Should you wish to fill out 2010, you don't have to download any sort of applications - simply give a try to our online PDF editor. We are focused on providing you the ideal experience with our tool by consistently releasing new features and enhancements. With these improvements, using our editor becomes easier than ever before! This is what you'll need to do to begin:

Step 1: Just click on the "Get Form Button" in the top section of this webpage to access our form editor. This way, you will find all that is necessary to fill out your document.

Step 2: With the help of our handy PDF file editor, you're able to do more than just fill in blank form fields. Edit away and make your forms seem sublime with custom text added in, or adjust the file's original input to excellence - all comes with an ability to incorporate stunning graphics and sign the document off.

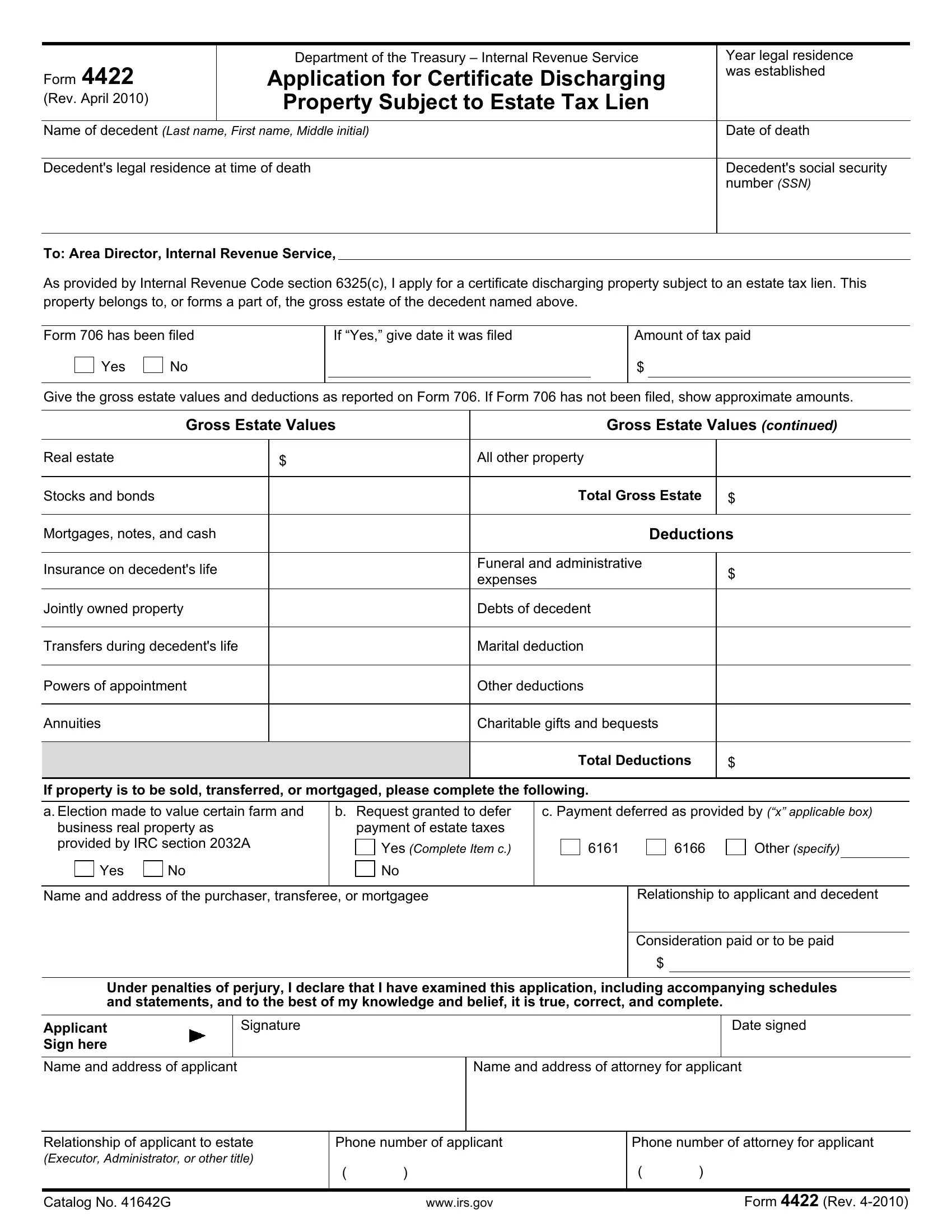

With regards to the fields of this specific PDF, this is what you need to know:

1. First, while filling in the 2010, begin with the form section that has the following blanks:

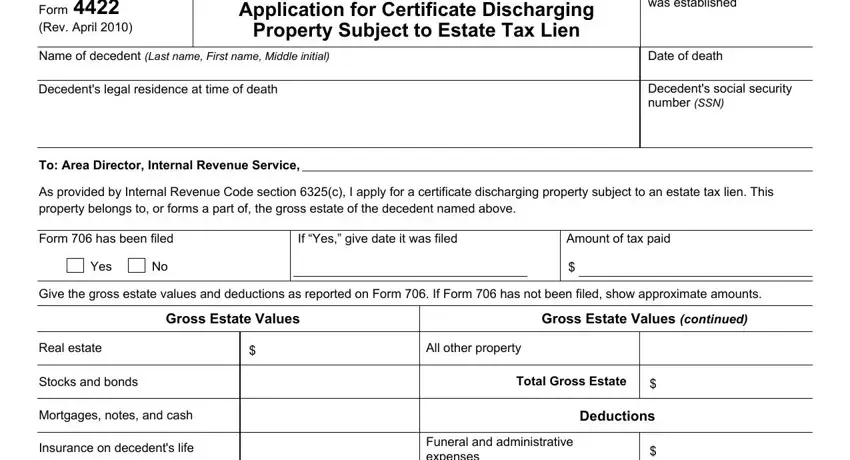

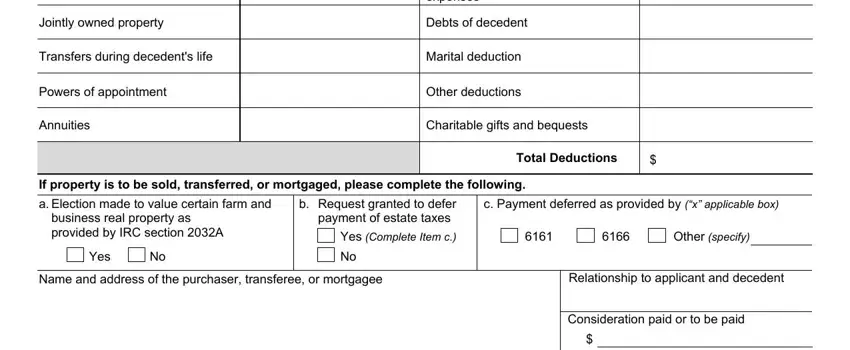

2. Once your current task is complete, take the next step – fill out all of these fields - Jointly owned property, Transfers during decedents life, Powers of appointment, Annuities, Funeral and administrative expenses, Debts of decedent, Marital deduction, Other deductions, Charitable gifts and bequests, Total Deductions, If property is to be sold, c Payment deferred as provided by, business real property as provided, Yes, and b Request granted to defer payment with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be very careful when filling in business real property as provided and Yes, since this is the part in which most users make some mistakes.

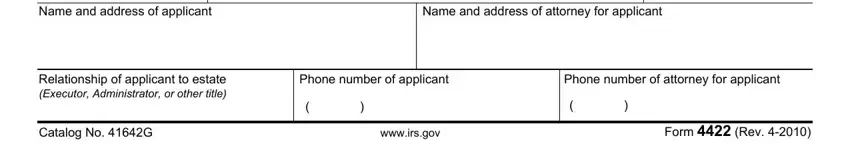

3. This stage is generally simple - fill in all of the form fields in Applicant Sign here Name and, Name and address of attorney for, Relationship of applicant to, Phone number of applicant, Phone number of attorney for, Catalog No G, wwwirsgov, and Form Rev to conclude this process.

4. The subsequent subsection will require your involvement in the subsequent places: Internal Revenue Service Attn, NOTE You can also obtain the, number, Catalog No G, wwwirsgov, and Form Rev. Make certain to enter all required information to go onward.

Step 3: Go through the information you've entered into the form fields and click the "Done" button. Sign up with us right now and easily gain access to 2010, all set for download. All adjustments made by you are preserved , meaning you can edit the pdf at a later point if necessary. When you use FormsPal, you can easily fill out documents without worrying about personal data breaches or entries being distributed. Our protected platform ensures that your personal information is stored safely.