General Instructions

Purpose of Form

Use Form 9452 to see if you must file a Federal income tax return for 2011. However, see Special Situations below before you begin.

Special Situations

If any of the following special situations apply to you, you must file a Federal income tax return for 2011 even if your gross income is less than the amount shown in the chart in Part Il.

Withholding. If you had taxes withheld from a job or your annuity or pension income, and you want to get a refund of the withheld taxes, you will need to file.

Earned Income Credit

1.If you wish to apply for the earned income credit you will need to file.

2.You must file if you received any advance earned income credit payments from your employer. These payments should be shown in box 9 of your W-2 form.

Special taxes

1.You must file if you owe any special tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA), Archer Medical Savings Account (MSA), or Coverdell Education Savings Account (ESA). You may owe this tax if you:

•Received an early distribution from (a) an IRA or other qualified retirement plan, (b) an annuity, or

(c) a modified endowment contract entered into after June 20, 1988.

•Made excess contributions to your IRA, Archer MSA, or Coverdell ESA.

•You received distributions from Coverdell ESAs in excess of your qualified higher education expenses.

•Were born before July 1, 1940, and you received less than the minimum required distribution from your qualified retirement plan.

2.You must file if you have a gain or loss on the sale of stocks or a gain from the sale of bonds or your home.

3.You must file if you owe social security and Medicare tax on tips you did not report to your employer.

4.You must file if you owe uncollected social security and Medicare or Tier 1 Railroad Retirement (RRTA) tax on tips you reported to your employer or on group-term life insurance.

5.You must file if you owe alternative minimum tax.

6.You must file if you owe recapture taxes.

Taxable self-employment income

You must file if you had net self- employment income of at least $400.

Church employee income

You must file if you had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes.

If someone else can claim you as a dependent, you may have to file a tax return even if your own income is much lower than the total gross income amounts in Part Il. If your gross income was $3,500 or more, you usually cannot be claimed as a dependent unless at the end of 2011 you were under age 19 (or a student under age 24).

Specific Instructions

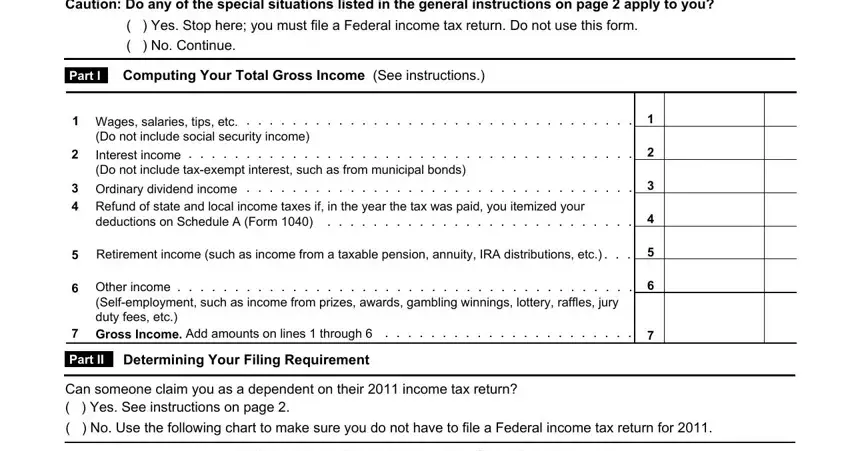

Part I

Complete Part I to figure your gross income for 2011.

Gross income means all income you received in the form of money, goods, property, and services that is not exempt from tax including any income from sources outside the United States (even if you may exclude part or all of it).

Social security benefits

1.Social security payments are

NOT taxable unless one-half of all your net social security benefits plus your adjusted gross income and any tax exempt interest total more than $25,000 if you are single (or married filing separately and you lived apart from your spouse for all of 2011), or $32,000 if married filing a joint return. Enter only the taxable portion of your social security benefits on line 6, Other taxable income.

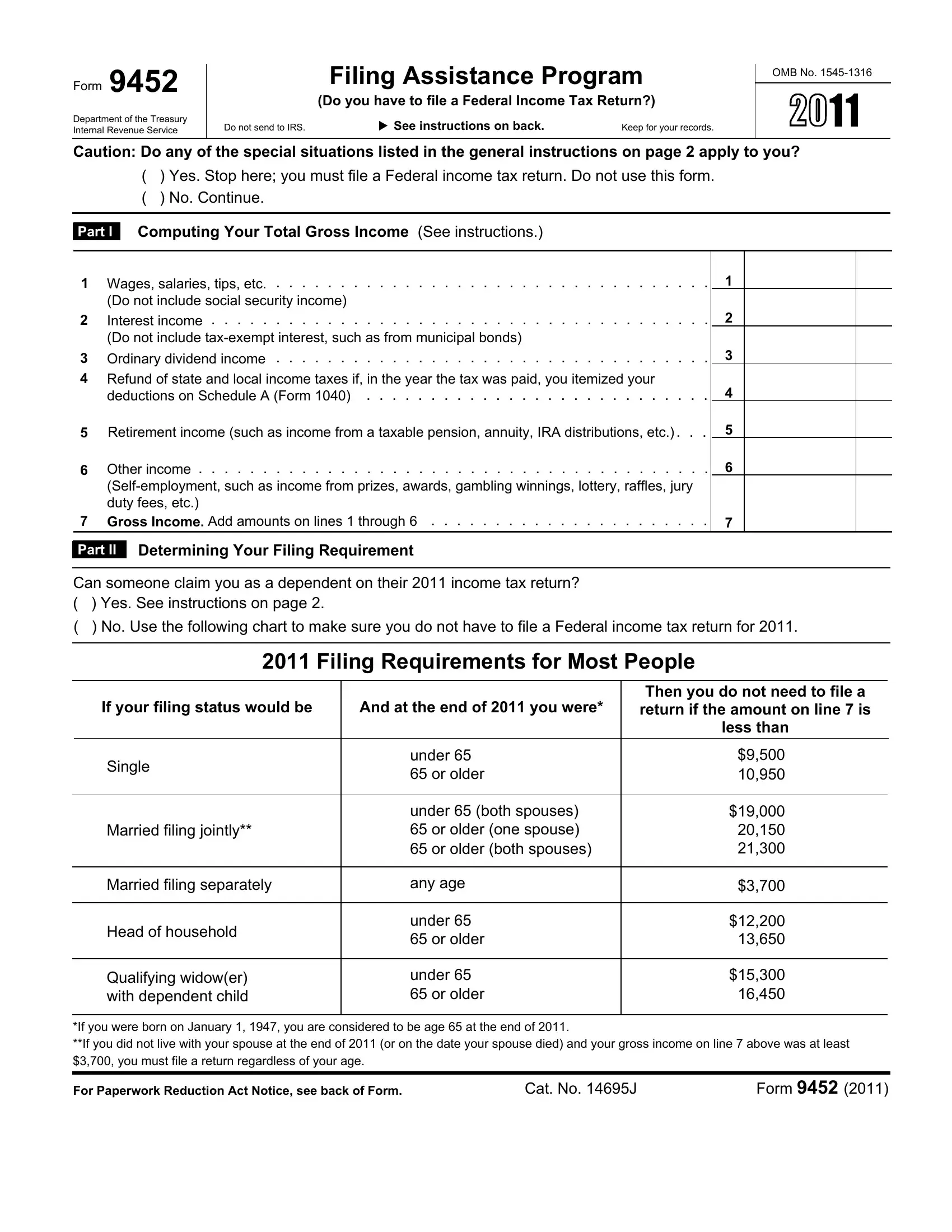

Part II

Use the table in Part II to determine your filing requirement.

If you were born on January 1, 1947, you are considered to be age 65 at the end of 2011.

Paperwork Reduction Act Notice. Your use of this worksheet is optional. It is provided to aid you in determining whether you must file a Federal tax return.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103. The time needed to complete this worksheet will vary depending on individual circumstances. The estimated average time is 30 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6406, Washington, DC 20224.