Dealing with PDF files online is actually very easy using our PDF editor. You can fill out 592 ftb form here with no trouble. We are dedicated to providing you the best possible experience with our tool by consistently adding new functions and improvements. Our editor has become even more intuitive thanks to the most recent updates! Currently, working with PDF files is a lot easier and faster than before. Starting is simple! What you need to do is take the next basic steps directly below:

Step 1: Access the PDF form inside our editor by clicking the "Get Form Button" in the top section of this page.

Step 2: This editor gives you the capability to change almost all PDF documents in a variety of ways. Modify it with customized text, correct existing content, and place in a signature - all possible within minutes!

With regards to the blanks of this precise form, here is what you need to do:

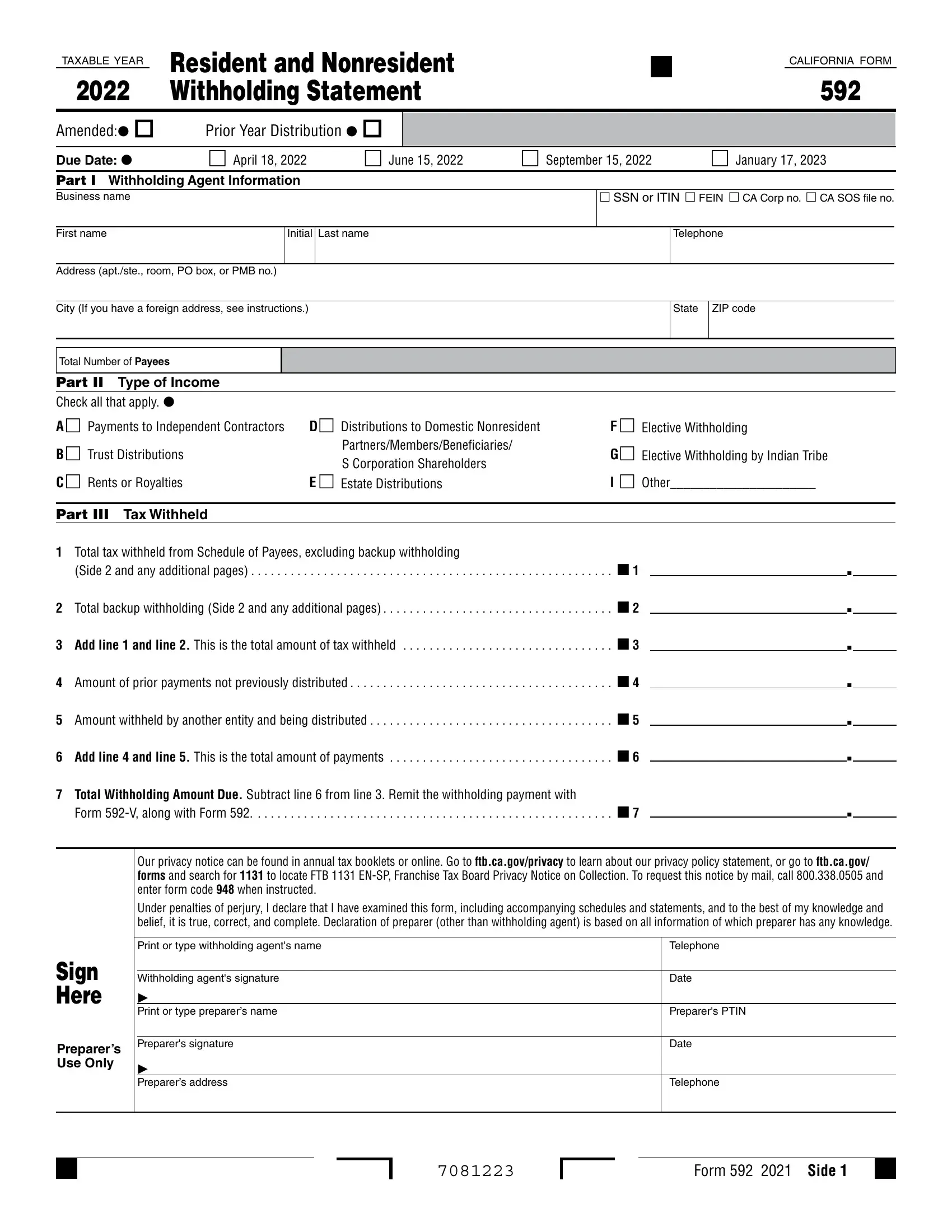

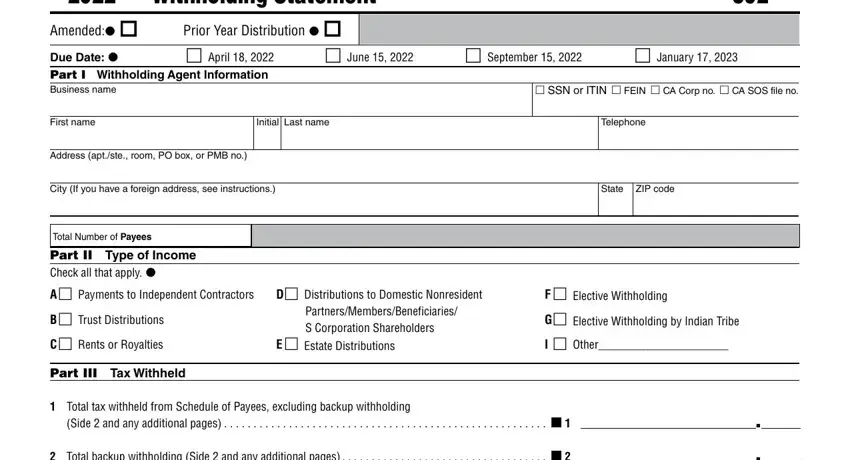

1. While submitting the 592 ftb form, ensure to incorporate all needed blank fields within the associated part. It will help hasten the work, allowing for your details to be handled without delay and correctly.

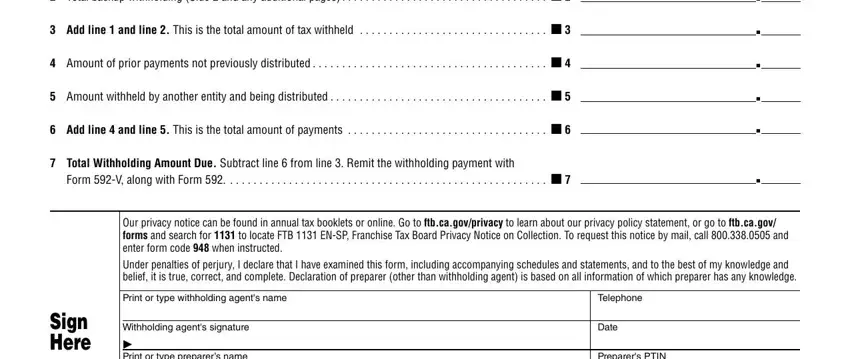

2. Just after finishing this step, go to the next part and fill out all required details in these fields - Total backup withholding Side, Add line and line This is the, Amount of prior payments not, Amount withheld by another entity, Add line and line This is the, Total Withholding Amount Due, Form V along with Form, Our privacy notice can be found in, Under penalties of perjury I, Print or type withholding agents, Sign Here, Withholding agents signature, Print or type preparers name, Telephone, and Date.

Be extremely careful while completing Print or type withholding agents and Under penalties of perjury I, because this is the section where a lot of people make mistakes.

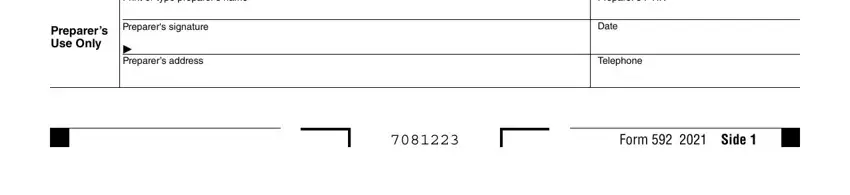

3. The next stage is usually easy - complete all of the empty fields in Print or type preparers name, Preparers Use Only, Preparers signature, Preparers address, Preparers PTIN, Date, Telephone, and Form Side to complete the current step.

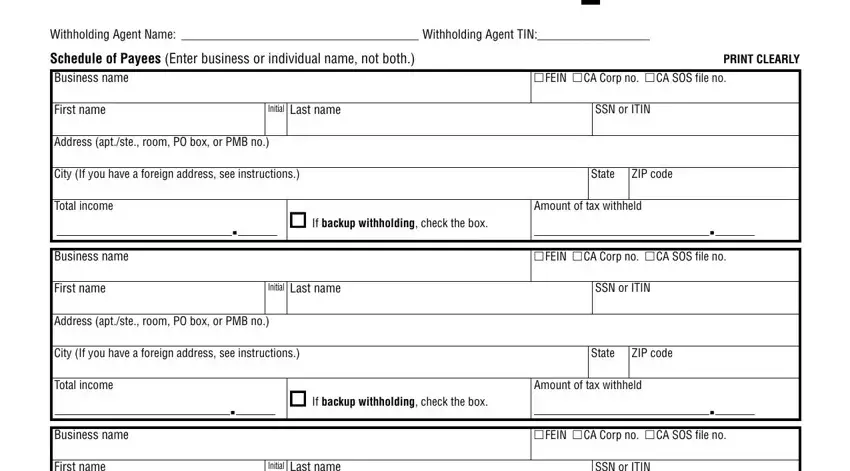

4. The fourth subsection comes with the next few fields to look at: Withholding Agent Name, Schedule of Payees Enter business, FEIN CA Corp no CA SOS file no, PRINT CLEARLY, First name, Initial Last name, SSN or ITIN, Address aptste room PO box or PMB, City If you have a foreign address, State, ZIP code, Total income, Business name, First name, and If backup withholding check the.

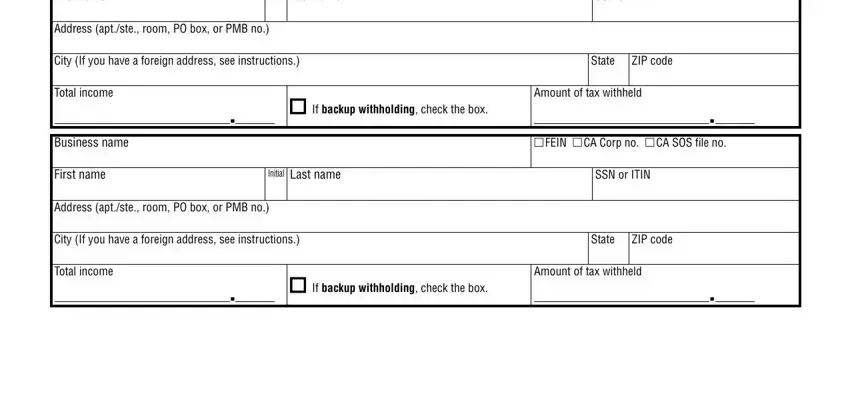

5. Finally, this final subsection is what you need to complete before submitting the document. The blank fields at this stage are the next: First name, Initial Last name, SSN or ITIN, Address aptste room PO box or PMB, City If you have a foreign address, State, ZIP code, Total income, Business name, First name, If backup withholding check the, Amount of tax withheld, FEIN CA Corp no CA SOS file no, Initial Last name, and SSN or ITIN.

Step 3: Before obtaining the next stage, it's a good idea to ensure that all blanks are filled in the right way. Once you are satisfied with it, click “Done." Sign up with FormsPal right now and instantly get access to 592 ftb form, ready for download. Each edit you make is conveniently preserved , letting you change the form at a later time as needed. When you use FormsPal, you'll be able to fill out documents without worrying about information incidents or data entries being shared. Our secure software helps to ensure that your personal information is stored safely.