We chose the most efficient computer programmers to design the PDF editor. This application will allow you to fill out the form 22 a file easily and won't take a great deal of your energy. This convenient instruction will allow you to learn how to start.

Step 1: The very first step will be to choose the orange "Get Form Now" button.

Step 2: So you are on the document editing page. You may modify and add text to the form, highlight words and phrases, cross or check selected words, include images, put a signature on it, get rid of unneeded areas, or take them out entirely.

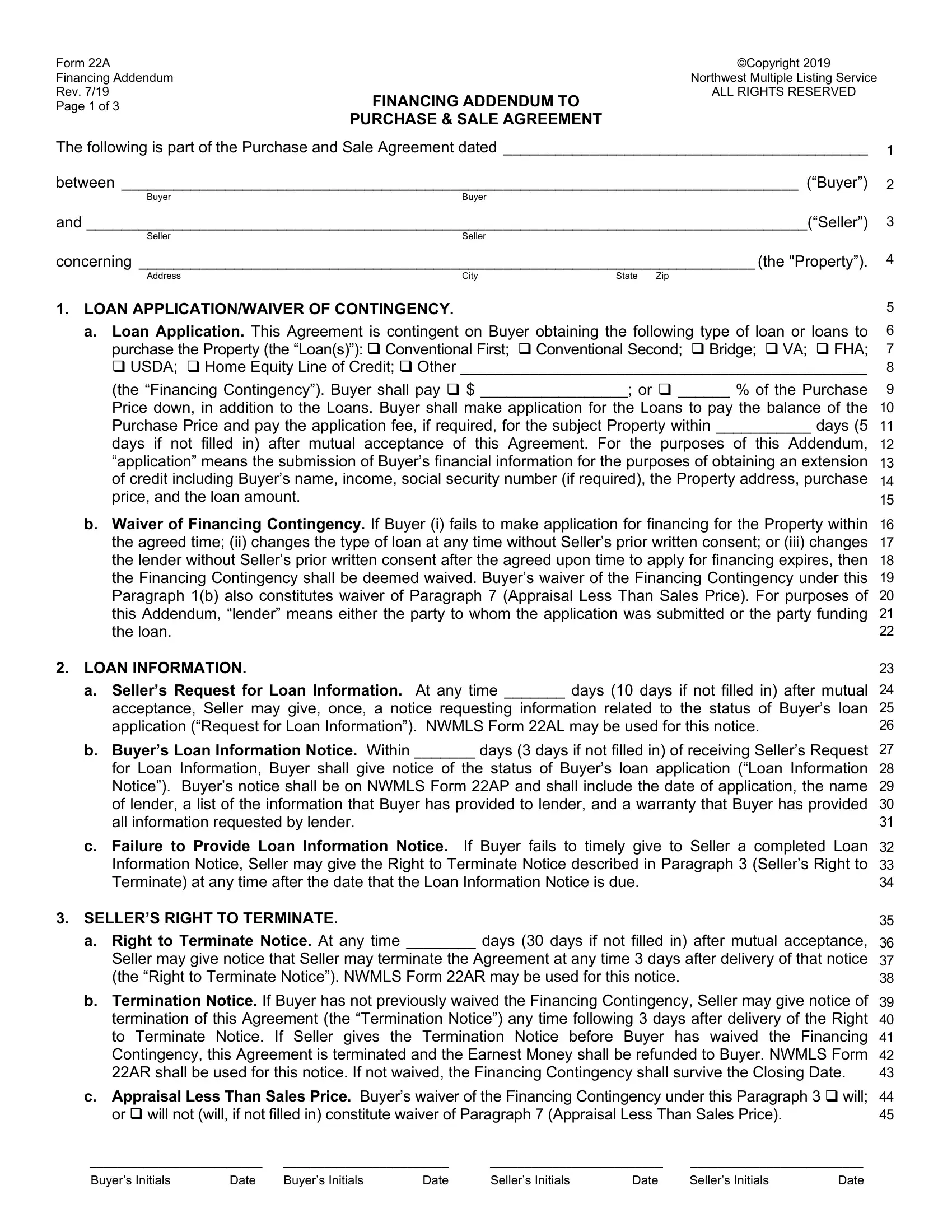

You have to provide the next details so you can create the file:

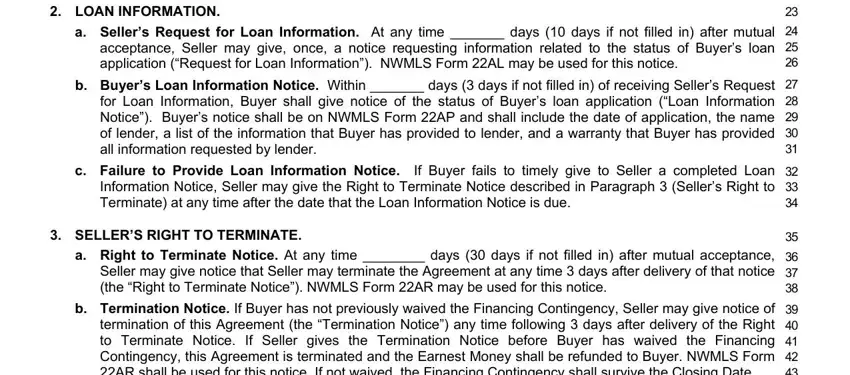

Include the essential details in the LOAN INFORMATION, a Sellers Request for Loan, b Buyers Loan Information Notice, c Failure to Provide Loan, SELLERS RIGHT TO TERMINATE, a Right to Terminate Notice At any, and b Termination Notice If Buyer has box.

Point out the most vital details about the b Termination Notice If Buyer has, c Appraisal Less Than Sales Price, or will not will if not filled in, and Buyers Initials Date Buyers field.

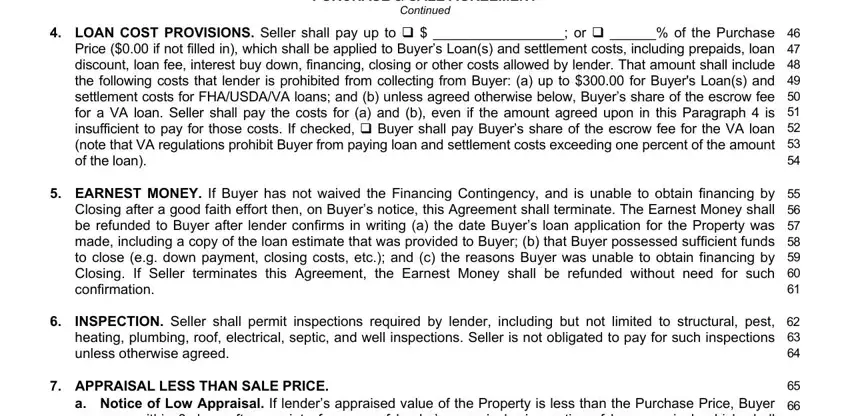

Inside the paragraph FINANCING ADDENDUM TO PURCHASE, LOAN COST PROVISIONS Seller shall, EARNEST MONEY If Buyer has not, INSPECTION Seller shall permit, APPRAISAL LESS THAN SALE PRICE, and a Notice of Low Appraisal If, record the rights and obligations of the parties.

Look at the areas ii If Seller proposes to reduce, and Buyers Initials Date Buyers and thereafter complete them.

Step 3: Choose the Done button to make sure that your completed document could be transferred to each device you select or forwarded to an email you indicate.

Step 4: Generate a minimum of a couple of copies of the file to stay away from any kind of possible complications.