In a world where corporations are constantly navigating the complex landscape of the U.S. tax system, understanding the nuances of specific forms like the Form 973 becomes crucial. Officially titled "Corporation Claim for Deduction for Consent Dividends" and revised in October 1992, this document plays a pivotal role for certain corporations. Its primary purpose is to facilitate these businesses in claiming deductions for consent dividends, as outlined under Section 561 of the Internal Revenue Code, thus offering a strategic tax planning tool. The form requires detailed information, including the corporation's name, employer identification number, stock classes, and the number of shares outstanding at the beginning and end of the tax year. It also necessitates an account of the actual distributions per share made within the tax year and any unequal treatments among shares. Beyond just filling out the form, corporations must also pay close attention to the consent of shareholders via Form 972, ensuring compliance with regulations pertaining to nonresident aliens and foreign shareholders, especially in terms of withholding tax obligations. With a deadline set for attachment to the annual tax return, the Form 973, alongside its supplemental documents and the need for meticulous record-keeping and understanding of withholding tax provisions, exemplifies the intricate interplay between corporate operations and tax liabilities—a testament to the complexities inherent in the U.S. tax code.

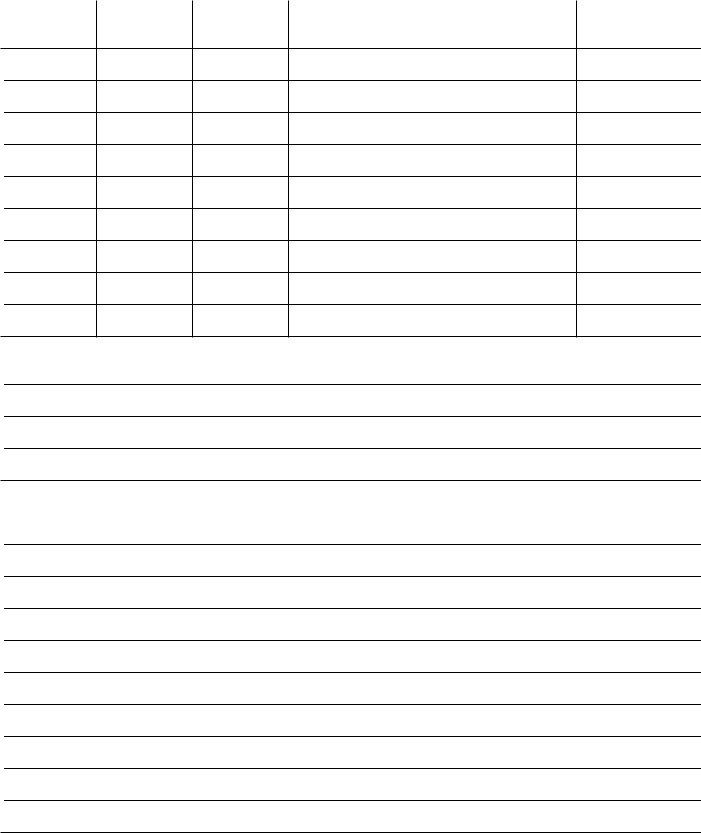

| Question | Answer |

|---|---|

| Form Name | Form 973 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | what is a 1092 form, what is a 1092 tax form, 1092 tax form, what is a 1092 |

Form 9 7 3 |

Corporation Claim for Deduction |

|

|

|

(Rev. October 1992) |

|

for Consent Dividends |

|

OMB No. |

(Under Section 561 of the Internal Revenue Code) |

|

|

||

|

|

Expires |

||

Department of the Treasury |

For tax year beginning |

, 19 , and ending |

, 19 |

|

Internal Revenue Service |

|

|||

Name of corporation |

|

|

Employer identification number |

|

|

|

|

|

|

Class of stock

Number of shares outstanding on first day of tax year

Number of shares outstanding on last day of tax year

Description of dividend rights

Actual distributions per share made in tax year *

* If a distribution was not made on all shares of any class, describe any unequal treatment:

Describe any other changes in outstanding stock during the tax year:

(Use more sheets if necessary.)

For Paperwork Reduction Act Notice, see back of form. |

Cat. No. 17059P |

Form 973 (Rev. |

Form 973 (Rev. |

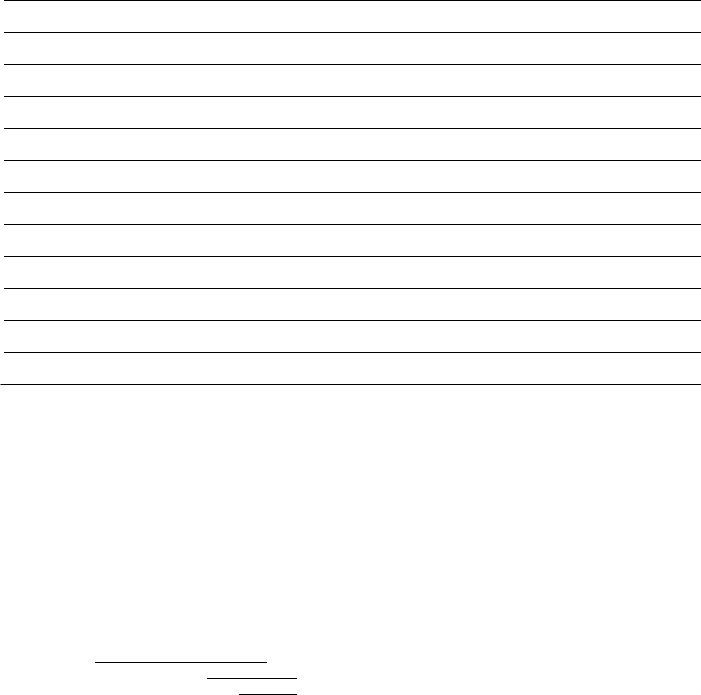

Page 2 |

|

|

If any stock outstanding on the last day of the tax year is entitled to cumulative dividends, show the amount for earlier years unpaid at the beginning of the tax year. Give the class or classes of stock involved.

(Use more sheets if necessary.)

Signature

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

▶ |

|

|

▶ |

|

|

▶ |

|

|

Signature of officer |

|

Date |

|

Title |

||||

Instructions |

|

|

|

When and Where To |

||||

(Section references are to the Internal Revenue Code unless |

corporation’s income tax return for the tax year the consent |

|||||||

dividend deduction is claimed. Also attach a completed Form |

||||||||

otherwise noted.) |

|

|

|

|||||

|

|

|

972, Consent of Shareholder To Include Specific Amount in |

|||||

Paperwork Reduction Act |

||||||||

Gross Income, for each shareholder who agreed to treat the |

||||||||

on this form to carry out the Internal Revenue laws of the United |

consent dividend as a taxable dividend. |

|||||||

States. You are required to give us the information. We need it |

Nonresident aliens and foreign |

|||||||

to ensure that you are complying with these laws and to allow |

||||||||

corporation receives a Form 972 from a nonresident alien or |

||||||||

us to figure and collect the right amount of tax. |

|

|

|

|||||

|

|

|

other foreign shareholder, the corporation must pay any |

|||||

The time needed to complete and file this form will vary |

||||||||

withholding tax it would have withheld if the dividend had been |

||||||||

depending on individual circumstances. The estimated average |

actually paid (see Regulations section |

|||||||

times are: |

|

|

|

1441 and 1442). File Form 1042, Annual Withholding Tax Return |

||||

Recordkeeping |

4 hr., 4 min. |

for U.S. Source Income of Foreign Persons, and Form 1042S, |

||||||

Foreign Person’s U.S. Source Income Subject to Withholding, to |

||||||||

Learning about the law or the form |

24 min. |

|||||||

report the tax withheld. See the instructions for these forms for |

||||||||

|

|

|

|

|

||||

Preparing and sending the form to the IRS |

29 min. |

more detailed information on filing and transmitting the payment. |

||||||

If you have comments concerning the accuracy of these time |

Pay the withholding tax in one of the following forms: |

|||||||

estimates or suggestions for making this form more simple, we |

1. Cash, |

|||||||

would be happy to hear from you. You can write to both the |

||||||||

2. U.S. Postal money order, |

||||||||

Internal Revenue Service and the Office of Management and |

||||||||

|

|

|

||||||

Budget at the addresses listed in the instructions of the tax |

3. A certified check drawn on a domestic bank if state or |

|||||||

return with which this form is filed. |

|

|

|

Federal law does not permit the certification to be rescinded |

||||

Purpose of |

before presentation, |

|||||||

|

|

|

||||||

a consent dividend deduction under section 565. |

|

|

|

4. A cashier’s check drawn on a domestic bank, or |

||||

Who Must |

5. A draft payable in U.S. dollars on a domestic bank or on a |

|||||||

(1) corporations that reasonably believe that they are subject to |

foreign bank that maintains a United States agency or branch. |

|||||||

the accumulated earnings tax, (2) personal holding companies, |

||||||||

(3) foreign personal holding companies, (4) regulated investment |

president, treasurer, assistant treasurer, chief accounting officer, |

||

companies, and (5) |

real estate investment trusts. |

||

or other corporate officer (such as tax officer) authorized to sign. |

|||

|

|

||

|

|

|

|