Our top rated web developers worked hard to make the PDF editor we are now extremely pleased to deliver to you. Our software makes it possible to simply prepare 2290 and saves your time. You just have to follow this procedure.

Step 1: The webpage has an orange button that says "Get Form Now". Press it.

Step 2: At this point, you are on the document editing page. You may add content, edit existing data, highlight certain words or phrases, insert crosses or checks, insert images, sign the document, erase unnecessary fields, etc.

For you to create the template, provide the content the application will ask you to for each of the following sections:

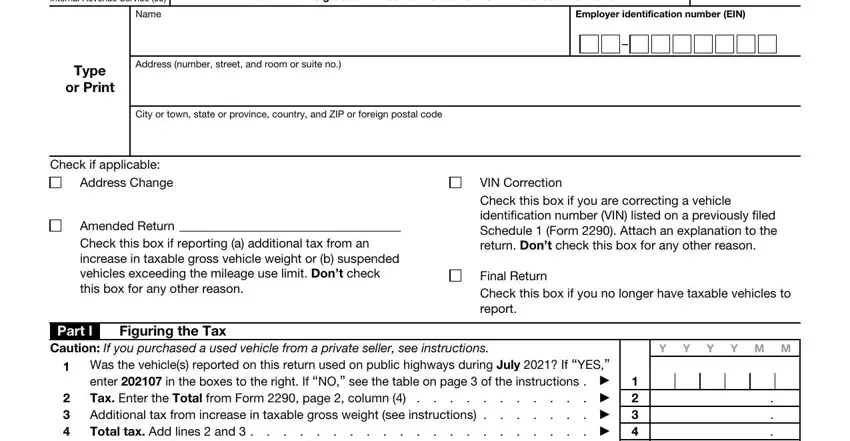

Include the essential data in the Rev July Department of the, Name, Heavy Highway Vehicle Use Tax, Employer identification number EIN, Address number street and room or, Type or Print, City or town state or province, Check if applicable, Address Change, Amended Return Check this box if, VIN Correction Check this box if, Final Return Check this box if you, Part I, Figuring the Tax, and Caution If you purchased a used area.

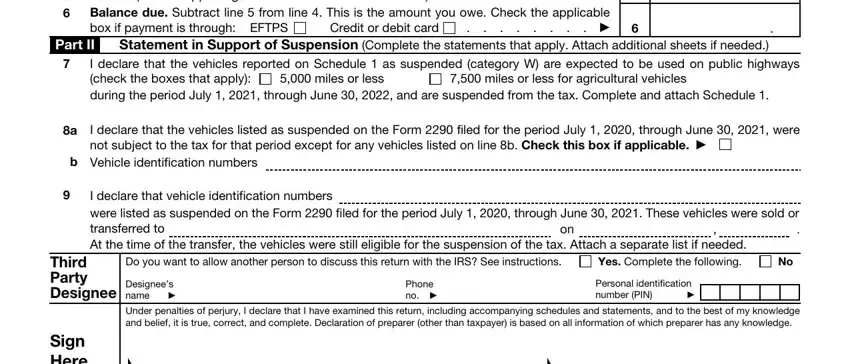

You'll be required to type in the data to help the platform fill in the segment Was the vehicles reported on this, Credit or debit card, EFTPS, Part II, Statement in Support of Suspension, miles or less for agricultural, miles or less, I declare that the vehicles listed, b Vehicle identification numbers, Third Party Designee, I declare that vehicle, Do you want to allow another, Designees name, Phone no, and Personal identification number PIN.

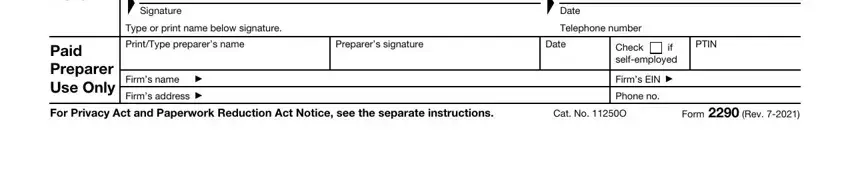

The Sign Here, Signature, Type or print name below signature, Date, Telephone number, Paid Preparer Use Only, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, PTIN, Check if selfemployed, Firms EIN, and Phone no section is where either side can put their rights and obligations.

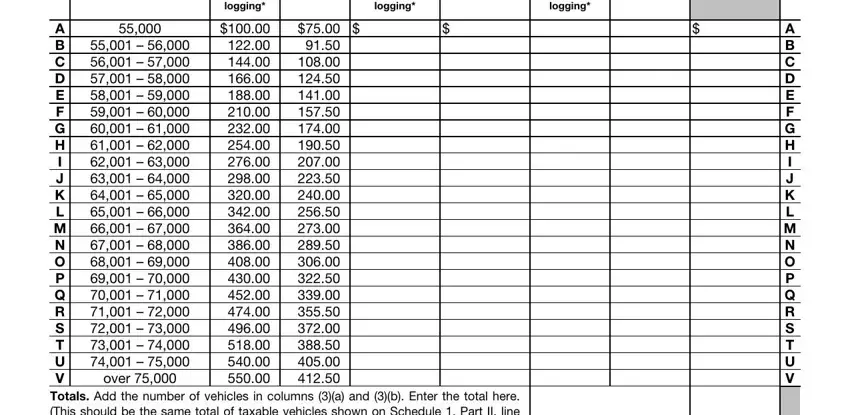

Look at the areas a Vehicles except logging, a Vehicles except logging, a Vehicles except logging, A B C D E F G, and A B C D E F G H I J K L M N O P Q and thereafter complete them.

Step 3: Hit the "Done" button. It's now possible to upload the PDF form to your gadget. As well as that, you'll be able to forward it by email.

Step 4: It will be more convenient to create duplicates of the document. You can be sure that we will not disclose or view your data.