Working with PDF forms online can be super easy using our PDF editor. You can fill in form 2021 pdf here with no trouble. To maintain our tool on the leading edge of efficiency, we aim to put into action user-driven features and enhancements on a regular basis. We're routinely pleased to receive suggestions - join us in reshaping how we work with PDF documents. It merely requires a few simple steps:

Step 1: Open the PDF form inside our tool by clicking on the "Get Form Button" at the top of this page.

Step 2: When you open the PDF editor, you'll see the form all set to be filled out. Aside from filling out different blanks, you may as well do some other actions with the file, namely writing any textual content, changing the initial textual content, inserting images, signing the document, and more.

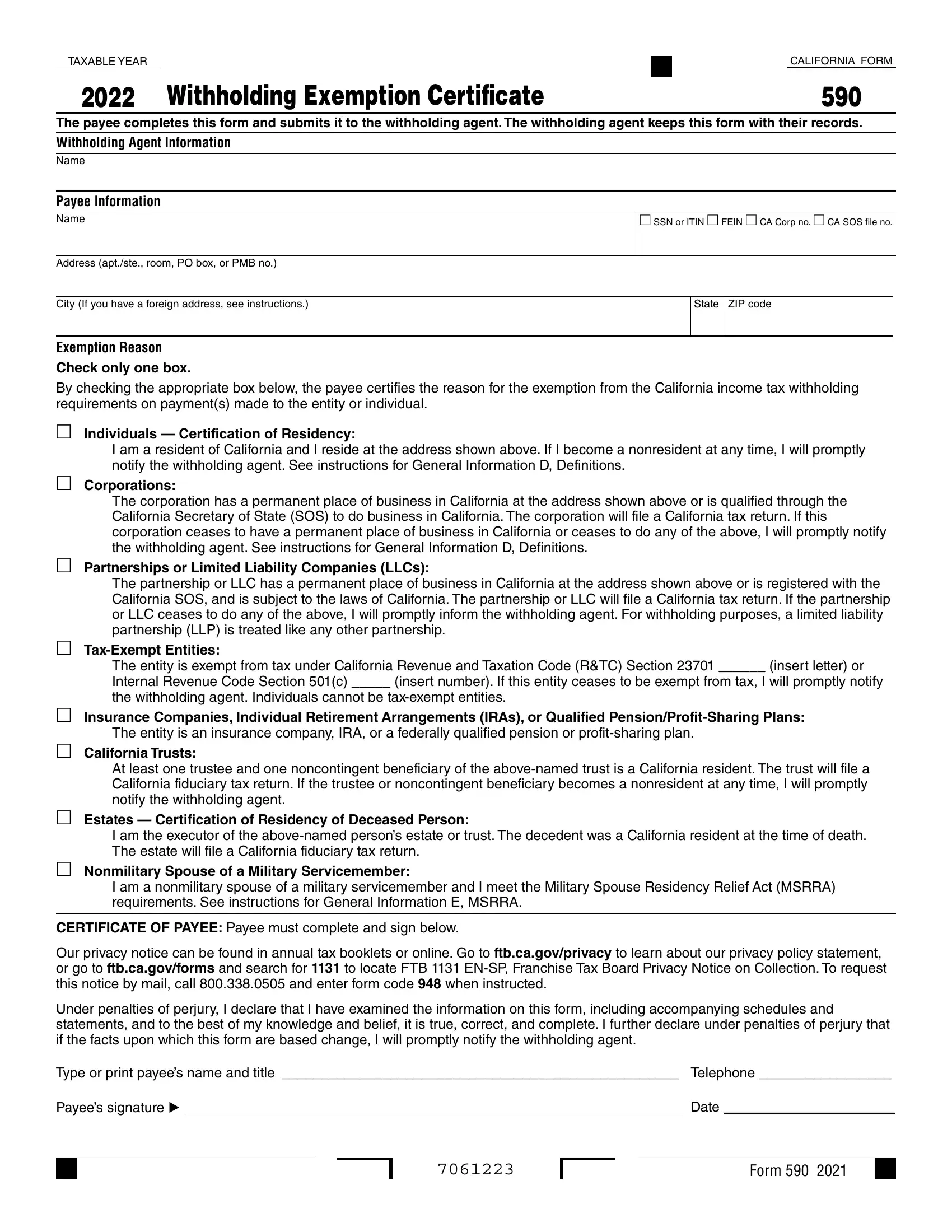

When it comes to blanks of this particular form, here's what you want to do:

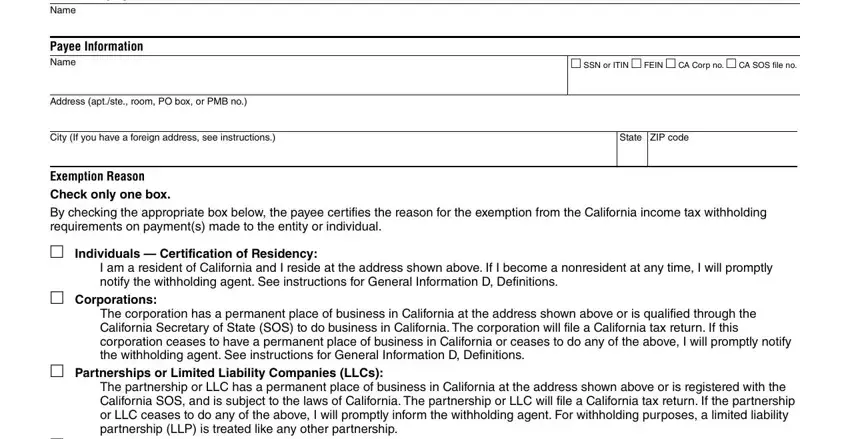

1. The form 2021 pdf will require particular details to be inserted. Ensure that the next fields are finalized:

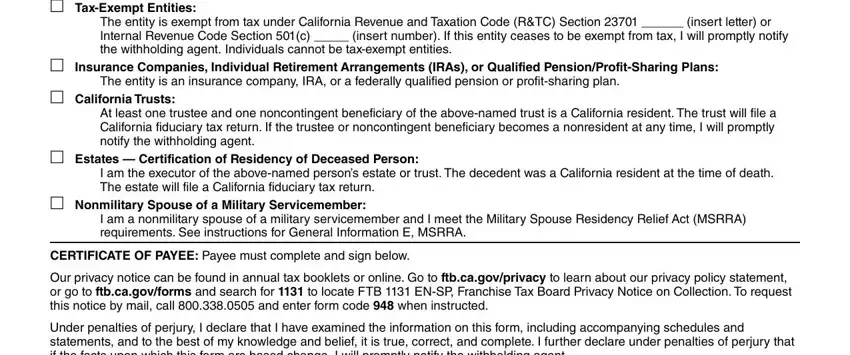

2. Once your current task is complete, take the next step – fill out all of these fields - TaxExempt Entities, The entity is exempt from tax, insert number If this entity, insert letter or, Insurance Companies Individual, The entity is an insurance company, California Trusts, At least one trustee and one, Estates Certification of, I am the executor of the, Nonmilitary Spouse of a Military, I am a nonmilitary spouse of a, CERTIFICATE OF PAYEE Payee must, Our privacy notice can be found in, and Under penalties of perjury I with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is easy to make errors while filling in the Insurance Companies Individual, consequently be sure you go through it again prior to when you finalize the form.

3. This next section is about Under penalties of perjury I, Type or print payees name and, Payees signature, Date, and Form - complete every one of these empty form fields.

Step 3: After you have glanced through the details in the document, click on "Done" to conclude your FormsPal process. Sign up with FormsPal right now and immediately gain access to form 2021 pdf, set for downloading. Every change you make is handily preserved , allowing you to modify the pdf later if required. FormsPal offers protected form editor with no personal information recording or distributing. Be assured that your data is safe with us!