In case you need to fill out Form 592 A, you don't have to install any sort of applications - simply give a try to our online PDF editor. To keep our editor on the cutting edge of efficiency, we work to put into operation user-driven capabilities and improvements regularly. We are routinely grateful for any feedback - help us with revampimg how you work with PDF documents. To get the ball rolling, take these simple steps:

Step 1: First, access the tool by clicking the "Get Form Button" in the top section of this site.

Step 2: With this handy PDF tool, you're able to do more than just fill out forms. Try each of the functions and make your forms seem sublime with custom text incorporated, or modify the original content to excellence - all comes with the capability to add your personal photos and sign the document off.

It will be straightforward to complete the document using this practical tutorial! Here's what you must do:

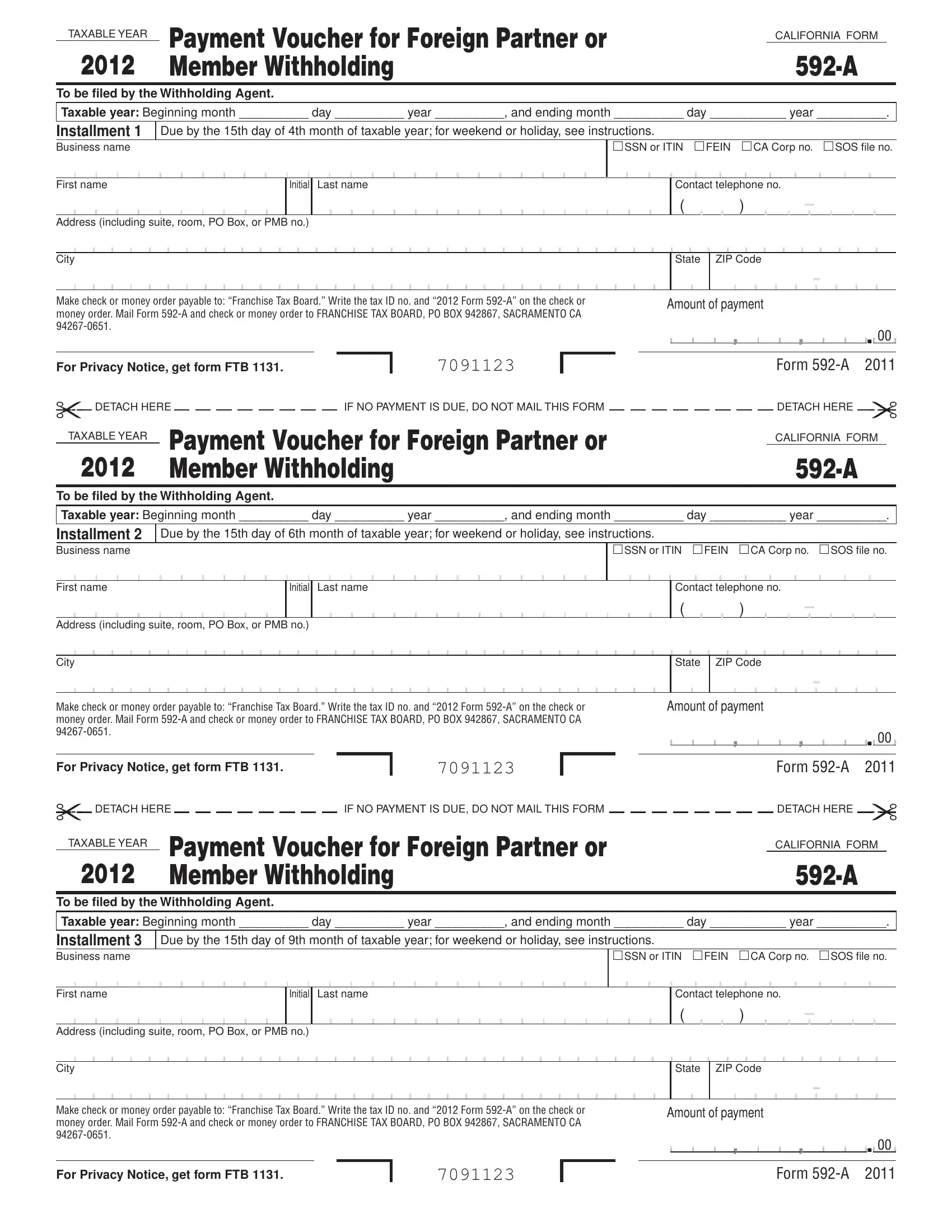

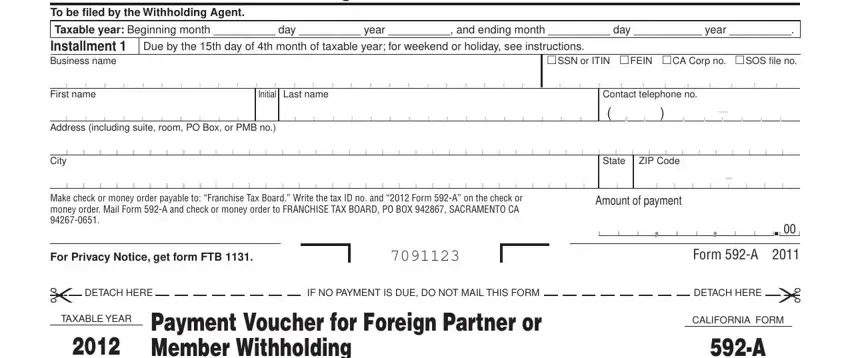

1. You need to complete the Form 592 A accurately, so pay close attention when filling in the parts containing all these fields:

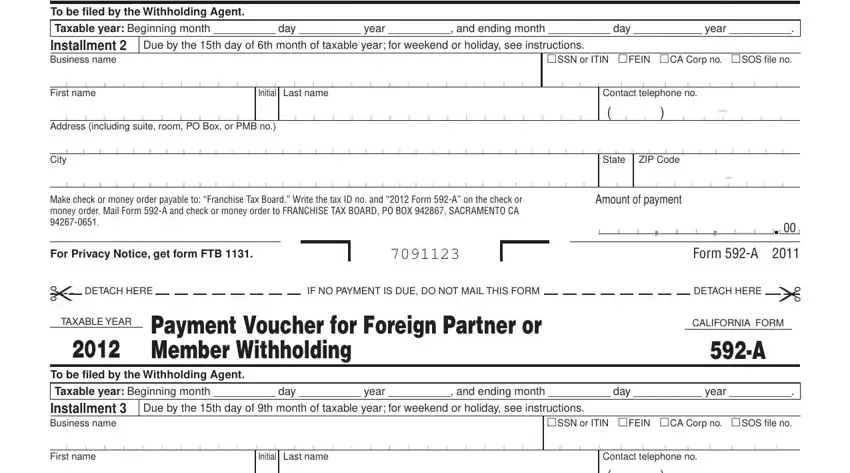

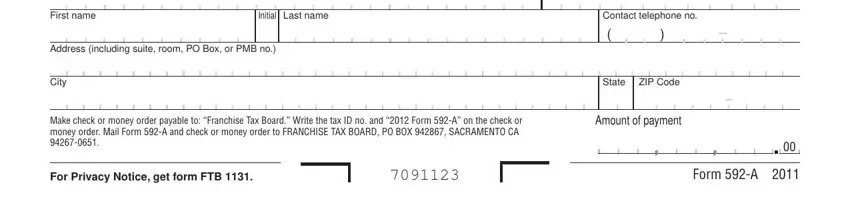

2. The third step is to fill in the following fields: Payment Voucher for Foreign, To be filed by the Withholding Agent, Taxable year Beginning month day, Due by the th day of th month of, SSN or ITIN FEIN CA Corp no, First name, Initial Last name, Address including suite room PO, City, Make check or money order payable, For Privacy Notice get form FTB, Contact telephone no, State ZIP Code, Amount of payment, and Form A.

Be extremely attentive when filling out First name and SSN or ITIN FEIN CA Corp no, as this is where most people make mistakes.

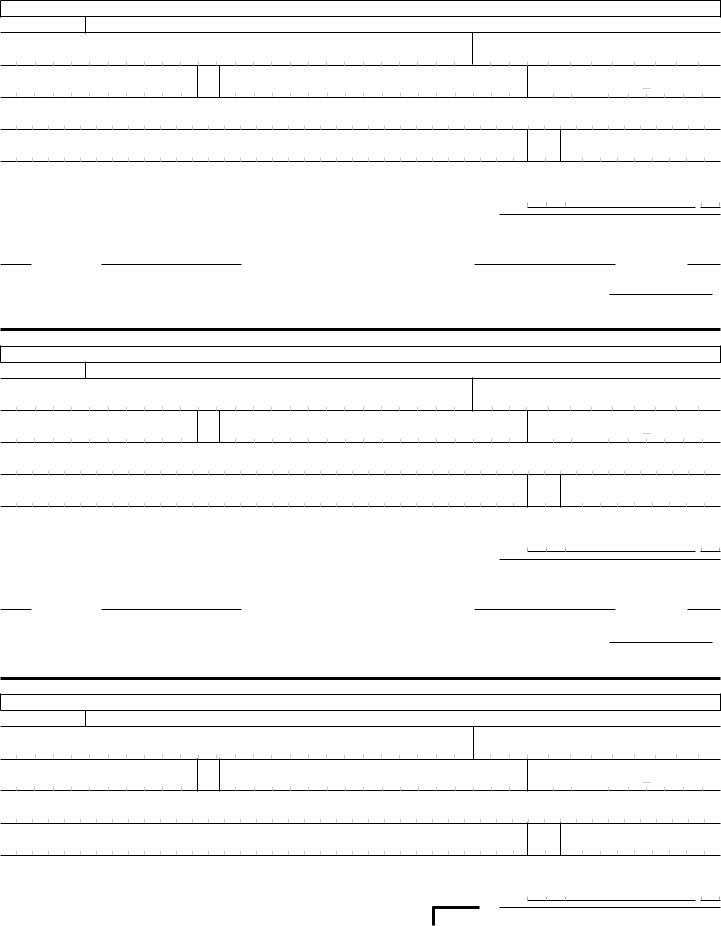

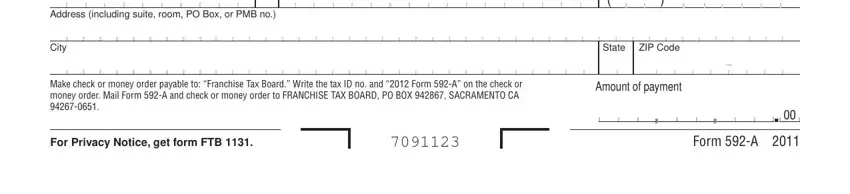

3. The next segment is considered quite straightforward, Address including suite room PO, City, Make check or money order payable, For Privacy Notice get form FTB, State ZIP Code, Amount of payment, and Form A - all of these form fields has to be completed here.

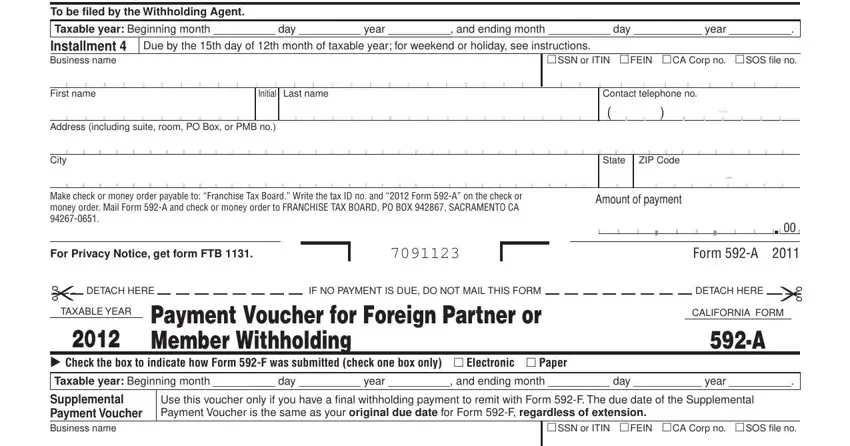

4. The fourth part comes with these particular blanks to look at: Payment Voucher for Foreign, To be filed by the Withholding Agent, Taxable year Beginning month day, Due by the th day of th month of, SSN or ITIN FEIN CA Corp no, First name, Initial Last name, Address including suite room PO, City, Make check or money order payable, For Privacy Notice get form FTB, Contact telephone no, State ZIP Code, Amount of payment, and Form A.

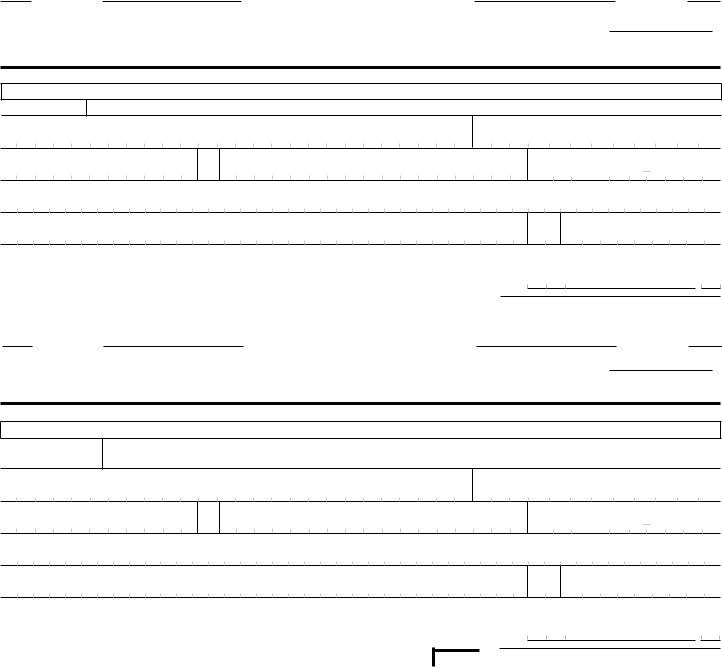

5. While you reach the finalization of your document, you'll find several more requirements that must be fulfilled. Specifically, First name, Initial Last name, Address including suite room PO, City, Make check or money order payable, For Privacy Notice get form FTB, Contact telephone no, State ZIP Code, Amount of payment, and Form A should all be done.

Step 3: Immediately after looking through the fields and details, click "Done" and you are done and dusted! Create a free trial plan with us and get immediate access to Form 592 A - which you'll be able to then start using as you wish from your FormsPal cabinet. At FormsPal.com, we do our utmost to guarantee that all of your information is kept protected.