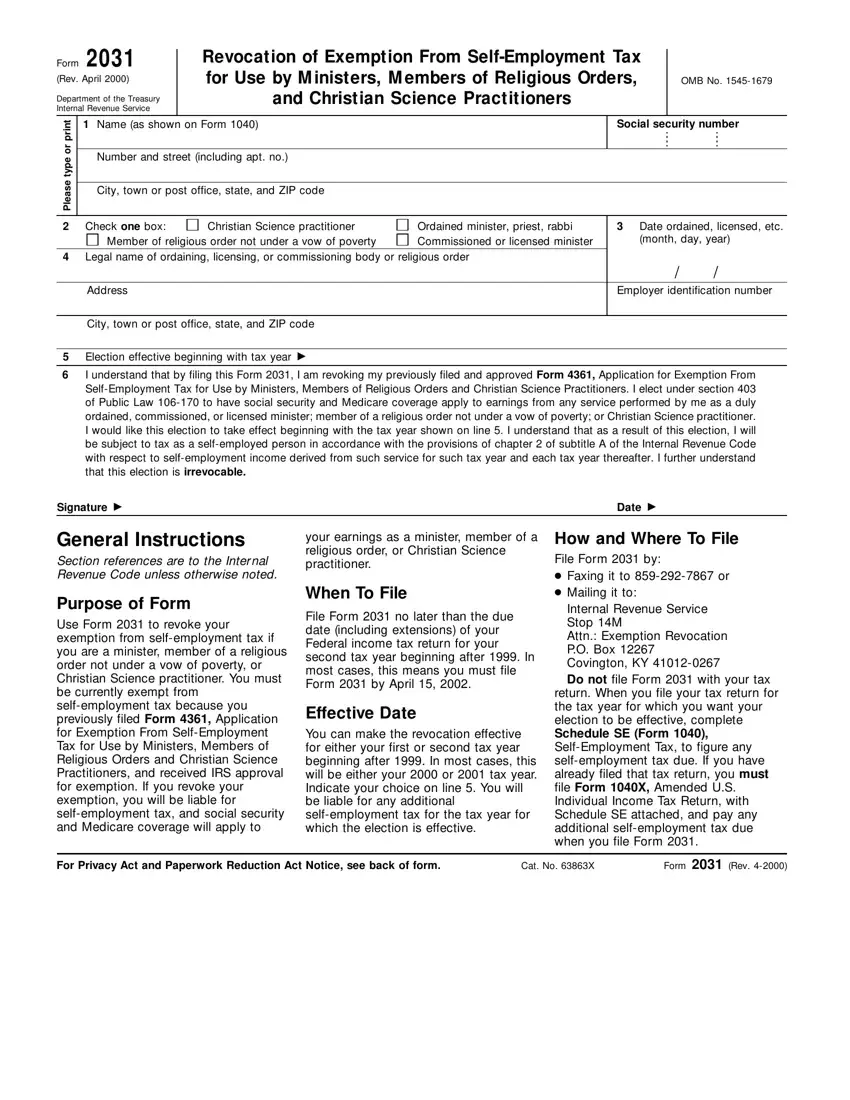

It is easy to complete forms using our PDF editor. Modifying the ordaining file is straightforward in case you follow these steps:

Step 1: On this website page, press the orange "Get form now" button.

Step 2: When you have entered the ordaining editing page you can notice all of the options you may conduct about your template at the upper menu.

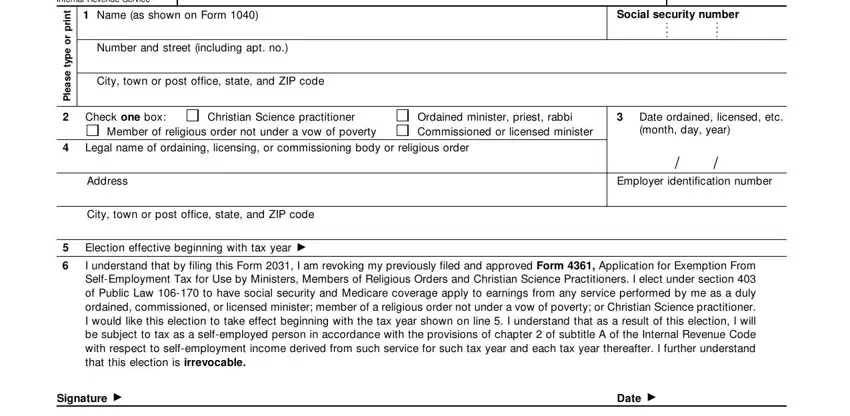

Fill out the ordaining PDF by typing in the information necessary for every single part.

Step 3: If you're done, click the "Done" button to export your PDF document.

Step 4: Ensure you avoid upcoming issues by preparing at least a couple of copies of the form.