You may complete Form 8879 F instantly in our PDFinity® editor. Our tool is consistently developing to deliver the best user experience achievable, and that is due to our dedication to constant enhancement and listening closely to user feedback. Getting underway is easy! All you should do is stick to the following easy steps below:

Step 1: Just press the "Get Form Button" above on this page to access our pdf file editor. Here you will find everything that is required to fill out your file.

Step 2: With the help of this state-of-the-art PDF editor, you may accomplish more than simply fill in blank fields. Try all of the features and make your forms seem high-quality with customized textual content put in, or tweak the file's original content to excellence - all comes with an ability to insert your own graphics and sign the PDF off.

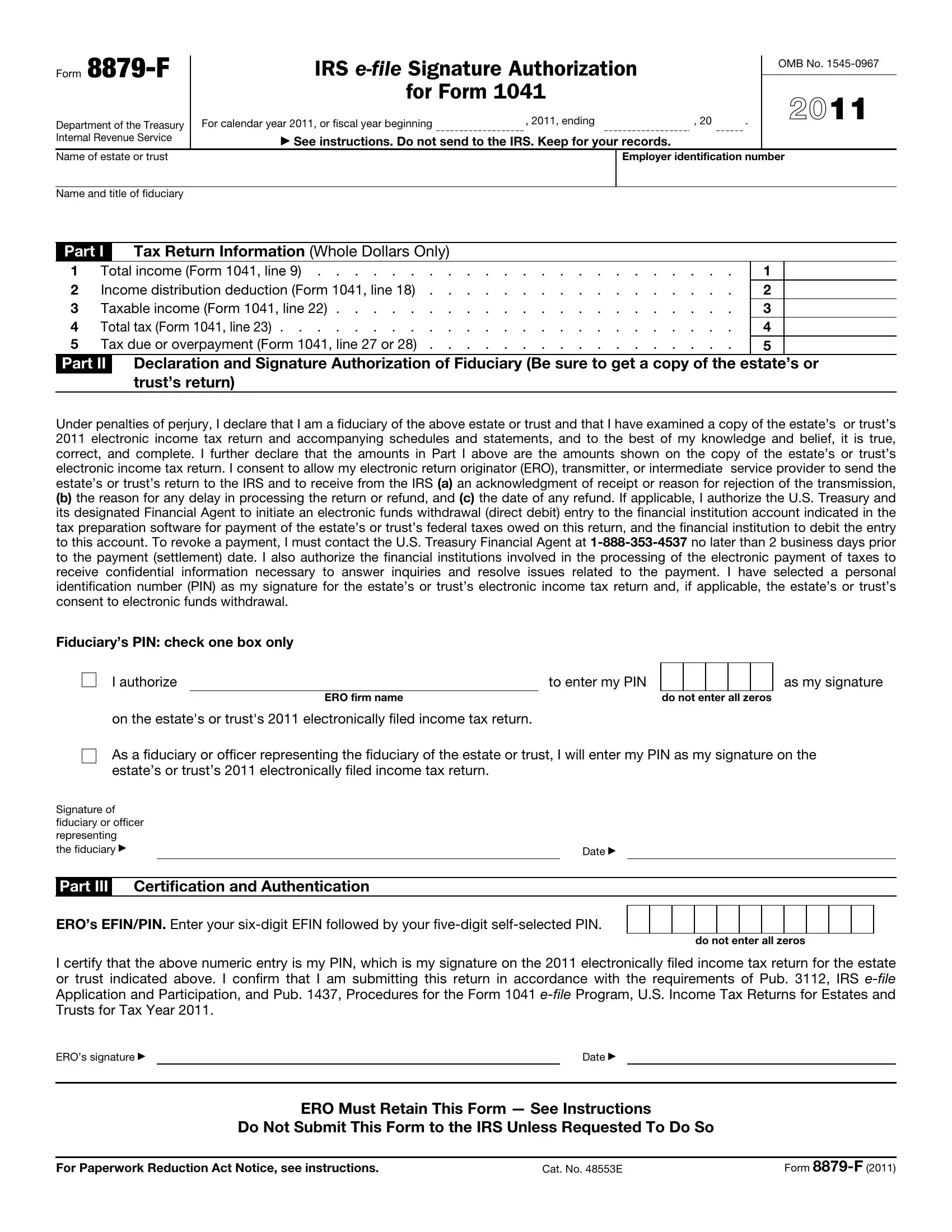

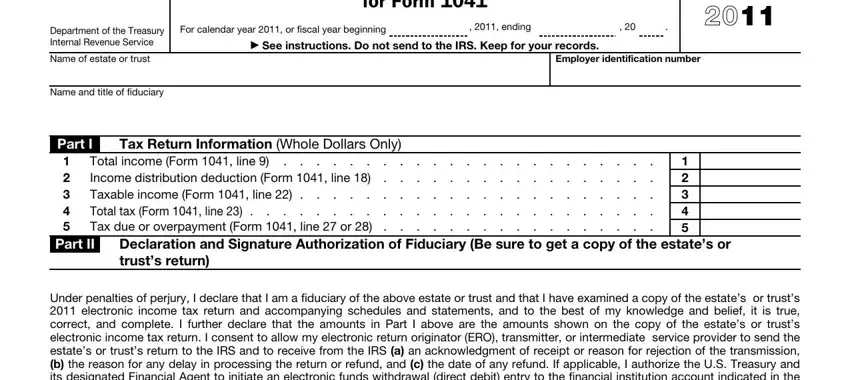

As a way to fill out this PDF form, make sure that you type in the information you need in every area:

1. Firstly, once filling in the Form 8879 F, start out with the section that contains the subsequent fields:

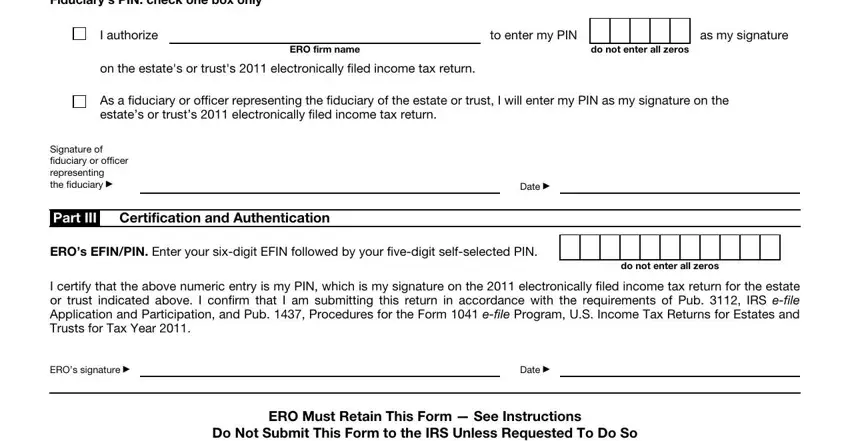

2. Now that the previous section is completed, it's time to include the required details in Fiduciarys PIN check one box only, I authorize, to enter my PIN, as my signature, ERO firm name, do not enter all zeros, on the estates or trusts, As a fiduciary or officer, Signature of fiduciary or officer, Part III, Certification and Authentication, Date, EROs EFINPIN Enter your sixdigit, do not enter all zeros, and I certify that the above numeric so you're able to proceed further.

Those who work with this form generally make mistakes when filling out EROs EFINPIN Enter your sixdigit in this part. You should read twice everything you type in right here.

Step 3: After proofreading the fields and details, hit "Done" and you are all set! Join us now and easily obtain Form 8879 F, set for download. All modifications made by you are saved , making it possible to edit the file further if necessary. FormsPal is invested in the confidentiality of our users; we make certain that all information going through our system remains secure.