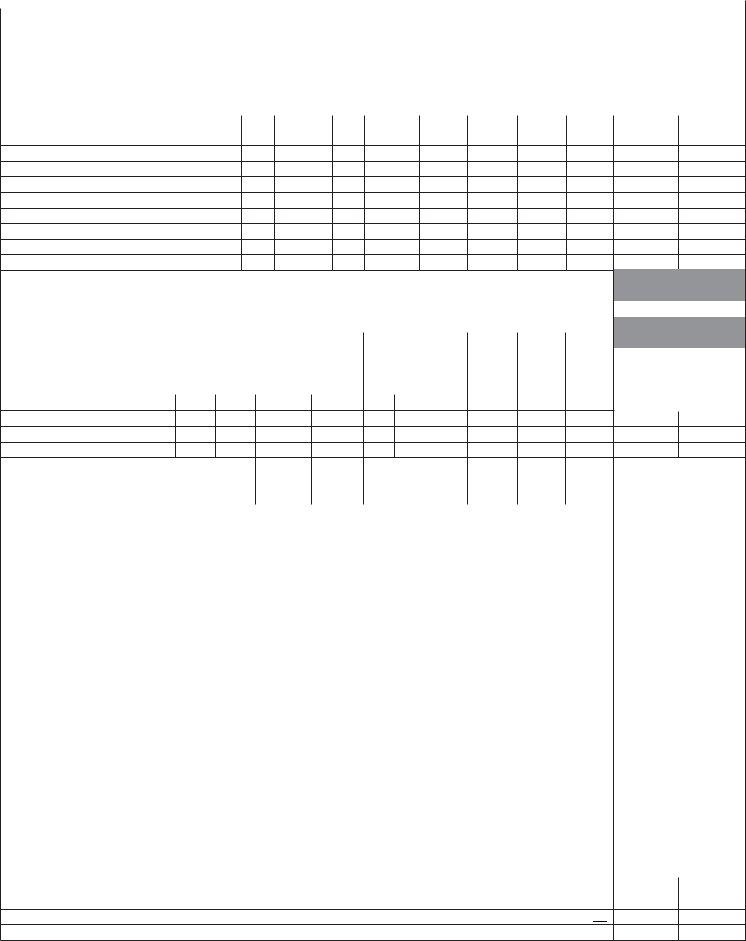

Understanding the intricacies of local taxation in Virginia, particularly when it pertains to tangible personal property, machinery and tools, and merchants' capital, can become a formidable task without the proper guidance. The Form 762, designated for the Return of Tangible Personal Property, Machinery and Tools, and Merchants’ Capital-For Local Taxation Only, serves as a comprehensive document required by Virginia residents for the year 2009. Essentially, this form offers a structured approach for reporting various types of tangible properties ranging from vehicles and boats to manufactured homes, aircraft, and even office equipment. Besides personal properties, it meticulously covers areas concerning machinery and tools employed in businesses, illuminating the specifics that differentiate personal assets from those used for commercial purposes. Moreover, the form delves into merchants' capital, demanding a detailed enumeration of inventory stock along with other taxable assets that a merchant might possess. This document not only aids in maintaining transparency with local tax authorities but also ensures individuals and businesses comply with the taxation laws specific to Virginia. Additionally, by setting forth guidelines regarding the taxability and assessment methods of different property types, Form 762 plays a pivotal role in simplifying the otherwise complex domain of local taxation, thereby facilitating a smoother transaction between taxpayers and tax collectors.

| Question | Answer |

|---|---|

| Form Name | Form 762 Virginia |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 762 virginia 762 form |

F |

RETURN OF TANGIBLE PERSONAL PROPERTY, MACHINERY AND TOOLS, |

2009 |

|||||||||||

O |

|

|

|

|

|

|

|

|

|

|

|||

RM 762 |

AND MERCHANTS’ CAPITAL — FOR LOCAL TAXATION ONLY |

|

|||||||||||

VIRGINIA |

Please print |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social security number or FEIN |

|||||

Name |

|

|

|

|

Name of wife or husband |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s social security number |

|||

Home address |

|

Number and street or rural route |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County or City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town or post office |

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

District, Ward or Town |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I TANGIBLE PERSONAL PROPERTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Motor vehicles |

* Leased vehicles for business use |

Business |

Trade Name of |

|

Model |

No. Cylinders |

Date |

Number |

Air Cond. |

Fair Market Value |

Fair Market Value |

||

Use |

Year |

or |

or |

Yes or |

as Listed by |

as Ascertained by |

|||||||

|

|

Motor Vehicle |

Acquired |

Owned |

Commissioner |

||||||||

do not qualify for the personal property tax reduction. |

Yes or No |

|

Series |

Tonnage |

No |

Taxpayer |

|||||||

|

|

|

|

|

of the Revenue |

||||||||

(a)Automobiles (not daily rental passenger cars)

VIN:

VIN:

(b)Motorcycles

(c)Trucks

(d)Tractors and trailers

(e)Antique motor vehicles

(f)All other motor vehicles and motor homes

2. Manufactured (mobile) offi ces, campers, travel trailers and recreational camping trailers

Manufacturer |

Year |

Model or Series |

Length and |

Date |

Number |

Cost |

|

|

Width |

Acquired |

Owned |

|

|

||||

|

|

|

|

|

|

|

|

|

3. Manufactured (mobile) homes (see instructions on back)

Manufacturer |

Year |

|

|

Model or Series |

|

|

Length and |

Date |

Number |

Cost |

|

||

|

|

|

|

Width |

Acquired |

Owned |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Boats and Watercraft (Assess the value of all |

Over |

Under |

Manufacturer |

Year |

Type |

Length and |

Date |

Number |

Cost |

|

|

||

4. property which pertains to craft |

5 Tons |

5 Tons |

Horsepower |

Acquired |

Owned |

|

|||||||

|

|

|

|

|

|

||||||||

(a)Used for recreation and pleasure only . . . .

(b)Boat trailers, etc. . . . . . . . . . . . . . .

(c)Other . . . . . . . . . . . . . . . . . . . .

5. |

Aircraft |

|

Manufacturer |

Year |

Model or |

Date |

Number |

Cost |

|

|

|||

|

Series |

Acquired |

Owned |

|

|

||||||||

|

(a) Aircraft owned by scheduled air carriers with seating capacity of |

|

|

|

|

|

|

|

|

|

|

||

|

no more than 50 persons |

|

|

|

|

|

|

|

|

|

|

||

|

(b) All other aircraft and flight simulators |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||||

6. |

Motor vehicles owned/leased by auxiliary police officers, members or auxiliary members of a volunteer rescue squad or fire department |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

Motor vehicles owned by a nonprofi t organization |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Heavy construction machinery (attach schedule) |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

||||||

9. |

Business furniture and listings not returnable as part of merchants’ capital or if not defined as intangible personal property |

. . . . . . . . |

|

|

|||||||||

10. |

Furniture and offi ce equipment, including books, used in practicing a profession |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

11. |

Tools, hand or power, including woodworking equipment and metal lathes . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

|

|

|

|

|

|

|

|

||||||

12. |

Farming implements, including gas engines, electric motors, etc., threshing machines, corn huskers, feed cutters, combines, harvesters, blowers, plows, |

|

|

|

|||||||||

|

harrows, rakes, mowers, animal drawn vehicles, peanut pickers, etc |

. . . . . . . . . . . . . . . . . . . . . . . |

. |

. . |

. . . . . . . . |

. . . . . . . . . |

|

|

|||||

13. |

Tangible personal property used in research and development business |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

|

|

|

|

|

|

|

|

||||||

14. |

Tangible personal property, leased, loaned or otherwise made available from federal, state or local government |

|

|

||||||||||

|

|

|

|

|

|

|

|

||||||

15. |

Tangible personal property consisting of programmable computer equipment and peripherals used in business |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Value as |

PART II |

MACHINERY AND TOOLS (see instructions on back) |

|

|

|

|

Date |

|

|

Original |

Value |

Ascertained by |

||

|

|

|

|

Acquired |

|

|

Capitalized |

as Listed by |

Commissioner |

||||

|

|

|

|

|

|

|

|

|

|

|

Cost |

Taxpayer |

of the Revenue |

16. |

Machinery and tools |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

17. Energy conversion equipment of MANUFACTURERS |

. . . . . . . . . . . . . . |

. . |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART III MERCHANTS’ CAPITAL (see instructions on back) |

|

|

|

|

|

|

|

|

Value |

Value as |

|||

|

|

|

|

|

|

|

|

Ascertained by |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

as Listed by |

Commissioner |

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

of the Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Inventory of stock on hand |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Daily rental property |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Daily rental passenger cars |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

All other taxable merchants’ capital |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. |

Total taxable merchants’ capital (add lines 18,19, 20 and 21) . . |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

PART IV |

OTHER TANGIBLE PERSONAL PROPERTY |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

Total amount of Part IV from line 32 on the back of the return . . |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

24. |

All other tangible personal property not specifi cally enumerated on this return . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

25. Total (add lines

NOTES OR COMMENTS:

VA DEPT OF TAXATION 2601043 Rev. 06/08

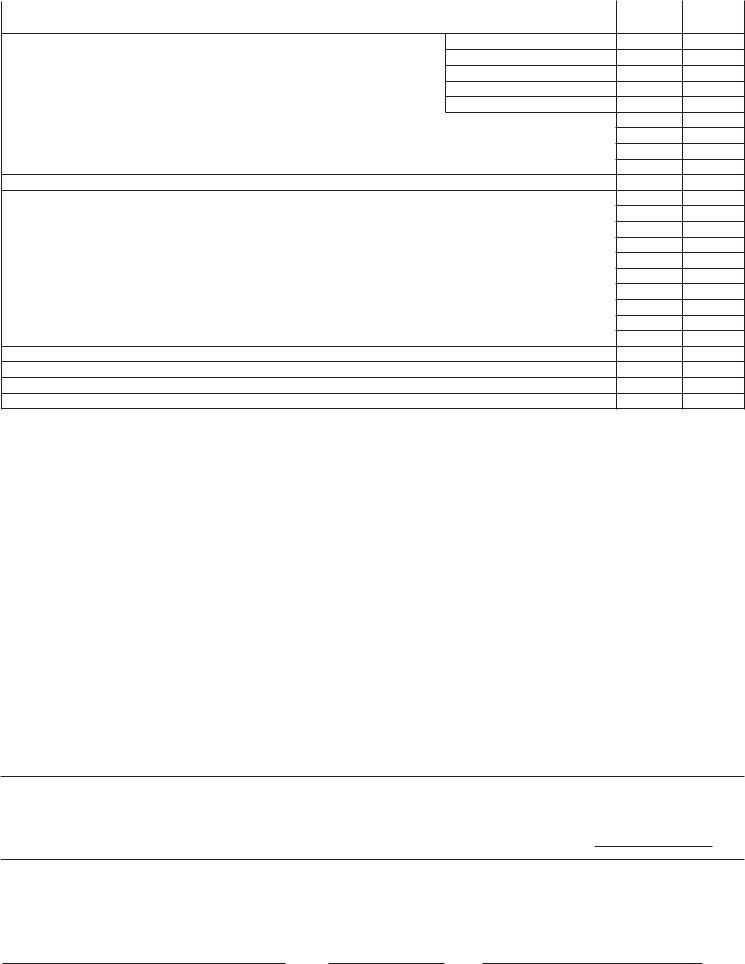

FORM 762 (2009) |

|

Page 2 |

|

|

|

|

|

|

Fair Market Value |

Fair Market Value |

|

|

as Ascertained by |

||

PART IV OTHER TANGIBLE PERSONAL PROPERTY |

as Listed by |

||

Commissioner |

|||

|

Taxpayer |

||

|

of the Revenue |

||

|

|

26.(a) Horses, mules and other kindred animals. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(b)Cattle. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Owned

(c)Sheep and goats. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(d)Hogs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number

(e)Poultry — chickens, turkeys, ducks, geese, etc.. . . . . . . . . . . . . . . . . . . . . . . . . .

(f)Equipment used by farmers or cooperatives to produce ethanol derived primarily from farm products. . . . . . . . . . . . . . . . . .

(g)Grains and other feeds used for the nurture of farm animals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(h)Grain, tobacco and other agricultural products in the hands of a producer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(i)Equipment and machinery used by farm wineries in the production of wine . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27.Felled timber, ties, poles, cord wood, bark and other timber products . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28.(a) Refrigerators, deep freeze units, air conditioners and automatic refrigerating machinery . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(b)Vacuum cleaners, sewing machines, washing machines, dryers and all other household machinery . . . . . . . . . . . . . . . . . . .

(c)Pianos and organs, television sets, radios, phonographs and records and all other musical instruments. . . . . . . . . . . . . . . .

(d)Watches and clocks and gold and silver plates and plated ware . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(e)Oil paintings, pictures, statuary, and other works of art $ _______ books $ ________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(f)Diamonds, cameos and other precious stones and precious metals used as ornaments or jewelry . . . . . . . . . . . . . . . . . . . .

(g)Sporting and photographic equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(h)Firearms and weapons of all kinds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(i)Bicycles and lawn mowers, hand or power. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(j)Household and kitchen furniture (state number of rooms ______ ). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29.Seines, pound nets, fykes, weirs and other devices for catching fi sh . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30.Poles, wires, switchboards, etc., telephone or telegraph instruments, apparatus, etc., owned by any person, firm, association or company not incorporated .

31.Toll bridges, turnpikes and ferries (except steam ferries owned and operated by chartered company) . . . . . . . . . . . . . . . . . . . .

32.Total of Part IV (add lines 26 through 31 and enter on line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

GENERAL INSTRUCTIONS: Complete Form 762, reporting property which you owned on January 1, 2009, then file it with the Commissioner of the Revenue of the County or City generally on or before May 1, 2009. Since some localities have due dates other than May 1, you may want to contact your local office to be sure of the proper due date. Write the word “None” opposite each item of property which you do not own. No property is assess- able as tangible personal property if defined by

DEFINITION OF MANUFACTURED HOMES (ALSO KNOWN AS MOBILE HOMES) FOR PART I, LINE 3

“Manufactured home” means a structure subject to federal regulation, which is transportable in one or more sections; is eight body feet or more in width and 40 body feet or more in length in the traveling mode, or is 320 or more square feet when erected on site; is built on a permanent chassis; is designed to be used as a

INFORMATION FOR PART II, MACHINERY AND TOOLS

If you are engaged in a manufacturing, mining, water well drilling, processing or reprocessing, radio or television broadcasting, dairy, dry cleaning or laundry business, report all machinery and tools used in manufacturing, mining, water well drilling, processing or reprocessing, radio or television broadcasting, dairy, dry cleaning or laundry business, such machinery and tools being segregated by

INFORMATION FOR PART III, MERCHANTS’ CAPITAL

If you are a merchant and if locality taxes the capital of merchants, report all other taxable personal property of any kind whatsoever, except money on hand and on deposit and except tangible personal property not offered for sale as merchandise, which tangible personal property should be reported as such on front of this return under the heading “TANGIBLE PERSONAL PROPERTY.”

FOR EXECUTORS, ADMINISTRATORS, TRUSTEES, COMMITTEES, GUARDIANS AND OTHER FIDUCIARIES

If this is the return of tangible personal property, machinery and tools, or merchants’ capital in the hands of an executor, administrator, trustee, committee, guardian or other fiduciary, such fiduciary must complete so much of both pages of this return as pertains to such property and, in addition, supply the information called for below:

1.Character of Fiduciary: Executor j Administrator j Trustee j Committee j Guardian j Other j

2.Name of Estate, Trust or Ward ________________________________________________________________________ |

(Specify) |

|

DECLARATION OF TAXPAYER

I declare that the statement and figures submitted on both pages of this return are true, full and correct to the best of my knowledge and belief. I certify that unless otherwise indicated as business use, the vehicles listed herein are for personal use.

NOTE — It is a misdemeanor for any person willfully to subscribe a return which he does not believe to be true and correct as to every material matter (Code of Virginia

(Signature of Taxpayer) |

(Date) |

(Taxpayer’s Phone Number) |

Executors, administrators, trustees and other fi duciaries must also supply information called for on this return.