form 15g filled sample pdf download can be filled out without difficulty. Just open FormsPal PDF editing tool to perform the job right away. The tool is continually improved by us, acquiring awesome functions and becoming better. Getting underway is simple! What you need to do is follow these basic steps directly below:

Step 1: Click on the "Get Form" button above. It's going to open up our editor so you can start completing your form.

Step 2: The editor will give you the opportunity to change your PDF in various ways. Transform it by including any text, adjust existing content, and add a signature - all manageable in minutes!

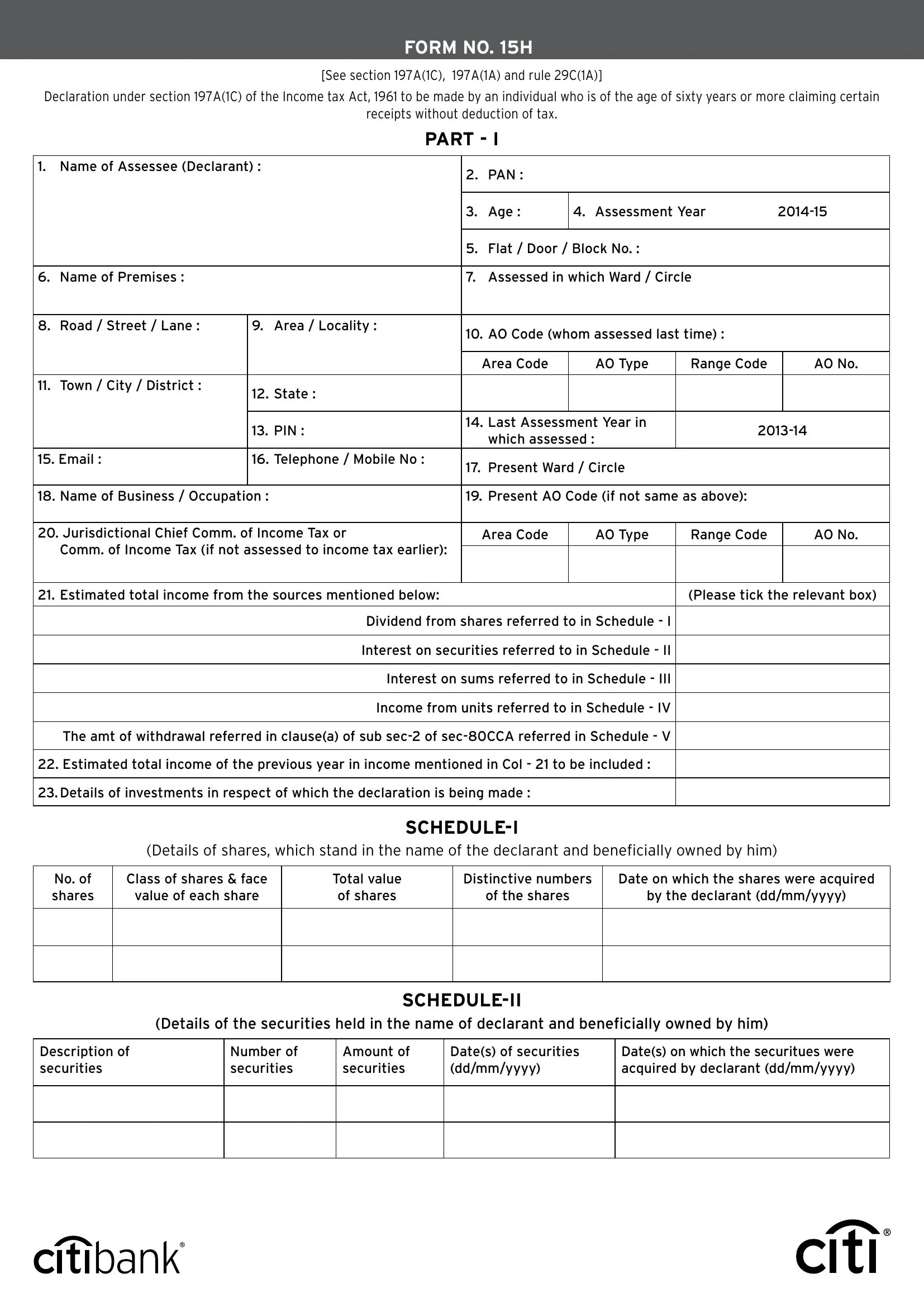

For you to fill out this document, ensure that you provide the information you need in each area:

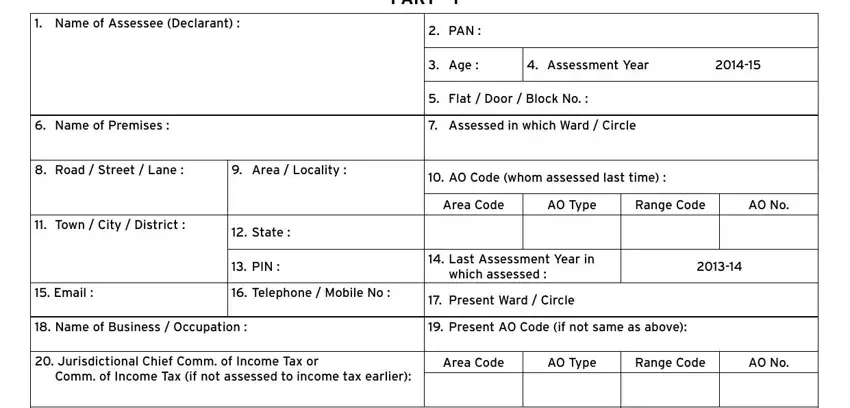

1. You need to fill out the form 15g filled sample pdf download properly, therefore be attentive while filling in the areas containing all of these blanks:

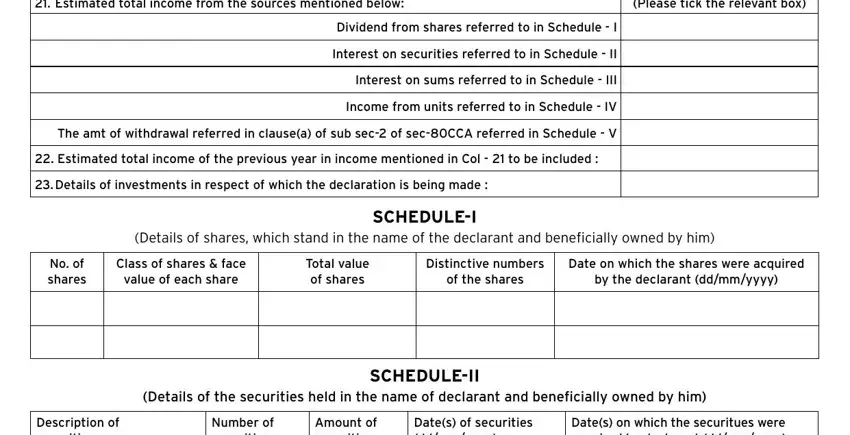

2. Right after filling in the previous step, head on to the subsequent part and fill out the necessary particulars in all these fields - Estimated total income from the, Please tick the relevant box, Dividend from shares referred to, Interest on securities referred to, Interest on sums referred to in, Income from units referred to in, The amt of withdrawal referred in, Estimated total income of the, Details of investments in respect, Details of shares which stand in, SCHEDULEI, No of shares, Class of shares face, value of each share, and Total value of shares.

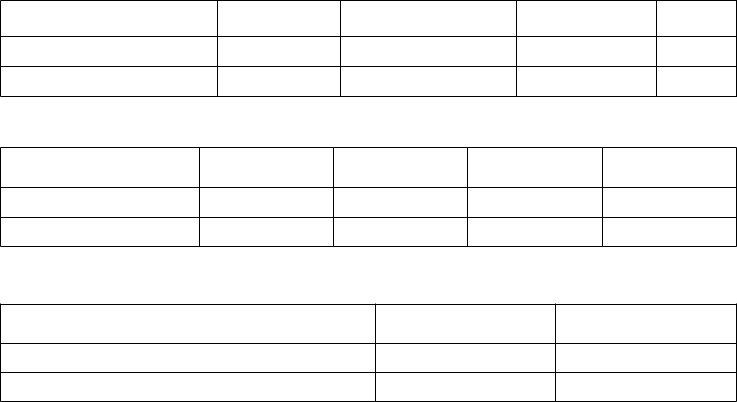

3. This 3rd part is usually relatively easy, Description of securities, Number of securities, Amount of securities, Dates of securities ddmmyyyy, and Dates on which the securitues were - these form fields is required to be filled out here.

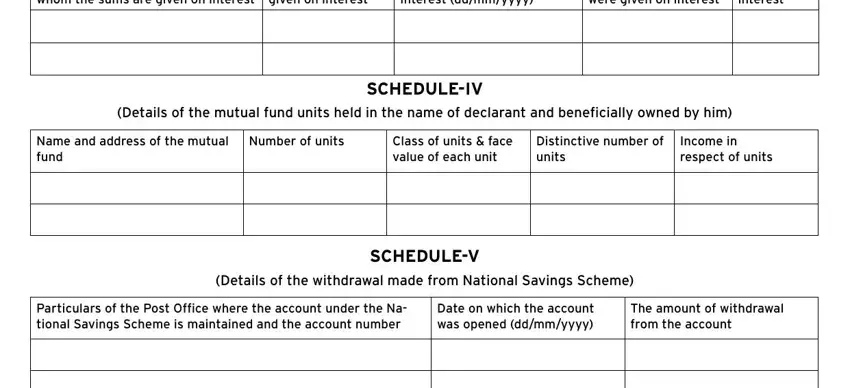

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name and address of the person to, Amount of sums given on interest, Date on which sums given on, Period for which sums were given, Rate of interest, Details of the mutual fund units, Name and address of the mutual fund, Number of units, Class of units face value of each, Distinctive number of units, Income in respect of units, SCHEDULEIV, Details of the withdrawal made, SCHEDULEV, and Particulars of the Post Office - to proceed further in your process!

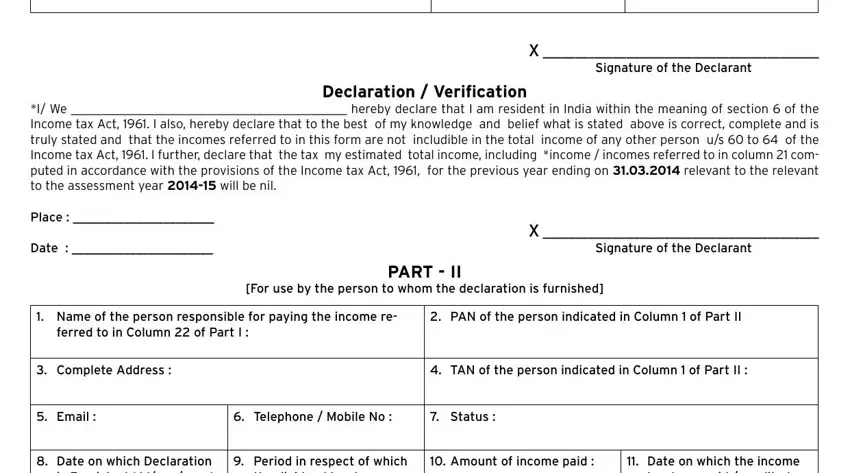

5. When you near the completion of your document, you'll find just a few more things to complete. Specifically, Signature of the Declarant, Declaration Verification, I We hereby declare that I am, Place, Date, Signature of the Declarant, For use by the person to whom the, PART II, Name of the person responsible, PAN of the person indicated in, ferred to in Column of Part I, Complete Address, TAN of the person indicated in, Email, and Telephone Mobile No should be filled in.

Always be really attentive while filling in Declaration Verification and PART II, as this is the part where many people make some mistakes.

Step 3: After going through the fields and details, hit "Done" and you're good to go! Find your form 15g filled sample pdf download when you sign up for a 7-day free trial. Quickly get access to the form from your personal account, with any edits and changes automatically kept! FormsPal guarantees secure form tools devoid of personal data record-keeping or distributing. Feel at ease knowing that your data is secure with us!