The ca state tax forms filling out procedure is effortless. Our PDF editor lets you use any PDF file.

Step 1: Click on the "Get Form Here" button.

Step 2: You'll find each of the functions that it's possible to undertake on your file when you have entered the ca state tax forms editing page.

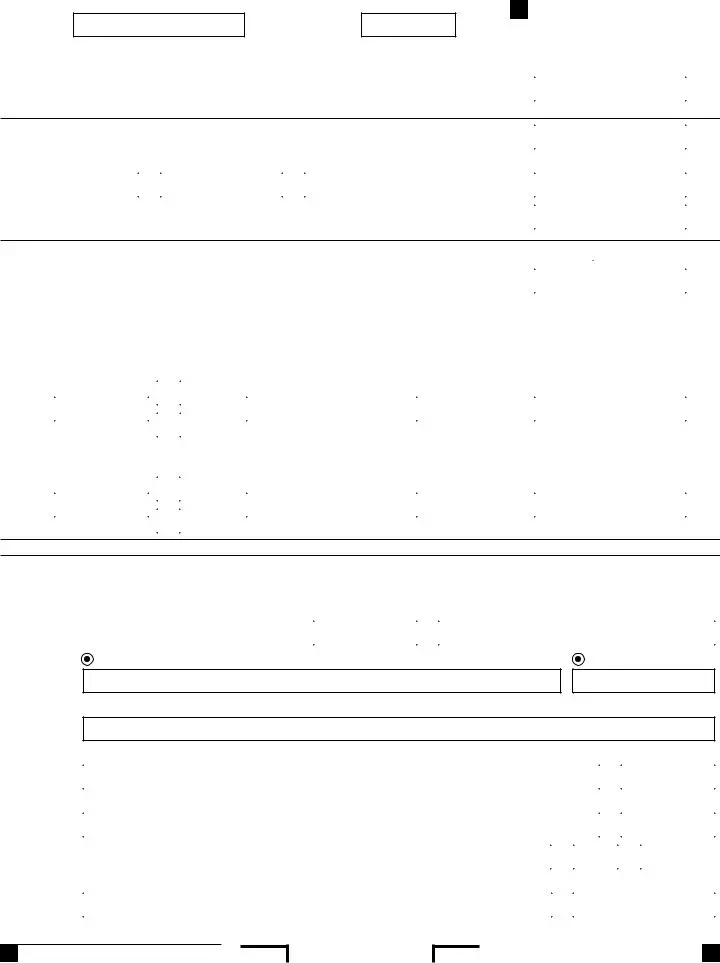

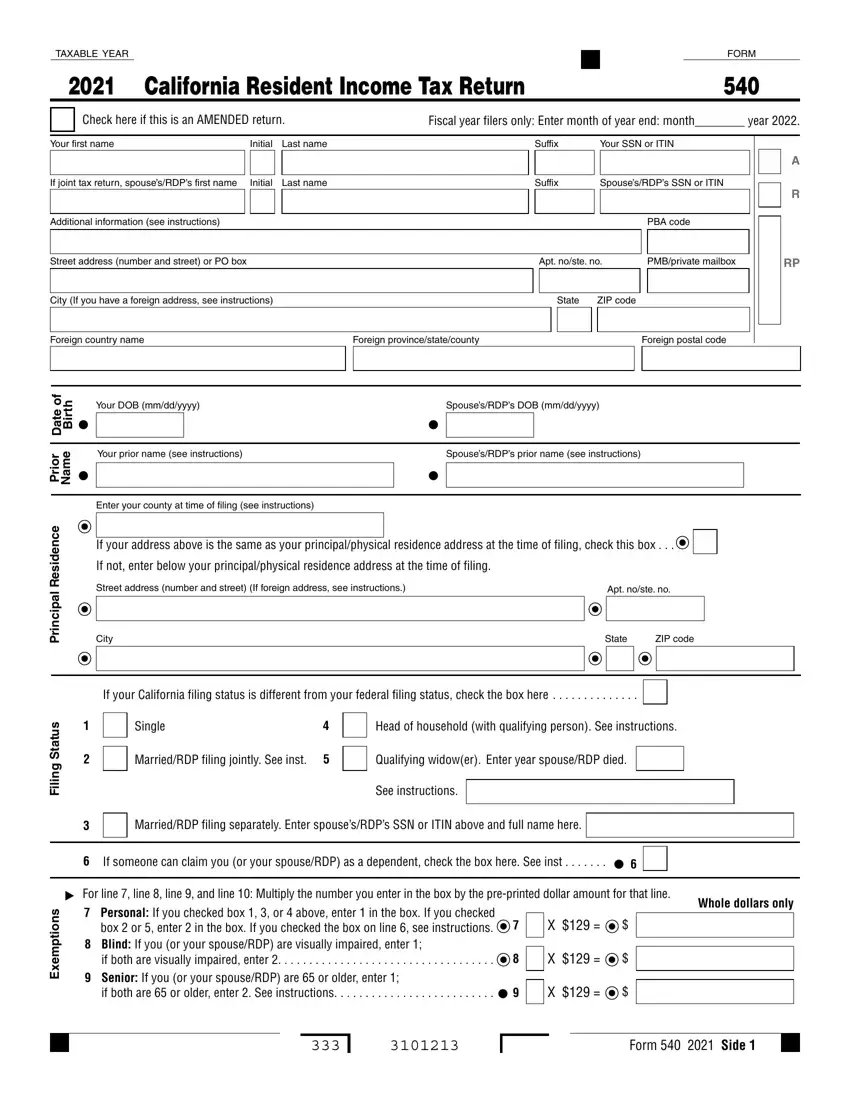

Fill in the ca state tax forms PDF and enter the information for each section:

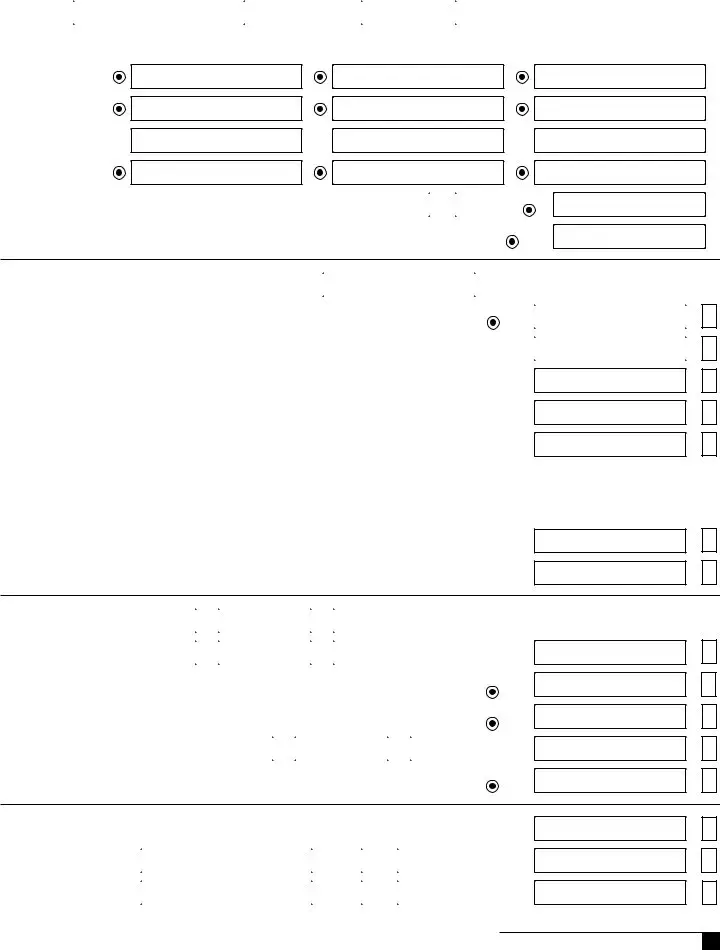

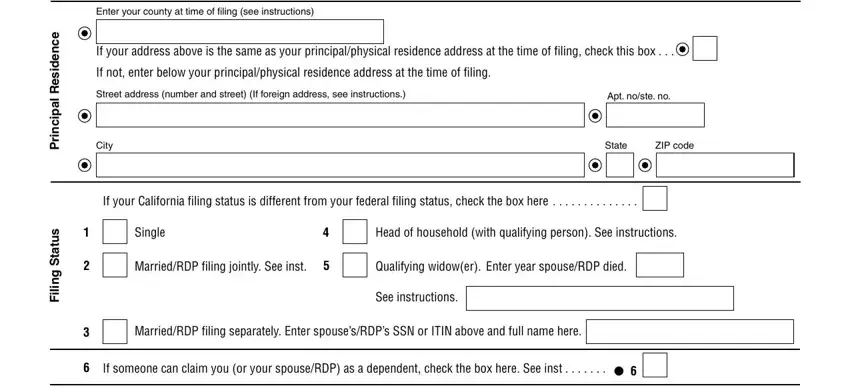

Provide the necessary details in the field Enter your county at time of, e c n e d i s e R, l a p i c n i r P, s u t a t S g n, i l i, If your address above is the same, If not enter below your, Street address number and street, Apt noste no, City, State, ZIP code, If your California filing status, Single, and MarriedRDP filing jointly See inst.

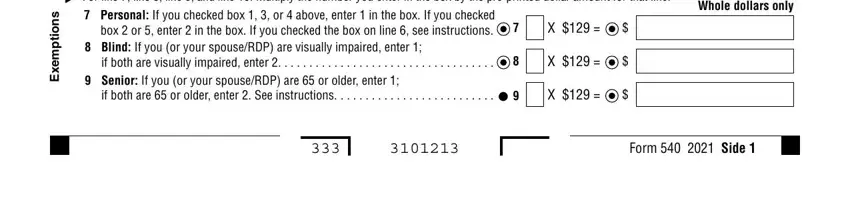

You will be requested to provide the data to let the system prepare the box s n o i t p m e x E, For line line line and line, Personal If you checked box or, Blind If you or your spouseRDP, if both are visually impaired, Senior If you or your spouseRDP, if both are or older enter See, Whole dollars only, and Form Side.

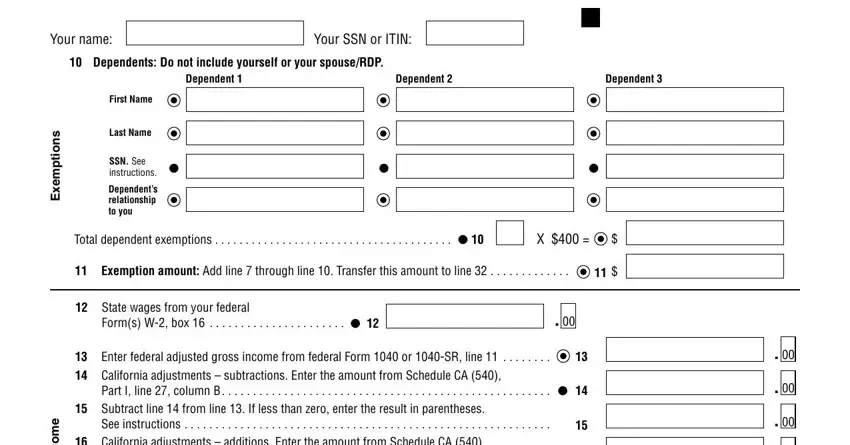

The Your name, Your SSN or ITIN, Dependents Do not include, Dependent, Dependent, Dependent, s n o i t p m e x E, e m o c n, First Name, Last Name, SSN See instructions, Dependents relationship to you, Total dependent exemptions, Exemption amount Add line, and State wages from your federal area needs to be applied to note the rights or responsibilities of both parties.

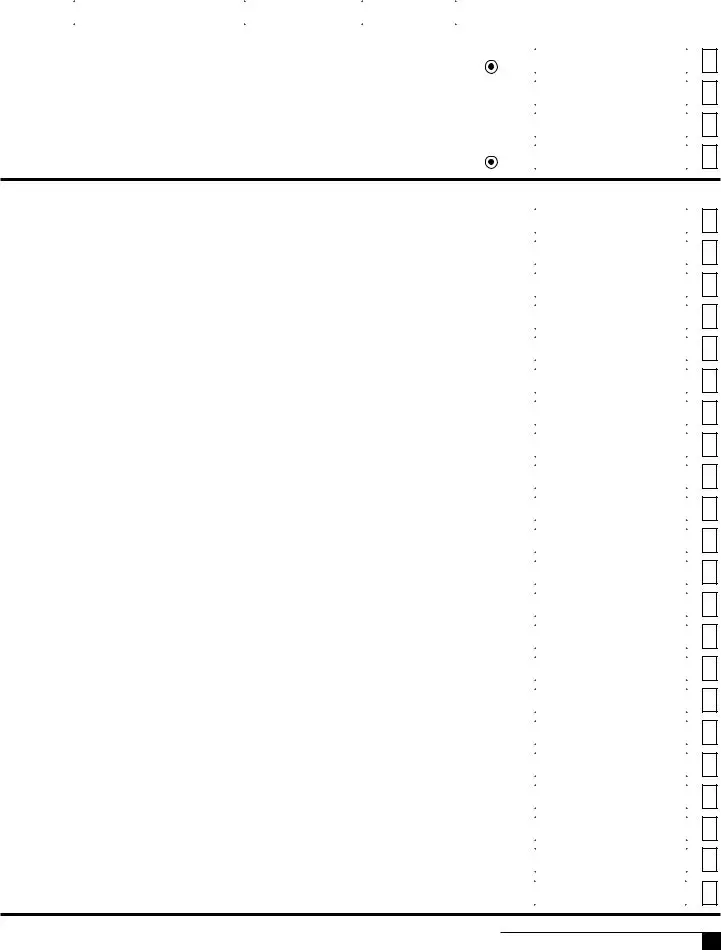

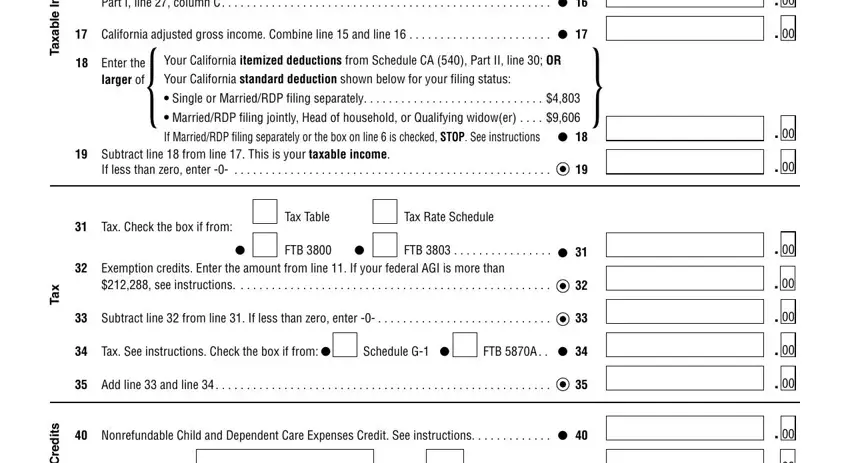

End up by analyzing the next areas and preparing them as required: e m o c n, e l b a x a T, x a T, s t i d e r C, Part I line column C, California adjusted gross income, Enter the larger of, Your California itemized, Your California standard deduction, Single or MarriedRDP filing, MarriedRDP filing jointly Head of, If MarriedRDP filing separately or, Subtract line from line This is, If less than zero enter, and Tax Check the box if from.

Step 3: After you have clicked the Done button, your file is going to be readily available transfer to any kind of gadget or email you identify.

Step 4: You will need to make as many duplicates of your file as you can to prevent possible misunderstandings.

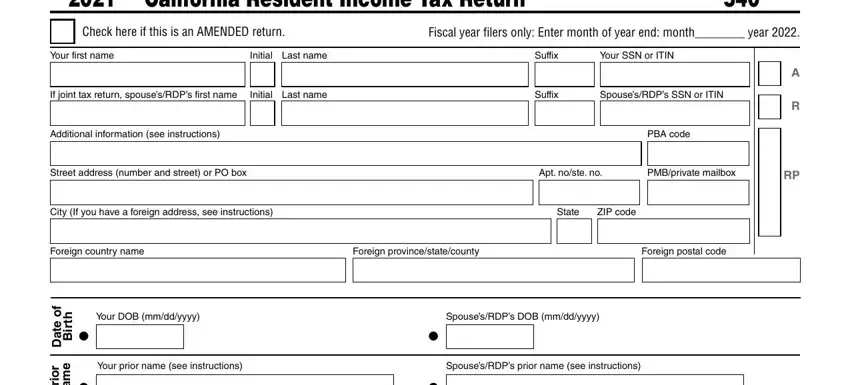

If not, enter below your principal/physical residence address at the time of filing.

If not, enter below your principal/physical residence address at the time of filing.