Using PDF forms online is easy with this PDF editor. Anyone can fill in edd form 2587 here with no trouble. FormsPal team is devoted to providing you with the absolute best experience with our tool by continuously presenting new features and enhancements. Our tool has become a lot more intuitive as the result of the newest updates! At this point, working with documents is simpler and faster than before. Here's what you will have to do to start:

Step 1: Just press the "Get Form Button" in the top section of this webpage to start up our pdf editor. There you will find everything that is necessary to work with your file.

Step 2: After you open the file editor, there'll be the document made ready to be filled out. Apart from filling out various blank fields, it's also possible to do various other things with the Document, namely writing your own words, changing the initial text, adding illustrations or photos, putting your signature on the PDF, and much more.

It really is simple to finish the form adhering to our detailed tutorial! This is what you need to do:

1. When filling out the edd form 2587, be sure to incorporate all of the necessary fields within the associated form section. This will help hasten the work, allowing your details to be handled without delay and appropriately.

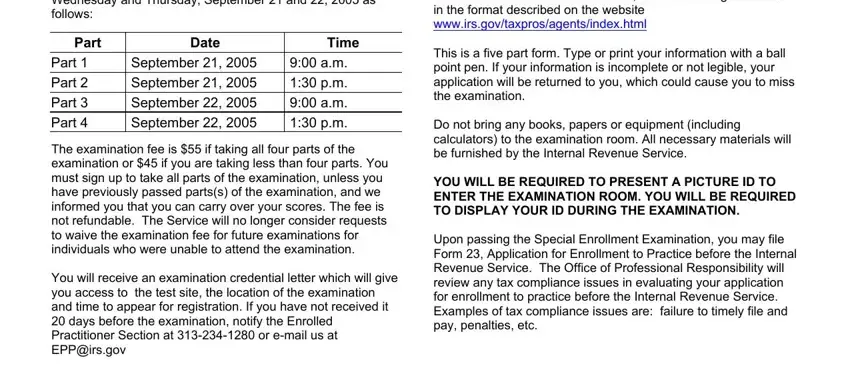

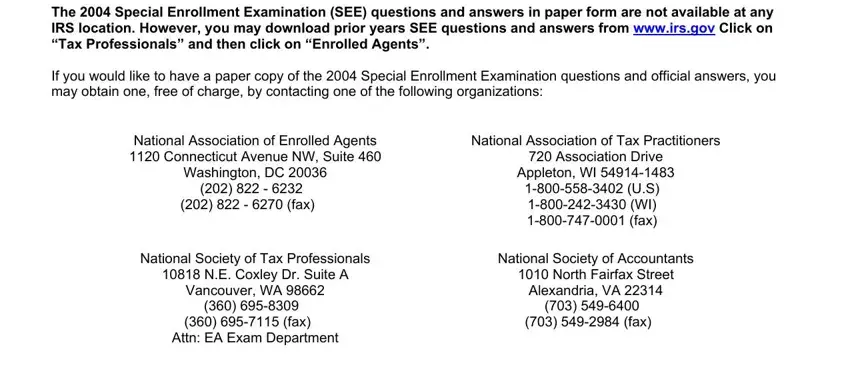

2. Once your current task is complete, take the next step – fill out all of these fields - The Special Enrollment, If you would like to have a paper, National Association of Enrolled, Washington DC, fax, National Society of Tax, NE Coxley Dr Suite A, Vancouver WA, fax, Attn EA Exam Department, National Association of Tax, Association Drive, Appleton WI, US WI fax, and National Society of Accountants with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning fax and Vancouver WA, be certain you get them right in this current part. Those two are surely the most important fields in the PDF.

3. The following part is related to The Federal Tax Products CDROM Pub, In addition to the CDRom, Form Rev Part National Office, Catalog Number Q, and Department of the Treasury - complete each one of these blanks.

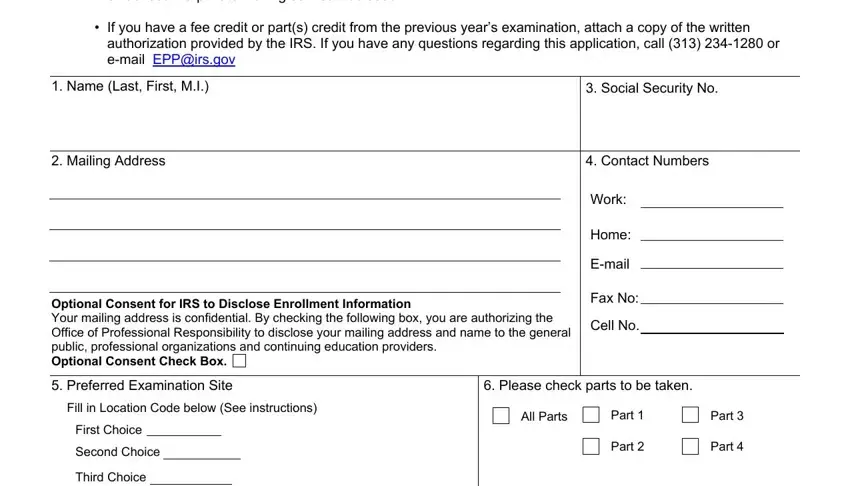

4. Filling out cid, Your application must be, If you have a fee credit or parts, Name Last First MI, Social Security No, Mailing Address, Contact Numbers, Optional Consent for IRS to, Work, Home, Email, Fax No, Cell No, Preferred Examination Site, and Please check parts to be taken is vital in this form section - make certain that you be patient and take a close look at each blank!

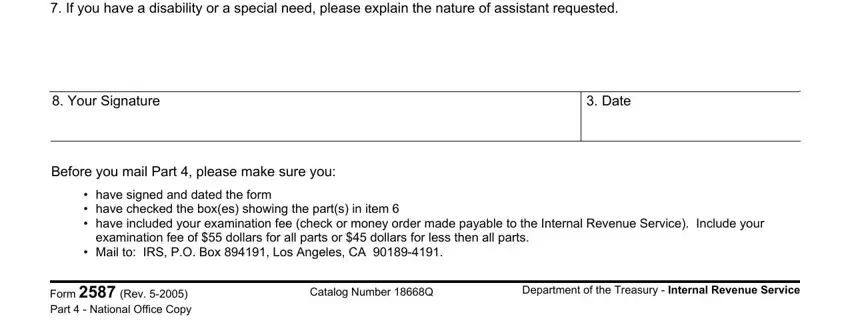

5. Because you come near to the conclusion of your file, you'll find a few more points to undertake. Notably, If you have a disability or a, Your Signature, Date, Before you mail Part please make, cid cid cid, cid, have signed and dated the form, Form Rev Part National Office, Catalog Number Q, and Department of the Treasury must be done.

Step 3: Proofread everything you have inserted in the form fields and hit the "Done" button. Make a 7-day free trial account with us and acquire direct access to edd form 2587 - with all changes kept and accessible from your personal account page. We do not share any details that you use whenever dealing with documents at our website.