texas 50 129 can be filled in online effortlessly. Just make use of FormsPal PDF editing tool to get it done in a timely fashion. Our editor is continually developing to provide the very best user experience achievable, and that is thanks to our resolve for continual improvement and listening closely to comments from customers. Here's what you'll want to do to get started:

Step 1: Just click the "Get Form Button" in the top section of this site to see our pdf form editing tool. Here you will find everything that is necessary to work with your file.

Step 2: The editor will give you the capability to change your PDF file in many different ways. Enhance it by including your own text, correct existing content, and add a signature - all when you need it!

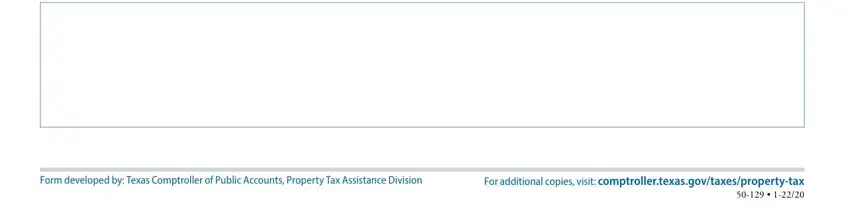

This form will require you to enter some specific details; to guarantee accuracy and reliability, be sure to take note of the recommendations directly below:

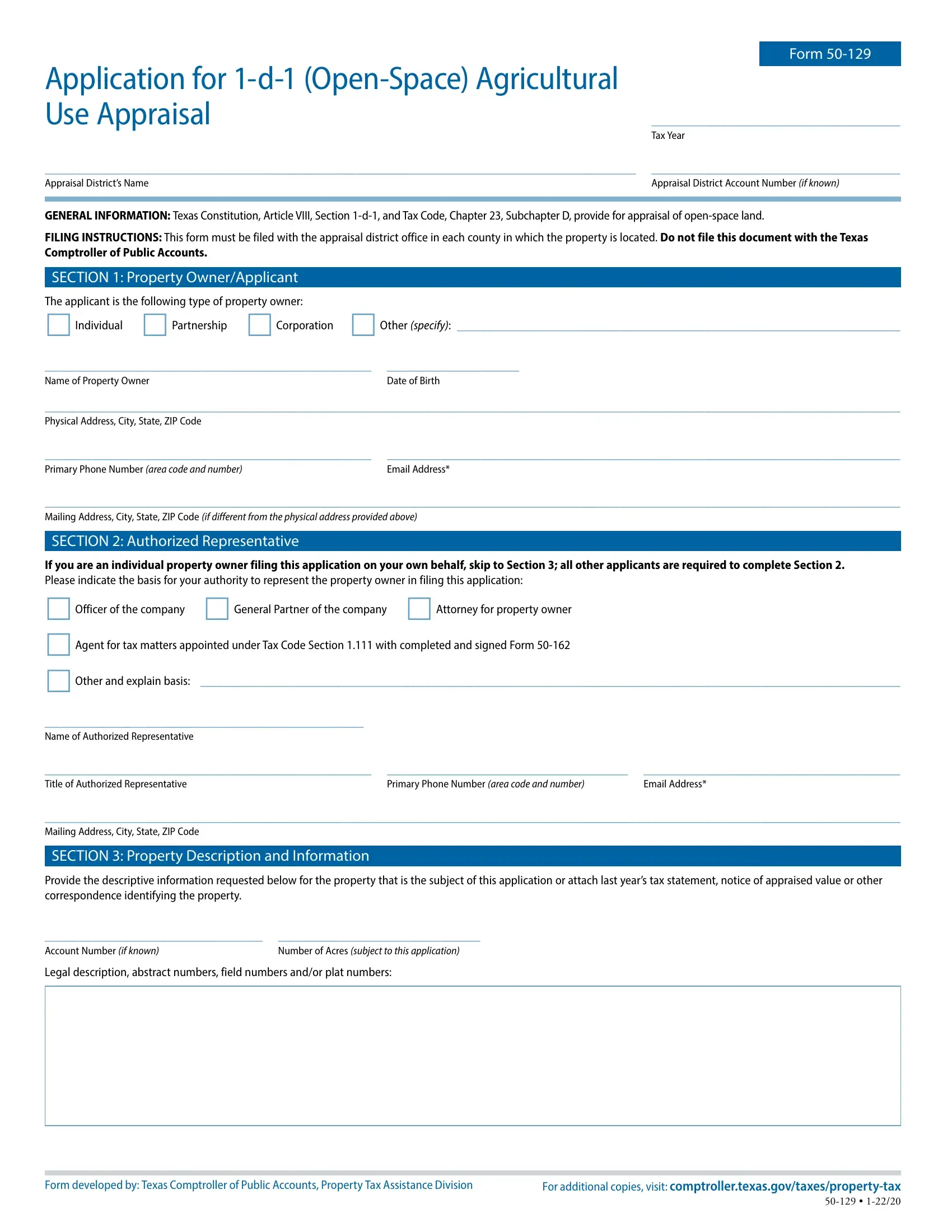

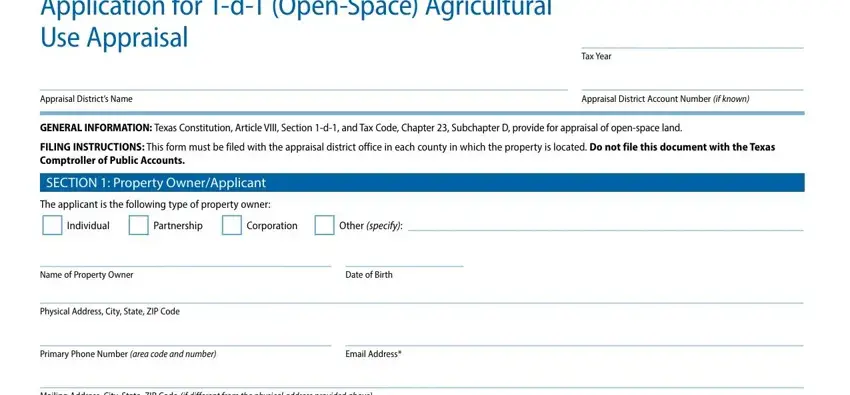

1. The texas 50 129 necessitates specific details to be inserted. Be sure the next blank fields are complete:

2. The subsequent stage is to fill in all of the following blanks: If you are an individual property, Officer of the company General, Name of Authorized Representative, Title of Authorized Representative, Primary Phone Number area code, Email Address, Mailing Address City State ZIP, SECTION Property Description and, Provide the descriptive, Account Number if known, Number of Acres subject to this, and Legal description abstract numbers.

3. The following segment is about Form developed by Texas, and For additional copies visit - complete each one of these empty form fields.

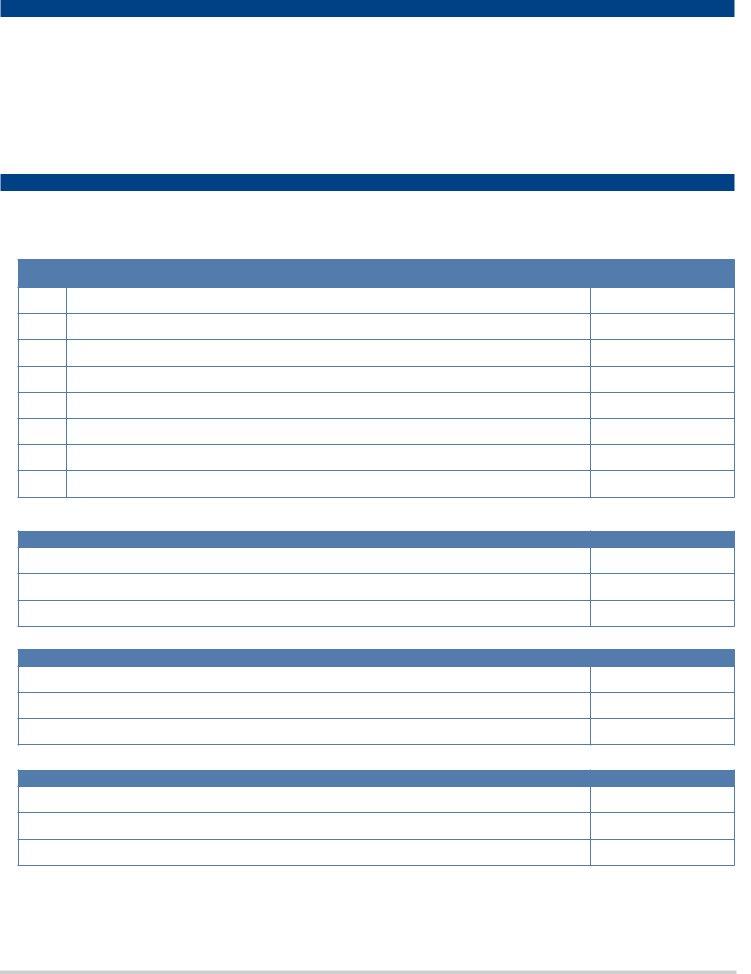

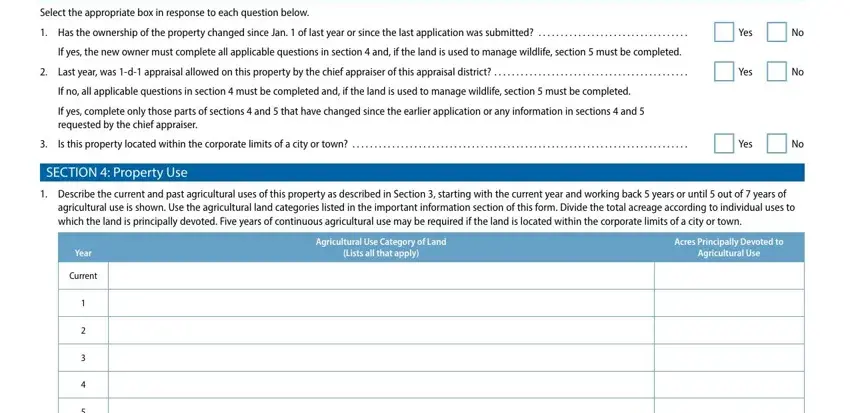

4. The subsequent paragraph will require your information in the subsequent areas: Select the appropriate box in, Has the ownership of the property, If yes the new owner must complete, If no all applicable questions in, If yes complete only those parts, Is this property located within, SECTION Property Use, Describe the current and past, agricultural use is shown Use the, Agricultural Use Category of Land, Lists all that apply, Acres Principally Devoted to, Agricultural Use, Year, and Current. Be sure you type in all required information to go onward.

As for Is this property located within and Current, make sure that you get them right in this current part. These are definitely the most significant ones in this file.

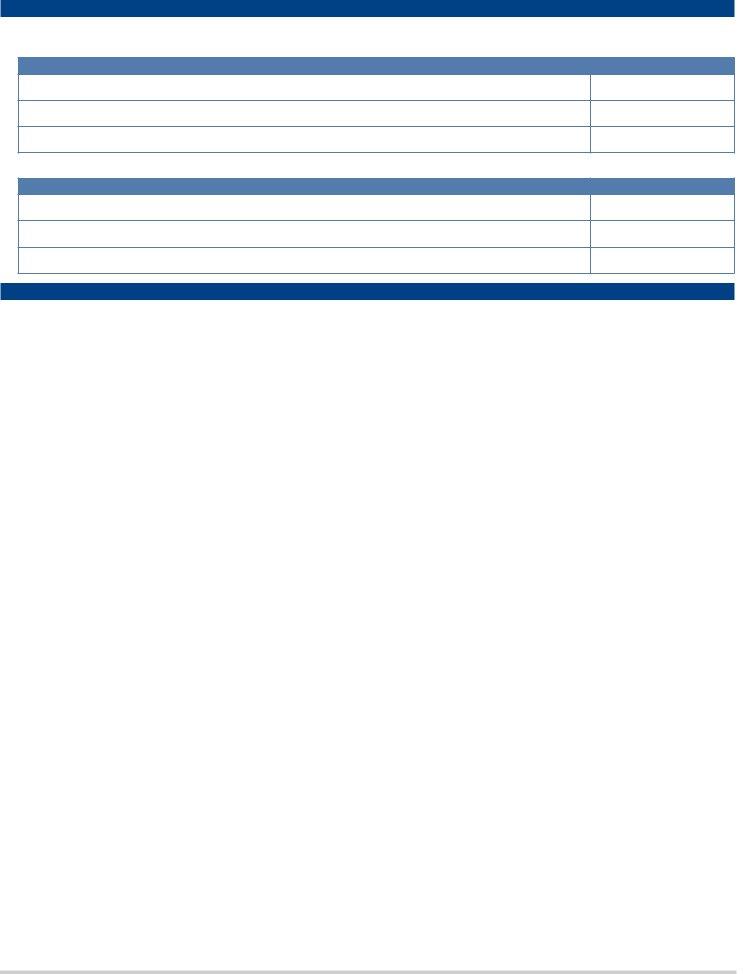

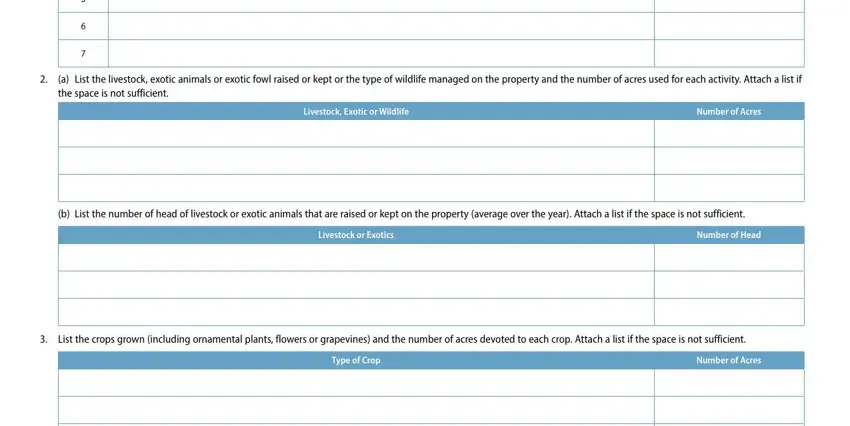

5. Now, the following final portion is precisely what you should finish before submitting the document. The blanks in this case are the next: a List the livestock exotic, Livestock Exotic or Wildlife, Number of Acres, b List the number of head of, Livestock or Exotics, Number of Head, List the crops grown including, Type of Crop, and Number of Acres.

Step 3: Revise the details you have entered into the blanks and then click on the "Done" button. Try a 7-day free trial account with us and acquire direct access to texas 50 129 - downloadable, emailable, and editable in your FormsPal account page. FormsPal is invested in the confidentiality of all our users; we make certain that all information put into our tool continues to be confidential.