Using the online PDF tool by FormsPal, you'll be able to fill in or modify taxinfo here. In order to make our tool better and less complicated to utilize, we constantly design new features, taking into consideration suggestions from our users. Starting is effortless! All you have to do is take these simple steps down below:

Step 1: Click the "Get Form" button at the top of this page to open our editor.

Step 2: With our state-of-the-art PDF file editor, you may accomplish more than just fill out forms. Express yourself and make your forms seem sublime with customized text incorporated, or optimize the original content to perfection - all supported by the capability to incorporate your own images and sign the file off.

This PDF form will need specific information; to guarantee accuracy and reliability, don't hesitate to heed the recommendations below:

1. You have to fill out the taxinfo correctly, hence take care while filling in the areas that contain these specific fields:

2. Given that this part is complete, you need to put in the needed particulars in Appraisal Districts Property, Tax Year, Property Owners Name, Present Mailing Address, City State ZIP Code, Phone area code and number, The Property Tax Assistance, and For more information visit our so you're able to move on to the third step.

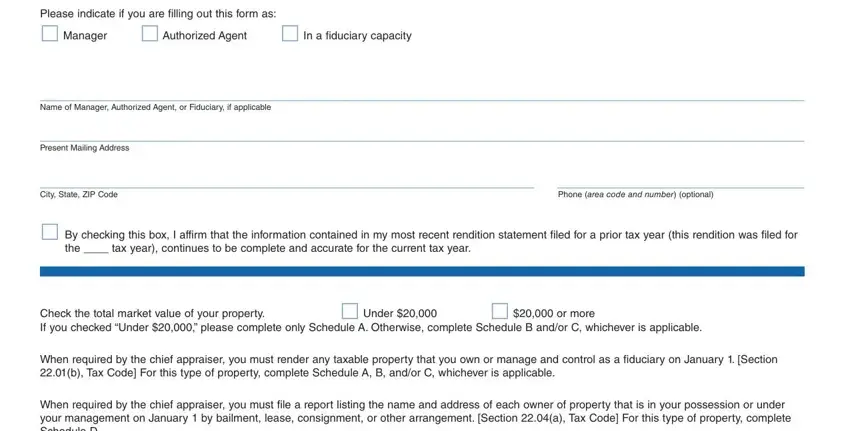

3. The following segment is all about Please indicate if you are illing, Manager Authorized Agent In a, Name of Manager Authorized Agent, Present Mailing Address, City State ZIP Code, Phone area code and number, By checking this box I affirm, the tax year continues to be, Check the total market value of, Under, or more, When required by the chief, and When required by the chief - fill in each of these blanks.

People generally get some points incorrect when filling in When required by the chief in this part. You should definitely double-check whatever you type in here.

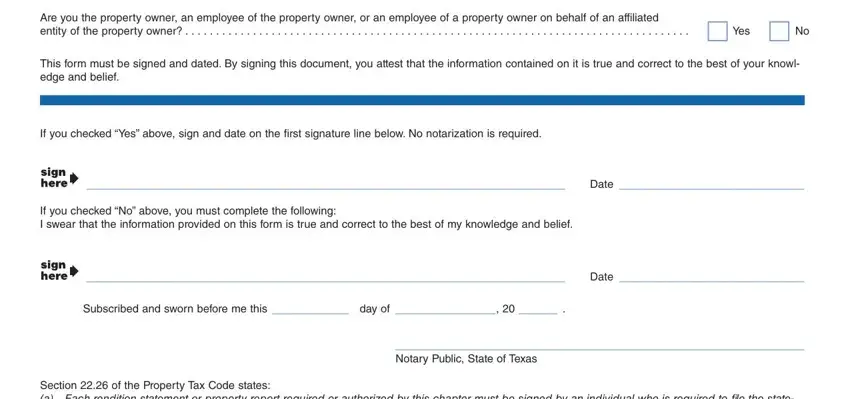

4. This next section requires some additional information. Ensure you complete all the necessary fields - Are you the property owner an, entity of the property owner, This form must be signed and dated, If you checked Yes above sign and, Date, If you checked No above you must, Date, Subscribed and sworn before me, Notary Public State of Texas, and Section of the Property Tax Code - to proceed further in your process!

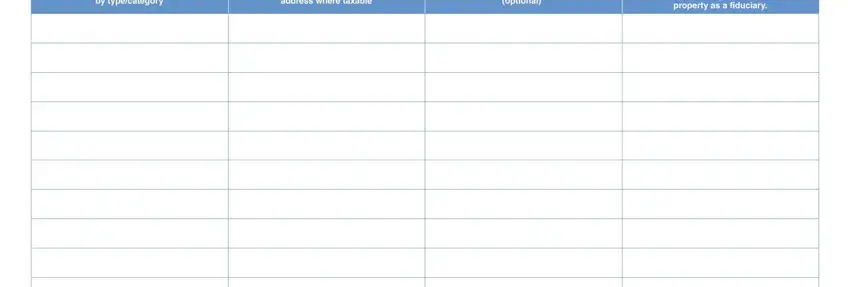

5. To finish your document, the particular subsection incorporates a few additional fields. Typing in by typecategory, Property address or address where, optional, and if you manage or control property will wrap up the process and you'll definitely be done in a flash!

Step 3: Before submitting the form, it's a good idea to ensure that form fields are filled out the correct way. The moment you establish that it is good, click on “Done." Make a free trial subscription with us and obtain immediate access to taxinfo - download, email, or edit in your FormsPal account page. When you work with FormsPal, you'll be able to fill out forms without worrying about personal information leaks or entries being shared. Our protected platform ensures that your personal data is maintained safe.