Handling PDF documents online is always a piece of cake using our PDF editor. Anyone can fill in llet number 3 here effortlessly. The tool is consistently improved by our team, receiving new awesome functions and becoming greater. If you are seeking to start, here's what you will need to do:

Step 1: Press the "Get Form" button above. It will open our tool so you can start filling in your form.

Step 2: With the help of our online PDF editing tool, you can actually accomplish more than just fill out blank form fields. Edit away and make your documents seem perfect with customized text put in, or adjust the original content to perfection - all accompanied by an ability to insert stunning photos and sign the PDF off.

With regards to the fields of this precise form, this is what you should do:

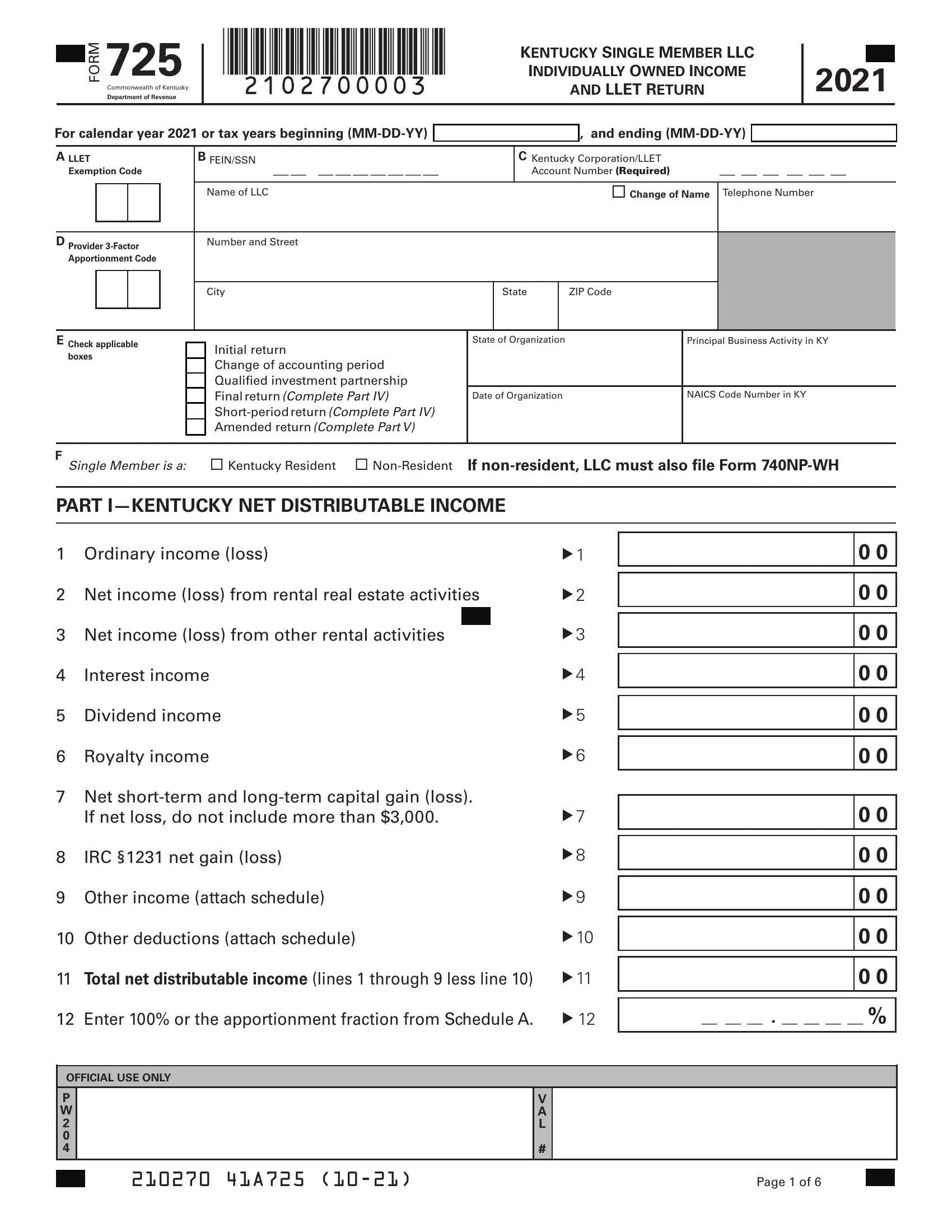

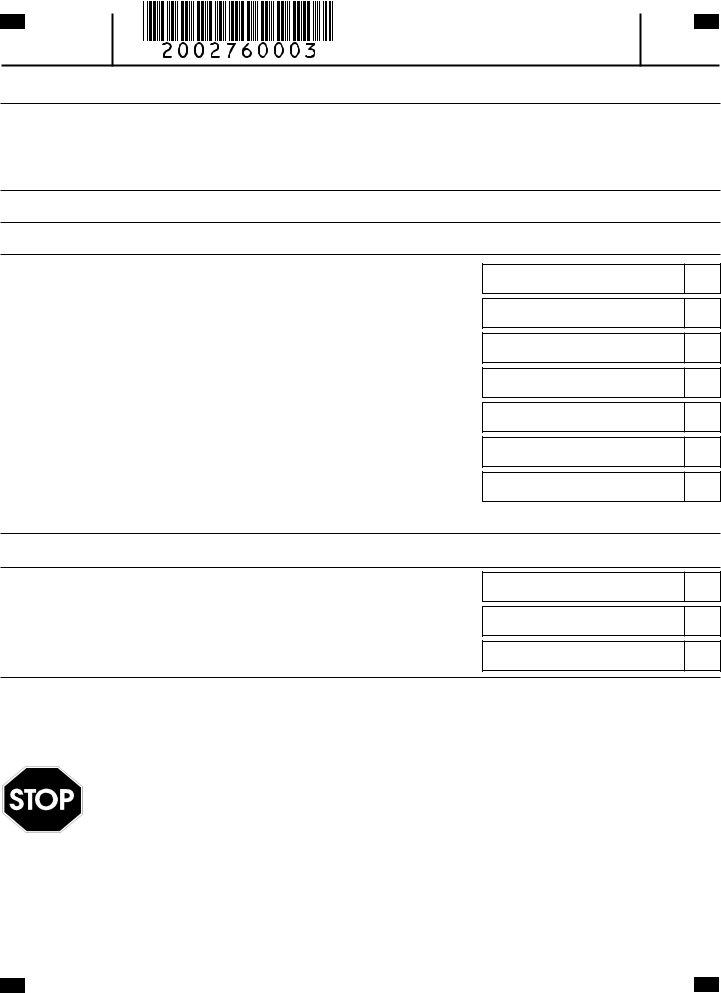

1. To begin with, while filling out the llet number 3, start in the page that features the next blank fields:

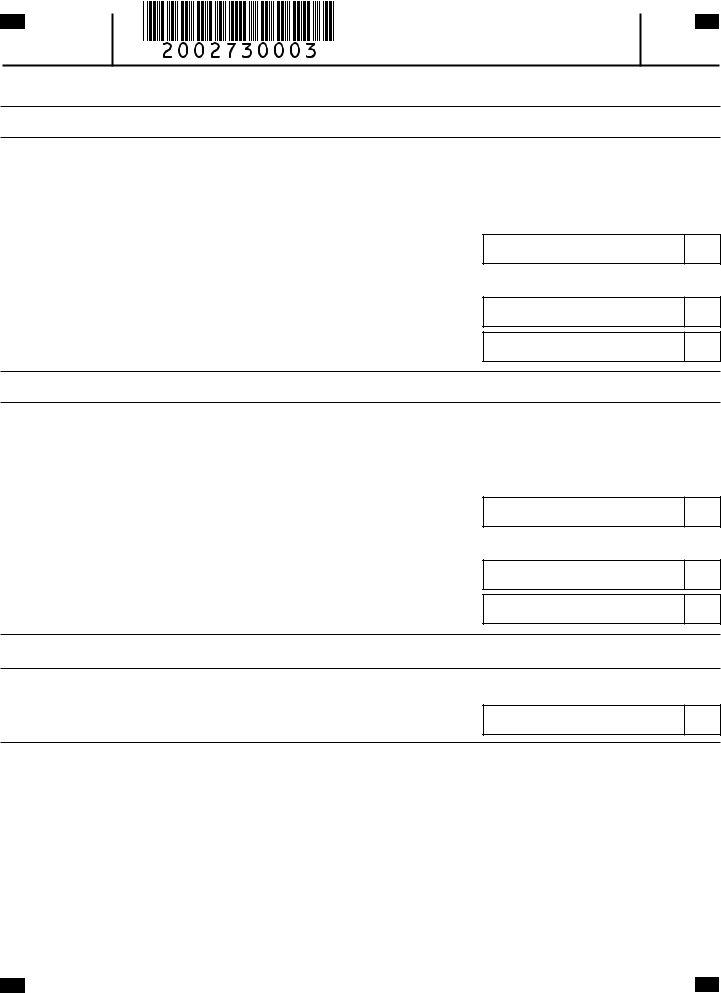

2. Once your current task is complete, take the next step – fill out all of these fields - Net income loss from rental real, Net income loss from other rental, Interest income, Dividend income, Royalty income, Net shortterm and longterm, If net loss do not include more, IRC net gain loss, Other income attach schedule, Other deductions attach schedule, Total net distributable income, and Enter or the apportionment with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

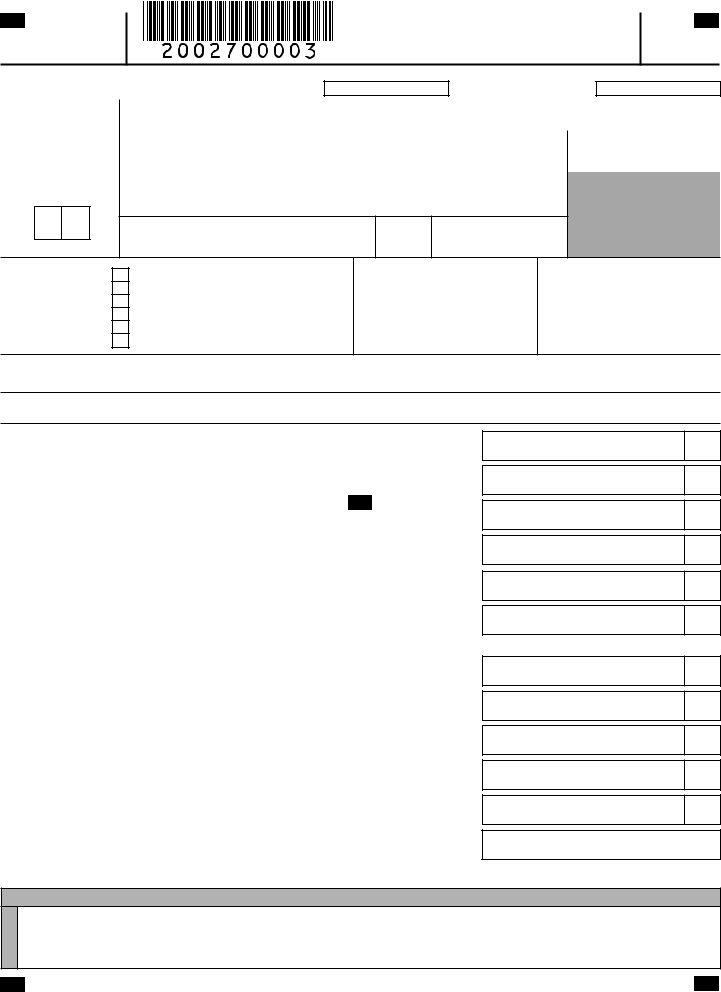

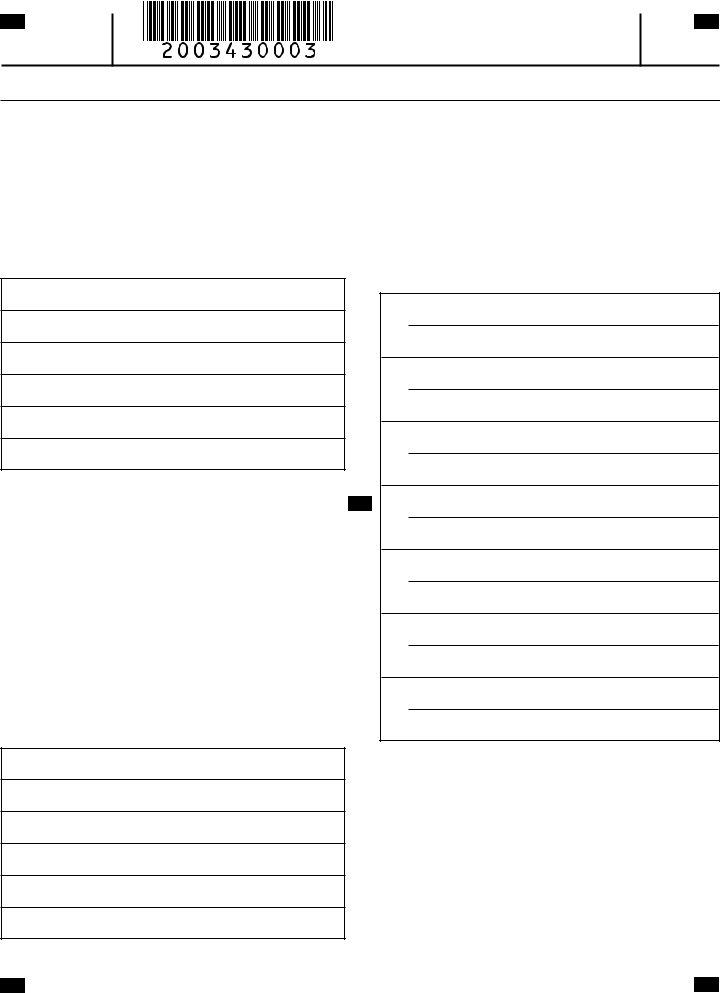

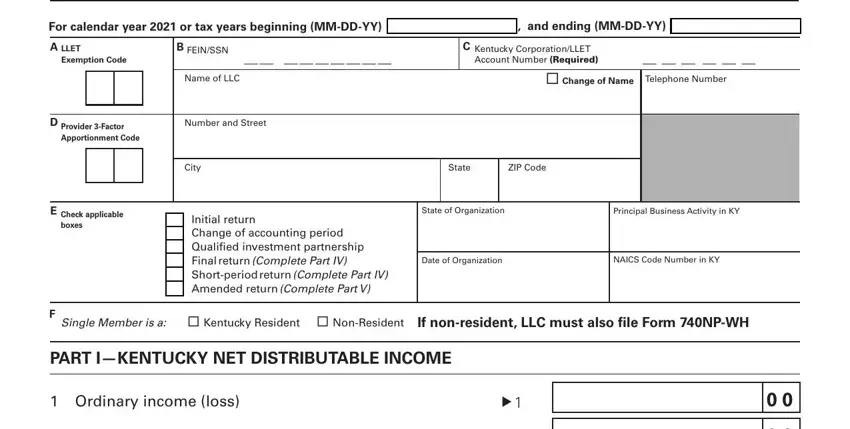

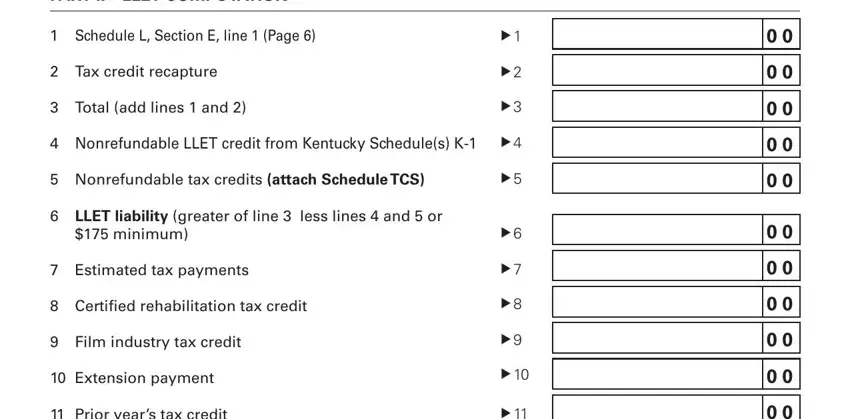

3. This next part is generally quite easy, PART IILLET COMPUTATION, Schedule L Section E line Page, Tax credit recapture, Total add lines and, Nonrefundable LLET credit from, Nonrefundable tax credits attach, LLET liability greater of line, minimum, Estimated tax payments, Certified rehabilitation tax credit, Film industry tax credit, Extension payment, and Prior years tax credit - every one of these blanks will have to be filled in here.

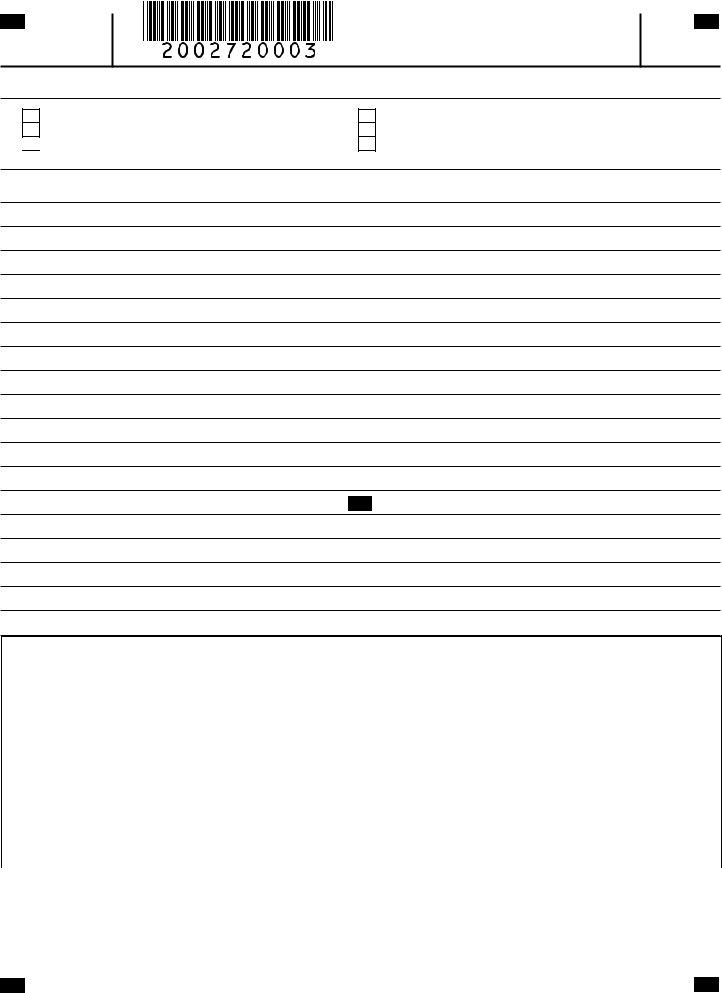

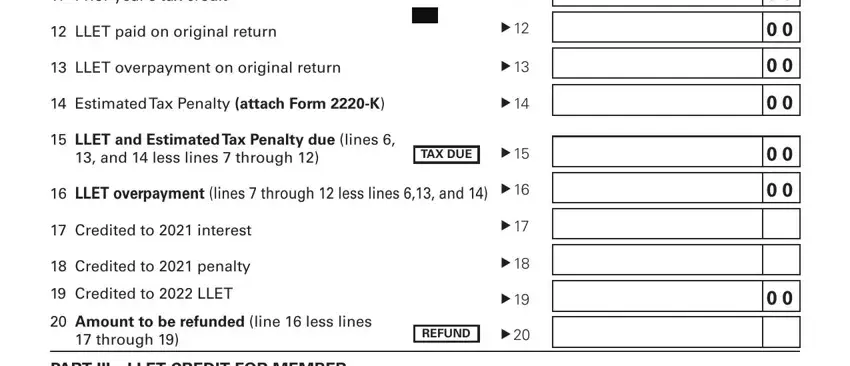

4. To go ahead, your next stage requires filling out a couple of blank fields. Examples include Prior years tax credit, LLET paid on original return, LLET overpayment on original, Estimated Tax Penalty attach Form, LLET and Estimated Tax Penalty, and less lines through, TAX DUE, LLET overpayment lines through, Credited to interest, Credited to penalty, Credited to LLET, Amount to be refunded line less, through, REFUND, and PART IIILLET CREDIT FOR MEMBER, which you'll find vital to moving forward with this process.

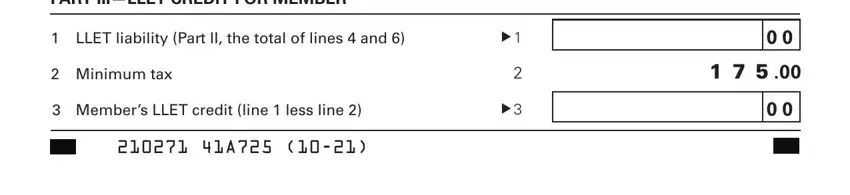

5. This last notch to conclude this form is essential. You need to fill in the necessary form fields, for example PART IIILLET CREDIT FOR MEMBER, LLET liability Part II the total, Minimum tax, and Members LLET credit line less, before submitting. Otherwise, it may give you an incomplete and potentially invalid paper!

In terms of PART IIILLET CREDIT FOR MEMBER and LLET liability Part II the total, make sure you review things in this current part. Both of these are considered the key ones in the page.

Step 3: Right after taking one more look at your fields you've filled out, press "Done" and you're good to go! Right after registering afree trial account at FormsPal, you'll be able to download llet number 3 or email it immediately. The PDF will also be at your disposal in your personal account menu with your every single modification. We don't sell or share any details that you enter while completing forms at our website.