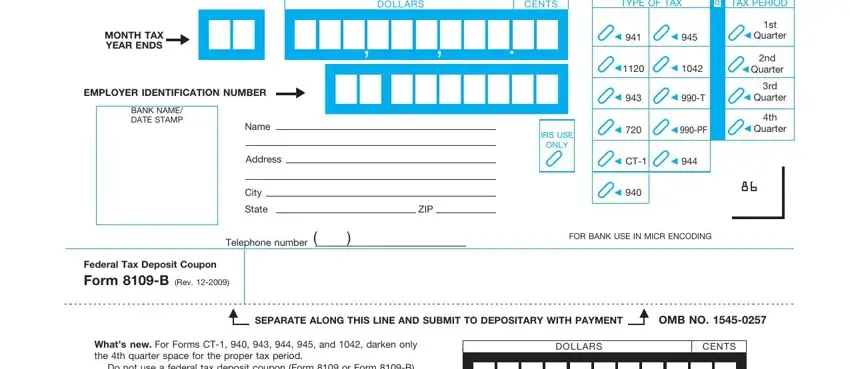

What’s new. For Forms CT-1, 940, 943, 944, 945, and 1042, darken only the 4th quarter space for the proper tax period.

Do not use a federal tax deposit coupon (Form 8109 or Form 8109-B) to make a payment with Forms CT-1X, 941-X, 943-X, 944-X, 945-X, or with Formulario 941-X(PR).

Note. Pen or #2 pencil can be used to complete the form. The name, address, and telephone number may be completed other than by hand. You cannot use photocopies of the coupons to make your deposits. Do not staple, tape, or fold the coupons.

The IRS encourages you to make federal tax deposits using the Electronic Federal Tax Payment System (EFTPS). For more information on EFTPS, go to www.eftps.gov or call 1-800-555-4477.

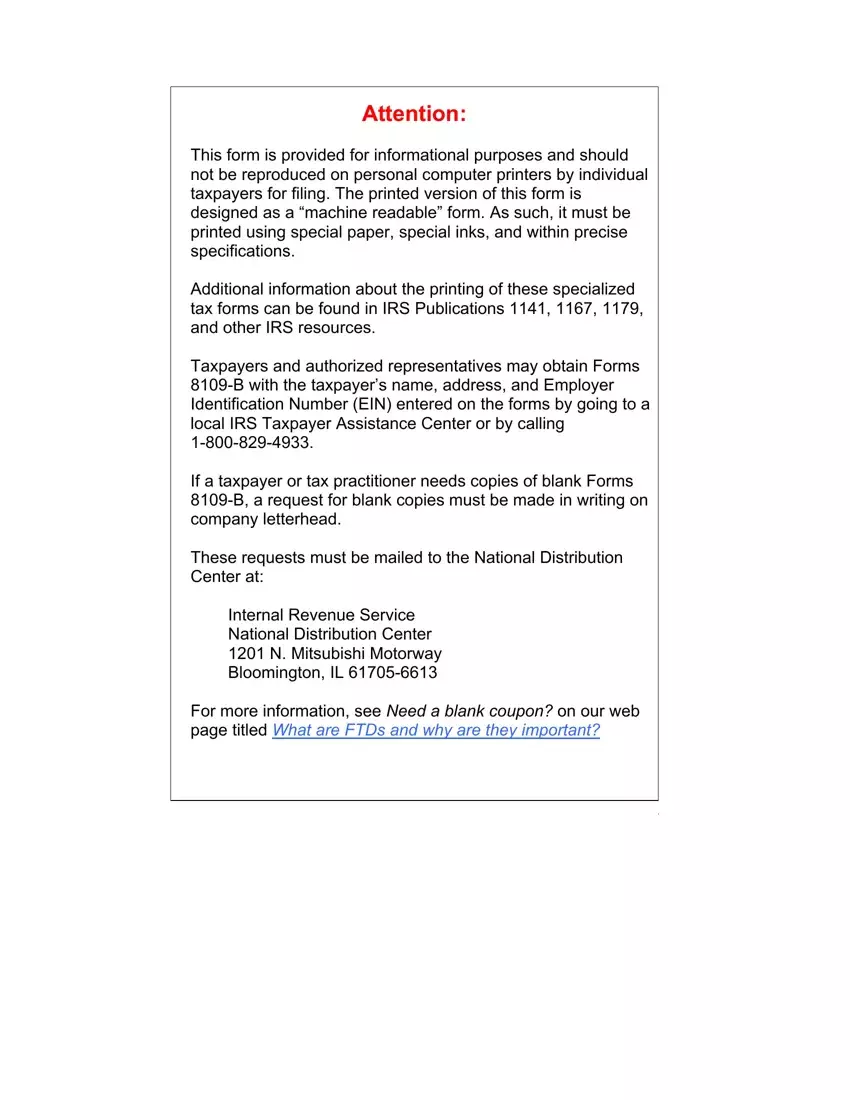

Purpose of form. Use Form 8109-B to make a tax deposit only in the following two situations.

1.You have not yet received your resupply of preprinted deposit coupons (Form 8109).

2.You are a new entity and have already been assigned an employer identification number (EIN), but you have not received your initial supply of preprinted deposit coupons (Form 8109). If you have not received your EIN, see Exceptions below.

Note. If you do not receive your resupply of deposit coupons and a deposit is due or you do not receive your initial supply within 5–6 weeks of receipt of your EIN, call 1-800-829-4933.

Caution. Do not use these coupons to deposit delinquent taxes assessed by the IRS. Pay delinquent taxes directly to the IRS using the stub included with the notice or by using EFTPS.

How to complete the form. Enter your name as shown on your return or other IRS correspondence, address, and EIN in the spaces provided. Do not make a name or address change on this form (see Form 8822, Change of Address). If you are required to file a Form 1120, 1120-C,

990-PF (with net investment income), 990-T, or 2438, enter the month in which your tax year ends in the MONTH TAX YEAR ENDS boxes. For example, if your tax year ends in January, enter 01; if it ends in December, enter 12. Make your entries for EIN and MONTH TAX YEAR ENDS (if applicable) as shown in Amount of deposit below.

Exceptions. If you have applied for an EIN, have not received it, and a deposit must be made, do not use Form 8109-B. Instead, send your payment to the IRS address where you file your return. Make your check or money order payable to the United States Treasury and show on it your name (as shown on Form SS-4, Application for Employer Identification Number), address, kind of tax, period covered, and date you applied for an EIN.

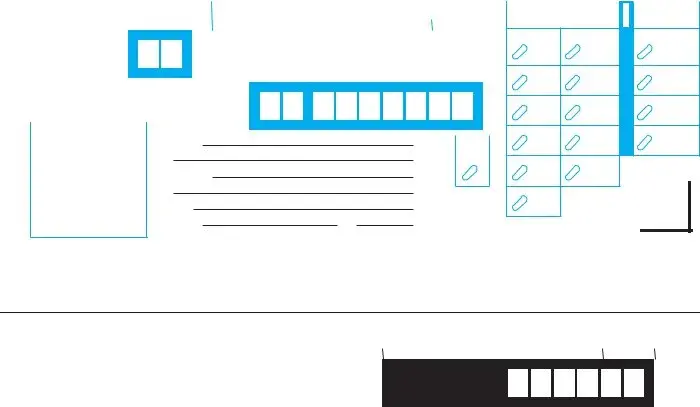

Amount of deposit. Enter the amount of the deposit in the space provided. Enter the amount legibly, forming the characters as shown below:

Hand print money amounts without using dollar signs, commas, a decimal point, or leading zeros. If the deposit is for whole dollars only, enter “00” in the CENTS boxes. For example, a deposit of $7,635.22 would be entered like this:

,

,

7 ,6 3 5.2 2

7 ,6 3 5.2 2

Caution. Darken only one space for TYPE OF TAX and only one space for TAX PERIOD. Darken the space to the left of the applicable form and tax period. Darkening the wrong space or multiple spaces may delay proper crediting to your account. See below for an explanation of Types of Tax and Marking the Proper Tax Period.

Types of Tax

Form 941 Employer’s QUARTERLY Federal Tax Return (includes Forms 941-M, 941-PR, and 941-SS)

Form 943 Employer’s Annual Federal Tax Return for Agricultural Employees

Form 944 Employer’s ANNUAL Federal Tax Return (includes Forms 944-PR, 944(SP), and 944-SS)

Form 945 Annual Return of Withheld Federal Income Tax

Form 720 Quarterly Federal Excise Tax Return

Form CT-1 Employer’s Annual Railroad Retirement Tax Return

Form 940 Employer’s Annual Federal Unemployment (FUTA) Tax Return (includes Form 940-PR)

Form 1120 U.S. Corporation Income Tax Return (includes Form 1120 series of returns and Form 2438)

Form 990-T Exempt Organization Business Income Tax Return

Form 990-PF Return of Private Foundation or Section 4947(a)(1) Nonexempt

Charitable Trust Treated as a Private Foundation

Form 1042 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

Marking the Proper Tax Period

Payroll taxes and withholding. For Form 941, if your liability was incurred during:

●January 1 through March 31, darken the 1st quarter space;

●April 1 through June 30, darken the 2nd quarter space;

●July 1 through September 30, darken the 3rd quarter space; and

●October 1 through December 31, darken the 4th quarter space.

For Forms CT-1, 940, 943, 944, 945, and 1042, darken only the 4th quarter space.

Do not use a federal tax deposit coupon (Form 8109 or Form 8109-B) to make a payment with Forms CT-1X, 941-X, 943-X, 944-X, 945-X, or with Formulario 941-X(PR).

Note. If the liability for Form 941 was incurred during one quarter and deposited in another quarter, darken the space for the quarter in which the tax liability was incurred. For example, if the liability was incurred in March and deposited in April, darken the 1st quarter space.

Excise taxes. For Form 720, follow the instructions above for Form 941. For Form 990-PF, with net investment income, follow the instructions on page 2 for Form 1120, 990-T, and 2438.

7

7