Understanding the complexities of Form 8921 is crucial for tax-exempt organizations and government entities mandated to report under section 6050V. Issued in August 2007 by the Department of the Treasury's Internal Revenue Service, this form serves as an Applicable Insurance Contracts Information Return. It outlines structured transactions, identifying key data such as the transaction date, structured transaction identifier, and essential organizational information, including the organization’s role and type. Part I focuses on identifying information pivotal for filing purposes, from organizational details to the amounts received or anticipated from structured transactions. With Part II delving into the parties involved in the structured transaction—ranging from creditors to brokers, and highlighting their roles, contributions, and expected financial outcomes—comprehensive reporting is emphasized. Part III expands on applicable insurance contracts, demanding details such as insurer's information, contract types, premium structures, and investment options. This form not only demands meticulous attention to detail, including the submission of related documents and promotional materials but also emphasizes transparency and accuracy, underlined by the declaration under penalties of perjury in Part IV. Thus, Form 8921 embodies a critical reporting tool, ensuring that applicable tax-exempt entities and government organizations disclose pertinent information regarding insurance contracts linked to structured transactions.

| Question | Answer |

|---|---|

| Form Name | Form 8921 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 10c, STI, Inflationindexed, Insurer |

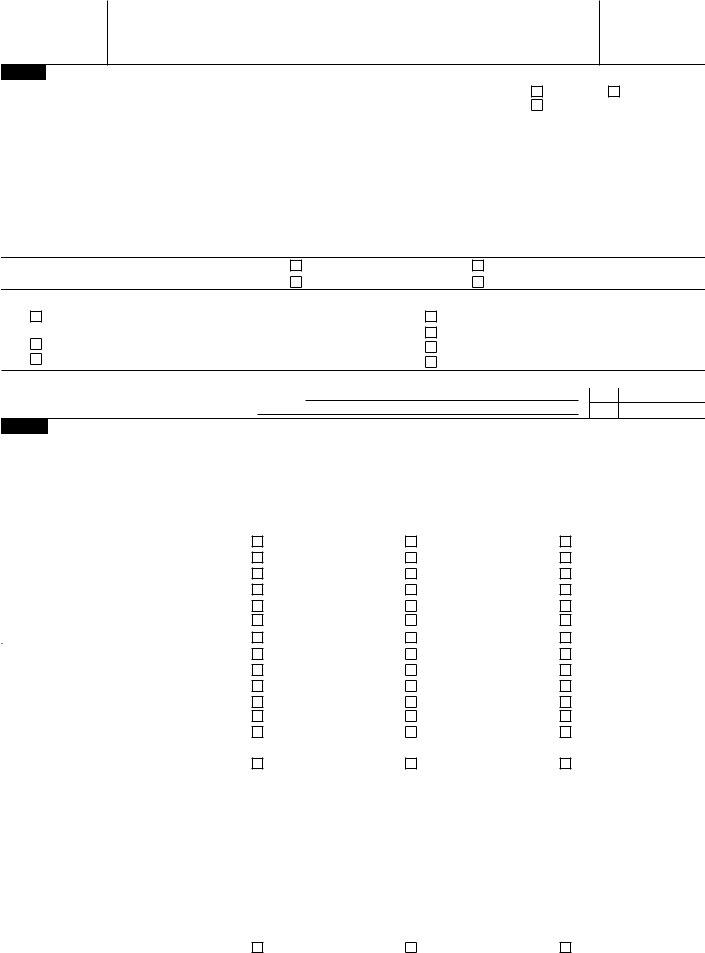

Form 8921

(August 2007)

Department of the Treasury Internal Revenue Service

Applicable Insurance Contracts Information Return

(For

OMB No.

Part I Identifying Information. See instructions for the required filing date.

1 |

Structured transaction date (MM/DD/YYYY) |

2 |

Structured transaction identifier (STI) |

3 |

Initial |

Corrected |

|

|

|

|

|

|

|

||

|

/ |

/ |

|

STI |

|

Updated |

|

4a |

Name of applicable exempt organization |

|

4b Employer identification number |

||||

|

|

|

|

|

|

||

4c |

Number and street (or P.O. box if mail is not delivered to street address) |

|

|

|

|||

|

|

|

|

|

|

|

|

4d |

City or town, state or country, and ZIP + 4 |

|

|

|

|

||

|

|

|

|

|

|

|

|

4e |

Website address ▶ |

|

|

|

|

||

4f |

State in which organized (or country, if foreign) |

|

|

|

|

||

5Organization’s role in the structured transaction (check all that apply):

Contract owner

Provide insurable interest

Contract beneficiary Other (specify) ▶

6Check the appropriate box identifying your type of organization:

Religious, charitable, scientific, literary, educational, amateur sports, or similar organization

Governmental organization

Fraternal society operating on a lodge system

Indian tribal government Veterans’ organization Cemetery company Employee stock ownership plan

7Enter amounts received or expected to be received by your organization under the structured transaction: a Amounts received as of the filing date of this Form 8921

b Amounts expected to be received in the future

7a

7b

Part II Parties to the Structured Transaction

|

Attach additional sheets, if necessary |

A |

B |

C |

8a |

Name of party |

|

|

|

8b |

Party’s social security or employer |

|

|

|

|

identification number |

|

|

|

|

|

|

|

|

8c |

Address of party |

|

|

|

|

|

|

|

|

8d |

Party’s role in the structured transaction |

Creditor |

Creditor |

Creditor |

|

|

Investor |

Investor |

Investor |

|

|

Broker/advisor |

Broker/advisor |

Broker/advisor |

|

|

Contract owner |

Contract owner |

Contract owner |

|

|

Contract beneficiary |

Contract beneficiary |

Contract beneficiary |

|

|

Other ▶ |

Other ▶ |

Other ▶ |

8e |

Type of party |

Individual |

Individual |

Individual |

|

|

Corporation |

Corporation |

Corporation |

|

|

Partnership |

Partnership |

Partnership |

|

|

Trust |

Trust |

Trust |

|

|

Government |

Government |

Government |

|

|

Other ▶ |

Other ▶ |

Other ▶ |

8f |

Check box if foreign |

|

|

|

8g |

Check box if an applicable exempt |

|

|

|

|

organization |

|

|

|

8h |

If a trust, partnership, or corporation, |

|

|

|

|

enter the number of beneficiaries, |

|

|

|

|

partners, members or stockholders |

|

|

|

|

|

|

|

|

8i |

Total amounts paid or to be paid by the |

|

|

|

|

party under the structured transaction |

|

|

|

|

|

|

|

|

8j |

Total amounts received by the party under the |

|

|

|

|

structured transaction as of the filing date |

|

|

|

|

|

|

|

|

8k |

Total amounts to be received by the party |

|

|

|

|

under the structured transaction in the future |

|

|

|

|

|

|

|

|

8l |

Check box if a portion or all of the amounts |

|

|

|

|

reported on line 8j or line 8k is to be paid from |

|

|

|

|

death, endowment, or annuity benefits. |

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 37732X |

Form 8921 |

||

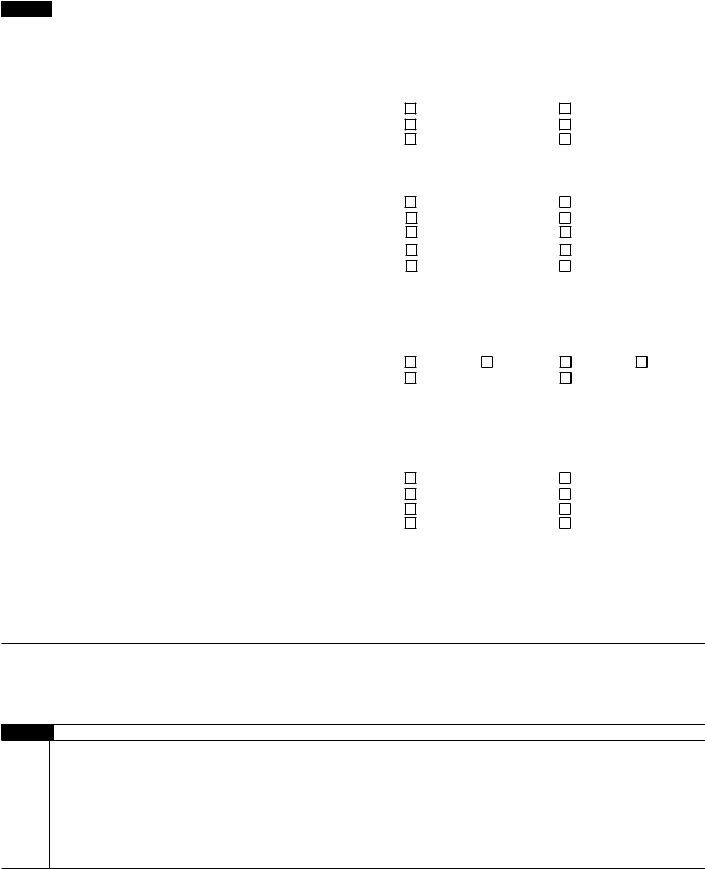

Form 8921 |

|

|

|

|

|

|

|

Page 2 |

||

|

|

|

|

|

|

|

|

|

|

|

Part III |

Applicable Insurance Contract Forms |

|

|

|

|

|

|

|

|

|

|

Attach additional sheets, if necessary |

|

|

A |

|

|

|

B |

|

|

9 |

Contract form identifier |

|

|

|

|

|

|

|

|

|

10a |

Insurer’s name |

|

|

|

|

|

|

|

|

|

10b |

Insurer’s employer identification number (EIN) |

|

|

|

|

|

|

|

|

|

10c |

State in which insurer is organized (or country, if foreign) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Applicable insurance contract type |

Life insurance |

|

Life insurance |

|

|||||

|

|

|

Deferred annuity |

Deferred annuity |

||||||

|

|

|

Immediate annuity |

Immediate annuity |

||||||

12a |

Earliest date on which an applicable insurance contract was issued |

/ |

|

/ |

/ |

|

/ |

|||

12b |

Latest date on which an applicable insurance contract was issued |

/ |

|

/ |

/ |

|

/ |

|||

12c |

Number of policies issued |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

Check if contract is group insurance |

|

|

|

|

|

|

|

|

|

13a |

Premium structure |

Fixed in contract |

Fixed in contract |

|||||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

Life of insured |

|

|

Life of insured |

|

||

|

|

|

|

|

years |

|

|

|

years |

|

|

|

|

Discretionary |

|

Discretionary |

|

||||

13b |

Aggregate premiums: first year |

|

|

|

|

|

|

|

|

|

13c |

Aggregate premiums: remaining years |

|

|

|

|

|

|

|

|

|

14a |

Aggregate value of death or endowment benefits at issue date |

|

|

|

|

|

|

|

|

|

14b |

Range of contract death or endowment benefits: smallest/largest |

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

||||

15a |

Type of immediate annuity payments (see instructions) |

Fixed or |

Variable |

Fixed or |

Variable |

|||||

|

|

|

|

|

|

|

|

|||

|

|

|

||||||||

15b |

Aggregate monthly annuity payments at issue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15c |

Range of contract monthly annuity payments: smallest/largest |

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

16a |

Aggregate amount of policy loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16b |

Aggregate amount of other contract distributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

17 |

Investment options (check all that apply) |

No option |

|

No option |

|

|||||

|

|

|

Guaranteed interest |

Guaranteed interest |

||||||

|

|

|

Bond or equity funds |

Bond or equity funds |

||||||

|

|

|

Other ▶ |

|

Other ▶ |

|

||||

18a |

Number of insureds: males/females |

/ |

|

/ |

|

|||||

18b |

Average age of insureds |

|

|

|

|

|

|

|

|

|

18c |

Age range at issue: youngest/oldest |

/ |

|

/ |

|

|||||

19a |

Number of insureds that are donors to your organization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19b |

Donations received from insureds in most recently completed |

|

|

|

|

|

|

|

|

|

|

calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20Attach a description of the structured transaction for which this Form 8921 is being filed. See instructions.

21Attach copies of related documents, including representative copies of applicable insurance contracts issued as part of the structured transaction for which this Form 8921 is being filed. (Identify such contracts with the contract form identifiers reported in line 9.) Also include any contracts governing the obligations of persons described in lines 8a through 8l and any agreements covering the relationship of your organization to such persons. Include promotional materials (including financial projections) provided to your organization, to your donors, or to other persons who have directly or indirectly held an interest in the applicable insurance contracts.

Part IV Signature

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Please ▶ |

|

|

|

|

Signature of authorized person |

Date |

|

||

Sign |

▶ |

|

|

|

Here |

|

|

|

|

Type or print name |

|

|

||

|

▶ |

|

( |

) |

|

|

|

||

|

Title |

Telephone number |

||

Form 8921