Using the online editor for PDFs by FormsPal, you'll be able to fill out or edit irs form 9041 here and now. To make our editor better and simpler to work with, we consistently come up with new features, considering feedback coming from our users. Getting underway is easy! All you need to do is adhere to these simple steps below:

Step 1: Click the "Get Form" button at the top of this webpage to get into our PDF editor.

Step 2: With our handy PDF tool, it's possible to accomplish more than simply fill in blank fields. Express yourself and make your documents appear great with customized textual content incorporated, or modify the original input to perfection - all that backed up by an ability to insert stunning graphics and sign the PDF off.

It will be easy to fill out the document using this detailed guide! Here is what you need to do:

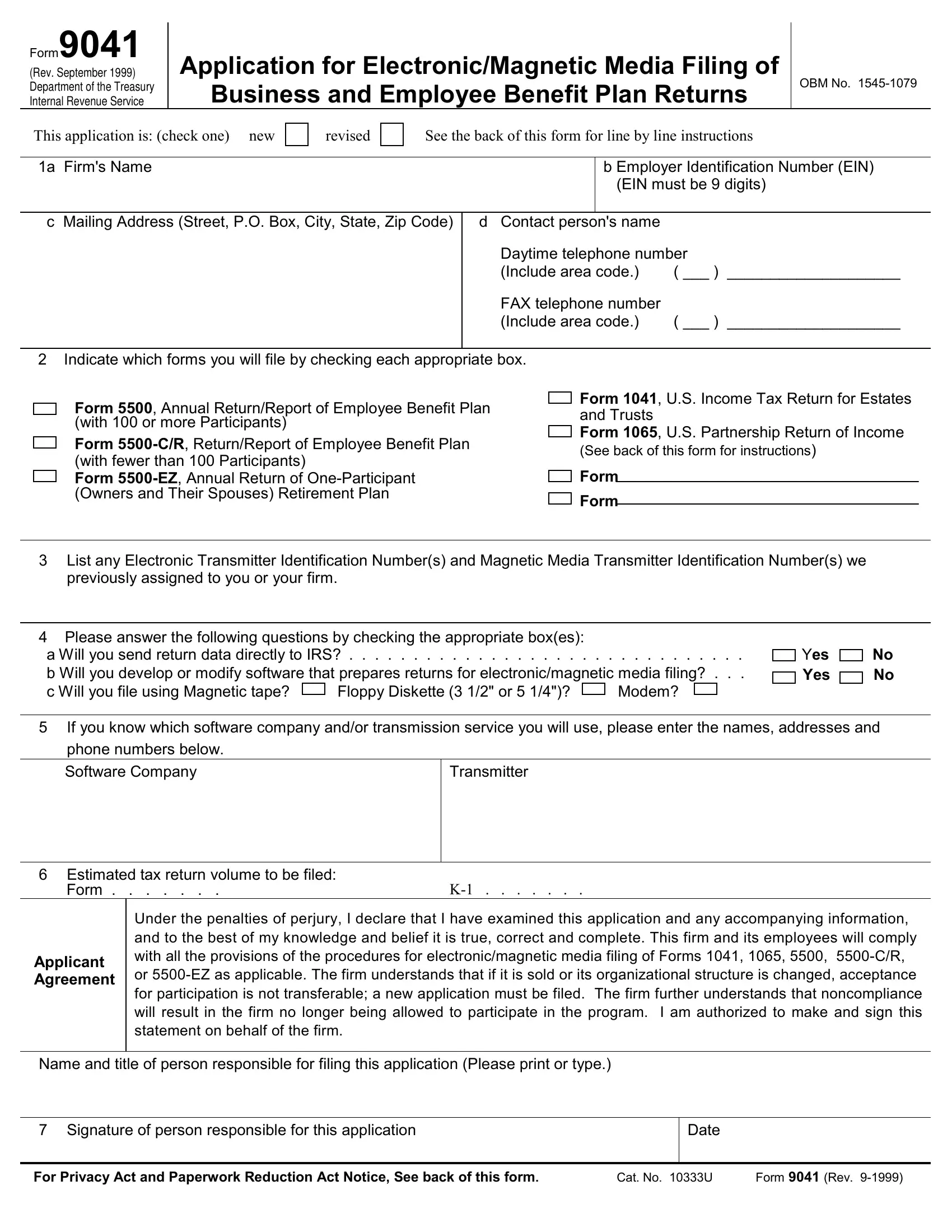

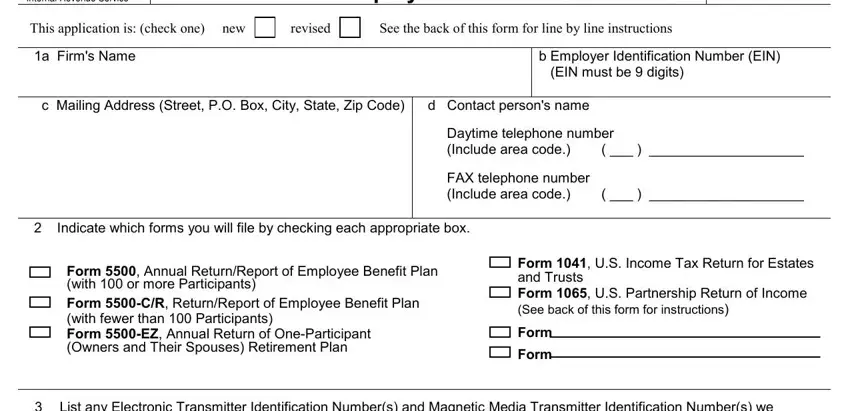

1. While filling in the irs form 9041, ensure to complete all needed blanks within its relevant part. It will help expedite the work, enabling your details to be processed fast and appropriately.

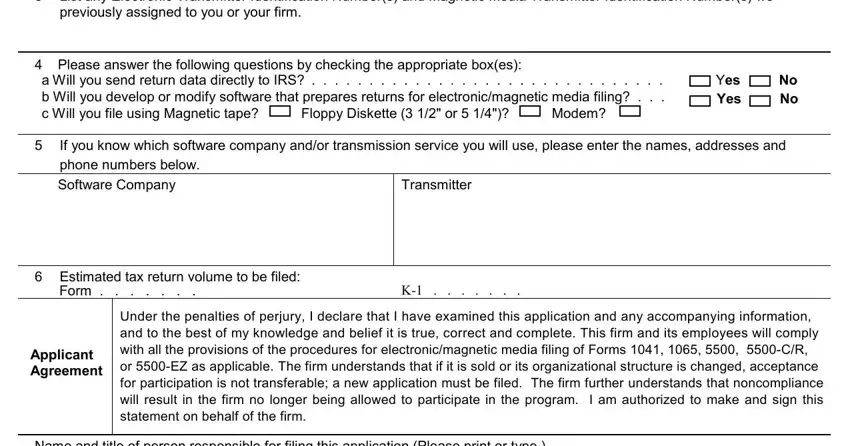

2. Soon after filling in this step, go on to the subsequent part and fill in the essential particulars in these blanks - List any Electronic Transmitter, previously assigned to you or your, Please answer the following, a Will you send return data, Yes No Yes No, If you know which software company, phone numbers below, Software Company, Transmitter, Estimated tax return volume to be, Form, Applicant Agreement, Under the penalties of perjury I, and Name and title of person.

Those who work with this form frequently make mistakes when filling in Estimated tax return volume to be in this section. Don't forget to re-examine what you enter right here.

3. This next segment is mostly about Name and title of person, Signature of person responsible, Date, and For Privacy Act and Paperwork - fill in all these fields.

Step 3: Prior to finishing your file, make sure that all form fields are filled in properly. Once you’re satisfied with it, press “Done." After creating a7-day free trial account at FormsPal, it will be possible to download irs form 9041 or send it via email immediately. The file will also be readily available in your personal account menu with your edits. FormsPal is devoted to the personal privacy of all our users; we ensure that all information used in our tool stays confidential.