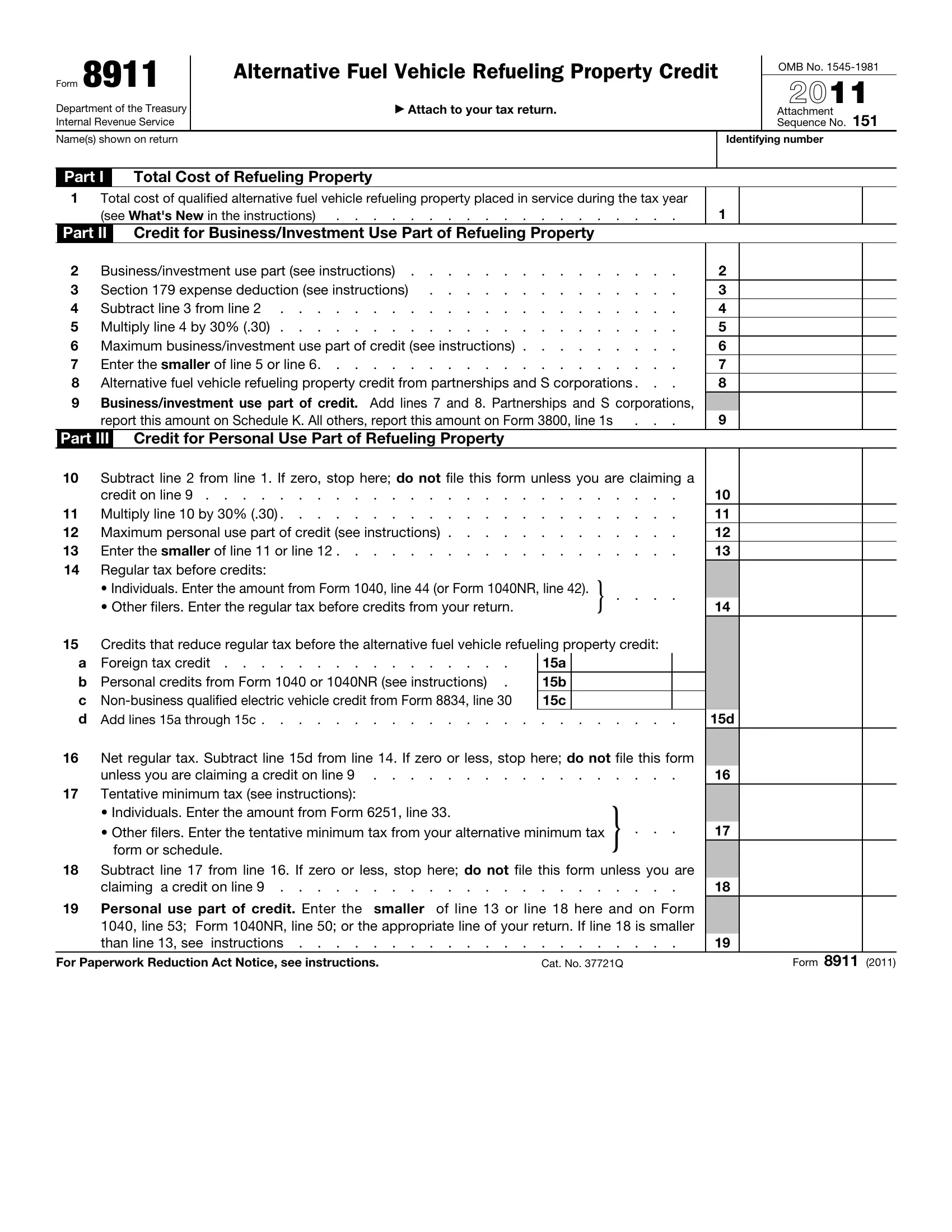

General Instructions

Section references are to the Internal Revenue Code.

What's New

The alternative fuel vehicle refueling property credit is scheduled to expire for non-hydrogen refueling property placed in service after 2011. Do not report this property on Form 8911 unless the credit is extended. See www.irs.gov/form8911 for the latest information about this credit.

The 50% credit rate and higher credit limits expired for refueling property placed in service in tax years beginning after 2010. The extra column used to reflect the higher rate on the 2009 and 2010 Forms 8911 has been removed.

Purpose of Form

Use Form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. The credit attributable to depreciable property (refueling property used for business or investment purposes) is treated as a general business credit. Any credit not attributable to depreciable property is treated as a personal credit. For more details, see section 30C and Notice 2007-43. Notice 2007-43 is available at www.irs.gov/irb/2007-22_IRB/ar10.html.

Taxpayers, other than partnerships or S corporations, whose only source of this credit is from those pass-through entities, are not required to complete or file this form. Instead, they can report this credit directly on Form 3800.

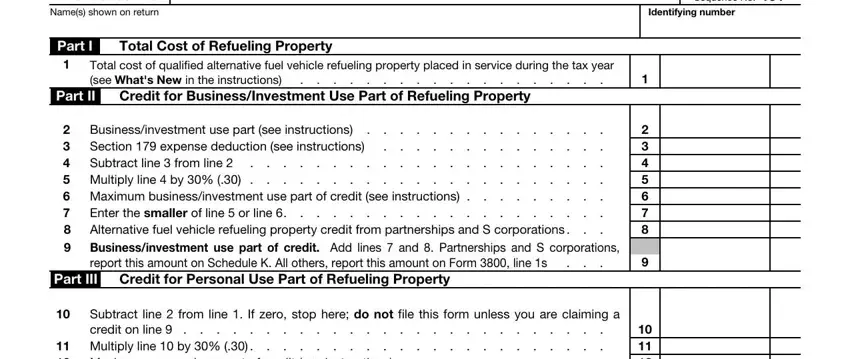

Amount of Credit

For property of a character subject to an allowance for depreciation (business/investment use property), the credit for all property placed in service at each location is generally the smaller of 30% of the property’s cost or $30,000. For property of a character not subject to an allowance for depreciation placed in service at your main home (personal use property), the credit for all property placed in service at your main home is generally the smaller of 30% of the property’s cost or $1,000.

Each property’s cost must first be reduced by any section 179 expense deduction taken for the property.

Qualified Alternative Fuel Vehicle Refueling Property

Qualified alternative fuel vehicle refueling property is any property (other than a building or its structural components) used for either of the following.

•To store or dispense an alternative fuel (defined below) other than electricity into the fuel tank of a motor vehicle propelled by the fuel, but only if the storage or dispensing is at the point where the fuel is delivered into that tank.

•To recharge an electric motor vehicle, but only if the recharging property is located at the point where the vehicle is recharged.

In addition, the following requirements must be met to qualify for the credit.

•You placed the refueling property in service during your tax year.

•The original use of the property began with you.

•The property is not used predominantly outside the United States.

•If the property is not business/investment use property, the property must be installed on property used as your main home.

Exception. If you are the seller of new refueling property to a tax-exempt organization, governmental unit, or a foreign person or entity, and the use of that property is described in section 50(b)(3) or (4), you can claim the credit, but only if you clearly disclose in writing to the purchaser the amount of the tentative credit allowable for the refueling property (included on line 7 of Form 8911). Treat all property eligible for this exception as business/investment use property.

Alternative fuel. The following are alternative fuels.

•Any fuel at least 85 percent of the volume of which consists of one or more of the following: ethanol, natural gas, compressed natural gas, liquefied natural gas, liquefied petroleum gas, or hydrogen.

•Any mixture which consists of two or more of the following: biodiesel (as defined in section 40A(d)(1)), diesel fuel (as defined in section 4083(a)(3)), or kerosene, and at least 20% of the volume of which consists of biodiesel determined without regard to any kerosene in such mixture.

•Electricity.

Basis Reduction

Unless you elect not to take the credit, you must reduce the basis of the property by the sum of the amounts entered on lines 7 and 13 for that property.

Recapture

If the property no longer qualifies for the credit, you may have to recapture part or all of the credit. For more details, see section 30C(e)(5).

Specific Instructions

Line 2

To figure the business/investment use part of the total cost, multiply the cost of each separate refueling property by the percentage of business/investment use for that property. If during the tax year you convert property used solely for personal purposes to business/investment use (or vice versa), figure the percentage of business/investment use only for the number of months you use the property in your business or for the production of income. Multiply that percentage by the number of months you use the property in your business or for the production of income and divide the result by 12.

Line 3

Enter any section 179 expense deduction you claimed for the property from Part I of Form 4562, Depreciation and Amortization.

Line 6

If you placed refueling property with business/investment use in service at just one location, enter $30,000.

If you placed refueling property with business/investment use in service at more than one location, but all property placed in service at any one location would result in an amount of not more than $30,000 if property from that location was reported separately on line 5, enter the amount from line 5 on both line 6 and line 7. If you placed refueling property with business/ investment use in service at more than one location, and property at at least one location would result in an amount of more than $30,000 if property from that location was reported separately on line 5, add the separate amounts for each location, but do not include in the total more than $30,000 for any single location.

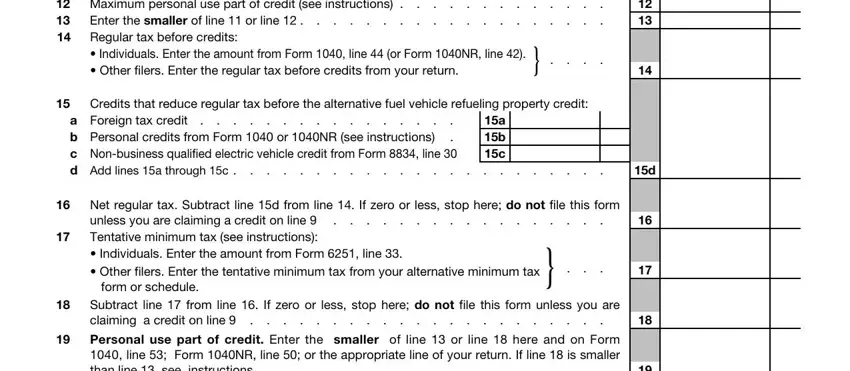

Line 12

Generally, enter $1,000. However, if the location of your main home changed during the tax year and you placed personal use refueling property in service at both locations during the tax year, enter $2,000.

Line 15b

Enter the total, if any, credits from Form 1040, lines 48 through 52 (or Form 1040NR, lines 46 through 49); Form 8396, line 9; Form 8859, line 9; Form 8834, line 23; Form 8910, line 22; Form 8936, line 15; and Schedule R, line 22.

Line 17

Although you may not owe alternative minimum tax (AMT), you must still figure the tentative minimum tax (TMT) to figure your credit. Complete and attach the applicable AMT form or schedule and enter the TMT on line 17.