The IRS Form 720X is a form that taxpayers use to amend their federal income tax return. There are many reasons why someone may need to file an amended return, and the Form 720X can be used for a variety of purposes. In this blog post, we'll go over what you need to know about the Form 720X and when you may need to use it. We'll also provide some tips on how to complete the form correctly so that you can avoid any potential problems with the IRS. Thanks for reading! Form 720X is one of several forms used by taxpayers who need to amend their Federal Income Tax returns. The major reason people use this form, specifically, is because they have made errors on their original 1040 tax form which cause them incorrect information as well as extra taxes owed/refunds not received. Other reasons for filing an amended return exist too - such as making changes in marital status or dependent deductions claimed after originally filing - but correcting inaccuracies from the original 1040 will top

| Question | Answer |

|---|---|

| Form Name | Form 720X |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | 720x, claimant, preparer, agri |

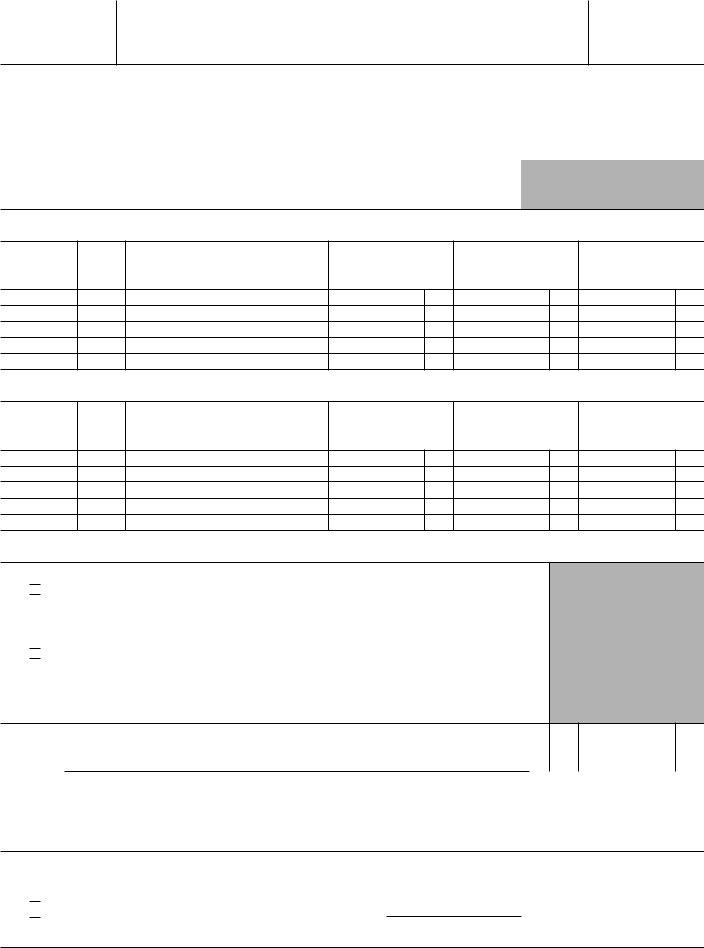

Form 720X (Rev. January 2009)

Department of the Treasury Internal Revenue Service

Amended Quarterly Federal Excise Tax Return

▶Use to correct a previously filed Form 720.

OMB No.

Type

or

Name (as shown on Form 720) |

Employer identification number (EIN) |

|

|

|

|

Number, street, and room or suite no. |

Telephone number (optional) |

|

|

( |

) |

|

|

|

City or town, state, and ZIP code |

|

|

|

|

|

1Adjustments to Liability Reported on Previously Filed Forms 720

(a)

Quarter ending

(b)

IRS No.

(c)

Tax

(d)

Tax as originally reported

on Form 720 or as previously adjusted

(e)

Adjusted tax

(f)

Change

(subtract col. (d)

from col. (e))

2 Adjustments to Schedule C (Form 720) (see instructions for allowable adjustments)

(a)

Quarter ending

(b)

CRN

(c)

Credit

(d)

Credit as originally

reported on Form 720 or as previously adjusted

(e)

Adjusted credit

(f)

Change (subtract col. (e) from col. (d))

3Statement in Support of Adjustment. For tax decreases only, indicate below the statement that applies to the adjustment.

aFor IRS Nos. 22, 26, 28, or 27, only collectors using the regular method for deposits check the box below. The claimant has repaid the amount of the tax to the person from whom it was collected

or has obtained the consent of that person to the allowance of the adjustment.

bFor all other IRS Nos. except for 18, 21, 98, 19, 29, 31, 30, 64, 125, 51, 117, and 20, or if the tax was based on use for 71, 79, 112, 118,

The claimant has not included the tax in the price of the article and has not collected the tax from the purchaser, has repaid the tax to the ultimate purchaser, or has attached the written consent of the ultimate purchaser to the allowance of the adjustment.

Caution. IRS No. 71 can only be adjusted for periods ending before January 1, 2008.

IRS Nos. 61 and 101 can only be adjusted for periods ending before October 1, 2006.

4Total adjustments. Combine all amounts in column (f) for lines 1 and 2 and enter the amount

here |

4 |

If the result is a balance due, pay the amount with this return. Enclose a check or money order with Form 720X and make it payable to the “United States Treasury.” Write on the check or money order: “Form 720X,” your name, address, EIN, and the date Form 720X was signed. Complete line 6 on page 2.

If the result is an overpayment, complete lines 5 and 6.

5Check if you want the overpayment:

a Refunded to you.

b Applied to your next Form 720. Enter quarter ending date. ▶ See Form 720 for how to apply your overpayment.

For Paperwork Reduction Act Notice, see the Instructions for Form 720. |

Cat. No. 32661B |

Form 720X (Rev. |

Form 720X (Rev. |

Page 2 |

6Explanation of adjustments. See the instructions for line 6 for requirements. Attach additional sheets with your name and EIN if more space is needed.

Sign Here

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

▶ |

|

|

|

|

Signature |

Date |

|

Title |

Type or print name below signature.

|

Preparer’s |

|

|

Date |

Check if |

Preparer’s SSN or PTIN |

||

|

|

|

|

|

|

|||

Paid |

signature ▶ |

|

|

|

|

|

||

|

|

|

|

|

||||

Preparer’s |

|

|

|

|

|

|

|

|

Firm’s name (or |

▶ |

|

|

|

EIN |

|

|

|

Use Only |

|

|

|

( |

) |

|||

address, and ZIP code |

|

|

|

Phone no. |

||||

|

yours if |

|

|

|

|

|

|

|

General Instructions |

|

When To File |

|

|

||||

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of Form

Use Form 720X to make adjustments to liability reported on Forms 720 you have filed for previous quarters. Do not use Form 720X to make changes to claims made on Schedule C (Form 720), except for the section 4051(d) tire credit and section 6426 credits.

Caution. You must include in gross income (income tax return) any overpayment from line 4 of Form 720X if you took a deduction on the income tax return that included the amount of the taxes and that deduction reduced the income tax liability. See Pub. 510, Excise Taxes, for more information.

Generally, adjustments that decrease your tax liability for a prior quarter must be made within 3 years from the time the return was filed or 2 years from the time the tax was paid, whichever is later.

Where To File

If you are filing Form 720X separately, send Form 720X to the Department of the Treasury, Internal Revenue Service, Cincinnati, OH

Specific Instructions

Line 1

Report each adjustment separately on line 1. You can use line 6 for your explanation or you can attach additional sheets with your name and EIN as needed.

Form 720X (Rev. |

Page 3 |

Communications excise tax, toll telephone service. Collectors stopped collecting and paying over the tax on nontaxable service billed after July 31, 2006. See Pub. 510 for the definition of nontaxable service. Collectors using the regular method for deposits must use Form 720X to claim a credit or refund for nontaxable service if the collector has repaid the tax to the person from whom the tax was collected, or obtained the consent of that person to the allowance of the credit or refund. The refund period is for nontaxable service that was billed after February 28, 2003, and before August 1, 2006. Collectors using the alternative method for deposits must adjust their separate accounts. For more information, see the Instructions for Form 720, Notice

The above paragraph applies to nontaxable service billed to customers of the collector. All Form 720 taxpayers, including collectors, must request a credit or refund on their 2006 federal income tax return for nontaxable service paid by the taxpayer.

Column (a). Enter the quarter ending date of the Form 720 you are amending. If you are amending more than one quarter, make sure each quarter is clearly identified. Enter the date in the MMDDYYYY format. For example, if you are adjusting the first quarter return for 2009, enter “03312009.”

Column (d). Enter the tax amount for the IRS No. entered in column (b) as originally reported on Form 720 or as later adjusted by you or the IRS.

Column (e). Enter the adjusted tax liability that should have been reported for the IRS No. in column (b).

Column (f). If column (e) is greater than column (d), subtract column (d) from column (e). This is an increase. If column (d) is greater than column (e), subtract column (e) from column (d). This is a decrease. Show the decrease in parentheses.

Line 2

4051(d) tire credit. You must use line 2 to report any adjustment to the section 4051(d) tire credit for a prior quarter. For example, if you report an additional taxable vehicle on line 1 for IRS No. 33, the applicable tire credit is reported on line 2. Enter CRN 366 in column 2(b). See the Instructions for Form 720 for more information on the tire credit.

6426 credits. You must use line 2 to report any adjustment to section 6426 credits, if (a) you are reporting a change to certain taxable fuel liability (section 4081 liability in the case of mixtures or section 4041 liability in the case of alternative fuel) on line 1, or (b) you were unable to claim the credits against the section 4041 or 4081 liability on a prior Form 720 because you were not registered. Section 6426 credits include the alcohol fuel mixture credit, biodiesel or renewable diesel mixture credit, alternative fuel credit, and alternative fuel mixture credit. Use a separate line for each adjustment. Enter the CRN from the table below in column 2(b). You must also complete line 6.

Credit |

CRN |

Credit Rate |

|

|

|

Alcohol fuel mixture credit |

|

|

Alcohol fuel mixtures containing ethanol |

393 |

$ .51/.45* |

Alcohol fuel mixtures containing alcohol |

394 |

.60 |

(other than ethanol) |

|

|

|

|

|

Biodiesel or renewable diesel mixture credit |

|

|

Biodiesel (other than |

388 |

.50/1.00* |

mixtures |

|

|

|

|

|

390 |

1.00 |

|

Renewable diesel mixtures |

307 |

1.00 |

Alternative fuel credit and alternative fuel mixture credit |

|

|

Liquefied petroleum gas (LPG) |

426 |

.50 |

“P Series” fuels |

427 |

.50 |

Compressed natural gas (CNG) |

428 |

.50 |

Liquefied hydrogen |

429 |

.50 |

Any liquid fuel derived from coal (including |

|

|

peat) through the |

430 |

.50 |

Liquid fuel derived from biomass |

431 |

.50 |

Liquefied natural gas (LNG) |

432 |

.50 |

Liquefied gas derived from biomass |

436 |

.50 |

Compressed gas derived from biomass |

437 |

.50 |

|

|

|

* This rate applies after December 31, 2008. |

|

|

Line 3a

Collectors using the alternative method for deposits must adjust their separate accounts for any credits or refunds made to customers of the collector. Form 720X cannot be used for this purpose. For more information, see Alternative method in the Instructions for Form 720.

Line 5

If you want your overpayment refunded to you, check the box for line 5a.

If you want your overpayment applied to your next Form 720, check the box for line 5b and enter the quarter ending date of your next Form 720. You can file Form 720X separately or you can attach it to your next Form 720.

Caution. If you checked the box on line 5b, be sure to include the overpayment amount on lines 6 and 7 on your next Form 720. See Form 720 for details. If you owe other federal tax, interest, or penalty, the overpayment will first be applied to the unpaid amounts.

Line 6

You can use line 6 for your explanation or you can attach additional sheets with your name and EIN as needed.

Adjustments on line 1. For each adjustment, you must include a detailed description of the adjustment and the computation of the amount.

Adjustments on line 2. Any section 6426 credits must first be applied against your section 4041 or 4081 liability. To make an adjustment, you must follow the instructions for lines 12, 13, and 14 in the Instructions for Form 720. For each adjustment you must attach a detailed explanation of the adjustment, including your registration number, and the computation of the amount. Your computation must include the number of gallons (or gasoline gallon equivalents for compressed gas) and credit rate (as shown above). You must include any information that is requested in the Instructions for Form 720, lines 12, 13, and 14. For example, the Certificate for Biodiesel and, if applicable, Statement of Biodiesel Reseller must be attached to Form 720X if it is the first claim filed that is supported by the certificate or statement. See the Instructions for Form 720 for more information.

Certifications. On line 6 or a separate sheet of paper, you must include the applicable statement shown below.

ALCOHOL FUEL MIXTURE CREDIT. Claimant produced an alcohol fuel mixture by mixing taxable fuel with alcohol. The alcohol fuel mixture was sold by the claimant to any person for use as a fuel or was used as a fuel by the claimant.

BIODIESEL MIXTURE CREDIT. Claimant produced a mixture by mixing biodiesel with diesel fuel. The biodiesel used to produce the mixture met ASTM D6751 and met EPA’s registration requirements for fuels and fuel additives. The mixture was sold by the claimant to any person for use as a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable, the Statement of Biodiesel Reseller.

RENEWABLE DIESEL MIXTURE CREDIT. Claimant produced a mixture by

mixing renewable diesel with liquid fuel (other than renewable diesel). The renewable diesel used to produce the renewable diesel mixture was derived from biomass, met EPA’s registration requirements for fuels and fuel additives, and met ASTM D975, D396, or other equivalent standard approved by the IRS. The mixture was sold by the claimant to any person for use as a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable, Statement of Biodiesel Reseller, both of which have been edited as discussed in the Instructions for Form 720.

ALTERNATIVE FUEL MIXTURE CREDIT. Claimant produced a mixture by mixing taxable fuel with alternative fuel. Claimant certifies that it (a) produced the alternative fuel, or (b) has in its possession the name, address, and EIN of the person(s) that sold the alternative fuel to the claimant; the date of purchase; and an invoice or other documentation identifying the amount of the alternative fuel. The claimant also certifies that it made no other claim for the amount of the alternative fuel, or has repaid the amount to the government. The alternative fuel mixture was sold by the claimant to any person for use as a fuel or was used as a fuel by the claimant.

Signature

Form 720X must be signed by a person authorized by the entity to sign this return. You must sign Form 720X even if it is filed with Form 720 to apply an overpayment.