You'll find nothing difficult about completing the form 15g in word format once you open our PDF editor. By taking these simple actions, you will definitely get the prepared PDF document within the minimum time period you can.

Step 1: Choose the orange "Get Form Now" button on the following page.

Step 2: You will find each of the options that you can take on your file once you've got entered the form 15g in word format editing page.

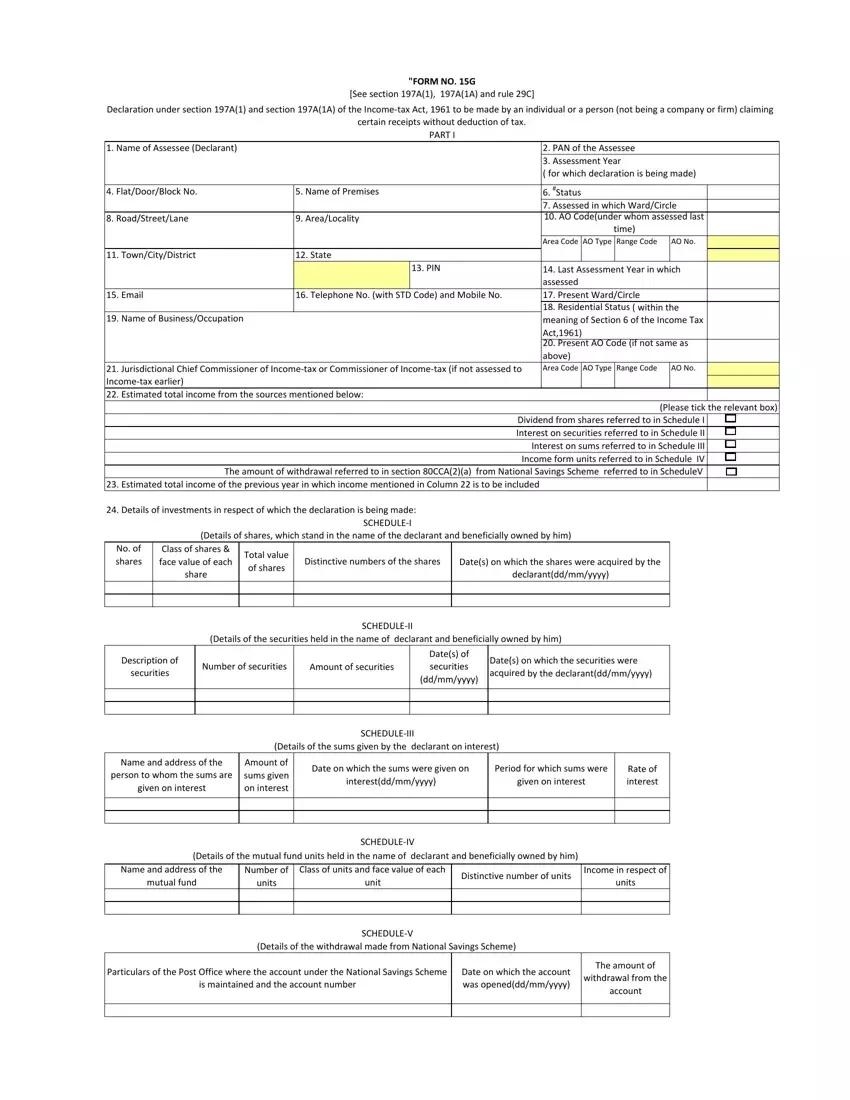

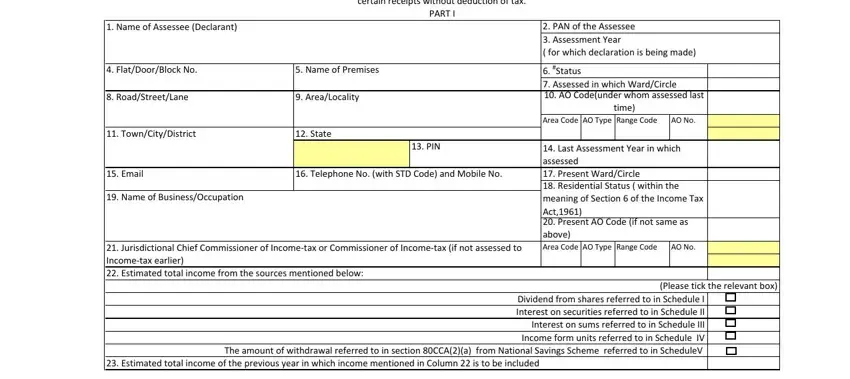

The following sections will create the PDF document that you will be filling in:

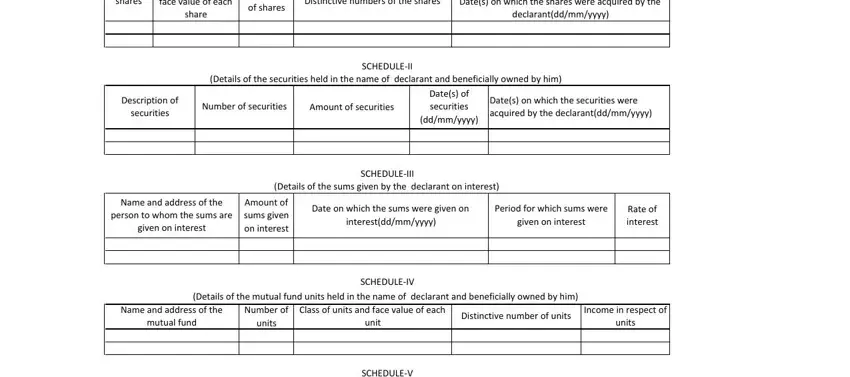

Write the requested particulars in the No of shares, Class of shares face value of, Total value of shares, Distinctive numbers of the shares, Dates on which the shares were, SCHEDULEII Details of the, Description of securities, Number of securities, Amount of securities, Dates of securities ddmmyyyy, Dates on which the securities were, SCHEDULEIII Details of the sums, Name and address of the person to, Amount of sums given on interest, and Date on which the sums were given part.

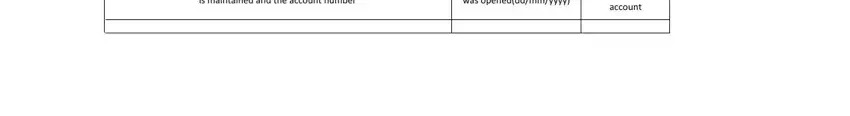

Write any data you may need in the segment Particulars of the Post Office, Date on which the account was, and The amount of withdrawal from the.

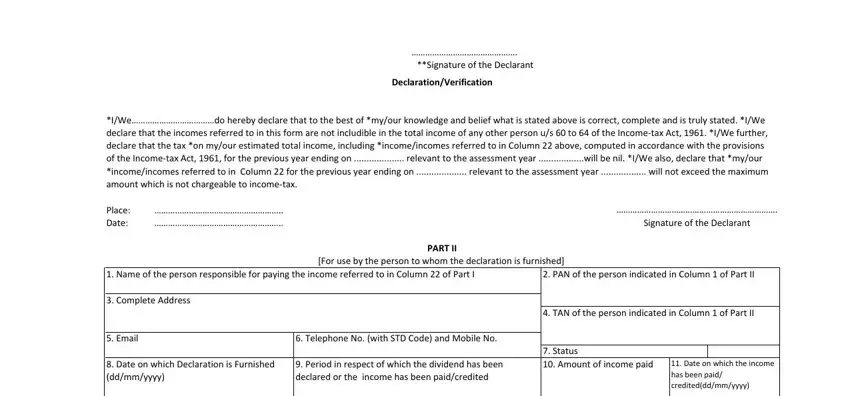

You need to spell out the rights and responsibilities of both sides in space Signature of the Declarant, DeclarationVerification, IWedo hereby declare that to the, Place Date, Signature of the Declarant, Name of the person responsible, PAN of the person indicated in, PART II For use by the person to, Complete Address, Email, Telephone No with STD Code and, Date on which Declaration is, Period in respect of which the, TAN of the person indicated in, and Status Amount of income paid.

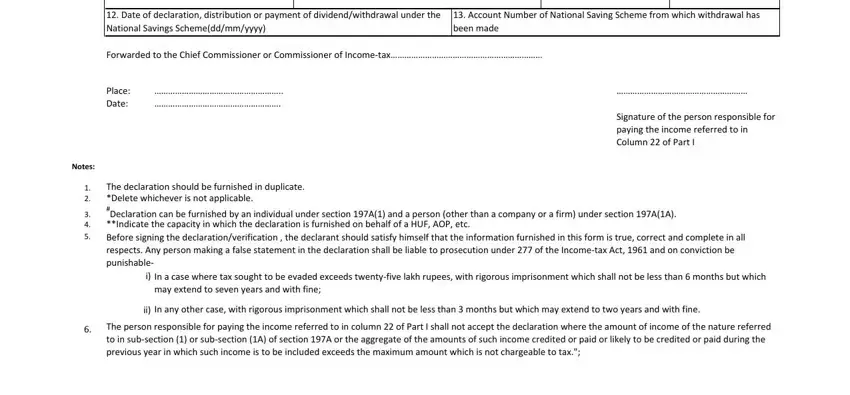

End by reviewing all of these areas and filling in the relevant particulars: Date of declaration distribution, Account Number of National Saving, Forwarded to the Chief, Place Date, Signature of the person, Notes, The declaration should be, In a case where tax sought to be, In any other case with rigorous, and The person responsible for paying.

Step 3: Choose the Done button to ensure that your finalized file is available to be transferred to every device you prefer or sent to an email you indicate.

Step 4: To prevent yourself from probable upcoming complications, take the time to possess no less than a couple of copies of each separate file.