maryland tax form 502 can be filled out without difficulty. Just use FormsPal PDF tool to accomplish the job in a timely fashion. We at FormsPal are devoted to providing you with the best possible experience with our tool by constantly adding new features and enhancements. With all of these improvements, working with our tool becomes better than ever before! Should you be seeking to begin, here is what it will require:

Step 1: Press the "Get Form" button above on this page to open our PDF tool.

Step 2: Using our state-of-the-art PDF tool, you can actually do more than simply complete blanks. Edit away and make your forms seem faultless with custom textual content put in, or tweak the file's original content to perfection - all that backed up by the capability to incorporate any kind of images and sign the PDF off.

It is actually simple to fill out the form with this helpful tutorial! This is what you should do:

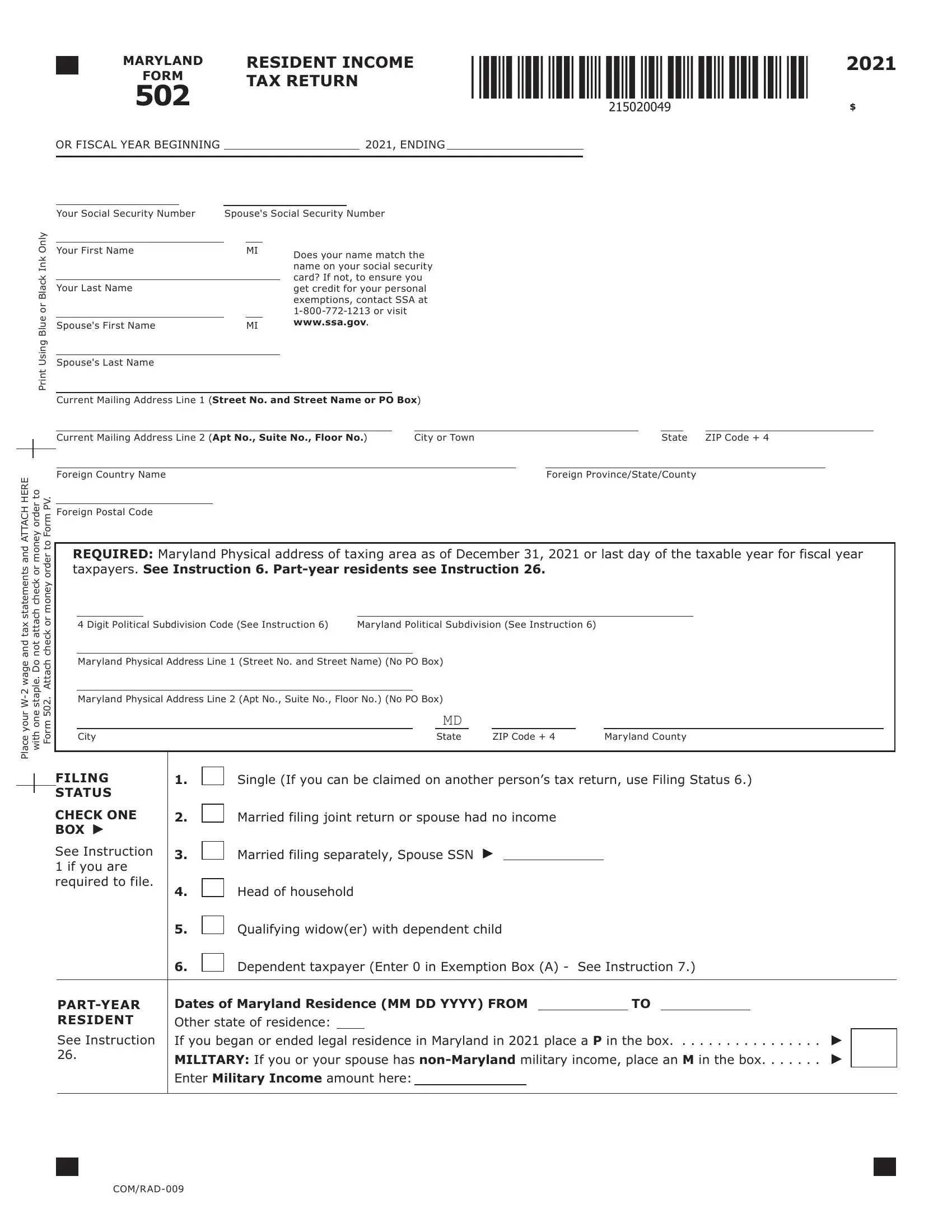

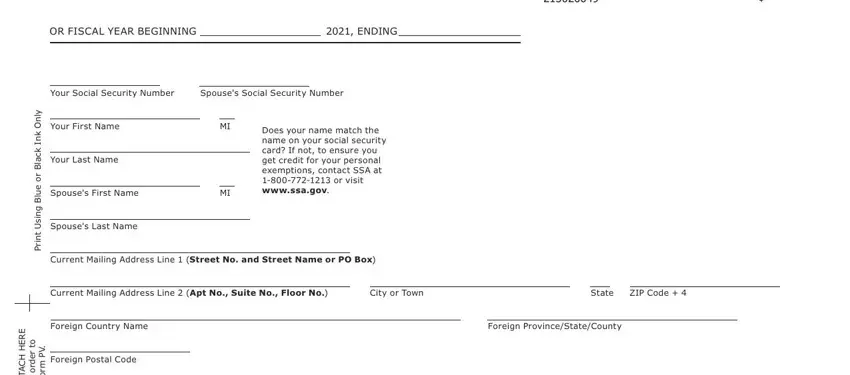

1. When submitting the maryland tax form 502, make sure to incorporate all needed blank fields within the associated form section. This will help to expedite the process, making it possible for your details to be processed efficiently and appropriately.

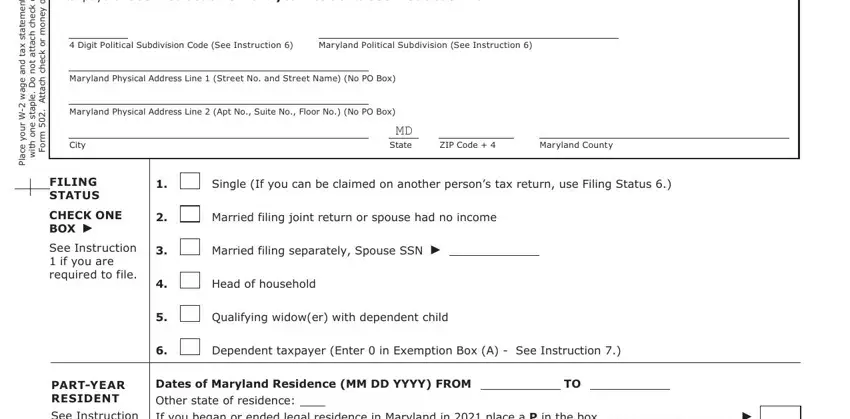

2. When this section is completed, you have to add the essential particulars in E R E H H C A T T A d n a s t n e, r u o y e c a P, r o k c e h c h c a t t a t o n o D, e p a t s e n o h t i, V P m r o F o t r e d r o y e n o, r o k c e h c h c a t t A m r, REQUIRED Maryland Physical address, Digit Political Subdivision Code, Maryland Political Subdivision See, Maryland Physical Address Line, Maryland Physical Address Line, City, FILING STATUS, CHECK ONE BOX, and See Instruction if you are so that you can proceed further.

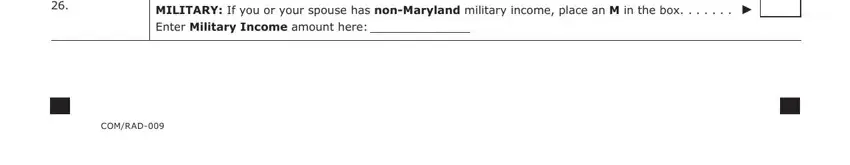

3. Completing See Instruction, If you began or ended legal, MILITARY If you or your spouse has, Enter Military Income amount here, and COMRAD is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be very careful when filling in If you began or ended legal and Enter Military Income amount here, as this is where most users make errors.

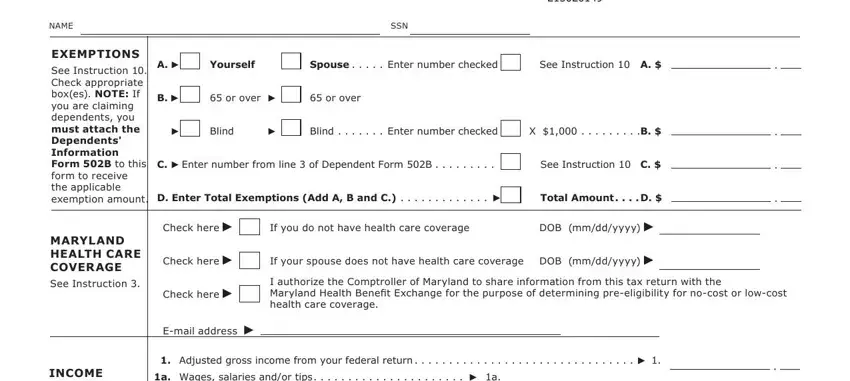

4. To go onward, the following step involves filling in several form blanks. These include NAME, SSN, EXEMPTIONS, See Instruction Check appropriate, MARYLAND HEALTH CARE COVER AGE, See Instruction, Yourself, or over, Blind, Spouse Enter number checked, See Instruction A, or over, Blind Enter number checked, X B, and Enter number from line of, which you'll find key to moving forward with this particular process.

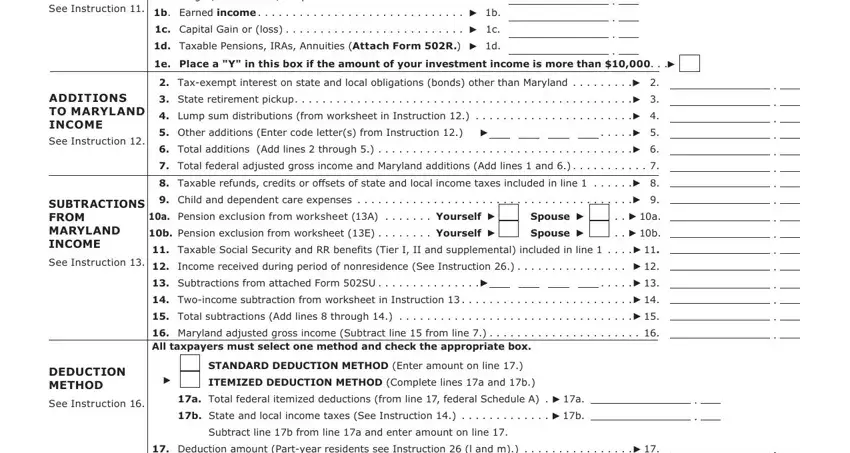

5. To wrap up your form, this particular area has some additional blanks. Filling out See Instruction, a Wages salaries andor tips, b Earned income, c Capital Gain or loss, d Taxable Pensions IRAs Annuities, e Place a Y in this box if the, Taxexempt interest on state and, State retirement pickup, Lump sum distributions from, ADDITIONS TO MARYLAND INCOME, See Instruction, SUBTRACTIONS FROM MARYLAND INCOME, See Instruction, Other additions Enter code, and Total additions Add lines will certainly conclude the process and you'll be done in a blink!

Step 3: Once you have looked over the details you filled in, click "Done" to conclude your FormsPal process. Find your maryland tax form 502 after you subscribe to a free trial. Immediately use the pdf document within your personal cabinet, along with any edits and adjustments being conveniently preserved! FormsPal guarantees your information privacy with a secure system that in no way saves or distributes any private data typed in. Feel safe knowing your documents are kept confidential every time you use our editor!