The 668 d filling out process is quick. Our tool lets you work with any PDF file.

Step 1: The following page has an orange button that says "Get Form Now". Please click it.

Step 2: You are now allowed to modify 668 d. You've got plenty of options with our multifunctional toolbar - you'll be able to add, erase, or alter the content material, highlight its specific areas, as well as perform similar commands.

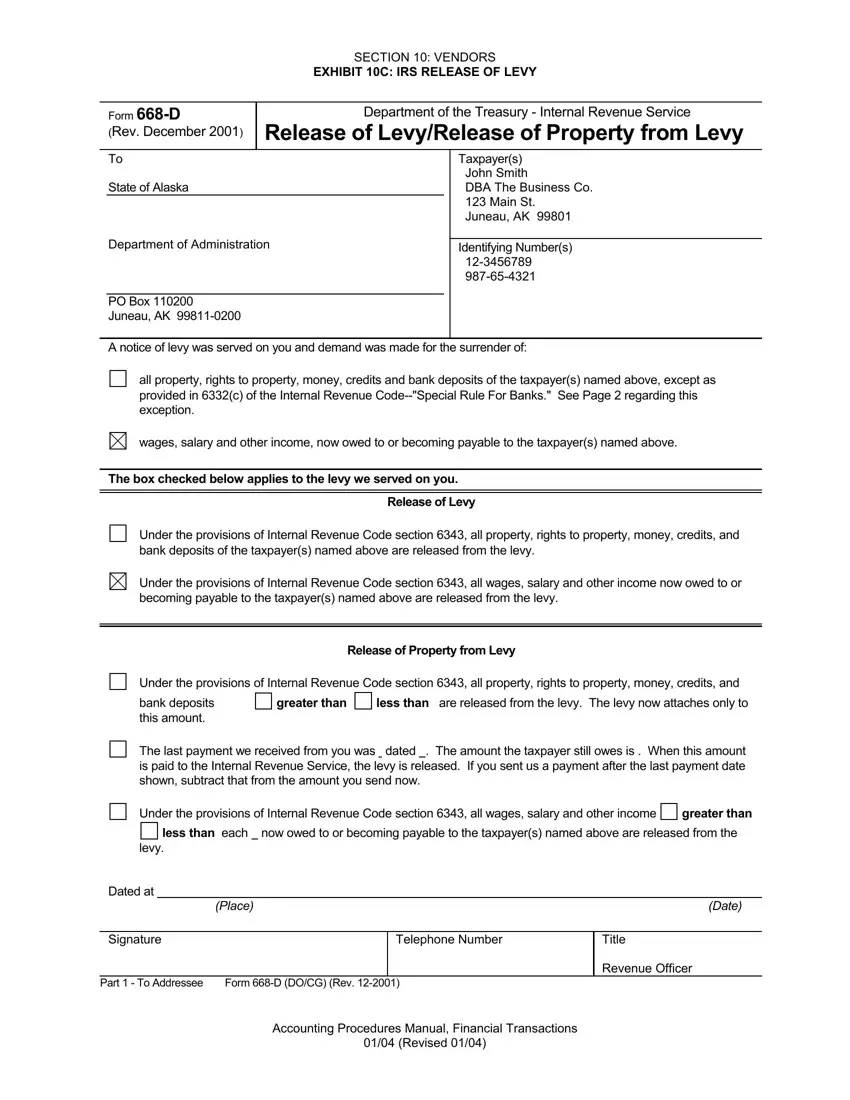

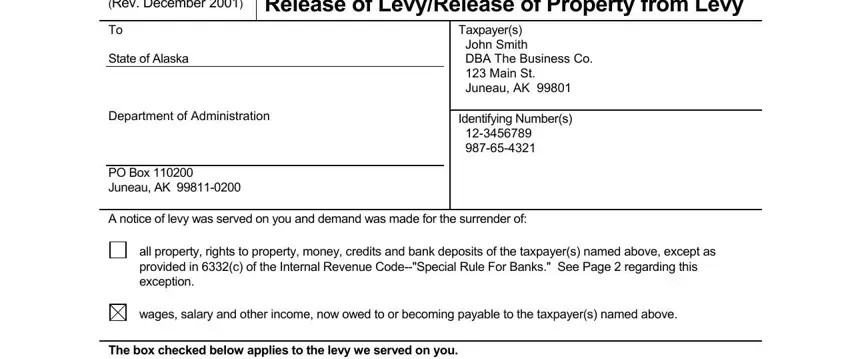

These areas are contained in the PDF form you'll be filling in.

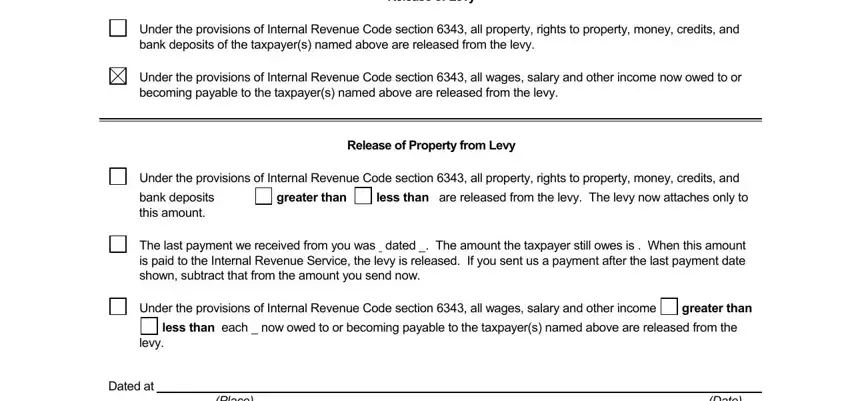

Complete the Release of Levy, Under the provisions of Internal, Under the provisions of Internal, Release of Property from Levy, Under the provisions of Internal, bank deposits this amount, greater than, less than are released from the, The last payment we received from, Under the provisions of Internal, greater than, less than each now owed to or, levy, Dated at Place, and Date field with the details asked by the application.

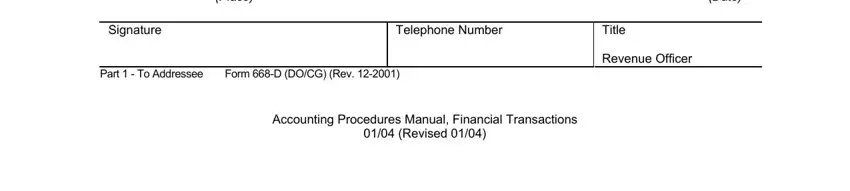

You'll be expected to type in the particulars to help the platform prepare the area Dated at Place, Date, Signature, Telephone Number, Title, Part To Addressee, Form D DOCG Rev, Revenue Officer, and Accounting Procedures Manual.

Step 3: Click the button "Done". Your PDF form can be exported. You can save it to your device or email it.

Step 4: It will be better to create copies of your form. You can rest easy that we won't distribute or read your data.