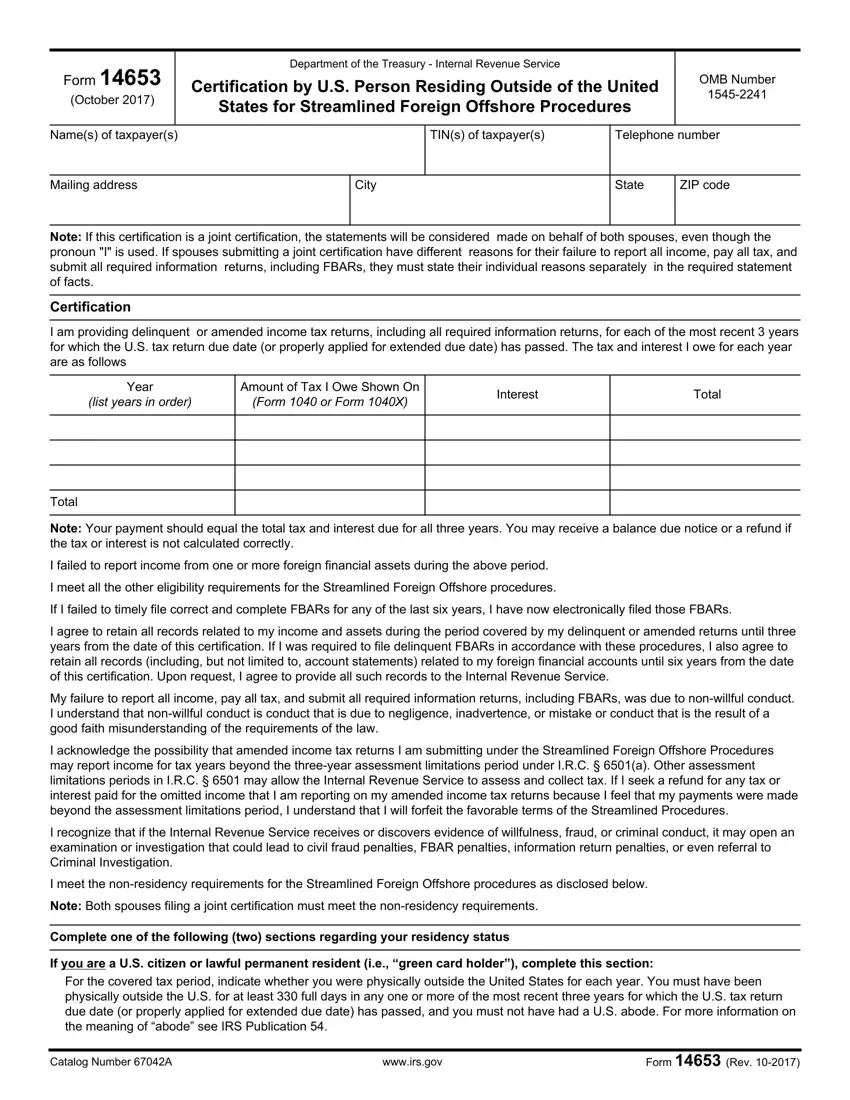

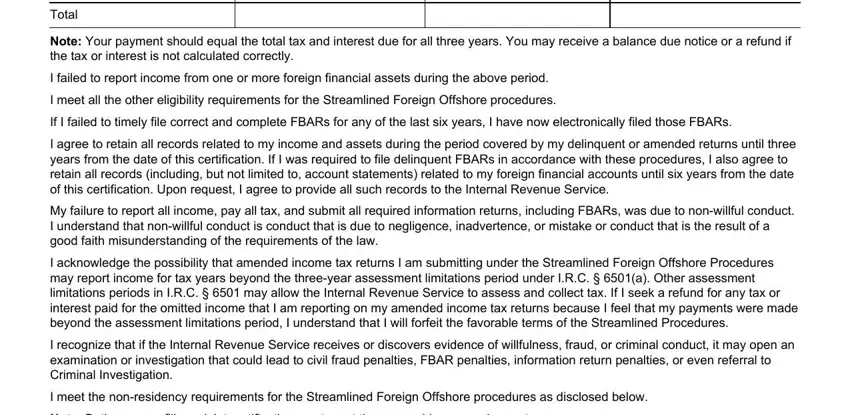

Fill in the Total, Note Your payment should equal the, I failed to report income from one, I meet all the other eligibility, If I failed to timely file correct, I agree to retain all records, My failure to report all income, I acknowledge the possibility that, I recognize that if the Internal, I meet the nonresidency, and Note Both spouses filing a joint areas with any data that will be demanded by the application.

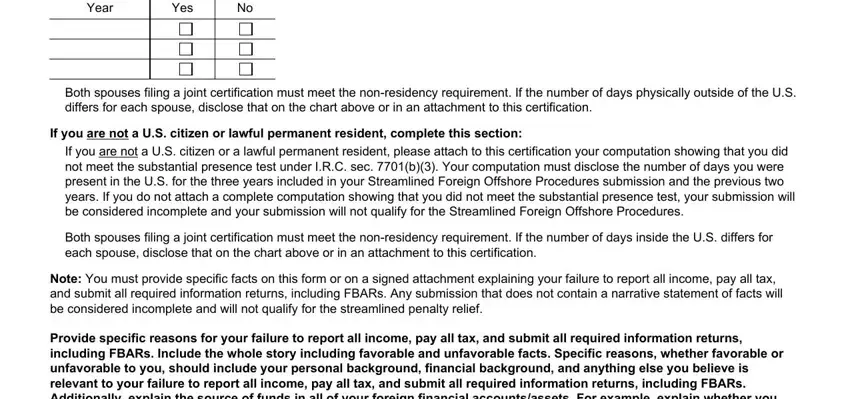

Jot down any details you may need in the section Year, Yes, Both spouses filing a joint, If you are not a US citizen or, If you are not a US citizen or a, Both spouses filing a joint, Note You must provide specific, and Provide specific reasons for your.

Identify the rights and obligations of the sides inside the space Provide specific reasons for your.

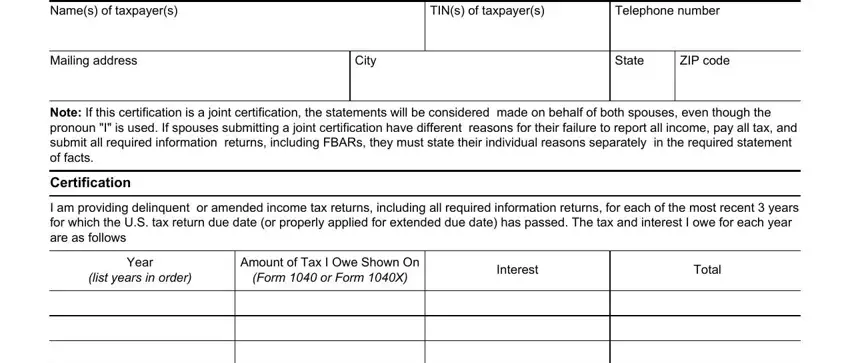

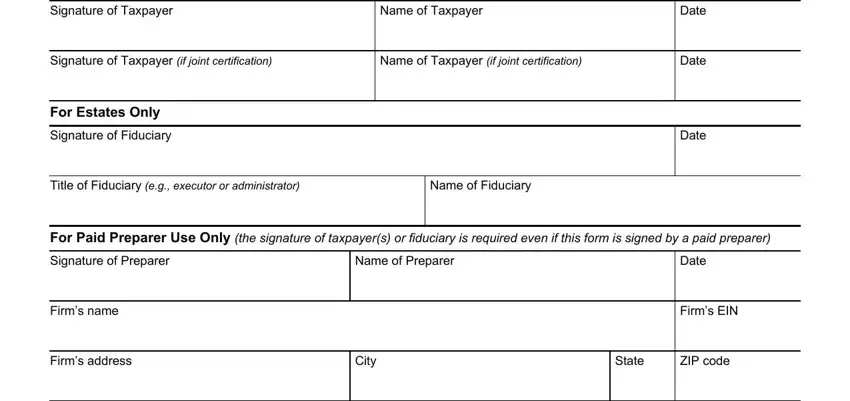

Check the sections Signature of Taxpayer, Name of Taxpayer, Signature of Taxpayer if joint, Name of Taxpayer if joint, For Estates Only, Signature of Fiduciary, Date, Date, Date, Title of Fiduciary eg executor or, Name of Fiduciary, For Paid Preparer Use Only the, Signature of Preparer, Name of Preparer, and Firms name and then fill them in.

Step 3: Select "Done". Now you may upload the PDF document.

Step 4: Make duplicates of the document - it can help you stay away from possible complications. And don't worry - we don't disclose or look at your details.