Our top level web programmers worked hard to create the PDF editor we're delighted to present to you. Our app helps you quickly fill in irs form 668 z release of federal tax lien and can save your time. You just have to stick to this particular guideline.

Step 1: The initial step would be to select the orange "Get Form Now" button.

Step 2: So you are going to be on your document edit page. You'll be able to add, adjust, highlight, check, cross, add or delete areas or text.

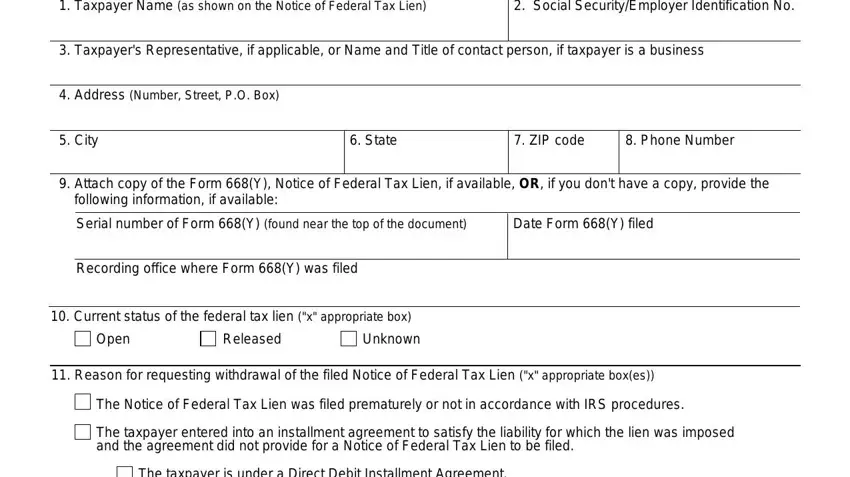

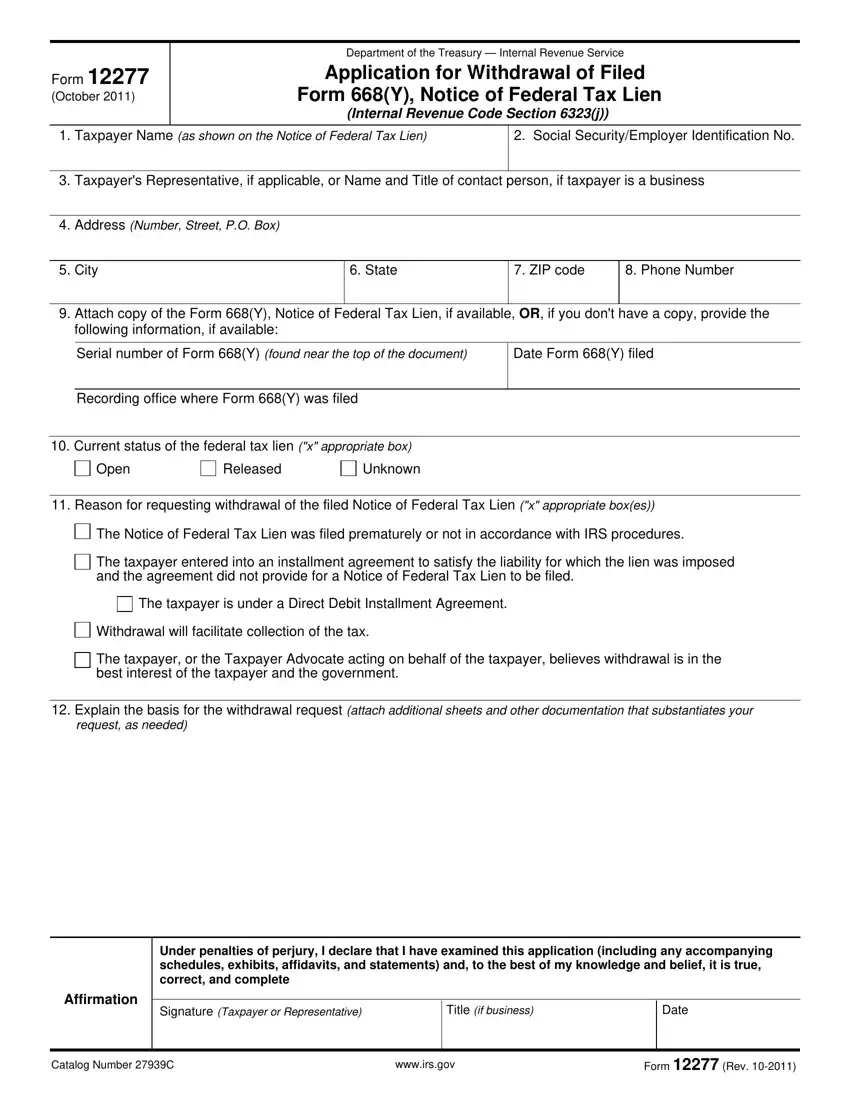

Feel free to provide the following information to create the irs form 668 z release of federal tax lien PDF:

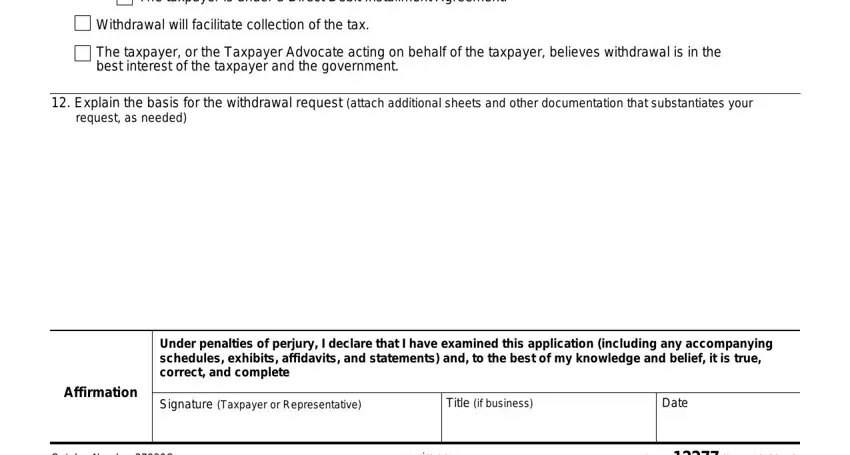

Provide the necessary particulars in the The taxpayer is under a Direct, Withdrawal will facilitate, The taxpayer or the Taxpayer, Explain the basis for the, request as needed, Under penalties of perjury I, Affirmation, Signature Taxpayer or, Title if business, Date, Catalog Number C, wwwirsgov, and Form Rev area.

The program will ask for extra info with a purpose to instantly complete the field Catalog Number C, wwwirsgov, and Form Rev.

Step 3: As you select the Done button, your finished file is easily exportable to all of your gadgets. Or, you might send it by means of mail.

Step 4: Be sure to create as many duplicates of your document as you can to avoid possible issues.

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the best interest of the taxpayer and the government.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the best interest of the taxpayer and the government.