|

General Information |

Qualified Small Business Stock |

|

|

California law does not conform to federal law changes regarding the |

|

In general, for taxable years beginning on or after January 1, 2010, |

|

increase in the percentage of the gain exclusion for the sales of qualified |

|

California law conforms to the Internal Revenue Code (IRC) as of |

|

small business stock acquired after February 17, 2009. California law |

|

January 1, 2009. However, there are continuing differences between |

|

allows an exclusion of 50% of any gain from the sale or exchange of |

|

California and federal law. When California conforms to federal tax law |

|

qualified small business stock held for more than 5 years. For California |

|

changes, we do not always adopt all of the changes made at the federal |

|

purposes, 80% of the issuing corporation’s payroll must be attributable |

|

level. For more information, go to ftb.ca.gov and search for conformity. |

|

to employment located within California (at time of issuance). Also, |

|

Additional information can be found in FTB Pub. 1001, Supplemental |

|

at least 80% of the value of the corporation’s assets must be used by |

|

Guidelines to California Adjustments, the instructions for California |

|

the corporation to actively conduct one or more qualified trades or |

|

Schedule CA (540 or 540NR), and the Business Entity tax booklets. |

|

businesses. |

|

|

|

The instructions provided with California tax forms are a summary of |

R&TC Section 18038.5 also provides for the deferral of gain from the |

|

California tax law and are only intended to aid taxpayers in preparing |

|

sale of small business stock that has been held for six months or more, |

|

their state income tax returns. We include information that is most useful |

|

if qualified replacement stock is purchased within 60 days after the sale |

|

to the greatest number of taxpayers in the limited space available. It is |

|

giving rise to the gain. Report gain deferred from the sale of qualified |

|

not possible to include all requirements of the California Revenue and |

|

small business stock in accordance with the instructions contained in |

|

Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider |

|

Revenue Procedure 98-48. |

|

the tax booklets as authoritative law. |

|

For more information, go to ftb.ca.gov and search for qsbs. |

|

|

|

Internet Access |

|

|

You can download, view, and print California tax forms and publications |

|

|

at ftb.ca.gov. |

|

|

Access other state agencies’ websites at ca.gov. |

|

|

|

|

|

Purpose |

|

|

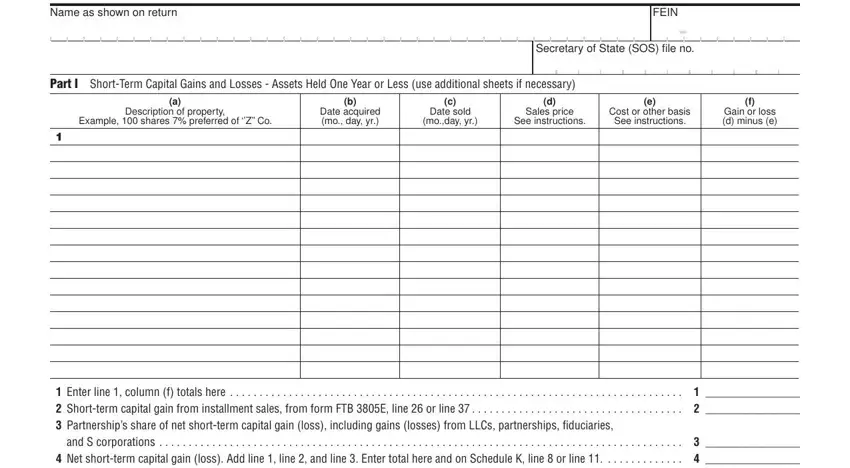

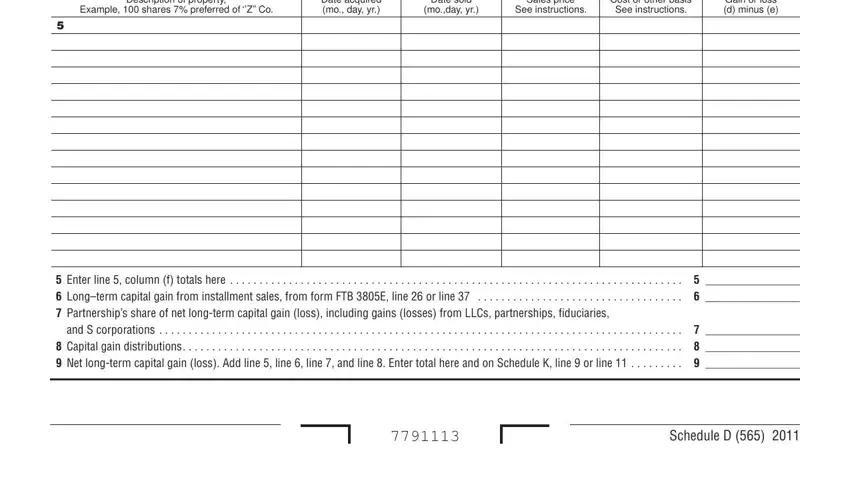

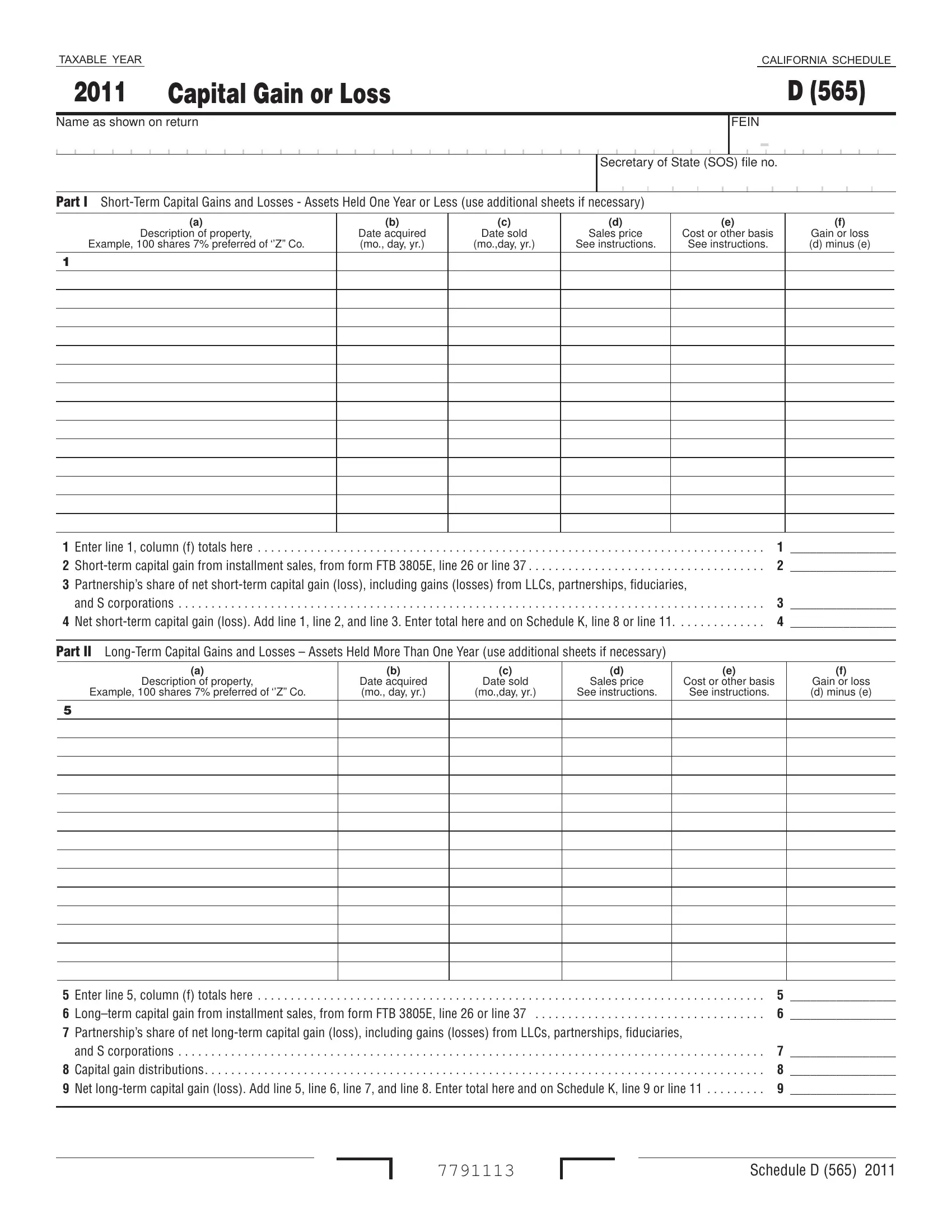

Use Schedule D (565), Capital Gain or Loss, to report the sale or |

|

|

exchange of capital assets, by the partnership, except capital gains |

|

|

(losses) that are specially allocated to any partners. Do not use this form |

|

|

to report the sale of business property. For sales of business properties, |

|

|

use California Schedule D-1, Sale of Business Property. |

|

|

Enter specially allocated short-term capital gains (losses) received |

|

|

from limited liability companies (LLCs) classified as partnerships, |

|

|

partnerships, S corporations, and fiduciaries on Schedule D (565), |

|

|

line 3. Enter specially allocated long-term capital gains (losses) received |

|

|

from LLCs classified as partnerships, partnerships, S corporations, and |

|

|

fiduciaries on Schedule D (565), line 7. Enter short-term and long-term |

|

|

capital gains (losses) that are specially allocated to partners on |

|

|

Schedule K-1 (565), Partner’s Share of Income, Deductions, Credits, etc. |

|

|

Do not include these amounts on Schedule D (565). See the instructions |

|

|

for Schedule K (565), Partners’ Share of Income, Deductions, Credits, |

|

|

etc., and Schedule K-1 (565) for more information. Also, refer to the |

|

|

instructions for federal Schedule D (1065), Capital Gains and Losses. |

|

|

Nonresident and Part-Year Resident Partners, get FTB Pub. 1100, |

|

|

Taxation of Nonresidents and Individuals Who Change Residency. |

|

|

With the enactment of AB 1115 (Stats. 2001, Ch 920) capital loss |

|

|

carryover and capital loss limitations for nonresident partners and |

|

|

part-year resident partners, for the portion of the year they were |

|

|

nonresidents, are determined based upon California source income |

|

|

and loss items only for the computation of their California taxable |

|

|

income. Moreover, the character of their gains and losses on the sale or |

|

|

exchange of property used in trade or business or certain involuntary |

|

|

conversions (IRC Section 1231) are determined for purposes of |

|

|

calculating their California taxable income by netting California sources |

|

|

Section 1231 gains and losses only. |

|

|

California law conforms to federal law for the recognition of gain |

|

|

on a constructive sale of property in which the partnership held an |

|

|

appreciated interest. |

|