GENERAL INSTRUCTIONS

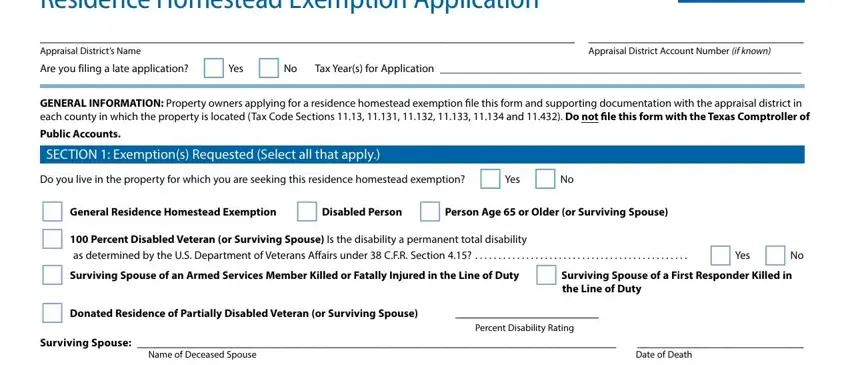

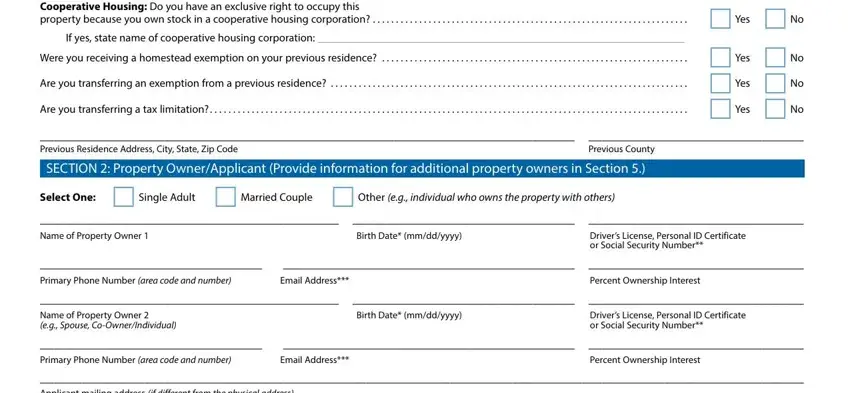

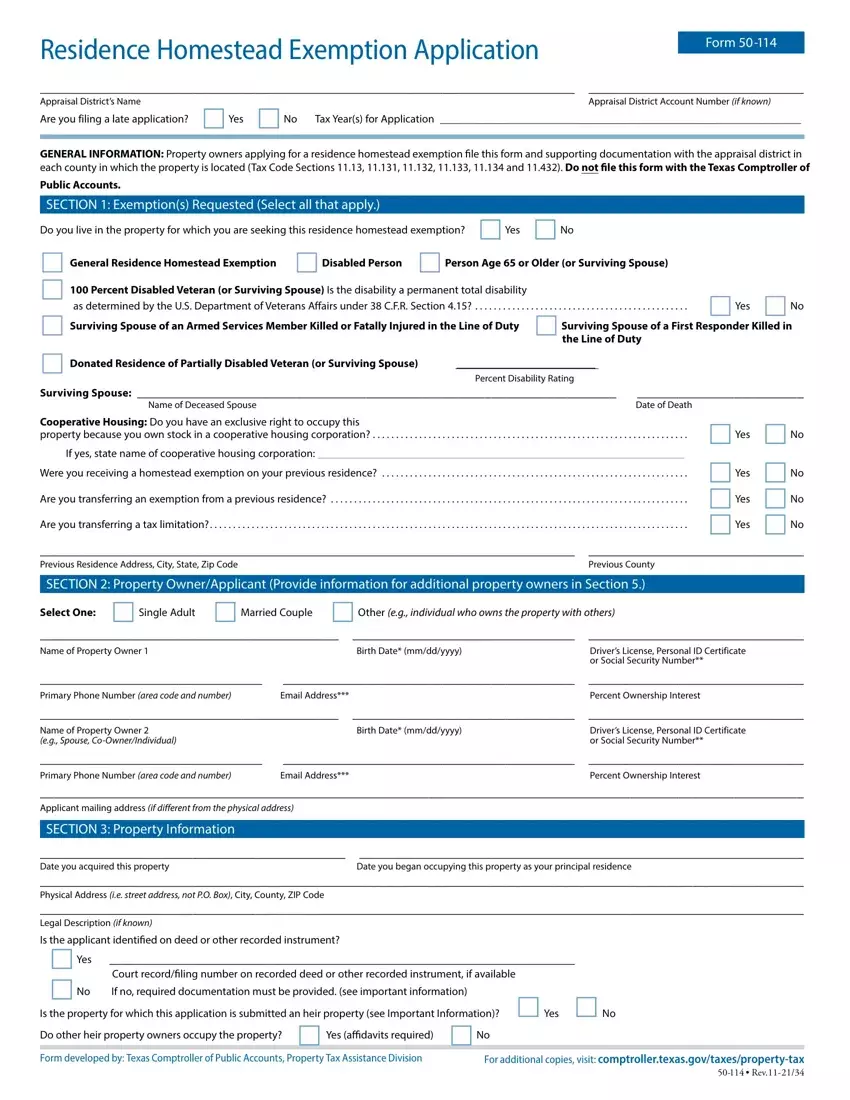

This application is for claiming residence homestead exemptions pursuant to Tax Code Sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Certain exemptions may also require Form 50-114-A. The exemptions apply only to property that you own and occupy as your principal place of residence.

FILING INSTRUCTIONS

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan. 1 and April 30 of the year for which the exemption is requested. Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices is on the Comptroller’s website.

APPLICATION DEADLINES

Generally, the completed application and required documentation is due no later than April 30 of the year for which the exemption is requested.

The due date for persons age 65 or older; disabled; or partially disabled veterans with donated homesteads to apply for the exemption is no later than the first anniversary of the qualification date.

A late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. (Tax Code Section 11.431). A late application for residence homestead exemption filed for a disabled veteran (not a surviving spouse) under Tax Code sections 11.131 or 11.132 may be filed up to 5 years after the delinquency date. Surviving spouse of a disabled veteran, who files under Tax Code sections 11.131 or 11.132, may file up to two years after the delinquency date, for a late application for residence homestead exemption.

If the chief appraiser grants the exemption(s), property owner does not need to reapply annually, but must reapply if the chief appraiser requires it, unless seeking to apply the exemption to property not listed in this application.

Property owners already receiving a general residence homestead exemption who turn age 65 in that next year are not required to apply for age 65 or older exemption if accurate birthdate information is included in the appraisal district records or in the information the Texas Department of Public Safety provided to the appraisal district under Transportation Code Section 521.049. (Tax Code Section 11.43(m))

REQUIRED DOCUMENTATION

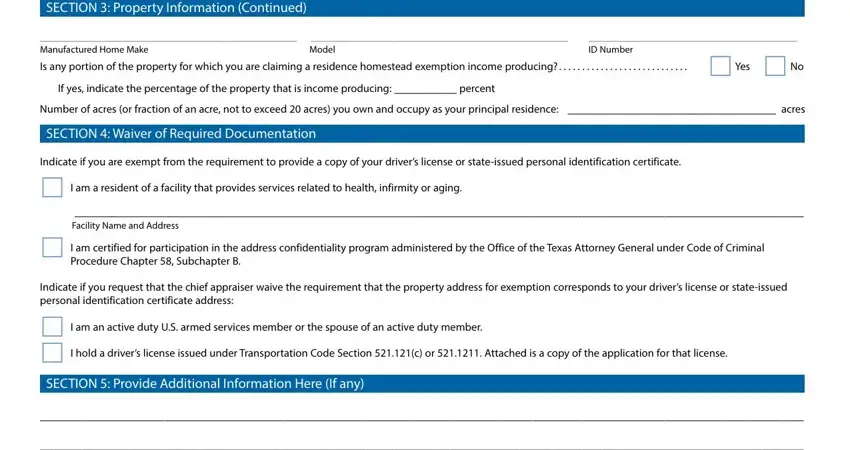

Attach a copy of property owner’s driver’s license or state-issued personal identification certificate. The address listed on the driver’s license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested. Property owners who reside in certain facilities or participate in a certain address confidentiality program may be exempt from this requirement. The chief appraiser may waive the requirements for certain active duty U.S. armed services members or their spouses or holders of certain driver’s licenses.

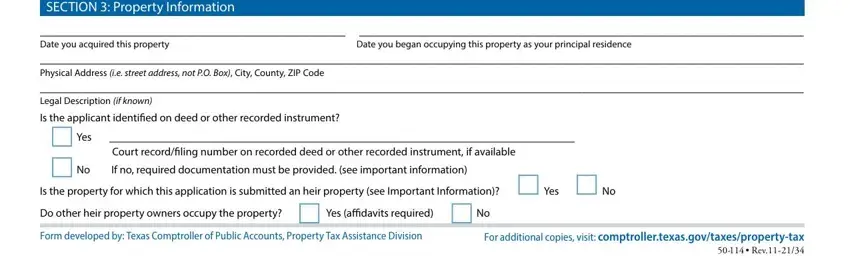

Heir property is property owned by one or more individuals, where at least one owner claims the property as a residence homestead, and the property was acquired by will, transfer on death deed, or intestacy. An heir property owner not specifically identified as the residence homestead owner on a deed or other recorded instrument in the county where the property is located must provide:

•an affidavit establishing ownership of interest in the property (See Form 114-A);

•a copy of the prior property owner’s death certificate;

•a copy of the property’s most recent utility bill; and

•A citation of any court record relating to the applicant’s ownership of the property, if available.

Each heir property owner who occupies the property as a principal residence, other than the applicant, must provide an affidavit that authorizes the submission of this application (See Form 50-114-A).

Manufactured homeowners must provide:

•a copy of the Texas Department of Housing and Community Affairs statement of ownership showing that the applicant is the owner of the manufactured home;

•a copy of the sales purchase agreement, other applicable contract or agreement or payment receipt showing that the applicant is the purchaser of the manufactured home; or

•a sworn affidavit (see Form 50-114-A) by the applicant indicating that:

1.the applicant is the owner of the manufactured home;

2.the seller of the manufactured home did not provide the applicant with the applicable contract or agreement; and

3.the applicant could not locate the seller after making a good faith effort.

ADDITIONAL INFORMATION REQUEST

The chief appraiser may request additional information to evaluate this application. Property owner must comply within 30 days of the request or the application will be denied. The chief appraiser may extend this deadline for a single period not to

exceed 15 days for good cause shown. (Tax Code Section 11.45)

DUTY TO NOTIFY

Property owner must notify the chief appraiser in writing before May 1 of the year after his or her right to this exemption ends.

EXEMPTION QUALIFICATIONS

General Residence Homestead Exemption (Tax Code Section 11.13(a) and (b))

Property was owned and occupied as owner’s principal residence on Jan. 1. No residence homestead exemption can be claimed by the property owner on any other property.

Disabled Person Exemption (Tax Code Section 11.13(c) and (d))

Persons under a disability for purposes of payment of disability insurance benefits under Federal Old-Age, Survivors, and Disability Insurance. Property owners not identified on a deed or other instrument recorded in the applicable real property records as an owner of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead. (See Form 50-114-A) An eligible disabled person age 65 or older may receive both exemptions in the same year, but not from the same taxing units. Contact the appraisal district for more information.

Age 65 or Older Exemption (Tax Code Section 11.13(c) and (d))

This exemption is effective Jan. 1 of the tax year in which the property owner becomes age 65. Property owners not identified on a deed or other instrument recorded in the applicable real property records as an owner of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead. (See Form 50-114-A) An eligible disabled person age 65 or older may receive both exemptions in the same year, but not from the same taxing units. Contact the appraisal district for more information.

Surviving Spouse of an Individual Who Qualified for Age 65 or Older Exemption (Tax Code Section 11.13(q)):

Surviving spouse of person who qualified for the age 65 or older exemption may receive this exemption if the surviving spouse was 55 years of age or older when the qualifying spouse died. The property must have been the surviving spouse’s residence homestead at the time of death and remain the surviving spouse’s residence homestead. This exemption cannot be combined with an exemption under 11.13(d).

100 Percent Disabled Veterans Exemption (Tax Code Section 11.131(b))

Property owner who has been awarded a 100 percent disability compensation due to a service-connected disability and a rating of 100 percent disabled or individual unemployability from the U.S. Department of Veterans Affairs or its successor.

Documentation must be provided to support this exemption request.

Surviving Spouse of a Disabled Veteran Who Qualified or Would Have Qualified for the 100 Percent Disabled Veteran’s Exemption (Tax Code Section 11.131(c) and (d))

Surviving spouse of a disabled veteran (who qualified for an exemption under Tax Code Section 11.131(b) at the time of his or her death or would have qualified for the exemption if the exemption had been in effect on the date the disabled veteran died) who has not remarried since the death of the veteran. The property must have been the surviving spouse’s residence homestead at the time of the veteran’s death and remain the surviving spouse’s residence homestead.

Donated Residence Homestead of Partially Disabled Veteran (Tax Code Section 11.132(b))

A disabled veteran with a disability rating of less than 100 percent with a residence homestead donated by a charitable organization at no cost or at some cost that is not more than 50 percent of the good faith estimate of the market value of the residence homestead as of the date the donation is made. Documentation must be provided to support this exemption request.

Surviving Spouse of a Disabled Veteran Who Qualified for the Donated Residence Homestead Exemption (Tax Code Section 11.132(c) and (d)):

Surviving spouse of a disabled veteran (who qualified for an exemption under Tax Code Section 11.132(b) at the time of his or her death) who has not remarried since the death of the disabled veteran and maintains the property as his or her residence homestead.

Surviving Spouse of a Member of Armed Services Killed in Line of Duty (Tax Code Section 11.133(b) and (c))

Surviving spouse of a U.S. armed services member who is killed or fatally injured in the line of duty who has not remarried since the death of the service member. Documentation must be provided to support this exemption request.

Surviving Spouse of a First Responder Killed in the Line of Duty (Tax Code Section 11.134)

Surviving spouse of a first responder who is killed or fatally injured in the line of duty who has not remarried since the death of the first responder. Documentation must be provided to support this exemption request.