When you intend to fill out Form 8621, there's no need to install any applications - simply make use of our online tool. Our tool is continually evolving to present the very best user experience possible, and that is because of our resolve for constant development and listening closely to user feedback. Getting underway is simple! All you should do is follow these easy steps below:

Step 1: Press the "Get Form" button above on this page to get into our PDF tool.

Step 2: The tool helps you customize nearly all PDF forms in various ways. Transform it with any text, correct what is already in the PDF, and place in a signature - all when it's needed!

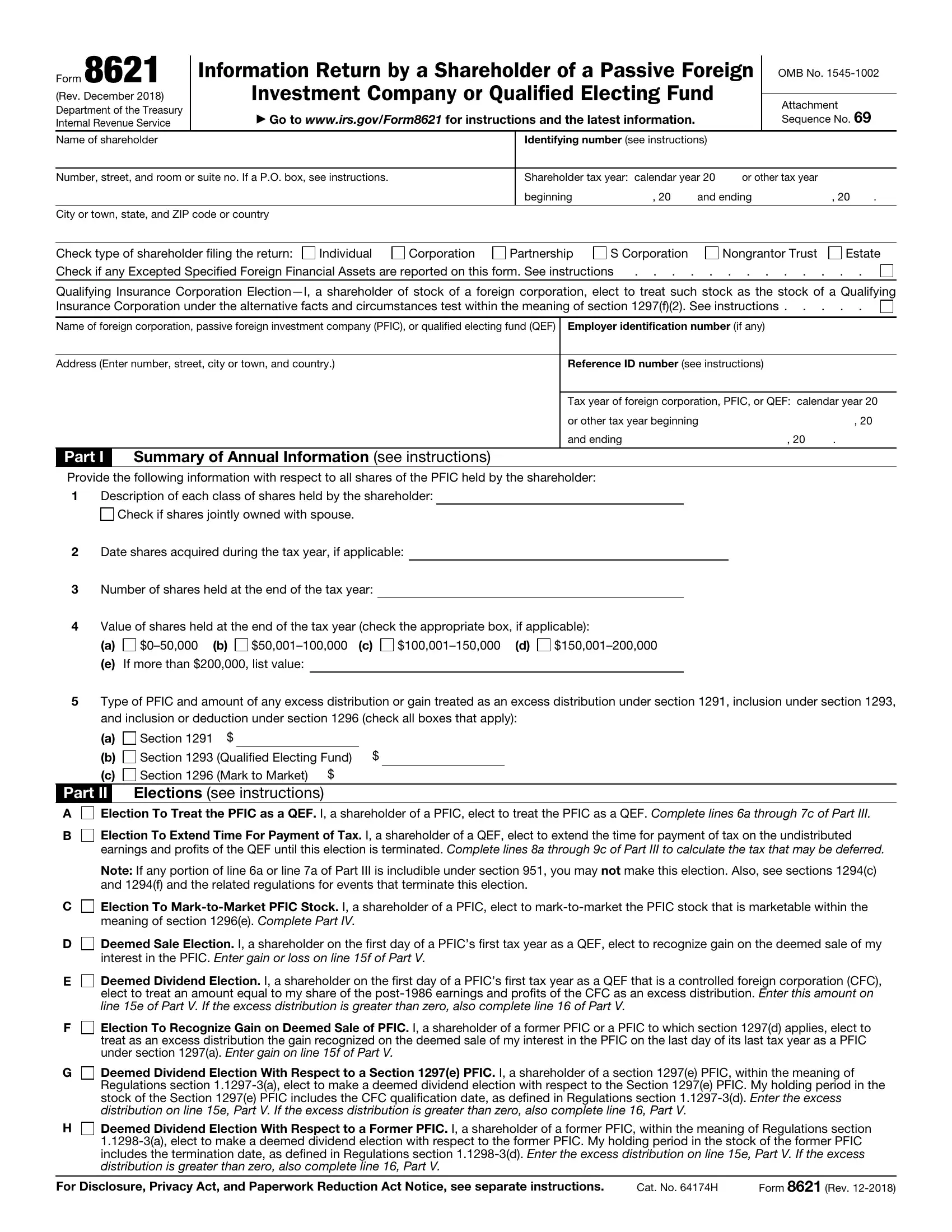

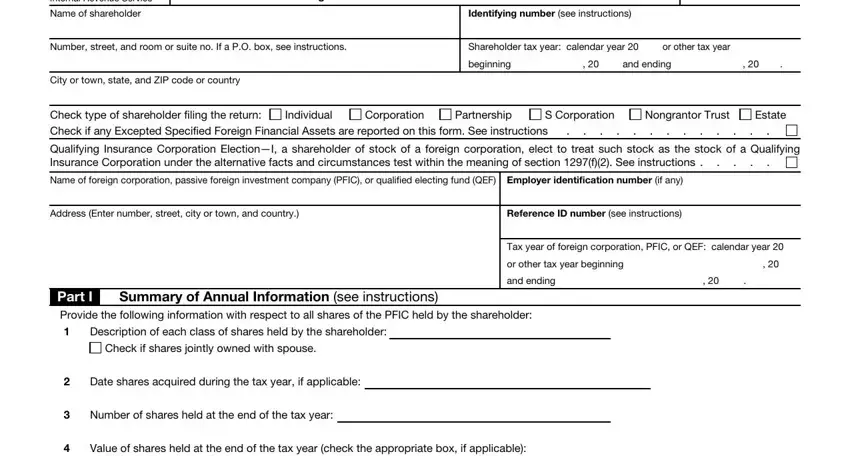

This document requires particular info to be filled in, hence ensure that you take the time to provide what's required:

1. Fill out your Form 8621 with a number of essential fields. Collect all the necessary information and be sure there's nothing neglected!

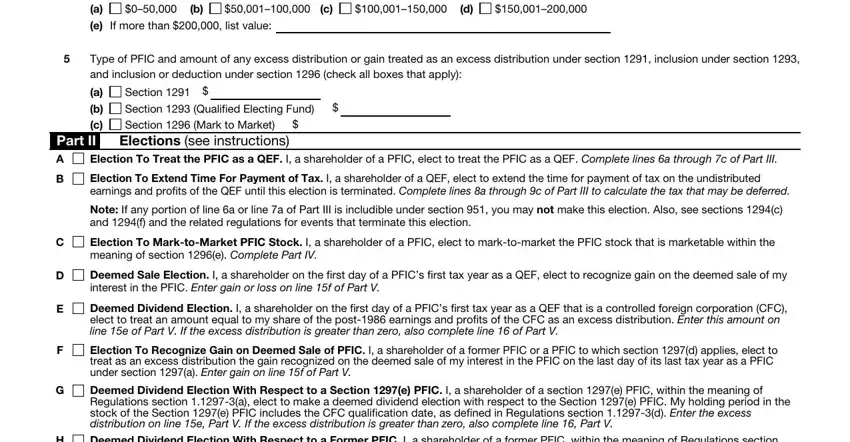

2. Now that this segment is done, you're ready to include the needed details in If more than list value, Type of PFIC and amount of any, c Part II, Section Section Qualified, Election To Treat the PFIC as a, Election To Extend Time For, Note If any portion of line a or, Election To MarktoMarket PFIC, Deemed Sale Election I a, Deemed Dividend Election I a, Election To Recognize Gain on, and Deemed Dividend Election With so that you can move on to the next step.

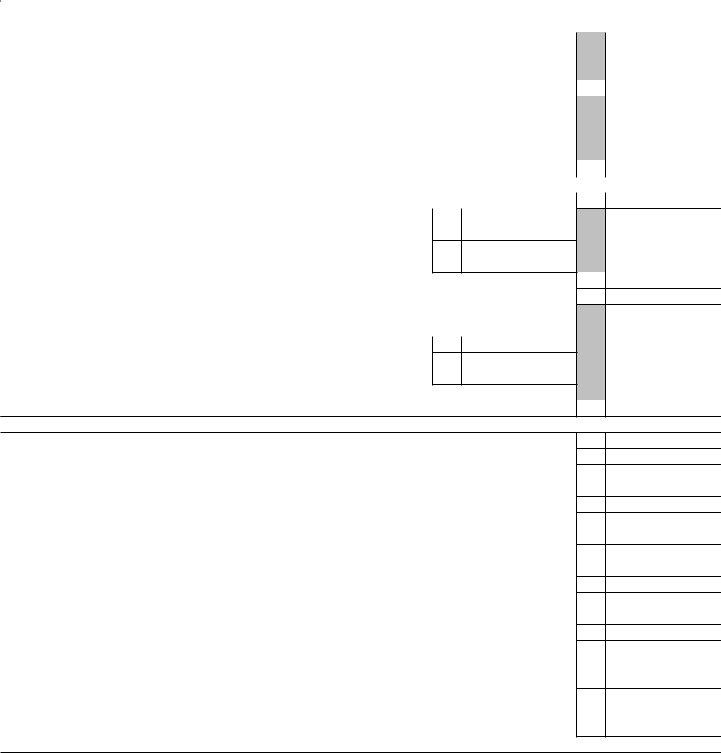

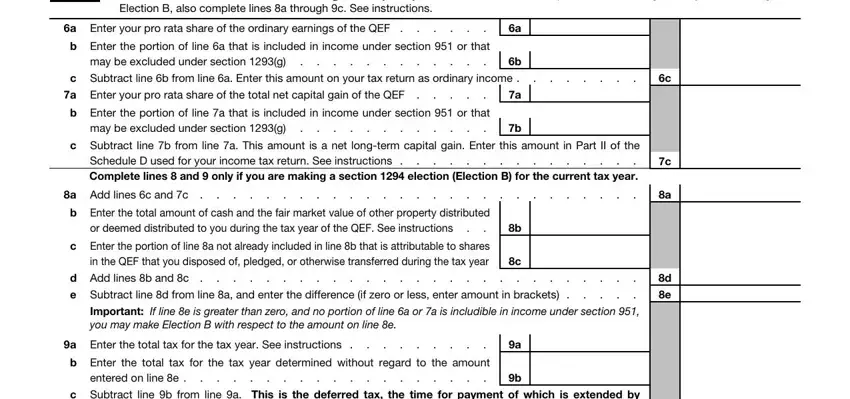

3. This next portion is all about Part III, Income From a Qualified Electing, a Enter your pro rata share of the, Enter the portion of line a that, c Subtract line b from line a, a Enter your pro rata share of the, Enter the portion of line a that, Subtract line b from line a This, a Add lines c and c, Enter the total amount of cash and, Enter the portion of line a not, d Add lines b and c e Subtract, Important If line e is greater, a Enter the total tax for the tax, and Enter the total tax for the tax - fill out all of these empty form fields.

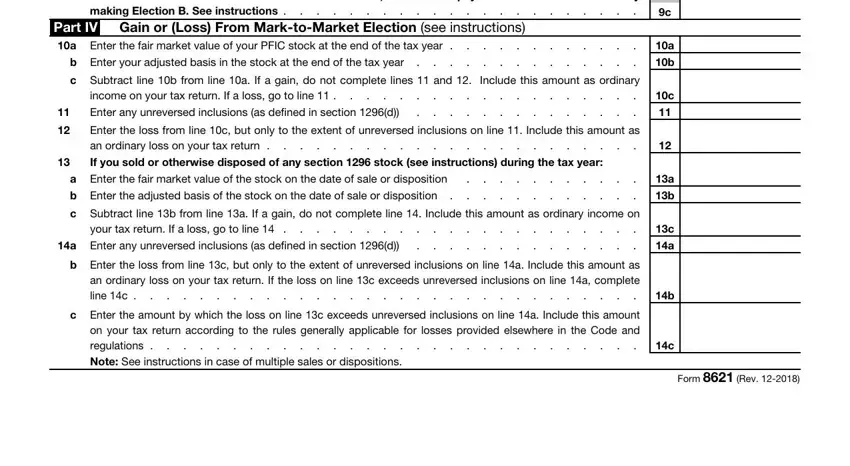

4. This next section requires some additional information. Ensure you complete all the necessary fields - Enter the total tax for the tax, Part IV Gain or Loss From, b Enter your adjusted basis in the, Subtract line b from line a If a, Enter the loss from line c but, If you sold or otherwise disposed, a Enter the fair market value of, Subtract line b from line a If a, a Enter any unreversed inclusions, Enter the loss from line c but, Enter the amount by which the loss, and Form Rev - to proceed further in your process!

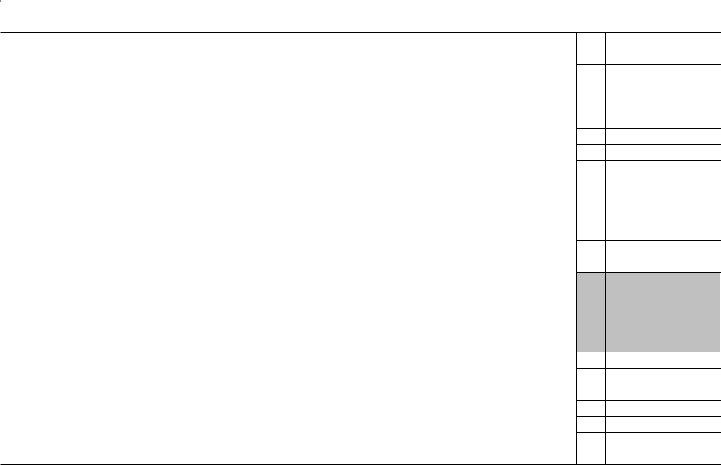

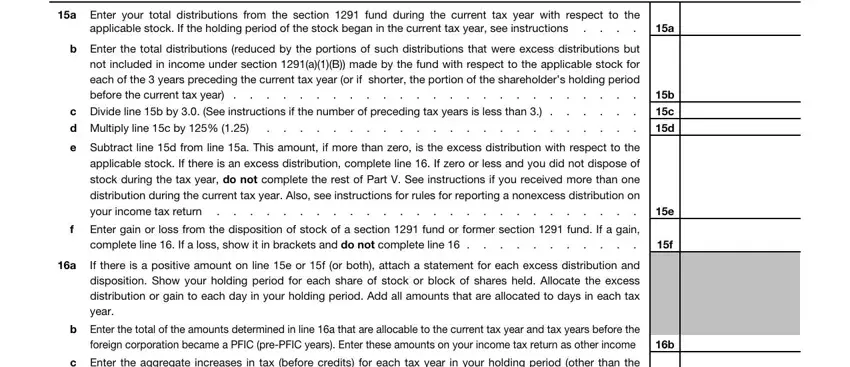

5. This document should be wrapped up by filling out this area. Here one can find a comprehensive listing of form fields that need appropriate information for your document usage to be accomplished: Enter your total distributions, Enter the total distributions, c Divide line b by See, Subtract line d from line a This, Enter gain or loss from the, If there is a positive amount on, Enter the total of the amounts, and Enter the aggregate increases in.

It is easy to make a mistake when filling out the Enter your total distributions, and so make sure that you reread it before you finalize the form.

Step 3: Confirm that the information is accurate and simply click "Done" to conclude the task. Sign up with FormsPal right now and easily gain access to Form 8621, all set for downloading. Each and every edit you make is handily kept , which enables you to change the document at a later stage if needed. FormsPal guarantees safe document completion devoid of personal information record-keeping or sharing. Rest assured that your data is safe here!