Using PDF documents online can be simple with our PDF editor. You can fill in Form 8546 here effortlessly. To maintain our editor on the cutting edge of practicality, we strive to put into action user-oriented features and improvements regularly. We are always glad to get feedback - assist us with revampimg PDF editing. Here is what you will have to do to start:

Step 1: First of all, access the tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: The editor gives you the opportunity to customize your PDF document in various ways. Enhance it by writing any text, correct what is already in the file, and add a signature - all within the reach of several clicks!

This PDF form will involve some specific information; in order to guarantee accuracy and reliability, you need to take note of the tips listed below:

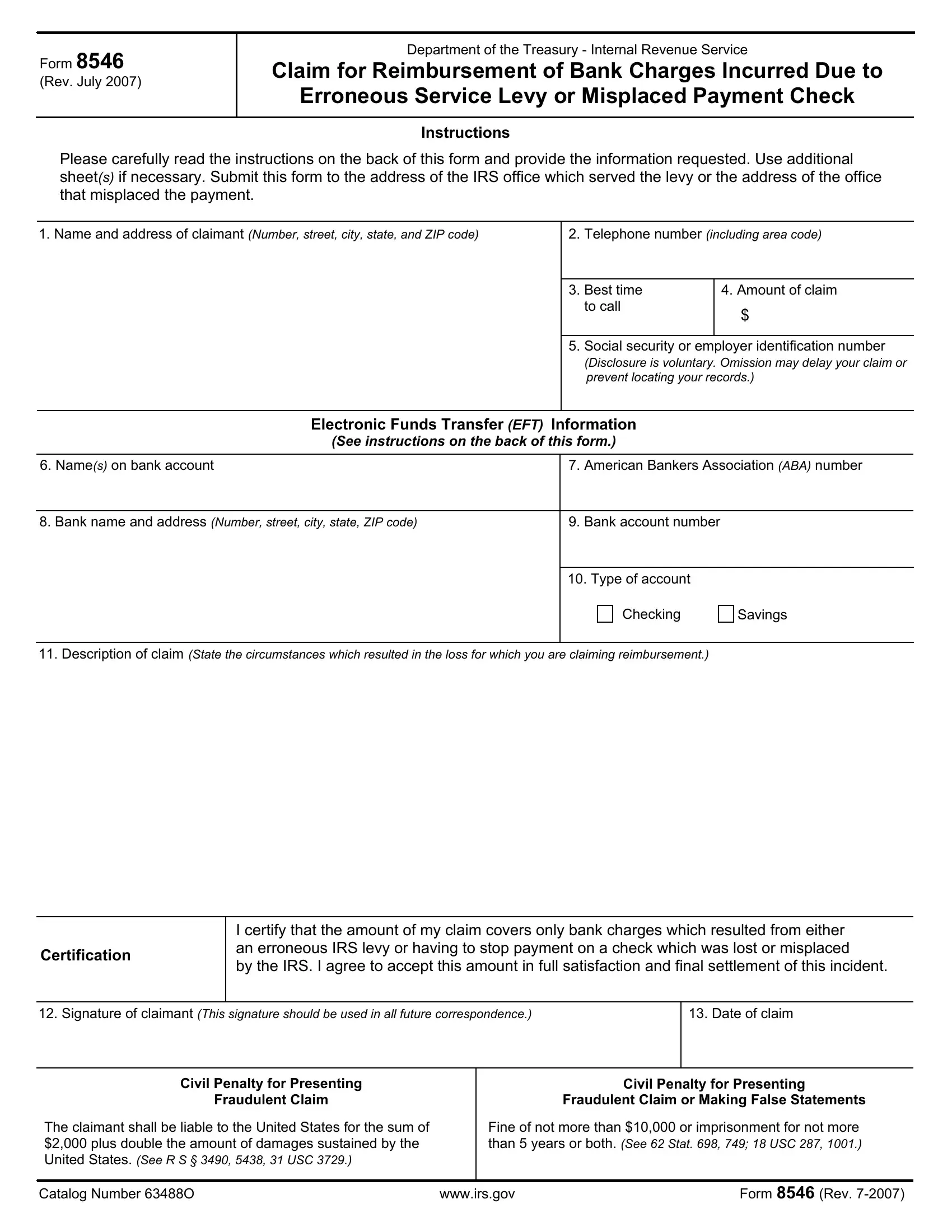

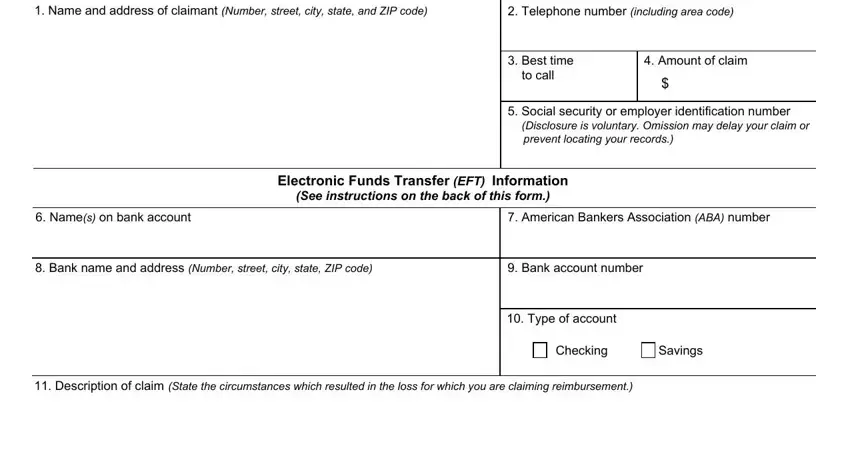

1. The Form 8546 will require certain information to be entered. Ensure that the following fields are completed:

Step 3: Spell-check all the details you've typed into the blank fields and then click on the "Done" button. Try a free trial account at FormsPal and acquire instant access to Form 8546 - downloadable, emailable, and editable in your FormsPal cabinet. When you use FormsPal, you can easily complete documents without the need to be concerned about database breaches or entries getting distributed. Our protected software ensures that your personal data is maintained safely.