General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 4970 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form4970.

Purpose of Form

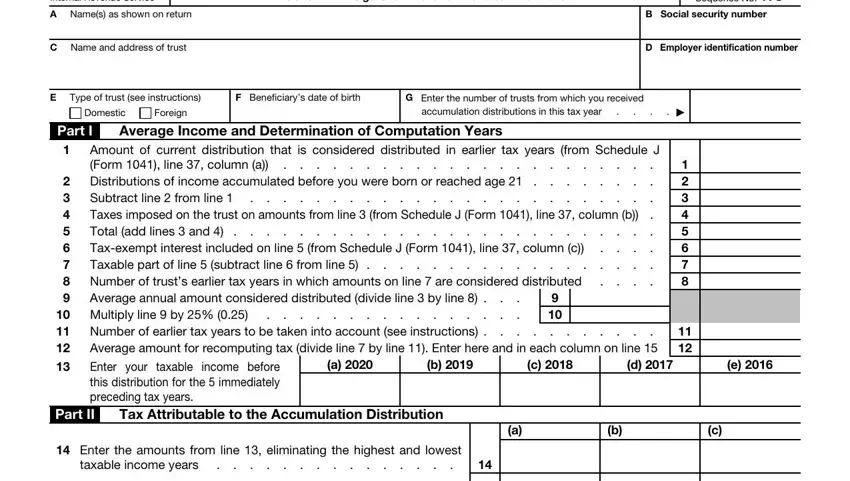

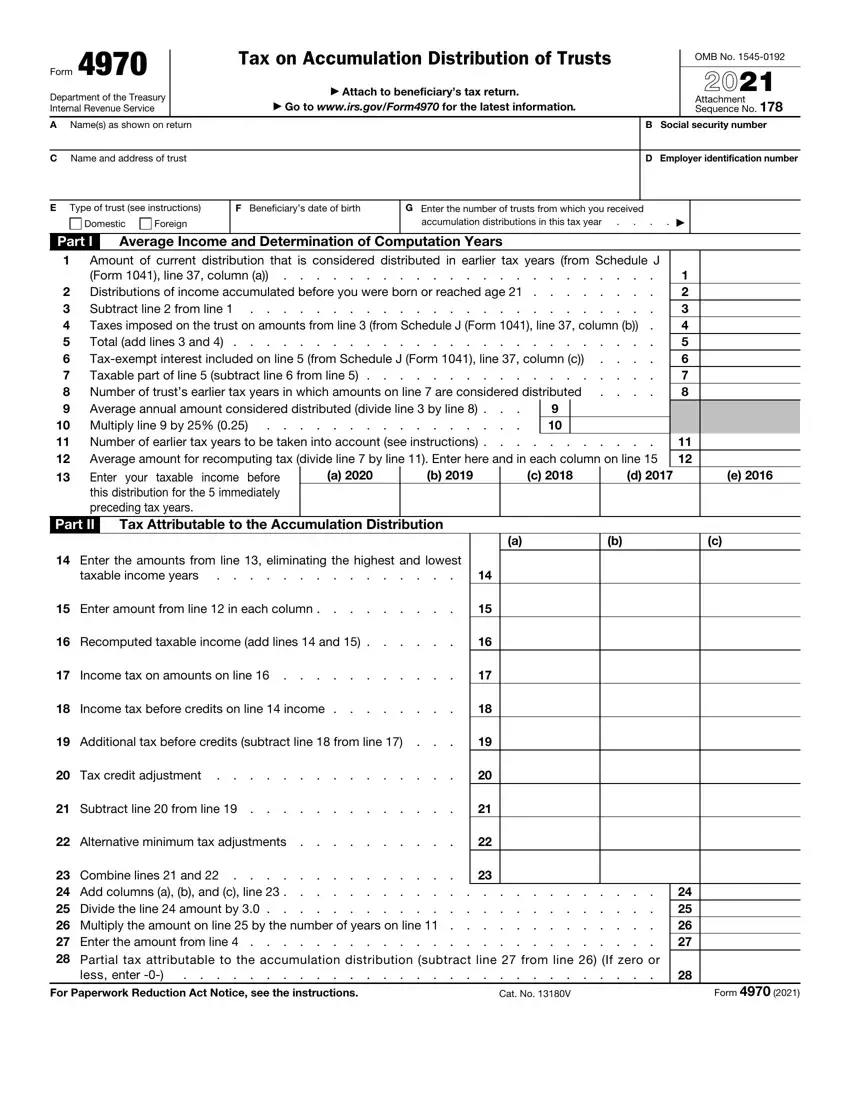

A beneficiary of certain domestic trusts (see Who Must File below) uses Form 4970 to figure the partial tax on accumulation distributions under section 667. The fiduciary notifies the beneficiary of an “accumulation distribution” by completing Part IV of Schedule J (Form 1041).

If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year (and the trust paid taxes on that income), you must complete Form 4970 to compute any additional tax liability. The trustee must give you a completed Part IV of Schedule J (Form 1041) so you can complete this form.

If you received accumulation distributions from more than one trust during the current tax year, prepare a separate Form 4970 for each trust from which you received an accumulation distribution. You can arrange the distributions in any order you want them considered to have been made.

Who Must File

Beneficiaries who received an accumulation distribution from certain domestic trusts that were created before March 1, 1984, must file Form 4970. For details, see section 665(c).

Foreign trust beneficiaries. If you received an accumulation distribution from a foreign trust, you must report the distribution and the partial tax on a 2021 Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

Don’t file Form 4970 for distributions from any foreign trusts, except to attach it as a worksheet to Form 3520 if those instructions direct you to.

Note: If the accumulation distributions are from a domestic trust that used to be a foreign trust, see Rev. Rul. 91-6, 1991-1 C.B. 89.

Definitions

Undistributed net income (UNI). UNI is the distributable net income (DNI) of the trust for any tax year less (1) the amount of income required to be distributed currently and any other amounts properly paid or credited or required to be distributed to beneficiaries in the tax year and

(2)the taxes imposed on the trust attributable to such DNI.

Accumulation distribution. An accumulation distribution is the excess of amounts properly paid, credited, or required to be distributed (other than income required to be distributed currently) over the DNI of the trust reduced by income required to be distributed currently.

Generally, except for tax-exempt interest, the distribution loses its character upon distribution to the beneficiary. See section 667(d) for special rules for foreign trusts.

Specific Instructions

Item E—Type of trust. If you received an accumulation distribution from a foreign trust, see Foreign trust beneficiaries, earlier. Don’t file this form other than as an attachment to Form 3520.

Line 1. For a nonresident alien or foreign corporation, include only the part of the accumulation distribution that is attributable to U.S. sources or is effectively connected with a trade or business carried on in the United States.

Line 2. Enter any amount from line 1 that represents UNI of a domestic trust accumulated before you were born or reached age 21. However, if the multiple trust rule applies, see the instructions for line 4.

Line 4. Multiple trust rule. If you received accumulation distributions from two or more other trusts that were considered to have been made in any of the earlier tax years in which the current accumulation distribution is considered to have been made, don’t include on line 4 the taxes attributable to the current accumulation distribution considered to have been distributed in the same earlier tax year(s).

For this special rule, only count as trusts those trusts for which the sum of this accumulation distribution and any earlier accumulation distributions from the trust, which are considered under section 666(a) to have been distributed in the same earlier tax year(s), is $1,000 or more.

Foreign trust. If the trust is a foreign trust, see section 665(d)(2).

Line 8. You can determine the number of years in which the UNI is deemed to have been distributed by counting the “throwback years” for which there are entries on lines 32 through 36 of Part IV of Schedule J (Form 1041). These throwback rules apply even if you wouldn’t have been entitled to receive a distribution in the earlier tax year if the distribution had actually been made then. There can be more than 5 “throwback years.”

Line 11. From the number of years entered on line 8, subtract any year in which the distribution from column (a), Part IV of Schedule J (Form 1041) is less than the amount on line 10 of Form 4970. If the distribution for each throwback year is more than line 10, then enter the same number on line 11 as you entered on line 8.

Line 13. Enter your taxable incomes for years 2016–2020, even if less than 5 years of the trust had accumulated income after you became 21. Use the taxable income as reported by you or as changed by the IRS. Include in the taxable income amounts considered distributed in that year as a result of prior accumulation distributions, whether from the same or another trust, and whether made in an earlier year or the current year.

If your taxable income as adjusted is less than zero, enter zero.

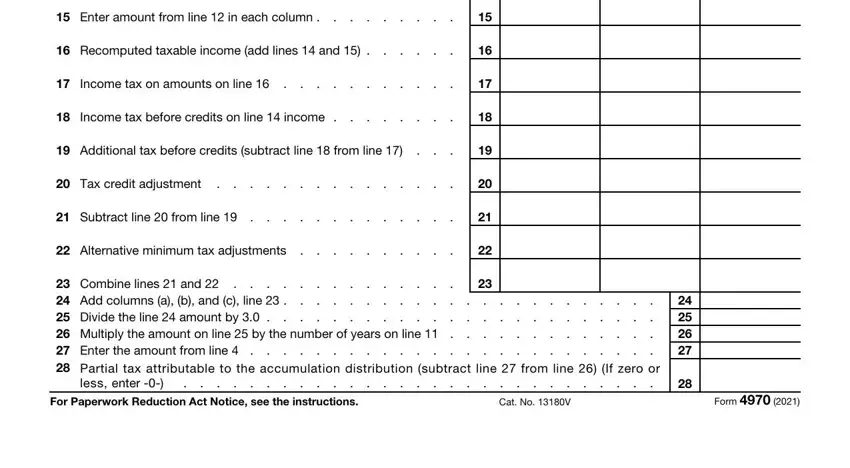

Line 17. Figure the income tax (excluding any alternative minimum tax (AMT)) on the income on line 16 using the tax rates in effect for your particular earlier tax year shown in each of the three columns. Use the Tax Rate Schedules, etc., as applicable. You can get the Tax Rate Schedules and prior year forms by downloading them at www.irs.gov.

Line 18. Enter your income tax (excluding any AMT) as originally reported, corrected, or amended, before reduction for any credits for your particular earlier year shown in each of the three columns.

Line 20. Nonrefundable credits that are limited to tax liability, such as the general business credit, may be changed because of an accumulation distribution. If the total allowable credits for any of the 3 computation years increase, enter the increase on line 20. However, don’t treat as an increase the part of the credit that was allowable as a carryback or carryforward credit in the current or any preceding year other than the computation year.

To refigure these credits, you must consider changes to the tax before credits for each of the 3 computation years due to previous accumulation distributions.

If the accumulation distribution is from a domestic trust that paid foreign income taxes, the limitation on the foreign tax credit under section 904 is applied separately to the

accumulation distribution. If the distribution is from a foreign trust, see sections 667(d) and 904(f)(4) for special rules.

Attach the proper form for any credit you refigure. The amount determined for items on this line is limited to tax law provisions in effect for those years involved.

Line 22. For each year entered in Part II, columns

(a)–(c), use and attach that year’s Form 4626, Alternative Minimum Tax—Corporations (for years prior to 2018); Form 6251, Alternative Minimum Tax—Individuals; or Schedule I (Form 1041), Alternative Minimum Tax—Estates and Trusts, to recompute the AMT for that year. Show any change in the AMT below the bottom margin of the appropriate form or schedule and enter the change on line 22.

Line 28. If estate taxes or generation-skipping transfer taxes apply to the accumulation distribution, reduce the partial tax proportionately for those taxes. See section 667(b)(6) for the computation.

Individuals. Include the amount from this line on Schedule 2 (Form 1040), line 8c. Write “ADT” on the line 8c entry space.

Trusts and decedents’ estates. Include the amount on Form 1041, Schedule G, line 8. Write “From Form 4970” and the amount of the tax to the left of the line 8 entry space.

Other filers. Add the result to the total tax liability before the refundable credits on your income tax return for the year of the accumulation distribution. Attach this form to that return.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for individual taxpayers filing this form is approved under OMB control number 1545-0074 and is included in the estimates shown in the instructions for their individual income tax return. The estimated burden for all other taxpayers who file this form is shown below.

Learning about the

law or the form . . . . . . . . 13 min. Preparing the form . . . . . . 52 min.

Copying, assembling,

and sending the form to the IRS . . 20 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.