|

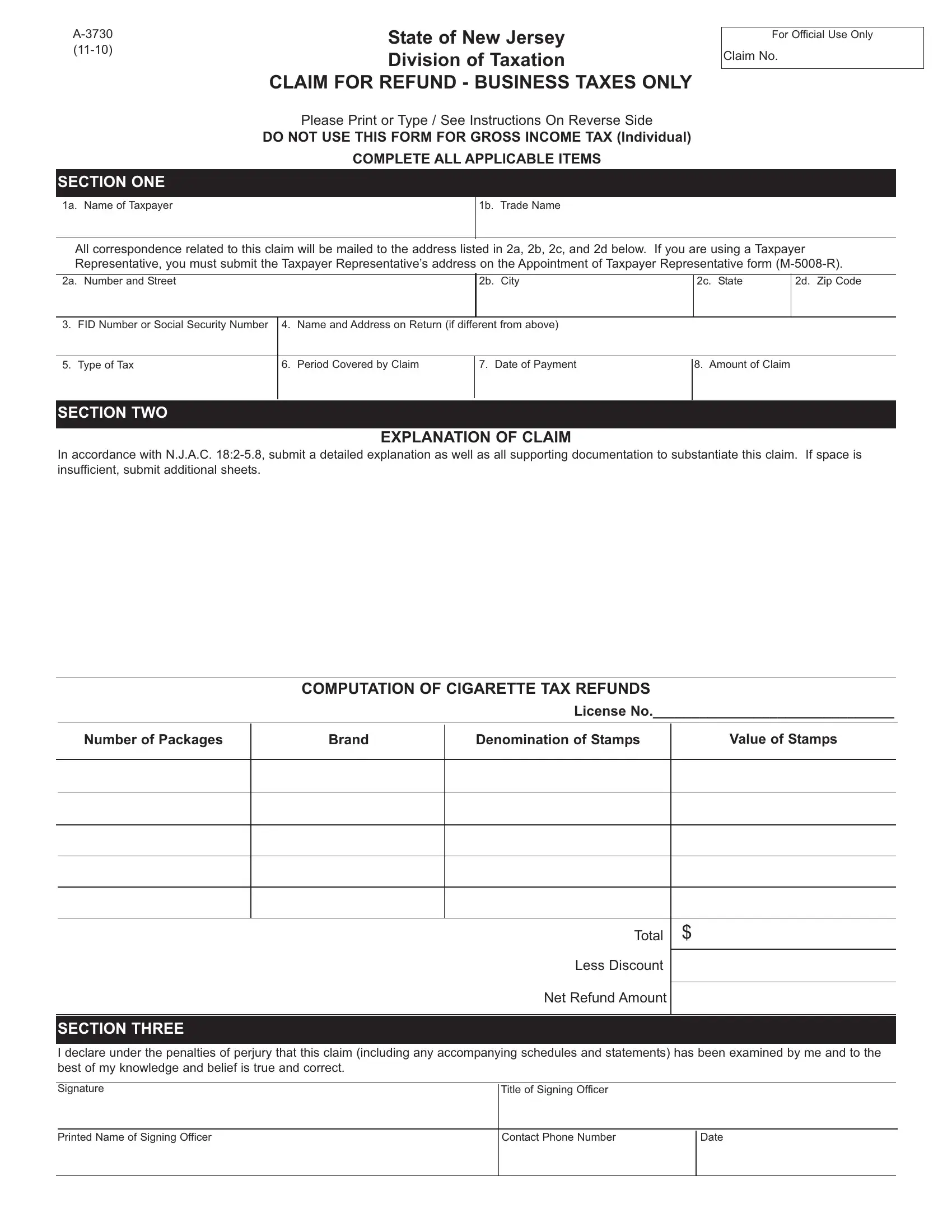

A-3730 |

State of New Jersey |

|

(11-10) |

|

Division of Taxation |

|

|

|

|

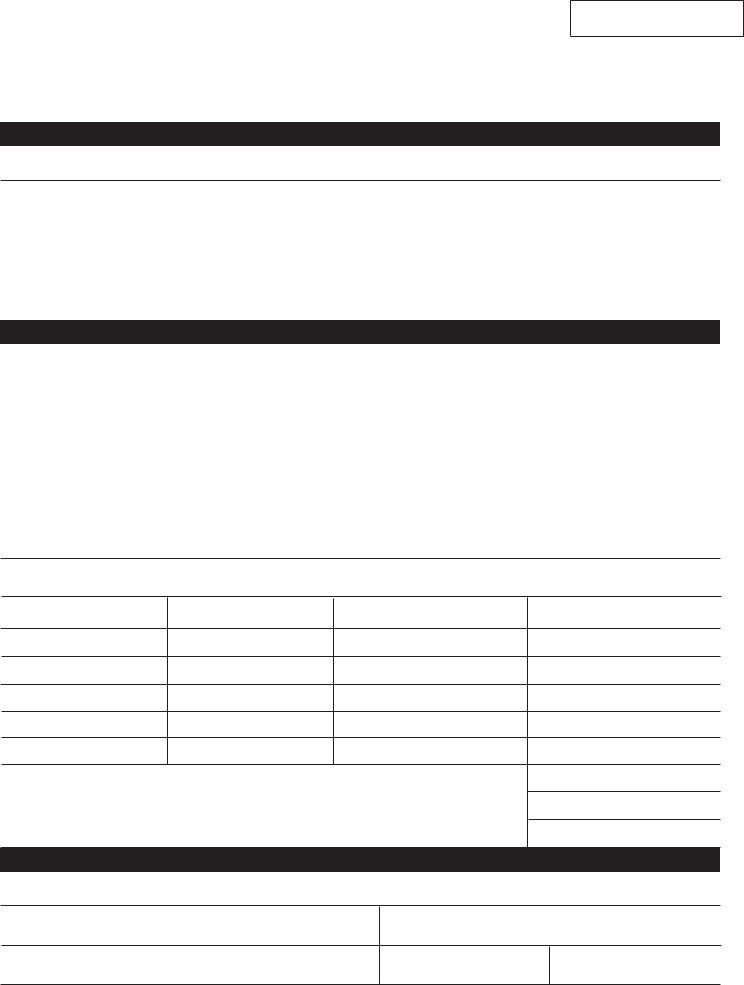

CLAIM FOR REFUND - BUSINESS TAXES ONLY |

|

|

Please Print or Type / See Instructions On Reverse Side |

|

|

DO NOT USE THIS FORM FOR GROSS INCOME TAX (Individual) |

|

|

COMPLETE ALLAPPLICABLE ITEMS |

|

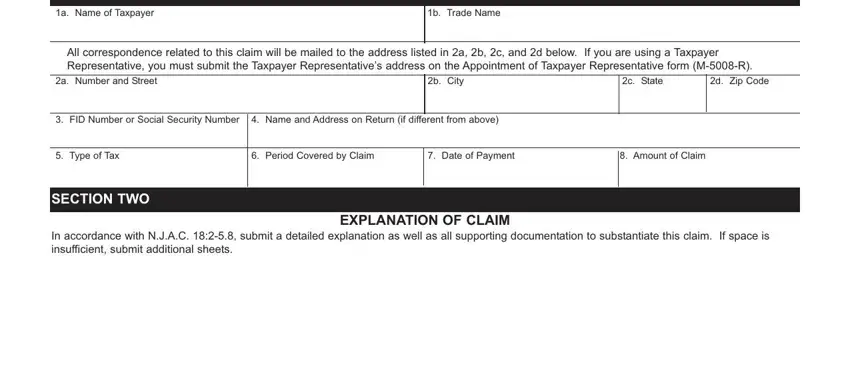

SECTION ONE |

|

|

|

1a. Name of Taxpayer |

|

1b. Trade Name |

|

|

|

|

|

|

For Official Use Only

Claim No.

All correspondence related to this claim will be mailed to the address listed in 2a, 2b, 2c, and 2d below. If you are using a Taxpayer Representative, you must submit the Taxpayer Representative’s address on the Appointment of Taxpayer Representative form (M-5008-R).

2a. |

Number and Street |

|

|

|

2b. |

City |

2c. State |

2d. Zip Code |

|

|

|

|

|

|

|

3. |

FID Number or Social Security Number |

4. |

Name and Address on Return (if different from above) |

|

|

|

|

|

|

|

|

|

|

|

5. |

Type of Tax |

6. |

Period Covered by Claim |

7. |

Date of Payment |

8. Amount of Claim |

|

|

|

|

|

|

|

|

|

|

SECTION TWO

EXPLANATION OF CLAIM

In accordance with N.J.A.C. 18:2-5.8, submit a detailed explanation as well as all supporting documentation to substantiate this claim. If space is insufficient, submit additional sheets.

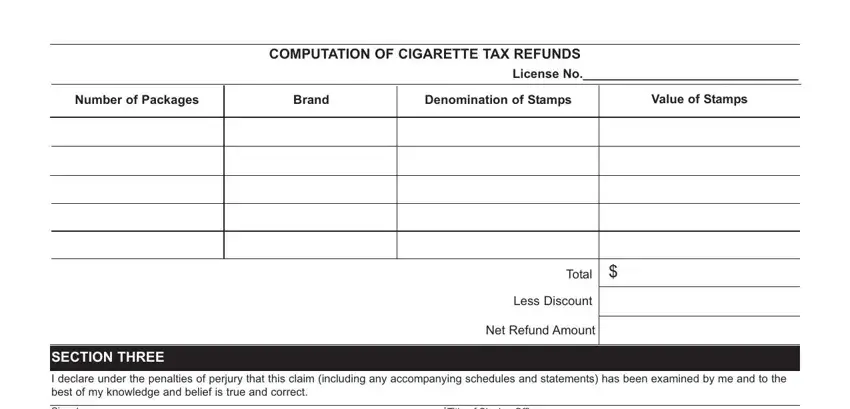

COMPUTATION OF CIGARETTE TAX REFUNDS

License No._______________________________

Total

Less Discount

Net Refund Amount

SECTION THREE

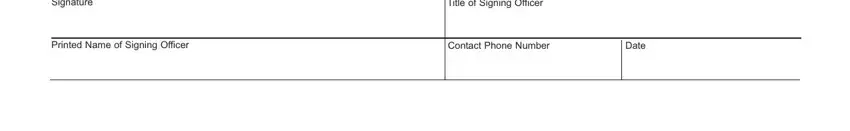

I declare under the penalties of perjury that this claim (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true and correct.

Printed Name of Signing Officer

INSTRUCTIONS

SECTION ONE - TAXPAYER INFORMATION

Please provide the following information:

1a & b . . . . . Taxpayer Name and Trade Name.

2a, b, c & d. . |

Taxpayer’s mailing address. All correspondence related to this claim will be mailed to this address. |

3 |

The Federal Identification Number or Social Security number of the Business/Individual filing this claim. |

4 |

Complete this line if the address on your tax returns is different than the mailing address. |

5 |

Indicate the appropriate Tax Type. Please submit a separate claim form for each tax type. If tax is reported on an |

|

annual basis, complete a separate claim for each taxable year. |

6 |

Enter the period covered by claim. |

7 |

If applicable, enter the date the tax was paid to the vendor. |

8 |

Enter the amount of the refund request. This line must be completed. |

SECTION TWO - EXPLANATION OF THE CLAIM

In accordance with N.J.A.C.. 18:2-5.8(g) “For the purpose of the Statute of Limitations on claims for refunds under N.J.S.A. 54:49-14 and N.J.S.A. 54A:9-8, and interest payments on late refunds under N.J.S.A. 54:49-15.1, the refund claim will not be deemed com- plete until all the required information is submitted.”

The claim must clearly set forth in detail each ground upon which the claim is based. Please provide sufficient documentation to apprise the Division of the exact basis of the refund request. Documentation includes such items as pertinent calculations, copies of invoices or receipts and proof of tax paid. If possible, please provide an electronic version (such as EXCEL) of any spreadsheets submitted.

In accordance with N.J.A.C. 18:2-5.8(d)1 Refund Claim Procedures, if adjusting a quarterly return an Amended return must accom- pany this claim.

SECTION THREE - SIGNATURES AND APPOINTMENT OF TAXPAYER REPRESENTATIVE

Whenever a claim is executed by an agent on behalf of the taxpayer, a signed Appointment of Taxpayer Representative form (M-5008-R) must accompany the claim.

Where the taxpayer is a corporation, the claim will be signed with the corporate name, followed by the signature and title of the offi- cer having the authority to sign for the corporation. In the case of a partnership, either partner shall sign.

For contact purposes please print the name of the signing officer and provide a phone number.

For the following taxes: S&U, ST-USE, UEZ, IST, S&U-EN AST-EN, TST, AC-LUX, .Hotel Occupancy Tax & Salem County send the form to:

NJ Division of Taxation

Sales Tax Refund Section

PO Box 289

Trenton, NJ 08695-0289

For Cigarette Tax and Tobacco Products Tax:

NJ Division of Taxation

Excise Tax Branch

PO Box 187

Trenton, New Jersey 08695-0187

For Corporate Business Tax (CBT) Refund, send the form to:

NJ Division of Taxation

CBTRefund Section

PO Box 259

Trenton, NJ 08695-0259

All Other Business Refund Requests:

NJ Division of Taxation

Taxpayer Accounting Branch

PO Box 266

Trenton, NJ 08695-0266

To File For a Gross Income Tax (Individual) Refund, File an Amended Return With The

NJ Division of Revenue

Revenue Processing Center

PO Box 555

Trenton, NJ 08647-0555

All forms can be found on the Division’s web site: www.state.nj.us/treasury/taxation