Form 8839 can be completed effortlessly. Simply use FormsPal PDF tool to finish the job right away. The editor is constantly maintained by us, getting additional features and growing to be greater. Starting is effortless! Everything you need to do is take these basic steps directly below:

Step 1: Firstly, access the tool by pressing the "Get Form Button" above on this page.

Step 2: As soon as you start the PDF editor, you will see the document ready to be filled in. In addition to filling out various fields, you may also do other things with the form, including putting on custom text, modifying the initial text, inserting graphics, signing the form, and much more.

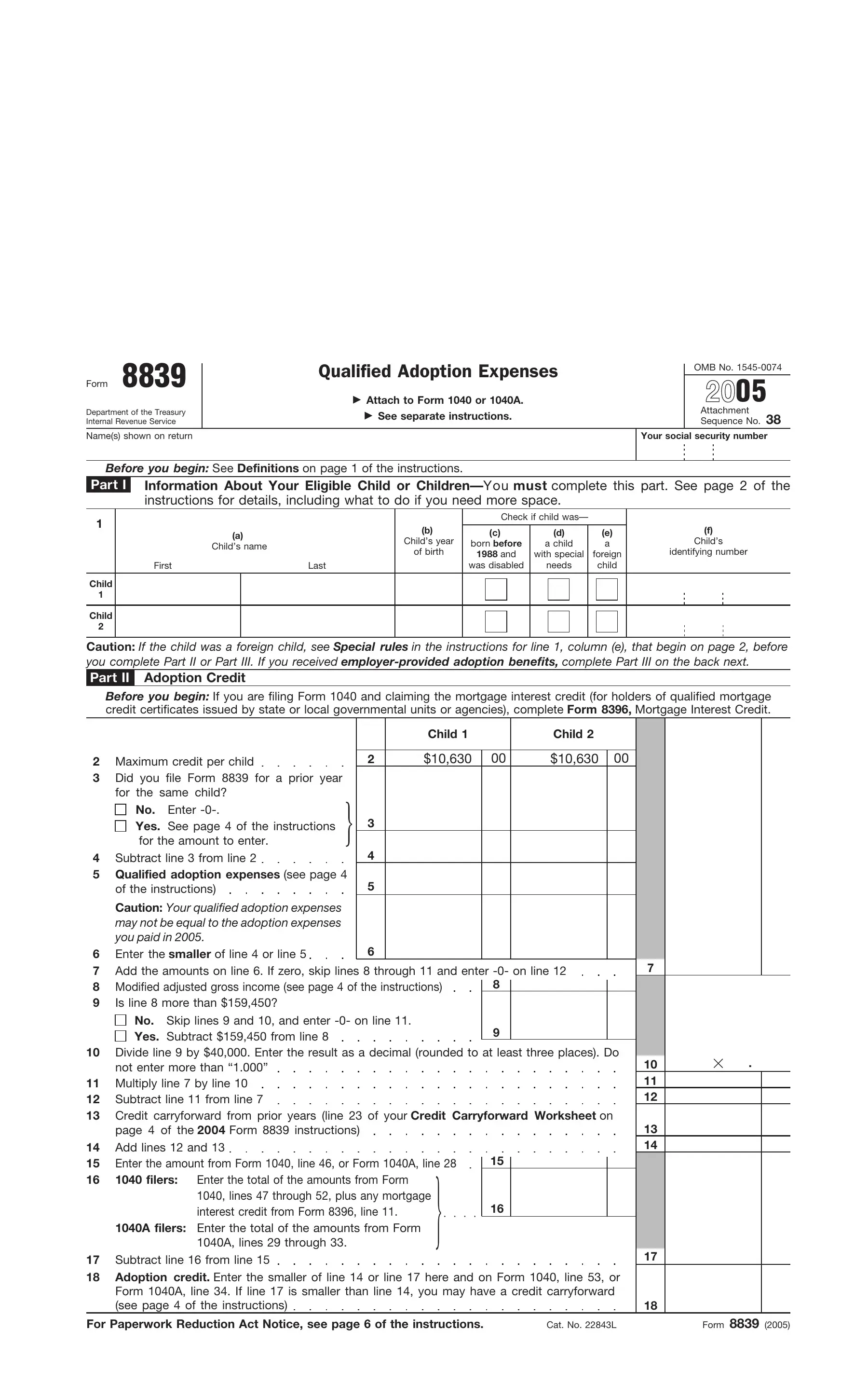

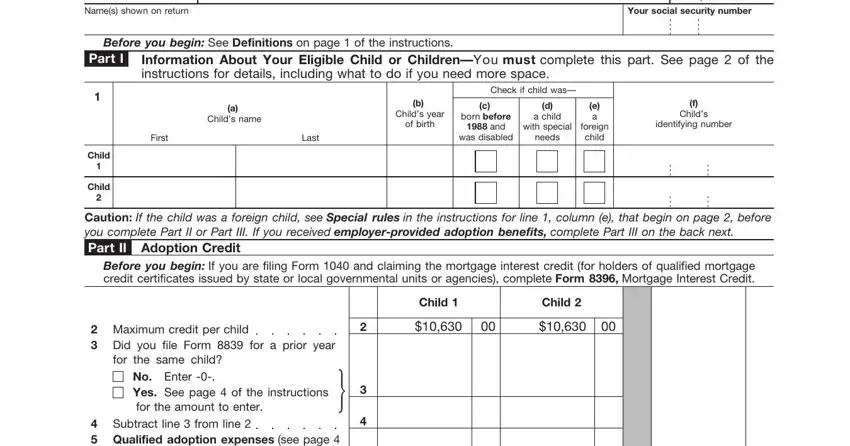

This PDF form requires particular information to be filled in, so be sure to take your time to enter precisely what is expected:

1. The Form 8839 will require specific information to be inserted. Be sure the next blank fields are complete:

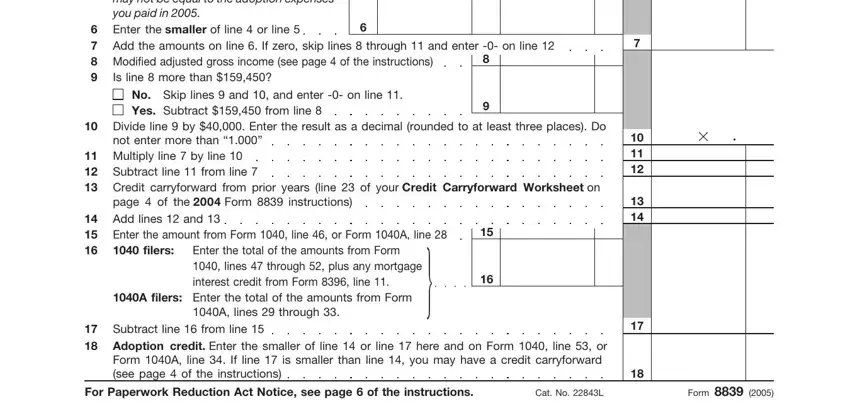

2. Right after this part is filled out, go to enter the relevant information in these - Caution Your qualified adoption, No Skip lines and and enter on, Divide line by Enter the result, Credit carryforward from prior, page of the Form instructions, Enter the total of the amounts, A filers Enter the total of the, A lines through, Subtract line from line Adoption, For Paperwork Reduction Act Notice, Cat No L, and Form.

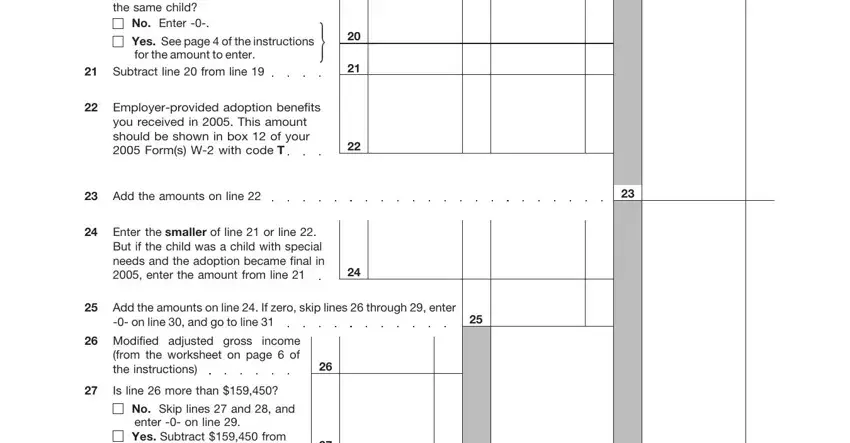

3. This next portion is mostly about Did you receive employerprovided, No Enter, Yes See page of the instructions, Subtract line from line, Employerprovided adoption benefits, Add the amounts on line, Enter the smaller of line or line, Add the amounts on line If zero, Modified adjusted gross income, Is line more than, and No Skip lines and and enter on - complete all of these fields.

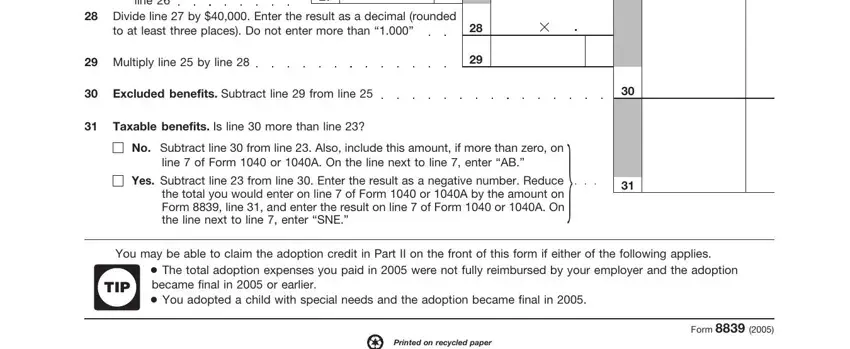

4. This next section requires some additional information. Ensure you complete all the necessary fields - No Skip lines and and enter on, Divide line by Enter the result, Multiply line by line, Excluded benefits Subtract line, Taxable benefits Is line more, Subtract line from line Also, Yes, Subtract line from line Enter, You may be able to claim the, TIP, The total adoption expenses you, Printed on recycled paper, and Form - to proceed further in your process!

Many people often make some mistakes while completing The total adoption expenses you in this section. Don't forget to go over what you enter here.

Step 3: Make certain your information is correct and simply click "Done" to finish the process. Right after getting a7-day free trial account at FormsPal, you will be able to download Form 8839 or send it via email right off. The PDF form will also be available from your personal cabinet with your every edit. We do not share or sell the details that you use whenever dealing with documents at our website.