Engaging with the tax system can often feel like navigating a labyrinth, but understanding the tools at your disposal can significantly ease the journey. Among these tools, the Alabama Department of Revenue Form 8821A stands out as a critical document for those needing to grant authorization to an appointee to access their tax information. This form, mirroring its federal counterpart, is designed to streamline the process by which individuals or entities can allow others—be it a tax professional, a financial advisor, or a legal representative—to inspect and receive confidential tax information on their behalf. It covers a broad spectrum of tax matters, including but not limited to individual, corporate, and sales taxes across various forms and time periods. The form not only specifies the type of tax information accessible but also outlines how and if the appointed parties will receive communications from the Alabama Department of Revenue. What sets 8821A apart is its provision for automating the revocation of previous authorizations upon its execution, ensuring that taxpayers' control over their information is both flexible and secure. Additionally, it underscores the requirement for explicit consent by way of signature, validating the taxpayer's intention to share potentially sensitive information. By exploring Form 8821A's functionalities and prerequisites, taxpayers empower themselves with the knowledge to manage their tax information adeptly, positioning this form as a pivotal asset in the realm of tax administration and compliance within Alabama.

| Question | Answer |

|---|---|

| Form Name | Form 8821A |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | ALABAMA, 8821a, TAXPAYER, 2000 |

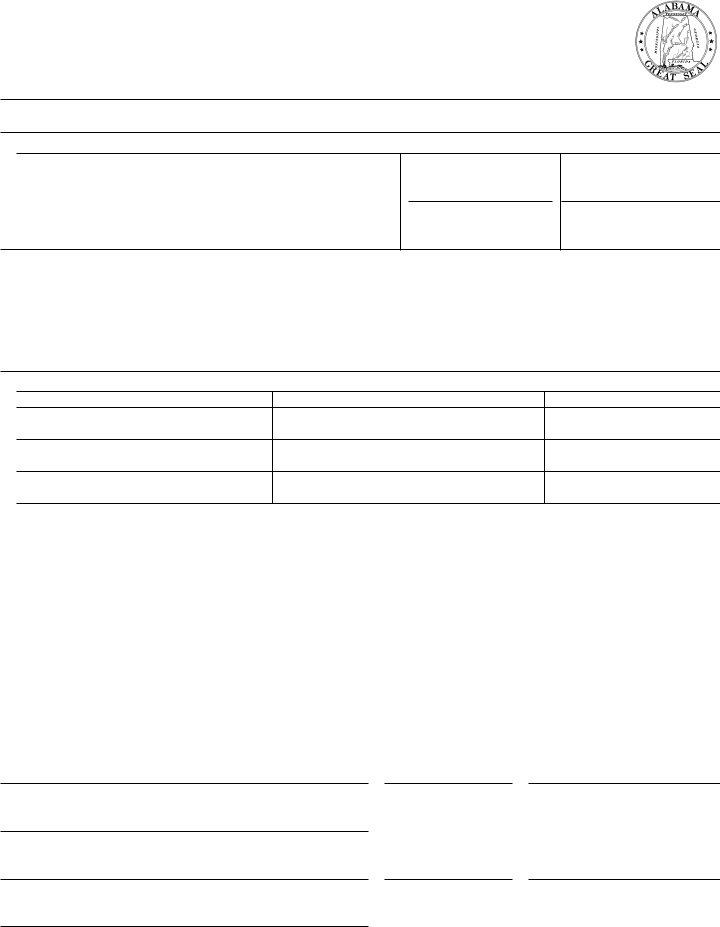

FORM |

ALABAMA DEPARTMENT OF REVENUE |

|

8821A |

||

Tax Information Authorization |

||

(REV. 5/02) |

||

|

NOTE: If you have questions concerning the completion of this form, please refer to the instructions for Federal Form 8821 (revised January 2000). Alabama Form 8821A is very similar to the federal form.

1 TAXPAYER INFORMATION

TAXPAYER NAME(S) AND ADDRESS (Please Type or Print)

SOCIAL SECURITY NUMBER(S)

EMPLOYER IDENTIFICATION NUMBER

DAYTIME TELEPHONE NUMBER

()

2 APPOINTEE (Please Type or Print)

|

NAME AND ADDRESS |

TELEPHONE NUMBER |

( |

) |

|

|

|||

|

|

FAX NUMBER |

( |

) |

|

|

|

|

|

is authorized to inspect and/or receive confidential tax information in any office of the Alabama Department of Revenue for the following tax matters:

3 TAX MATTERS

TYPE OF TAX (Individual, Corporate, Sales, etc.)

TAX FORM NUMBER (40, 20, 41, 65, etc.)

YEAR(S) or PERIOD(S)

4DISCLOSURE OF TAX INFORMATION (check only one of the following if applicable):

aIf you want tax information, notices, and other written communications sent to the appointee on an ongoing basis,

check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ b Check this box if you do not want any notices or communications sent to the appointee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■

5 RETENTION / REVOCATION OF TAX INFORMATION AUTHORIZATION.

This tax information authorization automatically revokes all earlier tax information authorizations on file with the Alabama Department of Revenue for the same tax matters and years or periods covered by this document. If you do not want to revoke

a prior tax information authorization, check this box. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■

6 SIGNATURE OF TAXPAYER(S).

If a tax matter concerns a joint return, either husband or wife must sign. If signed by a corporate officer, partner, guardian, executor, receiver, administrator, trustee, or party other than the taxpayer, I certify that I have the authority to execute this form with respect to the tax matters/periods covered.

▼

If this tax information authorization is not signed, it will be returned.

SIGNATURE |

DATE |

TITLE (IF APPLICABLE) |

PRINT NAME

SIGNATURE |

DATE |

TITLE (IF APPLICABLE) |

PRINT NAME

Form 8821A