Filling in form 8882 irs is easy. We designed our PDF editor to really make it easy to use and assist you to complete any form online. Below are some steps you need to stick to:

Step 1: The web page contains an orange button stating "Get Form Now". Click it.

Step 2: After you've accessed the editing page form 8882 irs, you'll be able to see every one of the functions readily available for the document inside the top menu.

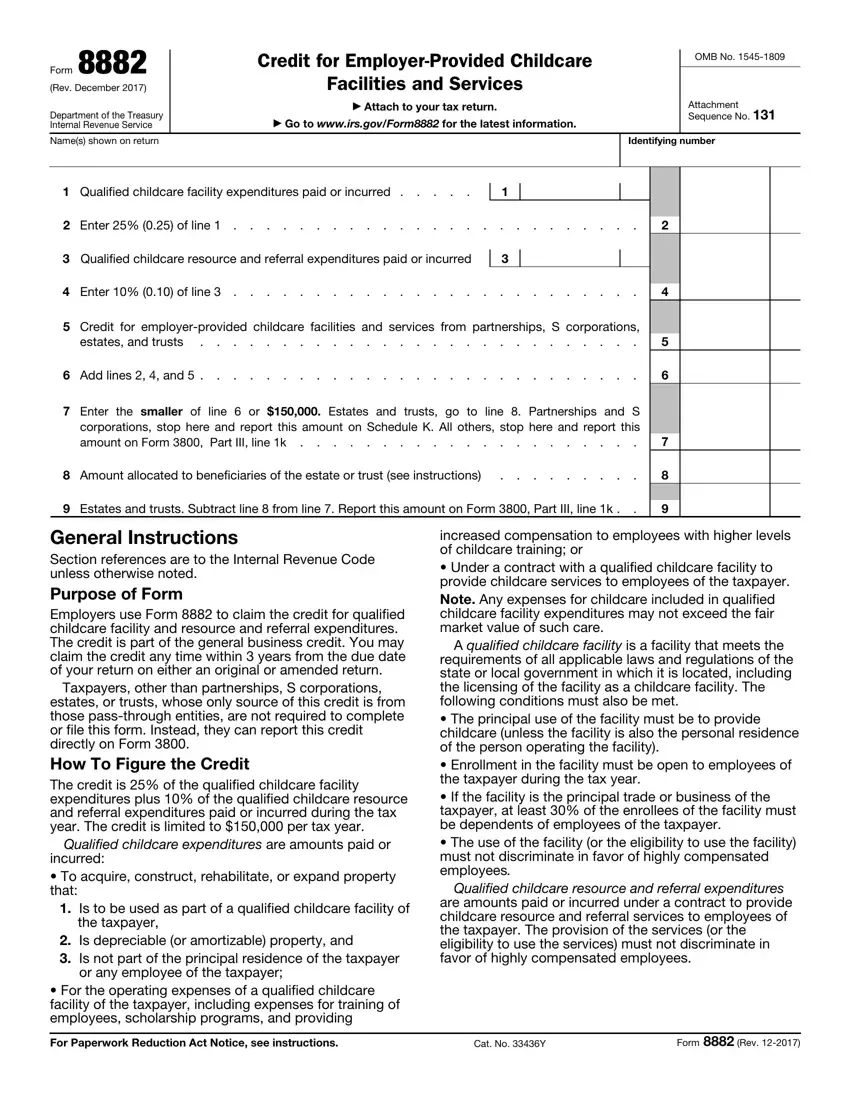

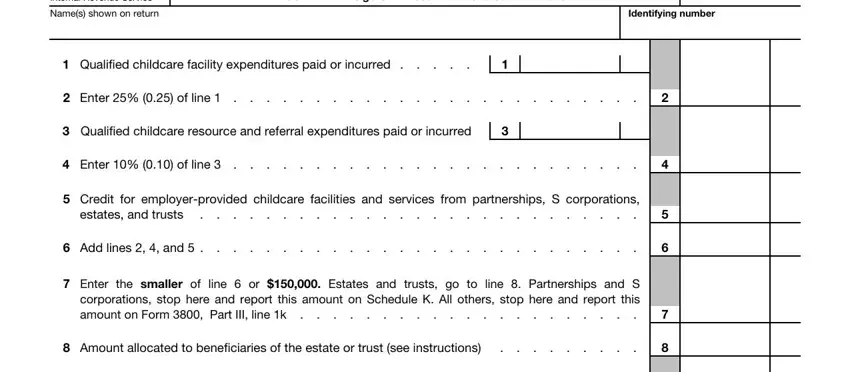

If you want to fill out the form 8882 irs PDF, enter the information for each of the segments:

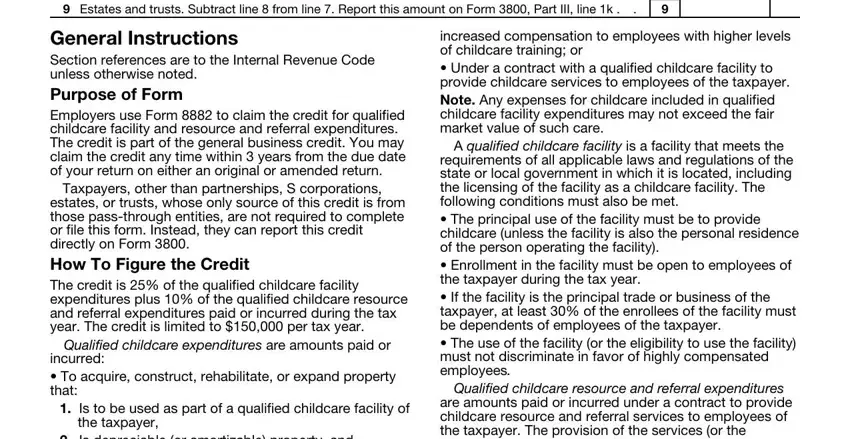

Provide the required details in the space Estates and trusts Subtract line, General Instructions Section, Qualified childcare expenditures, incurred To acquire construct, Is to be used as part of a, the taxpayer, Is depreciable or amortizable, increased compensation to, A qualified childcare facility is, and Qualified childcare resource and.

Step 3: Once you click the Done button, your ready form can be easily exported to any of your devices or to electronic mail given by you.

Step 4: To stay away from probable future difficulties, you need to possess up to two or three copies of each and every file.