With the help of the online PDF editor by FormsPal, you're able to complete or change Form 50 152 here. To make our tool better and less complicated to work with, we consistently design new features, considering feedback coming from our users. Here's what you'll need to do to start:

Step 1: First, access the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: This editor allows you to customize nearly all PDF documents in a variety of ways. Modify it with personalized text, adjust existing content, and include a signature - all manageable in no time!

This form will need particular info to be entered, hence make sure to take your time to type in precisely what is requested:

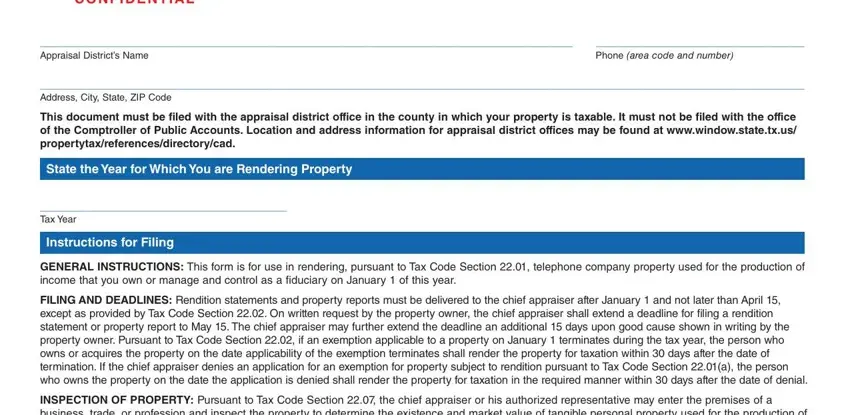

1. You need to fill out the Form 50 152 properly, therefore be attentive while working with the areas comprising all of these fields:

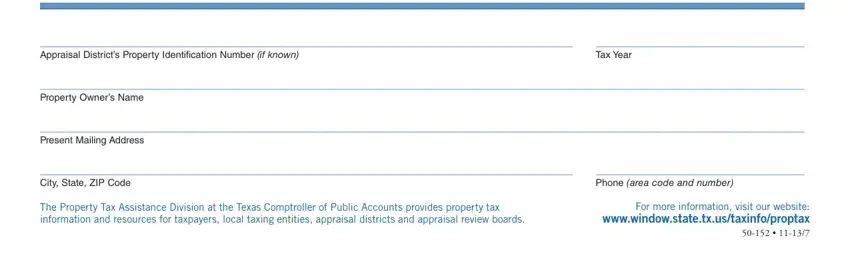

2. The third step is to fill out the following fields: Appraisal Districts Property, Tax Year, Property Owners Name, Present Mailing Address, City State ZIP Code, Phone area code and number, The Property Tax Assistance, and For more information visit our.

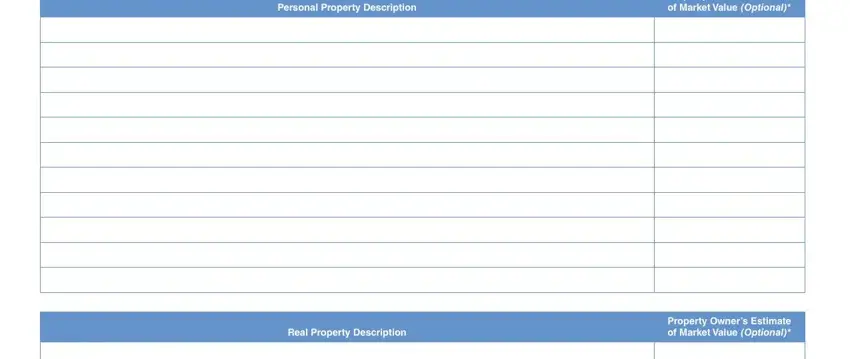

3. The next segment is generally fairly easy, Personal Property Description, Property Owners Estimate of Market, Real Property Description, and Property Owners Estimate of Market - every one of these form fields needs to be filled in here.

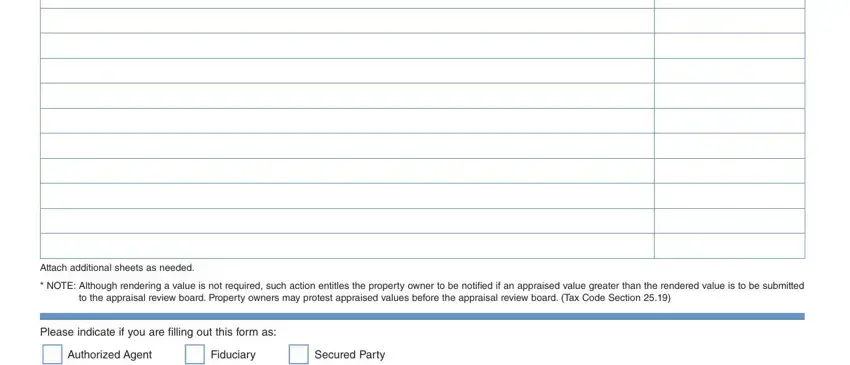

4. The subsequent subsection comes with these fields to enter your particulars in: Attach additional sheets as needed, NOTE Although rendering a value, to the appraisal review board, Please indicate if you are illing, and Authorized Agent Fiduciary.

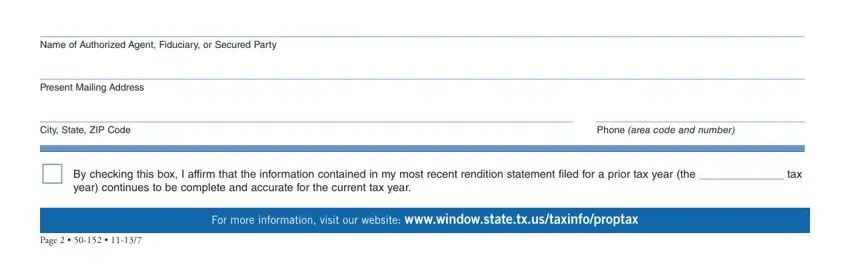

5. As a final point, this final part is precisely what you need to finish before finalizing the PDF. The fields in question are the following: Authorized Agent Fiduciary, Name of Authorized Agent, Present Mailing Address, City State ZIP Code, Phone area code and number, By checking this box I affirm, year continues to be complete and, Page cid cid, and For more information visit our.

Be very attentive when filling in City State ZIP Code and By checking this box I affirm, as this is the part where many people make errors.

Step 3: Prior to moving on, check that all blanks are filled out the correct way. As soon as you determine that it is good, click “Done." Right after registering a7-day free trial account with us, you will be able to download Form 50 152 or send it via email without delay. The document will also be readily available from your personal account menu with all of your edits. We do not share or sell any details you enter while dealing with forms at FormsPal.