In navigating the complexities of tax obligations, particularly those related to the year 1993, the Form 8841 plays a crucial role. Officially titled "Deferral of Additional 1993 Taxes," this form, overseen by the Department of the Treasury and facilitated by the Internal Revenue Service, allows taxpayers to calculate and defer certain tax liabilities from the mentioned year. It is designed to be attached to either Form 1040 or Form 1040NR, making it an essential document for individuals in peculiar tax situations. The form consists of several parts, starting with the calculation of the modified regular tax, adjusting for specific credits in Part II, and handling other modified taxes in Part III. Part IV finalizes the process by determining the amount of additional 1993 taxes that can be deferred. Moreover, the form necessitates a detailed understanding of one's modified credits and other taxes, requiring taxpayers to engage with other forms and worksheets, including the notorious Form 6251 for Alternative Minimum Tax calculations. The careful completion of Form 8841 can potentially alleviate some of the taxpayer's financial burdens by allowing for the deferral of certain tax amounts, making it an important document for qualifying individuals.

| Question | Answer |

|---|---|

| Form Name | Form 8841 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | irs form 8841, irs 8841, OMB, 1040NR |

Form 8 8 4 1 |

|

Deferral of Additional 1 9 9 3 Taxes |

|

OMB No. |

|

|

|

||

|

▶ See separate instructions. |

|

|

|

|

|

|

|

|

Department of the Treasury |

|

|

|

Attachment |

Internal Revenue Service |

|

▶ Attach to Form 1040 or Form 1040NR. |

|

Sequence No. 99 |

Name(s) shown on Form 1040 |

|

Social security number |

||

|

|

|

|

|

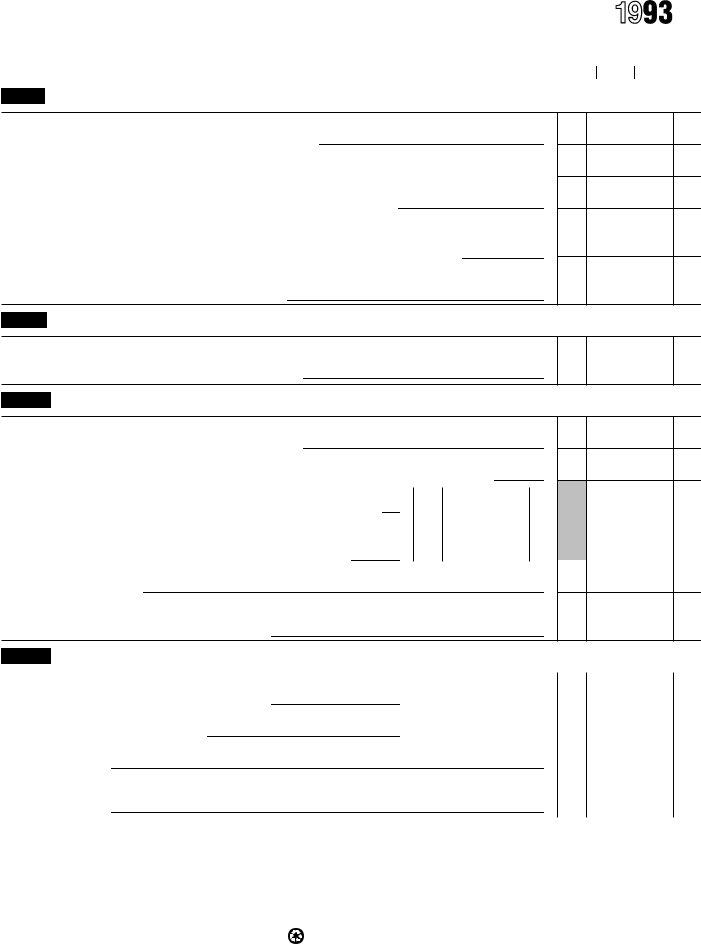

Part I Modified Regular Tax

1Enter your taxable income from Form 1040, line 37

2Figure the tax on the amount on line 1 using the tax computation in the instructions for this line

3Enter any amount from Form 4970 included on Form 1040, line 39

4If you completed Part III of Form 4972, refigure Part III using the tax computation in the instructions for this line and include the refigured amount from line 32 here. If you completed Part II or IV of Form 4972, also include the amounts you originally entered on lines 9 and 55

5Modified regular tax. Add lines 2 through 4 above and enter the result. If Form 1040, line 45, is zero, go to Part III. Otherwise, go to Part II

1

2

3

4

5

Part II Modified Credits

6Modified credits. Complete the worksheet in the instructions to figure your modified credits. Enter the amount from line 21 of that worksheet

6

Part III Modified Other Taxes

7Subtract the amount on line 6, if any, from line 5

8Add Form 1040, lines 47, 49 through 52, and any

9Enter the amount from Form 6251, line 26. You must complete Form

6251 through line 26 to figure the amount to enter on this line |

9 |

10If Form 1040, line 45, is zero, enter the sum of lines 2 and 3. Otherwise, subtract the amount from line 6 of the worksheet in the instructions,

if any, from the sum of lines 2 and 3 and enter the result |

10 |

11Subtract line 10 from line 9. If zero or less, enter

12Modified total tax. Add lines 7, 8, and 11

7

8

11

12

Part IV |

Deferral of Additional 1993 Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Enter the amount from Form 1040, line 53 |

13 |

|

|

|

|

|

14 |

Enter the amount from line 12 |

14 |

|

|

|

|

|

15Subtract line 14 from line 13. If zero or less, stop here; you do not have any additional 1993

taxes to defer |

15 |

16Deferral of additional 1993 taxes. Enter 2⁄3 of line 15 here and on Form 1040, line 58b. See

instructions |

|

16 |

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 15994L |

Form 8841 (1993) |

Printed on recycled paper