Using PDF forms online is certainly a breeze with this PDF tool. You can fill out irs form 5495 here effortlessly. Our team is committed to providing you the absolute best experience with our tool by consistently presenting new capabilities and improvements. Our editor is now much more helpful with the newest updates! Currently, filling out documents is a lot easier and faster than ever before. By taking a couple of easy steps, it is possible to begin your PDF journey:

Step 1: Open the PDF inside our editor by clicking the "Get Form Button" above on this webpage.

Step 2: This tool helps you work with PDF documents in a range of ways. Change it by adding your own text, adjust what's originally in the file, and place in a signature - all within several clicks!

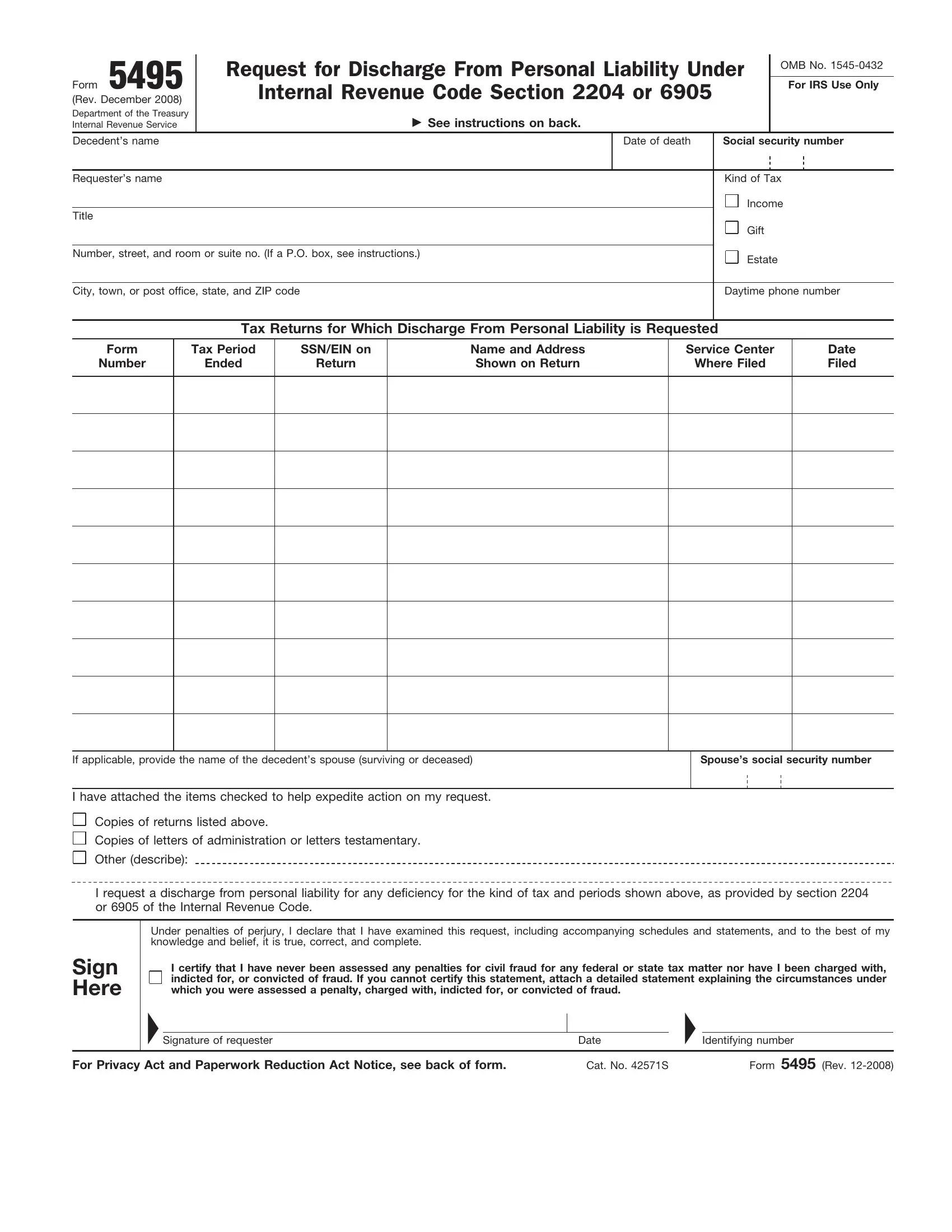

This PDF form will need particular details to be filled in, so you must take the time to enter precisely what is asked:

1. It is advisable to complete the irs form 5495 properly, so take care while working with the areas that contain all these blank fields:

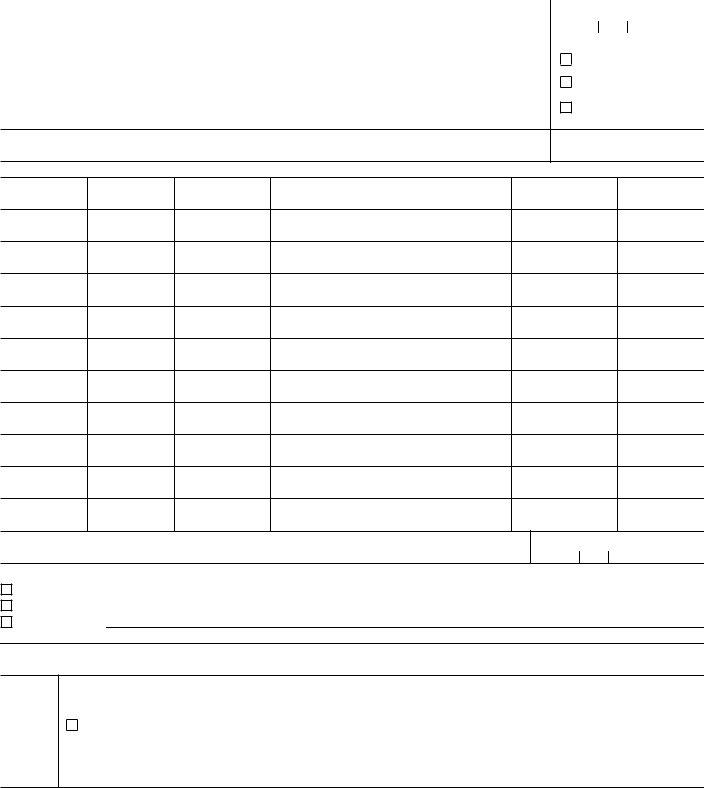

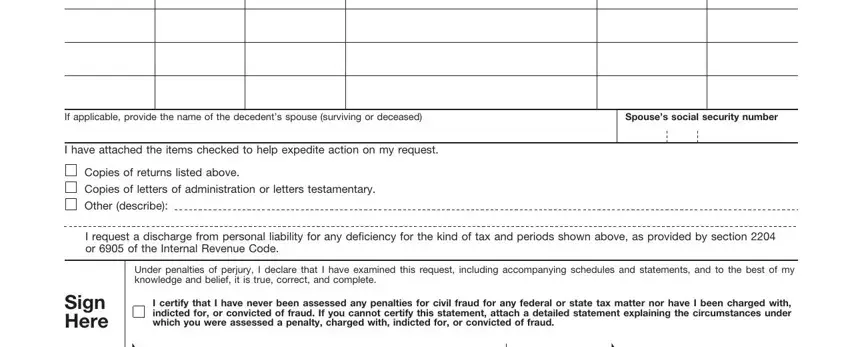

2. Soon after this section is done, go to enter the suitable details in all these: If applicable provide the name of, Spouses social security number, I have attached the items checked, Copies of returns listed above, I request a discharge from, Under penalties of perjury I, Sign Here, and I certify that I have never been.

It's very easy to make errors while completing the If applicable provide the name of, hence make sure to go through it again before you'll submit it.

Step 3: Glance through everything you have typed into the blank fields and click on the "Done" button. Right after setting up a7-day free trial account with us, it will be possible to download irs form 5495 or email it directly. The PDF document will also be readily accessible from your personal account page with all of your edits. At FormsPal, we aim to make sure that all of your information is kept secure.