Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 8833 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8833.

General Instructions

Purpose of Form

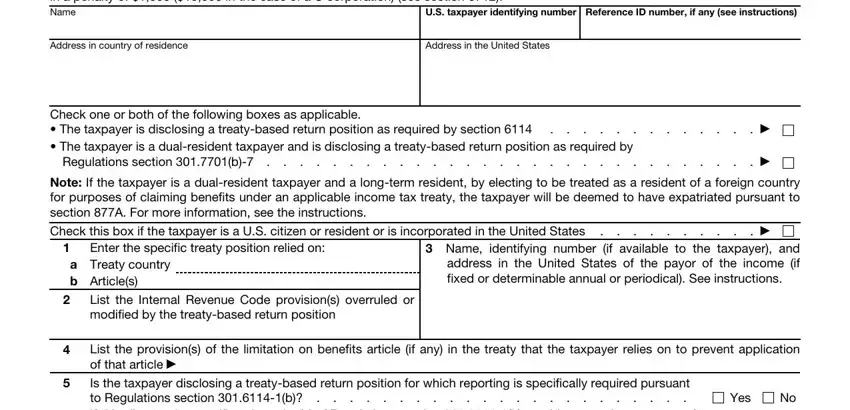

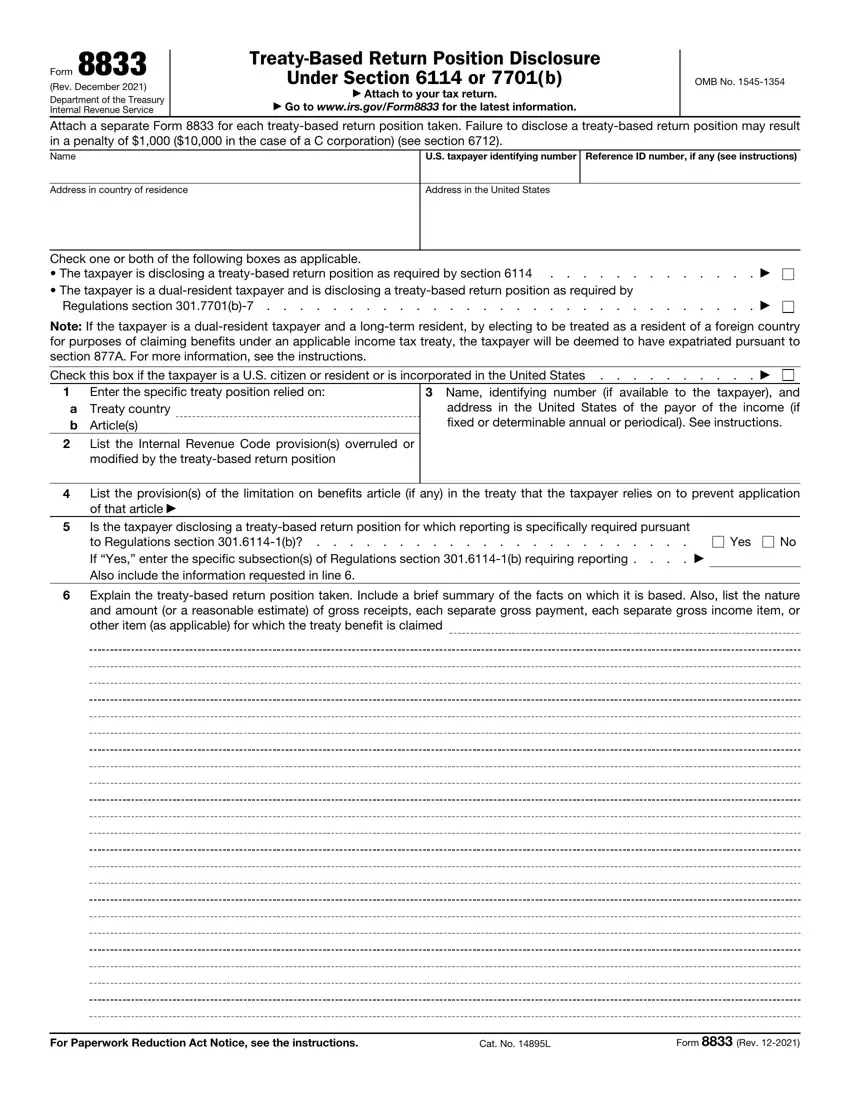

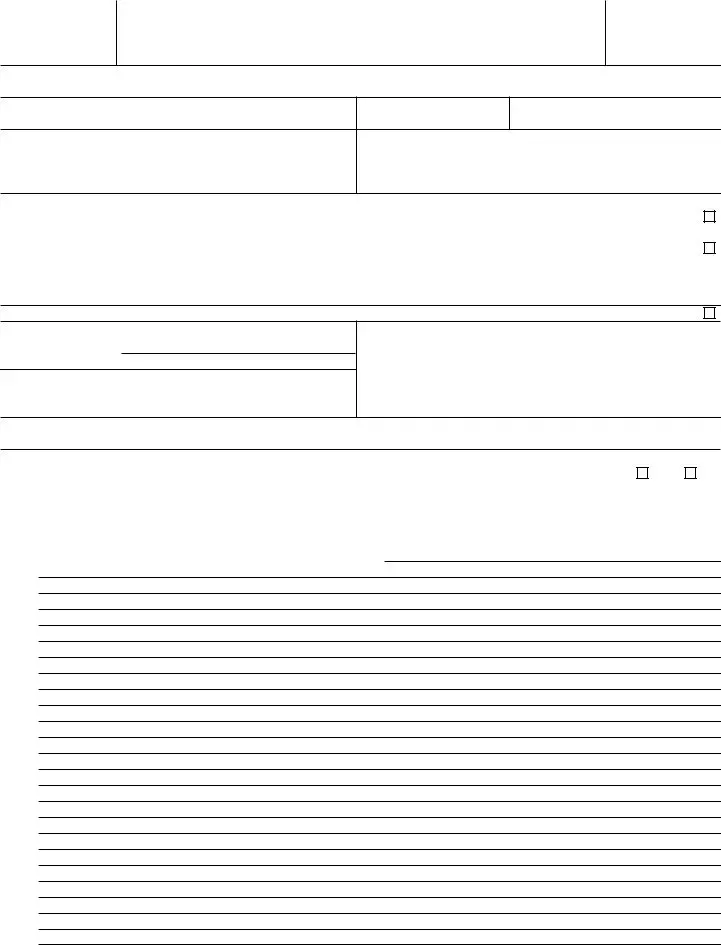

Form 8833 must be used by taxpayers to make the treaty-based return position disclosure required by section 6114 and the regulations thereunder (Regulations section 301.6114-1). The form must also be used by dual-resident taxpayers (defined later) to make the treaty-based return position disclosure required by Regulations section 301.7701(b)-7. A separate form is required annually for each treaty-based return position taken by the taxpayer, although a taxpayer may treat payments or income items of the same type received from the same payor as a single item for reporting purposes.

Who Must File

Generally, a taxpayer who takes a treaty-based return position must disclose that position, unless reporting is specifically waived. See Exceptions from reporting below.

A taxpayer takes a treaty-based return position by maintaining that a treaty of the United States overrules or modifies a provision of the Internal Revenue Code and thereby causes (or potentially causes) a reduction of tax on the taxpayer’s tax return. For these purposes, a treaty includes, but is not limited to, an income tax treaty; estate and gift tax treaty; or friendship, commerce, and navigation treaty.

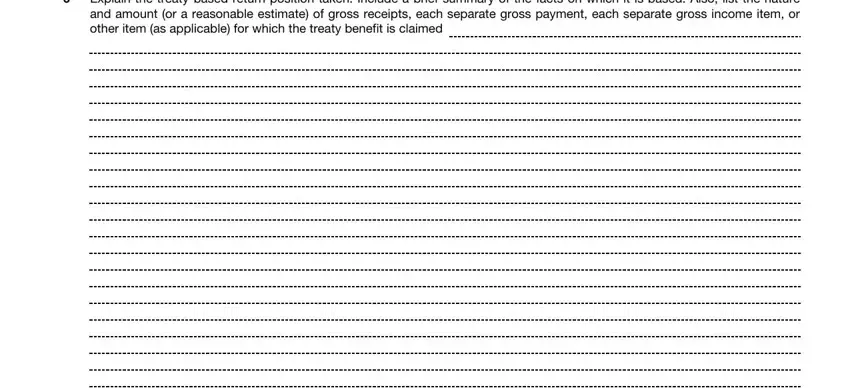

Reporting specifically required. Regulations section 301.6114-1(b) specifically requires reporting on a Form 8833 for the following treaty-based return positions. Note that this is not an exhaustive list of all positions that are reportable on a Form 8833 and that some specifically reportable positions are waived in certain circumstances under Regulations section 301.6114-1(c).

•That a nondiscrimination provision of the treaty prevents the application of an otherwise applicable Code provision, other than with respect to making an election under section 897(i);

•That a treaty reduces or modifies the taxation of gain or loss from the disposition of a U.S. real property interest;

•That a treaty reduces or modifies the branch profits tax (section 884(a)) or the tax on excess interest (section 884(f)(1) (B));

•That a treaty exempts from tax or reduces the rate of tax on dividends or interest paid by a foreign corporation that are U.S.-sourced under section 861(a)(2)(B) or section 884(f)(1)(A);

•That a treaty exempts from tax or reduces the rate of tax on fixed or determinable annual or periodical (FDAP) income that a foreign person receives from a U.S. person, but only if:

(1)The amount is not properly reported on Form 1042-S and the foreign person is: (a) a controlled foreign corporation (as defined in section 957) in which the U.S. person is a U.S. shareholder (as defined in section 951(b)); (b) a foreign corporation that is controlled by a U.S. person within the meaning of section 6038; (c) a foreign corporation that is a 25-percent shareholder of the U.S. person under section 6038A; or (d) a foreign related party, as defined under section 6038A(c)(2)(B);

(2)The foreign person is related to the payor under section 267(b) or section 707(b) and receives income exceeding $500,000, in the aggregate, from the payor and the treaty contains a limitation on benefits article; or

(3)The treaty imposes additional conditions for the entitlement of treaty benefits (for example, the treaty requires the foreign corporation claiming a preferential rate on dividends to meet ownership percentage and ownership period requirements);

•That income effectively connected with a U.S. trade or business of a taxpayer is not attributable to a permanent establishment or a fixed base in the United States;

•That a treaty modifies the amount of business profits of a taxpayer attributable to a permanent establishment or a fixed base in the United States;

•That a treaty alters the source of any item of income or deduction (unless the taxpayer is an individual);

•That a treaty grants a credit for a foreign tax which is not allowed by the Code;

•That the residency of an individual is determined under a treaty and apart from the Code. See Dual-resident taxpayer below.

Exceptions from reporting. Regulations section 301.6114-1(c) waives reporting on a Form 8833 for certain treaty-based return positions. In some instances, the waiver narrowly applies to exempt from reporting a treaty position that is

specifically reportable, and thus careful review of the regulations is advised. In addition, some waivers do not apply to positions that are specifically required to be reported under these form instructions. See Reporting specifically required by Form 8833 instructions, later.

Positions for which reporting is waived include, but are not limited to, the following. See Regulations section 301.6114-1(c) for other waivers from reporting.

•That a treaty reduces or modifies the taxation of income derived by an individual from dependent personal services, pensions, annuities, social security, and other public pensions, as well as income derived by artists, athletes, students, trainees, or teachers;

•That a Social Security Totalization Agreement or Diplomatic or Consular Agreement reduces or modifies the income of a taxpayer;

•That a treaty exempts a taxpayer from the excise tax imposed by section 4371, but only if certain conditions are met (for example, the taxpayer has entered into an insurance excise tax closing agreement with the IRS);

•That a treaty exempts from tax or reduces the rate of tax on FDAP income, if the beneficial owner is an individual or governmental entity;

•If a partnership, trust, or estate has disclosed a treaty position that the partner or beneficiary would otherwise be required to disclose;

•Unless modified by the instructions

below, that a treaty exempts from tax or reduces the rate of tax on FDAP income that is properly reported on Form 1042-S and the amount is received by a:

a.Related party (within the meaning of section 6038A(c)(2)) from a reporting corporation within the meaning of section 6038A(a) (a domestic corporation that is 25% foreign owned and required to file Form 5472);

b.Beneficial owner that is a direct account holder of a U.S. financial institution or qualified intermediary, or a direct partner, beneficiary, or owner of a withholding foreign partnership or trust, from that U.S. financial institution, qualified intermediary, or withholding foreign partnership or withholding foreign trust (whether the Form 1042-S reporting is on a specific payee or pooled basis); or

c.Taxpayer that is not an individual or a State, if the amounts are not received through an account with an intermediary or with respect to an interest in a partnership or a simple or grantor trust, and if the amounts do not total more than $500,000 for the tax year.