This PDF editor was developed with the goal of making it as effortless and user-friendly as possible. These actions will help make filling out the 710a form fast and simple.

Step 1: The following website page includes an orange button stating "Get Form Now". Please click it.

Step 2: You are now able to edit 710a form. You've got lots of options with our multifunctional toolbar - you can include, erase, or alter the information, highlight its specific parts, as well as undertake other sorts of commands.

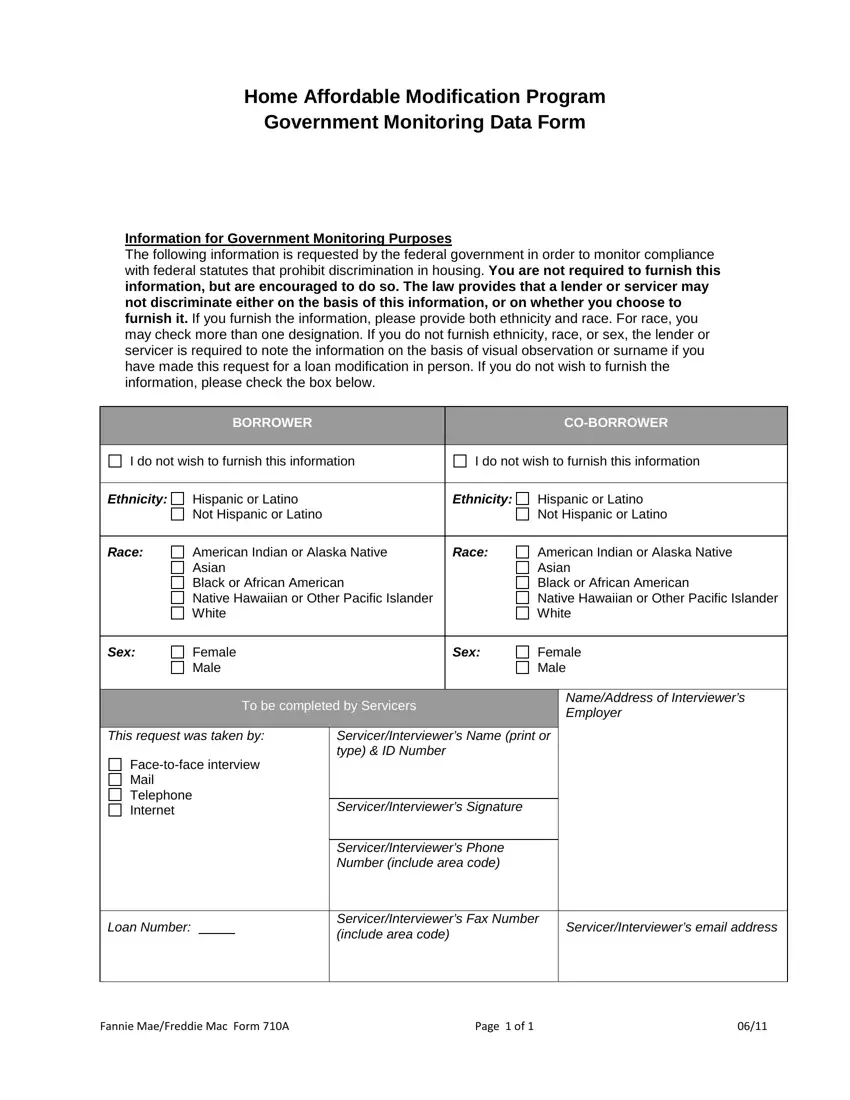

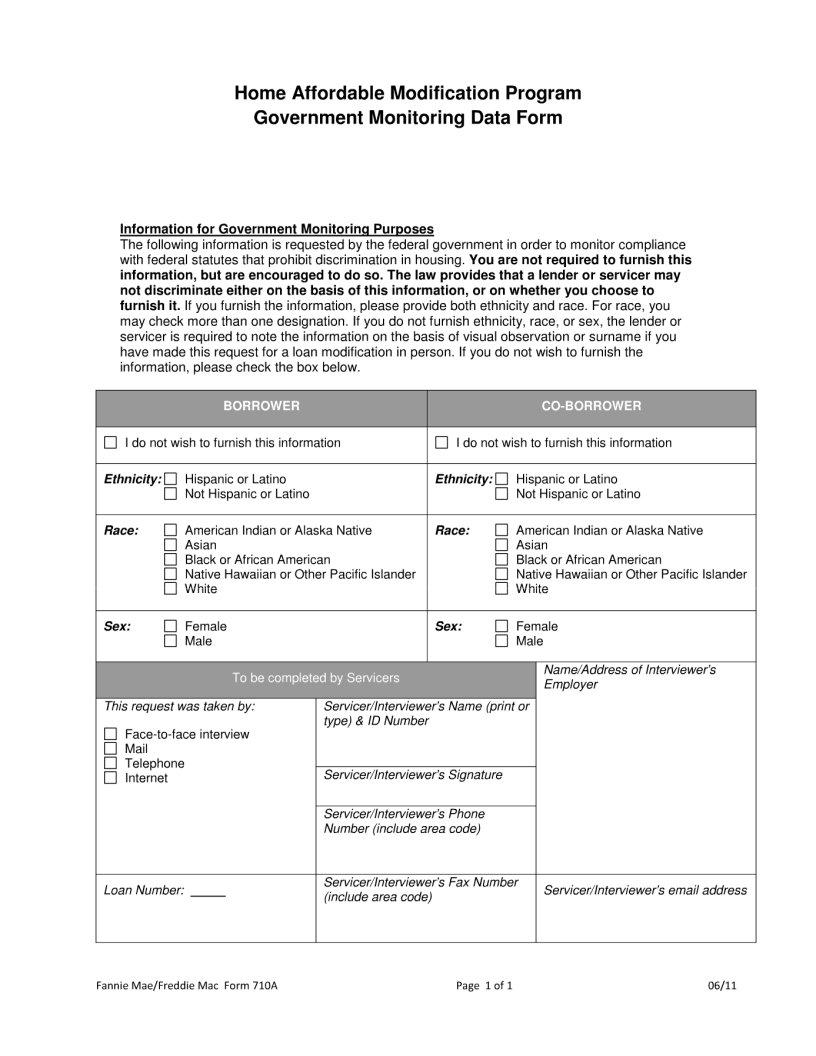

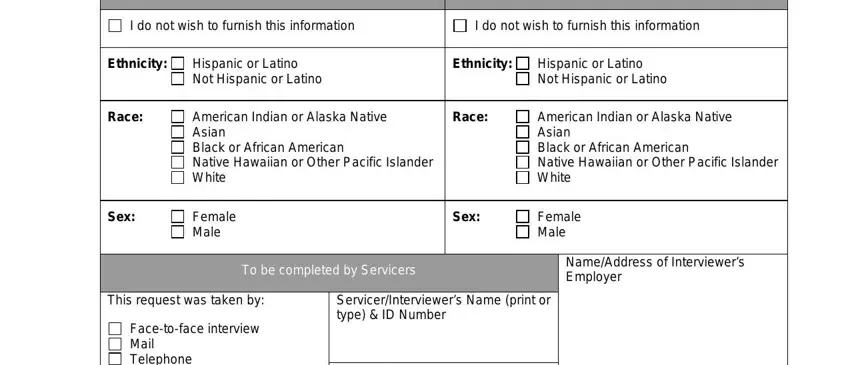

The PDF document you plan to create will contain the following parts:

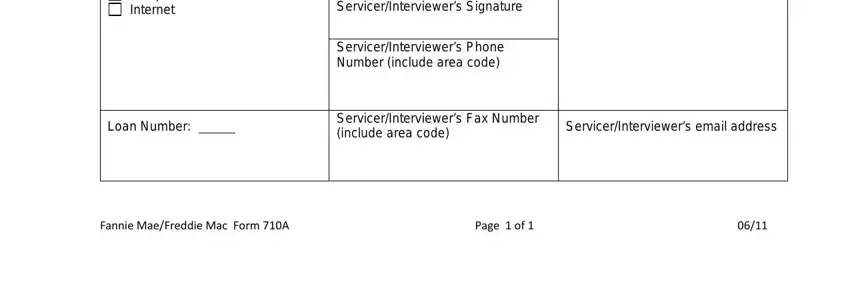

Put the demanded data in the Loan, Number Service, r, Interviewers, Signature Service, r, Interviewers, email, address Fannie, Mae, Freddie, Mac, Form, A and Page, of area.

Step 3: After you click the Done button, your finished file is readily transferable to any of your gadgets. Or, you can send it by using email.

Step 4: Be sure to generate as many copies of your document as possible to avoid potential misunderstandings.