Managing documents with our PDF editor is more straightforward compared to anything. To modify form 6765 example the document, there is little you need to do - basically continue with the actions down below:

Step 1: This webpage contains an orange button stating "Get Form Now". Simply click it.

Step 2: Now, you can begin editing your form 6765 example. Our multifunctional toolbar is available to you - add, erase, alter, highlight, and carry out many other commands with the words and phrases in the file.

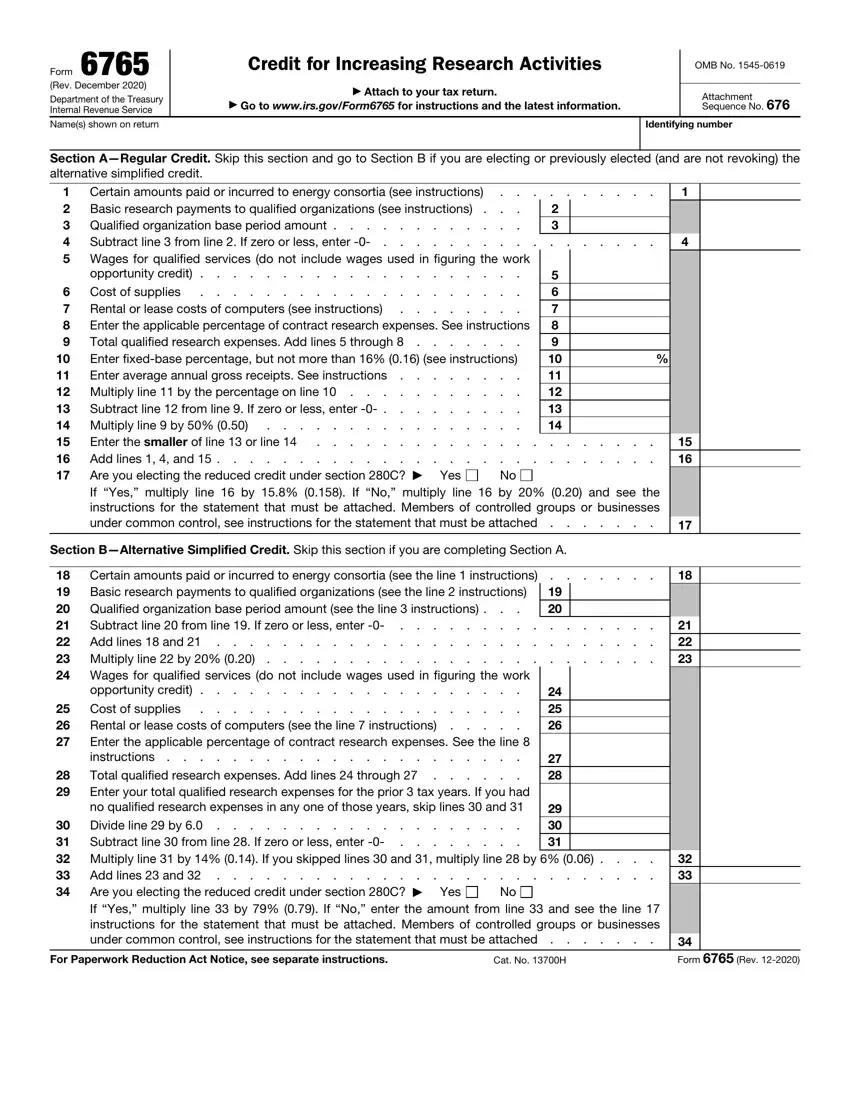

Feel free to type in the following details to fill out the form 6765 example PDF:

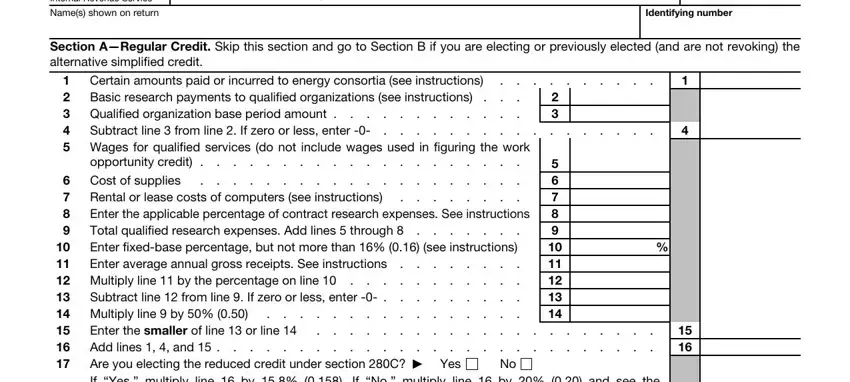

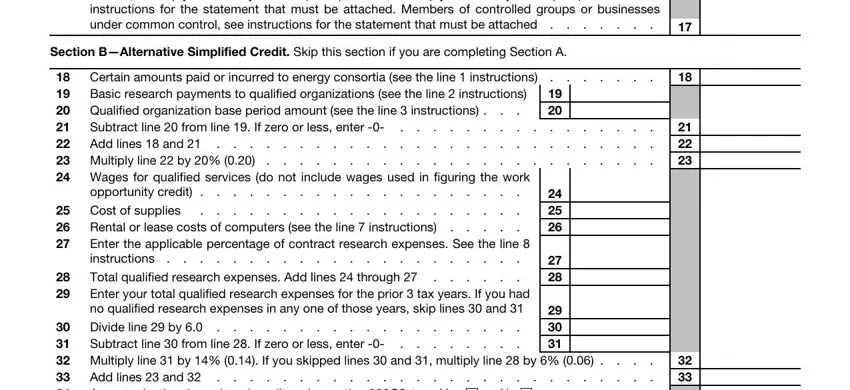

Enter the appropriate data in the area Enter the smaller of line or, Section BAlternative Simplified, Basic research payments to, Certain amounts paid or incurred, Wages for qualified services do, Subtract line from line If zero, Cost of supplies Rental or, Enter the applicable percentage of, Subtract line from line If, Divide line by Multiply line, and Add lines and Are you electing.

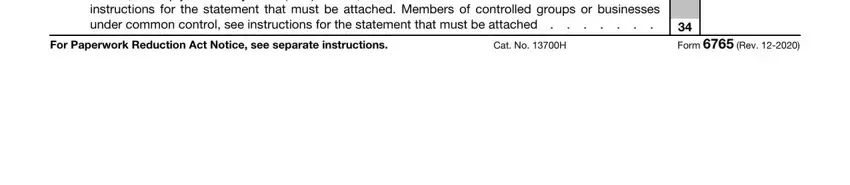

Determine the important details in the Add lines and Are you electing, For Paperwork Reduction Act Notice, Cat No H, and Form Rev part.

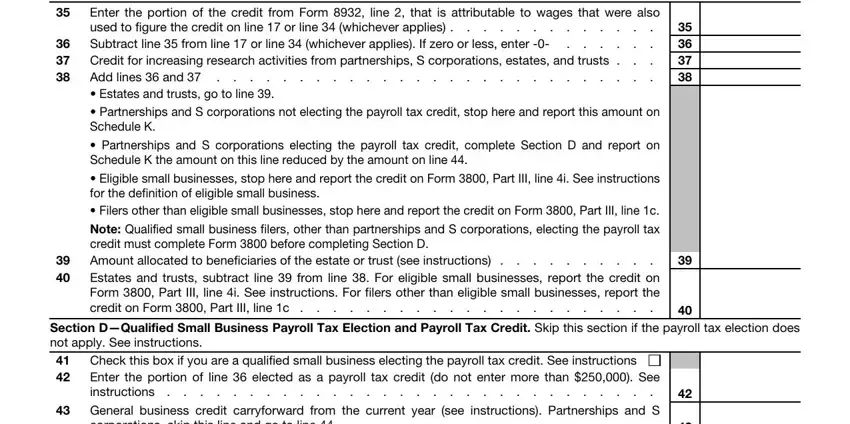

For space Enter the portion of the credit, Credit for increasing research, Add lines and Estates and, Section DQualified Small Business, Check this box if you are a, General business credit, and corporations skip this line and go, state the rights and responsibilities.

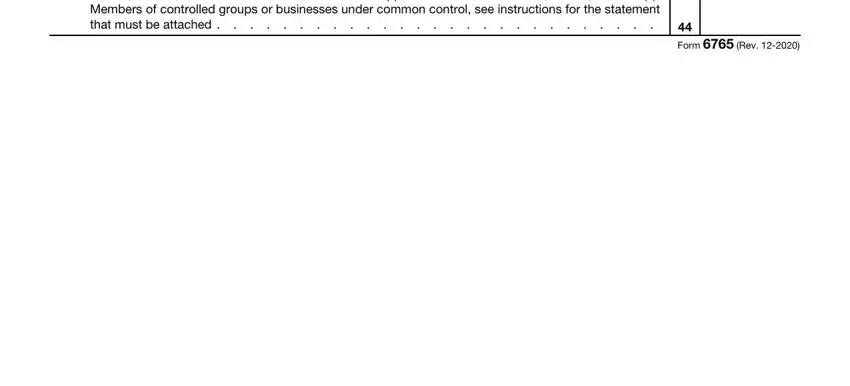

Fill in the document by checking all these areas: Partnerships and S corporations, and Form Rev.

Step 3: Hit "Done". You can now upload the PDF document.

Step 4: To prevent probable future concerns, please be sure to obtain at least several copies of each and every form.