Through the online PDF editor by FormsPal, you can fill out or alter 5500 ez here and now. The tool is continually updated by our staff, getting awesome functions and growing to be much more convenient. In case you are looking to begin, here is what it will take:

Step 1: Access the PDF doc in our editor by clicking the "Get Form Button" in the top part of this page.

Step 2: This editor helps you customize almost all PDF files in many different ways. Transform it with customized text, adjust what's already in the document, and place in a signature - all possible within minutes!

It really is straightforward to complete the form using out detailed guide! Here is what you need to do:

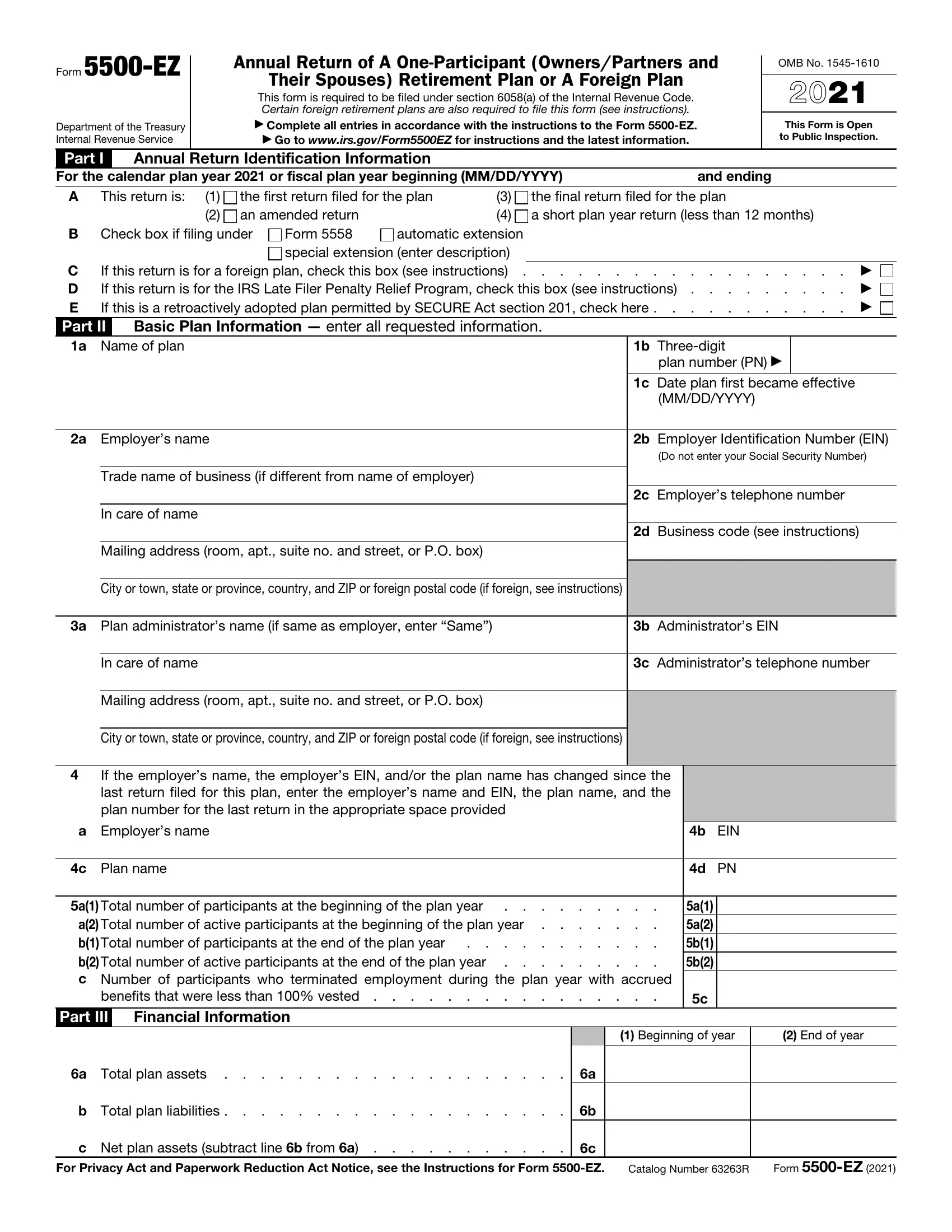

1. To start with, once filling in the 5500 ez, start with the page containing following blank fields:

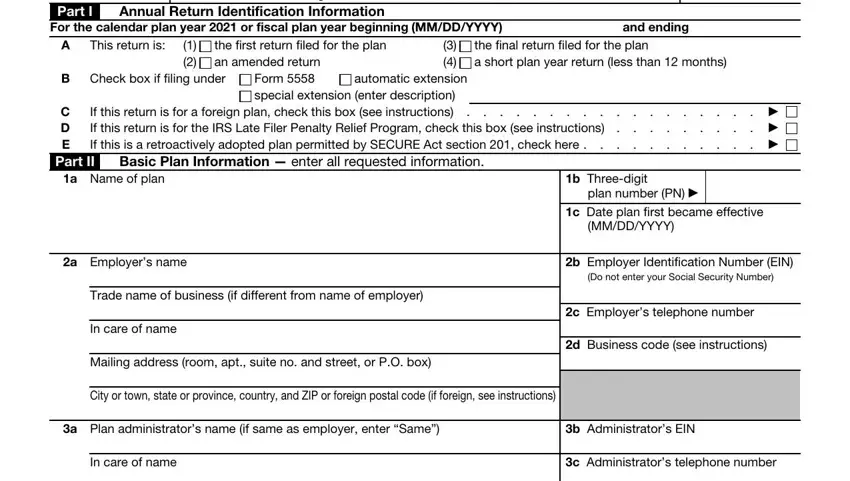

2. Once your current task is complete, take the next step – fill out all of these fields - Mailing address room apt suite no, City or town state or province, If the employers name the, a Employers name, c Plan name, a Total number of participants at, a Total number of active, benefits that were less than, Part III, Financial Information, b EIN, d PN, a a b b, a Total plan assets, and b Total plan liabilities with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make errors when filling in the b Total plan liabilities, thus ensure that you take a second look prior to deciding to finalize the form.

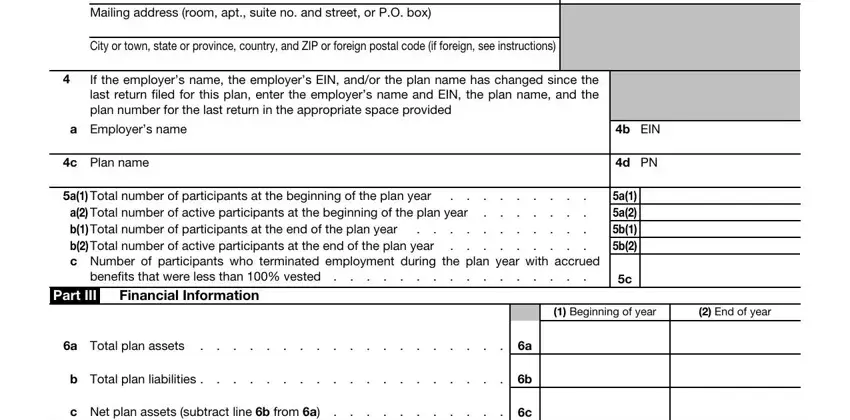

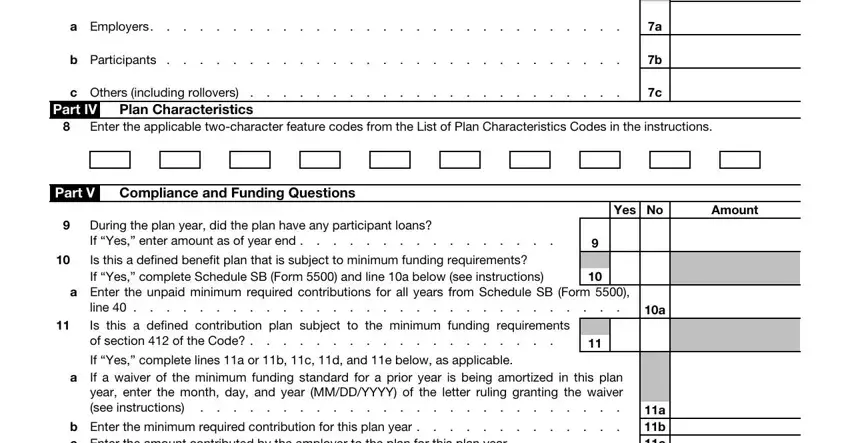

3. In this stage, review Contributions received or, Amount, a Employers, b Participants, c Others including rollovers, Plan Characteristics, Part IV, Enter the applicable twocharacter, Part V, Compliance and Funding Questions, During the plan year did the plan, If Yes enter amount as of year end, Is this a defined benefit plan, Yes No, and Amount. All of these have to be filled out with highest attention to detail.

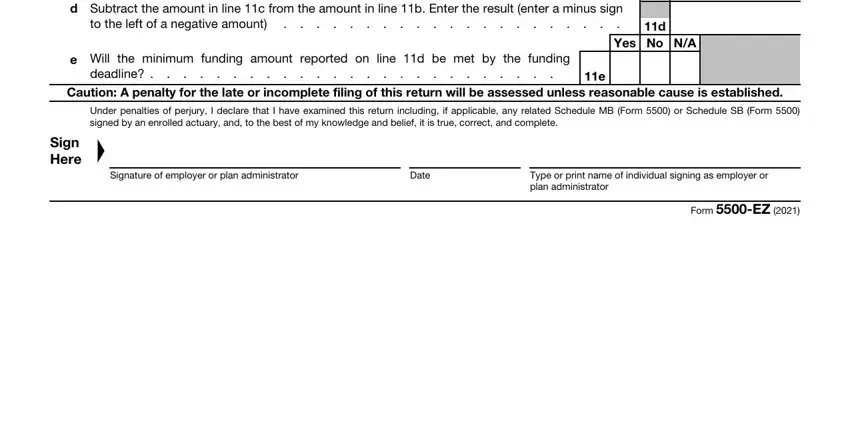

4. It is time to proceed to the next form section! Here you've got all of these b Enter the minimum required, to the left of a negative amount, a b c, e Will the minimum funding amount, deadline, Caution A penalty for the late or, Under penalties of perjury I, Yes No NA, Sign, Here, Signature of employer or plan, Date, Type or print name of individual, and Form EZ blanks to do.

Step 3: After double-checking the fields and details, click "Done" and you are all set! Acquire the 5500 ez the instant you sign up for a free trial. Readily get access to the pdf document in your personal account, along with any modifications and changes being automatically saved! FormsPal is committed to the personal privacy of all our users; we always make sure that all personal data going through our editor stays protected.