You are able to fill in Form 8804 W instantly with our online PDF tool. The tool is constantly upgraded by us, getting powerful features and growing to be better. Here is what you would want to do to get started:

Step 1: Click the "Get Form" button above on this page to get into our PDF tool.

Step 2: The tool offers the capability to change nearly all PDF files in many different ways. Transform it by including personalized text, adjust original content, and add a signature - all doable in no time!

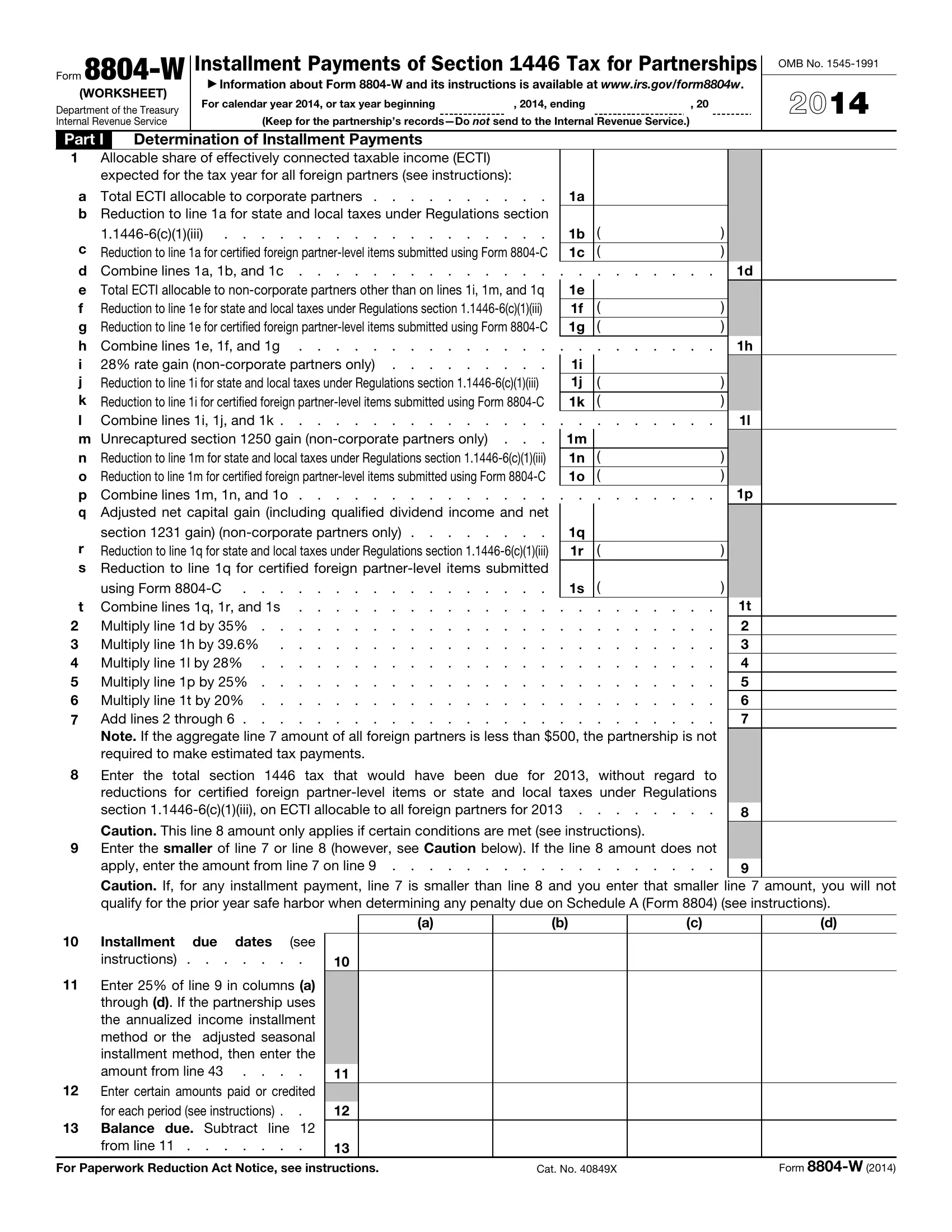

This PDF will need particular information to be filled out, thus be sure you take your time to provide precisely what is required:

1. Whenever filling in the Form 8804 W, make sure to include all needed fields within its corresponding area. It will help to hasten the process, enabling your details to be handled quickly and accurately.

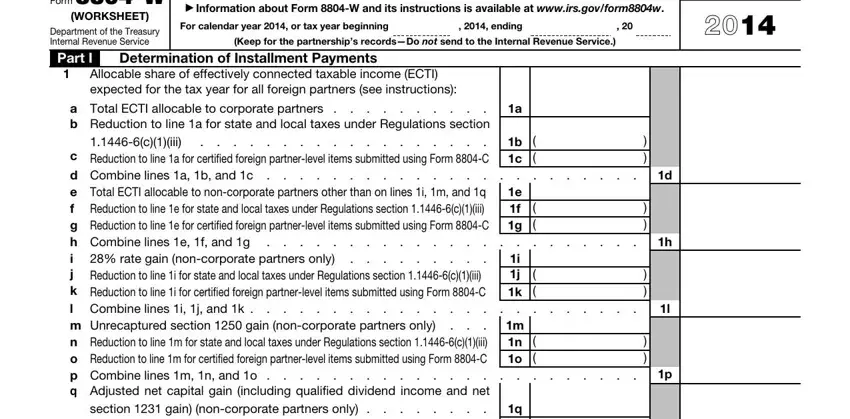

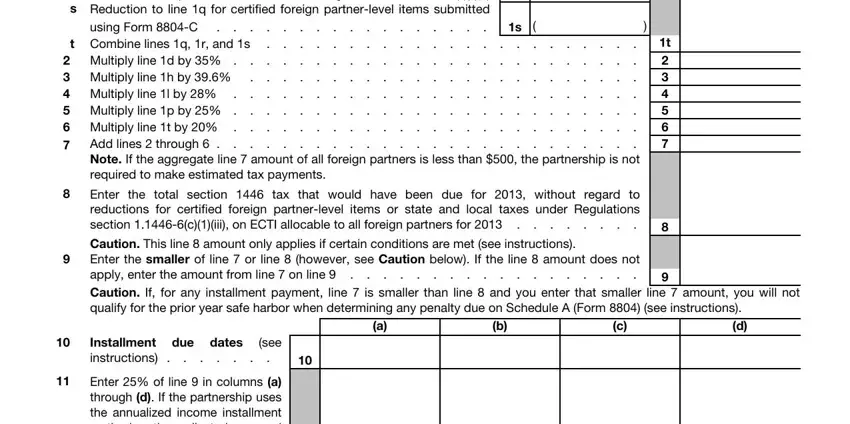

2. Just after finishing the last section, go on to the next part and fill out all required particulars in all these blanks - using Form C, section gain noncorporate, Multiply line d by Multiply, t Combine lines q r and s, Enter the total section tax that, q r, Caution This line amount only, Installment due dates instructions, see, and Enter of line in columns a.

It's easy to get it wrong while filling in the Multiply line d by Multiply, therefore be sure you look again before you'll send it in.

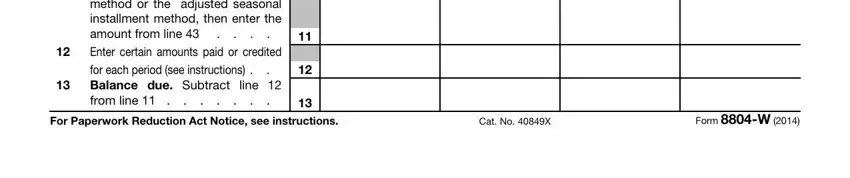

3. The next part is usually easy - fill in every one of the form fields in Enter of line in columns a, For Paperwork Reduction Act Notice, Cat No X, and Form W to complete the current step.

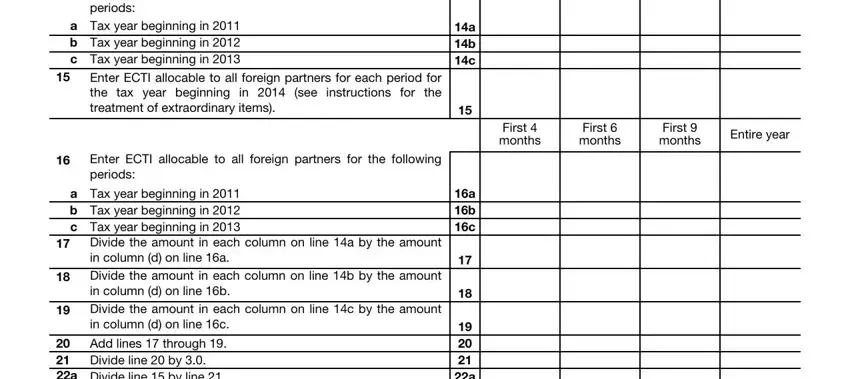

4. The fourth part arrives with all of the following empty form fields to look at: Enter ECTI allocable to all, a Tax year beginning in b Tax, Enter ECTI allocable to all, Enter ECTI allocable to all, a Tax year beginning in b Tax, Divide the amount in each column, Add lines through Divide line, a Divide line by line, a b c, a b c, a b c, First months, First months, First months, and Entire year.

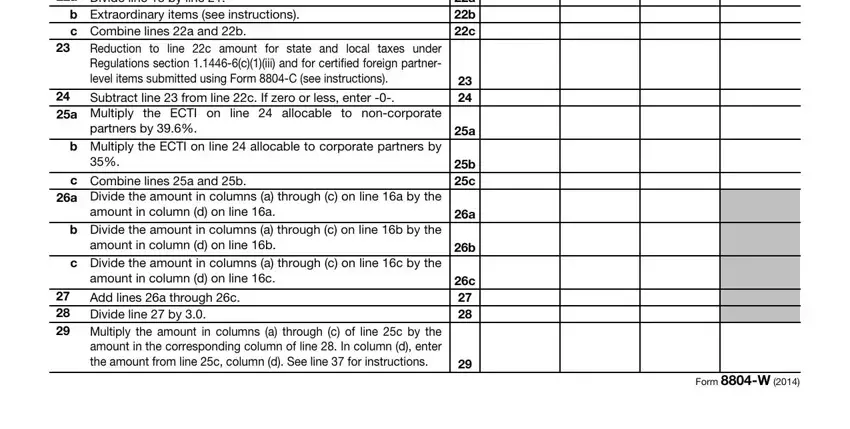

5. The final stage to conclude this form is critical. Be sure you fill out the mandatory fields, including a Divide line by line, b Extraordinary items see, Reduction to line c amount for, Subtract line from line c If zero, a Multiply the ECTI on line, partners by, b Multiply the ECTI on line, c Combine lines a and b, a Divide the amount in columns a, amount in column d on line a, b Divide the amount in columns a, amount in column d on line b, c Divide the amount in columns a, amount in column d on line c, and Add lines a through c Divide line, prior to using the pdf. Neglecting to do this can lead to an incomplete and probably incorrect document!

Step 3: Right after rereading the entries, press "Done" and you are done and dusted! Sign up with FormsPal now and immediately get Form 8804 W, available for downloading. All modifications you make are saved , which means you can change the form later when required. We don't share or sell any details that you type in while working with documents at FormsPal.