Handling PDF documents online is certainly easy with our PDF editor. Anyone can fill in form 8633 here without trouble. The editor is continually improved by our staff, acquiring additional features and becoming greater. All it takes is several easy steps:

Step 1: First of all, access the pdf tool by pressing the "Get Form Button" in the top section of this page.

Step 2: When you access the editor, there'll be the form ready to be filled out. Besides filling in different fields, you might also do several other actions with the form, including adding your own words, changing the initial text, adding graphics, affixing your signature to the PDF, and more.

This form needs specific details; to guarantee accuracy, remember to take note of the guidelines further on:

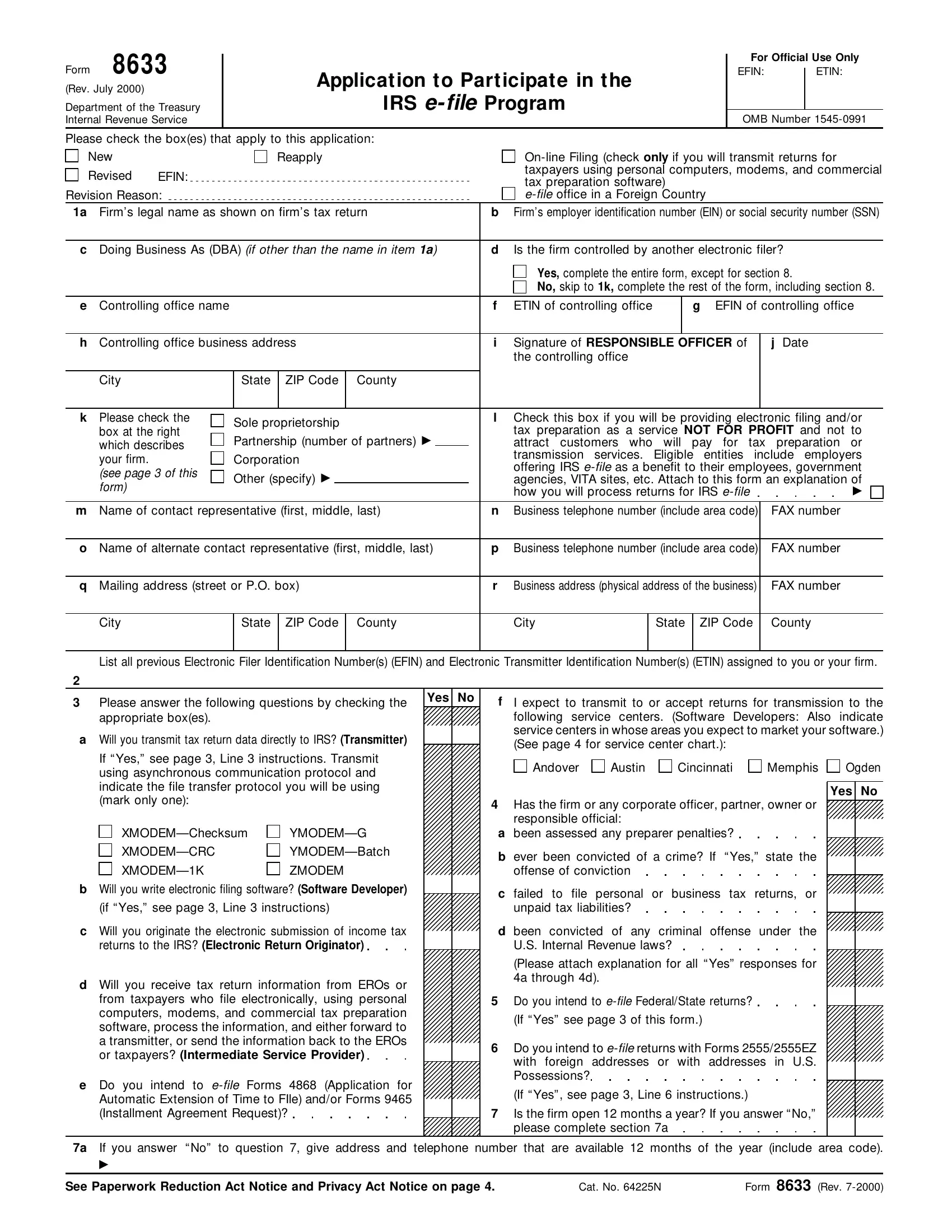

1. To get started, once filling out the form 8633, beging with the area that includes the subsequent blank fields:

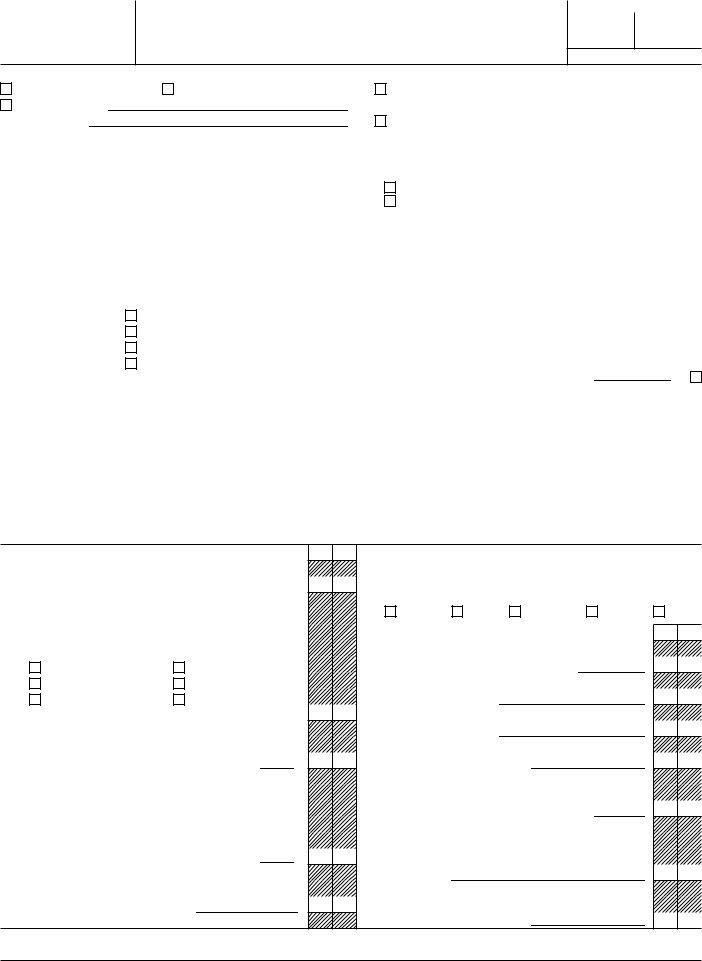

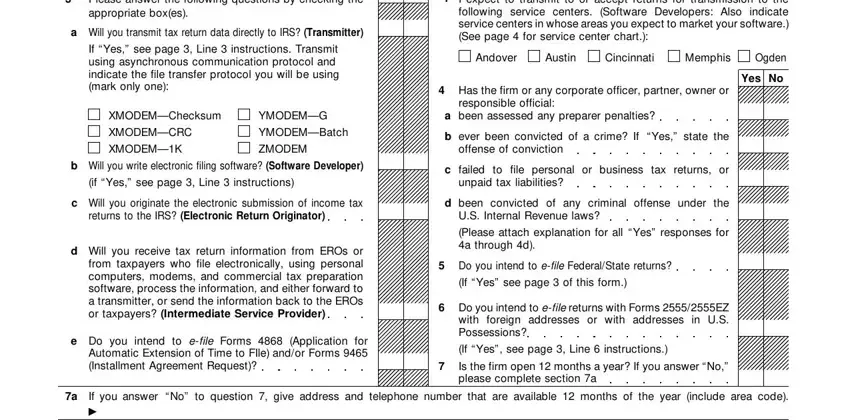

2. After this part is done, go on to enter the suitable details in these - Please answer the following, Yes No, Will you transmit tax return data, If Yes see page Line, XMODEMChecksum, YMODEMG, XMODEMCRC, XMODEMK, YMODEMBatch, ZMODEM, Will you write electronic filing, if Yes see page Line instructions, Will you originate the electronic, Will you receive tax return, and e Do you intend to efile Forms.

People who work with this form generally make mistakes when filling in Will you transmit tax return data in this part. Be sure you re-examine what you enter right here.

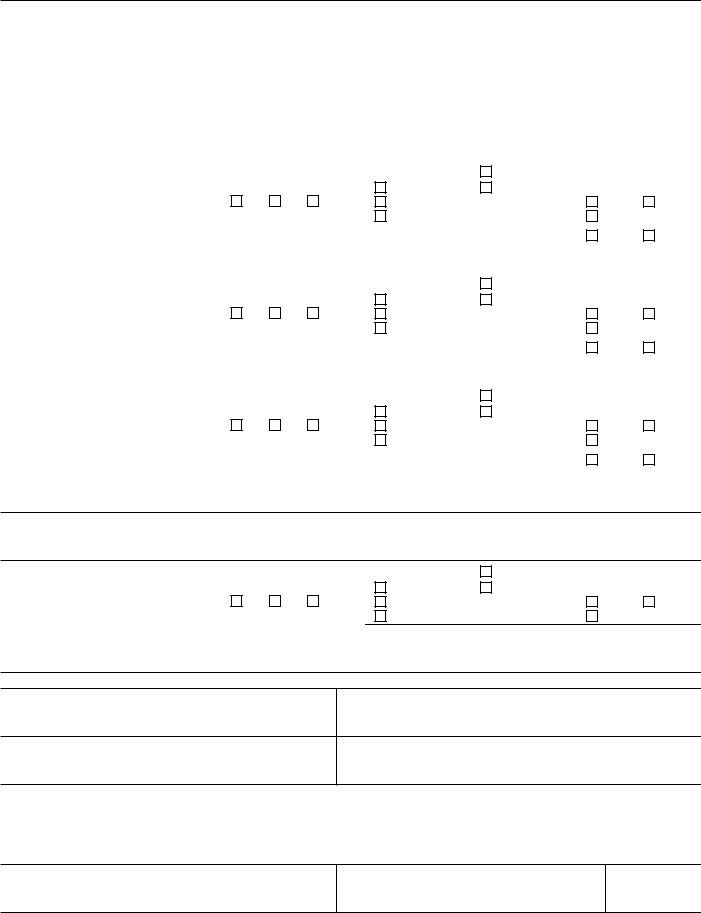

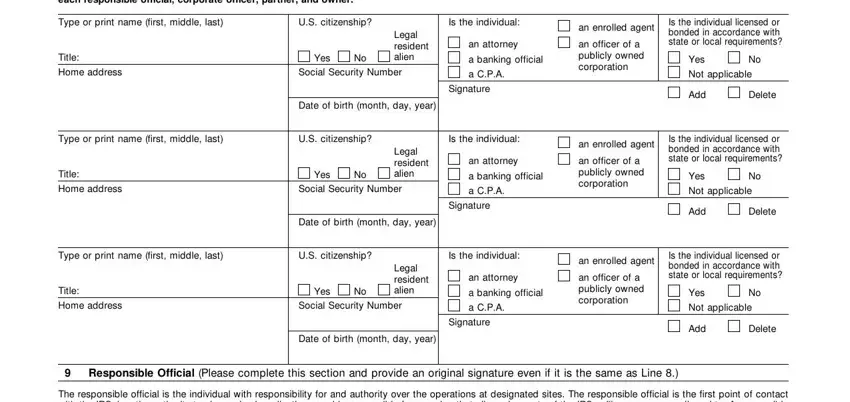

3. In this part, take a look at Unless you marked the box in l or, Type or print name first middle, US citizenship, Is the individual, Title, Home address, Yes, Legal resident alien, Social Security Number, Date of birth month day year, an attorney, a banking official, a CPA, Signature, and Type or print name first middle. All of these have to be taken care of with highest focus on detail.

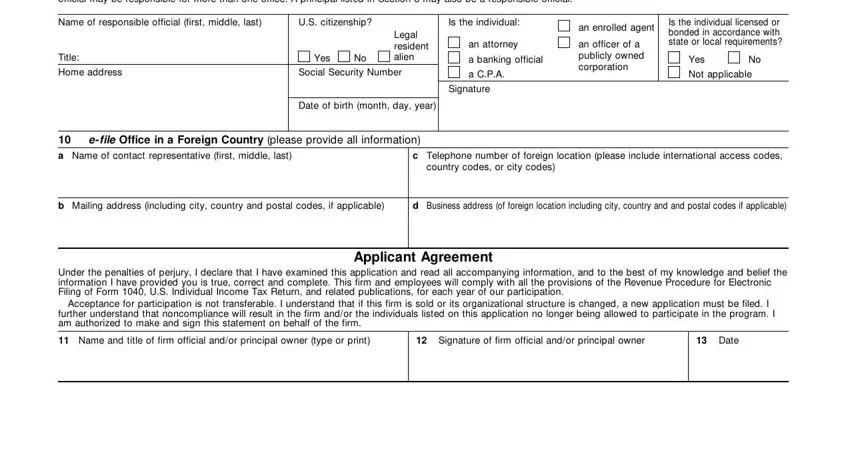

4. The subsequent subsection comes with these form blanks to focus on: The responsible official is the, Name of responsible official first, US citizenship, Is the individual, Title, Home address, Yes, Legal resident alien, Social Security Number, Date of birth month day year, an attorney, a banking official, a CPA, Signature, and an enrolled agent.

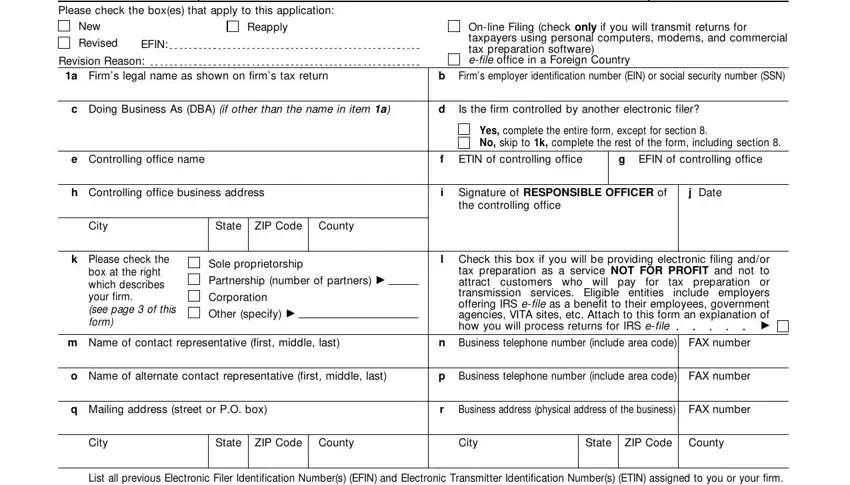

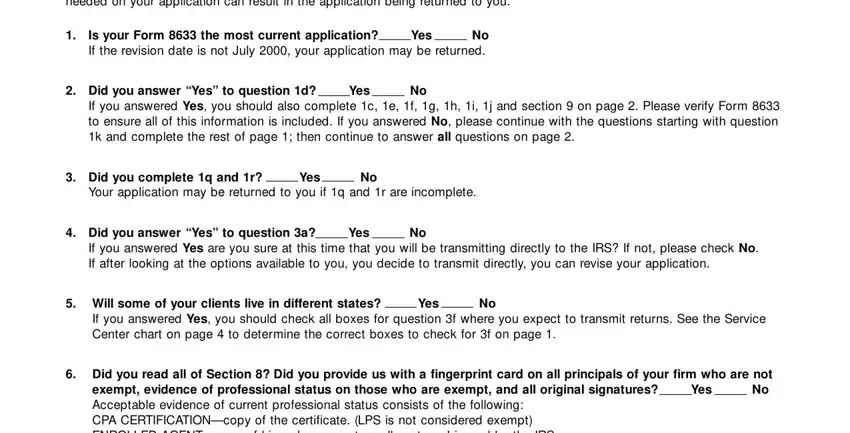

5. The form has to be completed by dealing with this area. Further there is a detailed list of blank fields that have to be filled out with appropriate details for your form submission to be complete: Please answer this checklist after, Is your Form the most current, Yes, Did you answer Yes to question d, Yes, Did you complete q and r Your, Yes, Did you answer Yes to question a, Yes, Will some of your clients live in, Yes, Did you read all of Section Did, and Yes.

Step 3: As soon as you've glanced through the details in the fields, press "Done" to finalize your document generation. Join FormsPal right now and instantly gain access to form 8633, available for download. Every last edit you make is conveniently kept , which means you can edit the document at a later stage if necessary. FormsPal is dedicated to the privacy of our users; we make certain that all information handled by our editor remains protected.