Form 709-A, known as the Short Form Gift Tax Return, was a version used in the past to facilitate simpler gift tax reporting requirements under certain conditions. Specifically designed for married couples who sought to report nontaxable gifts in a manner that allowed them to split the gifts' values, this form represented a streamlined alternative to the more detailed Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. It catered to citizens or residents of the United States who were married throughout the entire calendar year and whose gift-giving activities fell within specific parameters, such as the type of recipient and the amount per recipient. The form required detailed information about the donor, including social security numbers, residence, and citizenship status, alongside inquiries about previous gift tax return filings. Crucially, it distinguished between gifts to a spouse, which had varying reporting requirements based on the spouse's citizenship, and gifts to non-spousal recipients — specifically highlighting the exclusion of certain gifts for educational or medical expenses from the reporting requirement. Form 709-A encapsulated procedural aspects, such as consent from spouses to split gift amounts and legal declarations from the donor (and preparer, if applicable), underlining the rigorous attention to detail warranted in tax compliance. Moreover, the form underscored the potential tax liability implications of gift-splitting between spouses, despite the form's use indicating no immediate tax due. It represented a critical document for eligible taxpayers navigating the complexities of gift taxation while attempting to leverage allowances within tax law for their benefit.

| Question | Answer |

|---|---|

| Form Name | Form 709 A |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | nontaxable, terminable, Washington, Donees |

Form 7 0 9 - A

(Rev. July 1993)

Department of the Treasury Internal Revenue Service

United States Short Form Gift Tax Return

(For “Privacy Act” notice, see the Form 1040 instructions)

Calendar year 19

OMB No.

Expires

1 |

Donor’s first name and middle initial |

2 Donor’s last name |

3 |

Donor’s social security number |

|

|

|

|

|

|

|

4 |

Address (number, street, and apartment number) |

|

5 |

Legal residence (domicile) |

|

|

|

|

|

|

|

6 |

City, state, and ZIP code |

|

7 |

Citizenship |

|

|

|

|

|

|

|

8 |

Did you file any gift tax returns for prior periods? |

|

|

Yes |

No |

|

If “Yes,” state when and where earlier returns were filed ▶ |

|

|

|

|

9 |

Name of consenting spouse |

|

10 |

Consenting spouse’s |

|

|

|

|

|

social security number |

|

|

|

|

|

|

|

Note: Do not use this form to report gifts of closely held stock. Instead, use Form 709.

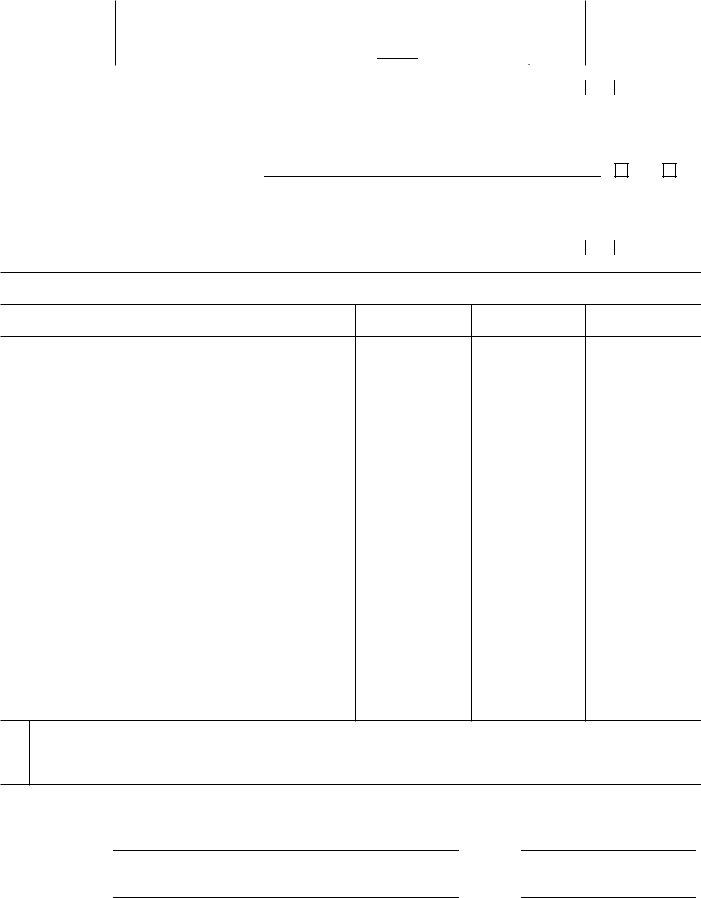

List of Gifts

(a)

Donee’s name and address and description of gift

(b)

Donor’s adjusted

basis of gift

(c)

Date of gift

(d)

Value at date of gift

Consent

I consent to have the gifts made by my spouse to third parties during the calendar year considered as made

Consenting |

|

spouse’s signature ▶ |

Date ▶ |

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief it is true, correct, and complete. Declaration of preparer (other than donor) is based on all information of which preparer has any knowledge.

Donor’s signature ▶ |

Date ▶ |

|

|

Preparer’s signature |

|

|

|

(other than donor’s) ▶ |

Date ▶ |

|

|

Preparer’s address |

|

|

|

(other than donor’s) ▶ |

|

|

|

For Paperwork Reduction Act Notice, see the instructions on the reverse side of this form. |

Cat. No. 10171G |

Form |

|

Form |

Page 2 |

|

|

General Instructions

For Privacy Act notice, see the Form 1040 instructions.

Paperwork Reduction Act

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

13 min. |

Learning about the |

|

law or the form |

11 min. |

Preparing the form |

14 min. |

Copying, assembling, |

|

and sending the |

|

form to the IRS |

20 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form more simple, we would be happy to hear from you. You can write to both the Internal Revenue Service, Attention: Reports Clearance Officer, T:FP, Washington, DC 20224; and the Office of Management and Budget, Paperwork Reduction Project

Introduction

Form

Who May File

Gifts to your

Gifts to donee other than your spouse.—

You must file a gift tax return if you gave either of the following gifts to someone other than your spouse:

1. Gifts of future interests of any amount;

or

2.Gifts of present interests of more than $10,000 to any one donee.

1.Gifts that were paid on behalf of an individual as tuition to an educational organization; or

2.Gifts that were paid on behalf of an individual as payment for medical care to a provider of medical care.

You may use Form

1.You are a citizen or resident of the United States, and were married during the entire calendar year to one individual who is also a citizen or resident of the United States. Both you and your spouse must have been alive at the end of the calendar year.

2.Your only gifts (other than gifts for tuition or medical care) to a third party consisted entirely of present interests in tangible personal property, cash, U.S. Savings Bonds, or stocks and bonds listed on a stock exchange. A “

3.Your gifts to any one

4.During the calendar year, you did not make any gifts of terminable interests to your spouse.

5.During the calendar year, your spouse

did not make any gifts to any of the donees listed on this form, did not make gifts of terminable interests to you, did not make gifts (other than gifts for tuition or medical care) of over $10,000 to any other donee, and did not make any gifts of future interests to any other donee.

6.You and your spouse agree to split all of the gifts either of you made during the calendar year.

7.You did not file a Form 709 for this calendar year.

If all seven requirements above are met, you may also use Form

Note: Gifts include transfers of property when no money changes hands and also transfers when some payment was made, but the payment made was less than the value of the item transferred.

When To File

Form

Any extension of time granted to file your calendar year income tax return will also extend the time to file Form

You may not file Form

Where To File

File Form

Additional Help

Pub. 448, Federal Estate and Gift Taxes, contains further information on the gift tax, including information about the following matters:

1.Annual exclusion.

2.Present and future interest.

3.Fair market value.

4.Adjusted basis. Get Pub. 551, Basis of Assets, and the instructions for Schedule D (Form 1040).

5.Extension of time to file.

6.Terminable interest.

7.Gifts for tuition or medical care.

Specific Instructions

Column (a)

List the names and addresses of all third party donees to whom you made gifts (other than gifts for tuition or medical care) totaling more than $10,000 during the calendar year. Do not list the names of donees to whom you gave only gifts for tuition or medical care or to whom you gave gifts (other than tuition or medical care) of present interests of $10,000 or less.

Describe the gifts in enough detail so they may be easily identified.

If you list bonds, include in your description:

●The number of bonds transferred;

●The principal amount of the bonds;

●The name of the obligor;

●The date of maturity of the bonds;

●The rate of interest;

●The date or dates on which interest is payable;

●The series number (if there is more than one issue);

●The exchange where the bond is listed; and

●The CUSIP number, if available. The CUSIP number is a

If you list stocks, you should include:

●The number of shares transferred;

●Whether the stocks are common or preferred. (If the stocks are preferred, list the issue and par value.);

●Exact name of corporation;

●Principal exchange where the stocks are sold; and

●The CUSIP number, if available (see

“ bonds” above).

If you list tangible personal property (such as a car), describe the property in enough detail so that its fair market value can be accurately figured.

Column (b)

Show the basis you would use for income tax purposes if you sold or exchanged the property.

Column (d)

If you make the gift in property other than money, determine the fair market value as of the date the gift was made.

Consent

Your spouse must consent to split all gifts made by either of you. Your spouse gives this consent by signing in the space provided. You give your consent by signing in the space for the donor’s signature. The guardian of a legally incompetent spouse may sign the consent. The executor for a deceased spouse may sign the consent if the spouse died after the close of the calendar year. Although a properly filed Form

Signature

You, as a donor, must sign the return. If you pay another person, firm, or corporation to prepare your return, that person must also sign the return as preparer unless he or she is your regular,