Our PDF editor makes writing documents effortless. It is extremely simple to update the [FORMNAME] file. Keep to these particular steps in an attempt to do it:

Step 1: Hit the orange button "Get Form Here" on this page.

Step 2: Now you're on the file editing page. You may enhance and add information to the form, highlight words and phrases, cross or check selected words, add images, put a signature on it, delete unrequired fields, or take them out entirely.

The next parts will compose the PDF form that you will be creating:

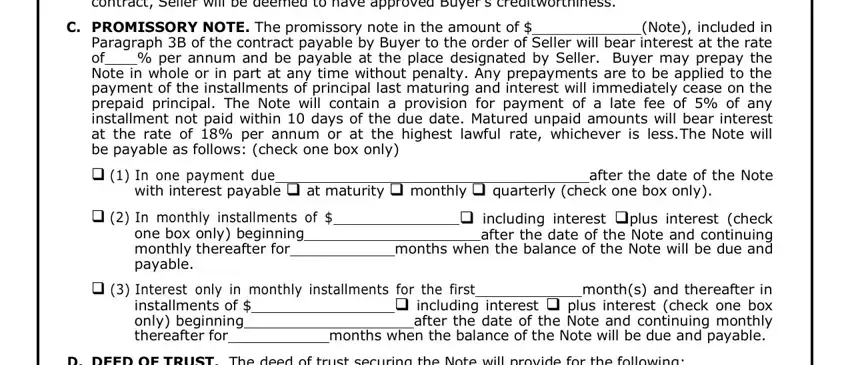

Write down the required data in the field B BUYERS CREDIT APPROVAL If the, C PROMISSORY NOTE The promissory, Note included in Paragraph B of, In one payment due, after the date of the Note, with interest payable at maturity, In monthly installments of, one box only beginning monthly, including interest plus interest, Interest only in monthly, installments of only beginning, months and thereafter in, and D DEED OF TRUST The deed of trust.

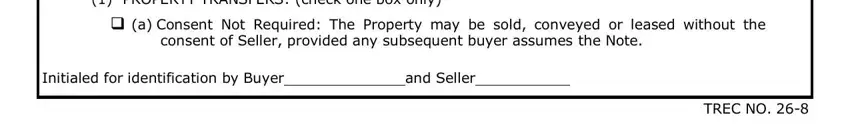

Inside the area discussing PROPERTY TRANSFERS check one box, a Consent Not Required The, consent of Seller provided any, Initialed for identification by, and Seller, and TREC NO, you are required to note down some vital details.

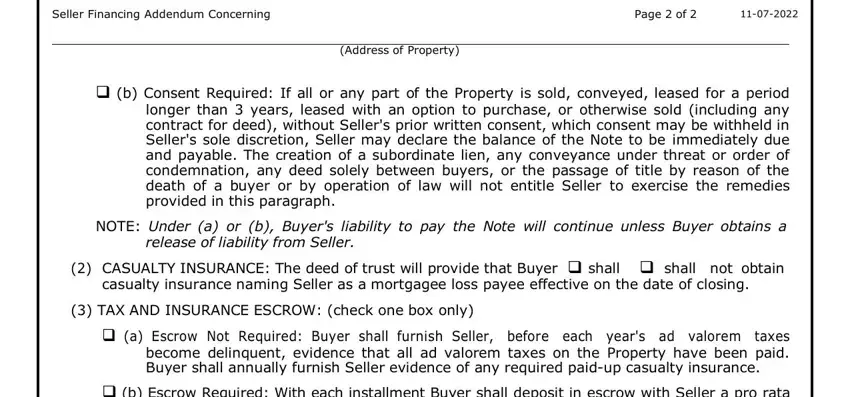

The Seller Financing Addendum, Page of, Address of Property, b Consent Required If all or any, NOTE Under a or b Buyers liability, release of liability from Seller, CASUALTY INSURANCE The deed of, TAX AND INSURANCE ESCROW check, a Escrow Not Required Buyer shall, and b Escrow Required With each section is where both sides can put their rights and obligations.

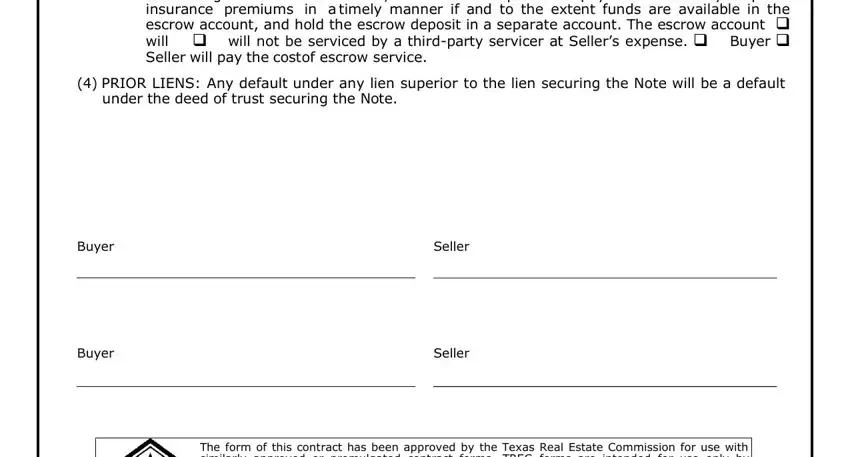

Finalize by reviewing these sections and filling them out as required: b Escrow Required With each, PRIOR LIENS Any default under any, under the deed of trust securing, Buyer, Buyer, Seller, Seller, TREC, and The form of this contract has been.

Step 3: Once you've clicked the Done button, your document should be obtainable for upload to each electronic device or email you identify.

Step 4: It's going to be simpler to create duplicates of the form. You can rest assured that we will not share or check out your information.