The notion behind our PDF editor was to permit it to be as straightforward as possible. The overall procedure of completing form a2 canara bank stress-free so long as you adhere to all of these actions.

Step 1: Hit the orange button "Get Form Here" on the page.

Step 2: Now you are on the document editing page. You may edit, add information, highlight certain words or phrases, place crosses or checks, and include images.

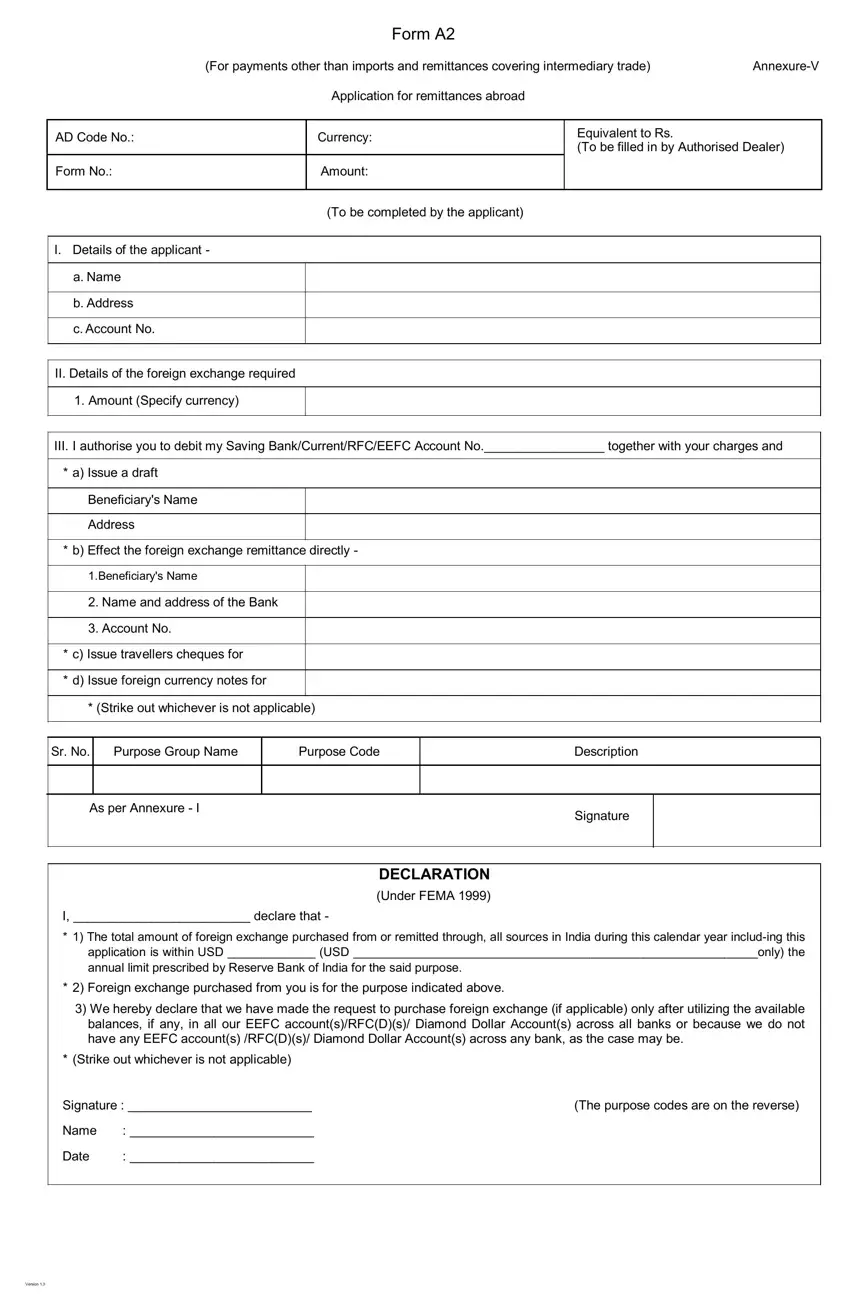

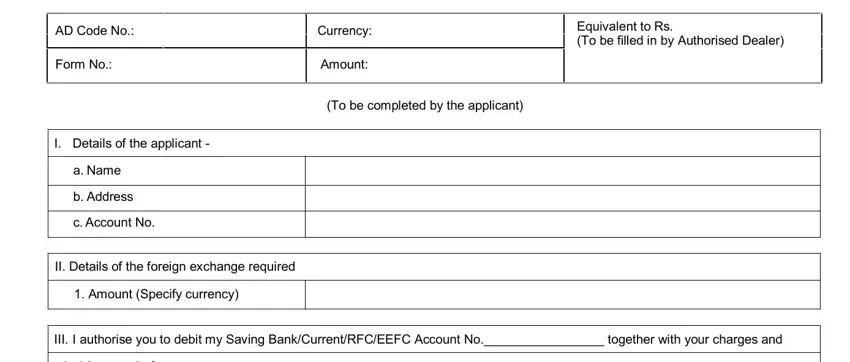

You will need to enter the next details to complete the document:

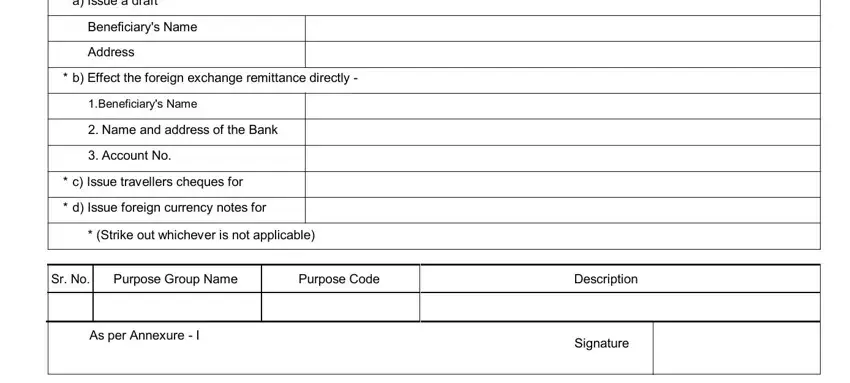

Remember to complete the a Issue a draft, Beneficiarys Name Address, b Effect the foreign exchange, Beneficiarys Name, Name and address of the Bank, Account No, c Issue travellers cheques for, d Issue foreign currency notes for, Strike out whichever is not, Sr No, Purpose Group Name, Purpose Code, As per Annexure I, Description, and Signature field with the appropriate details.

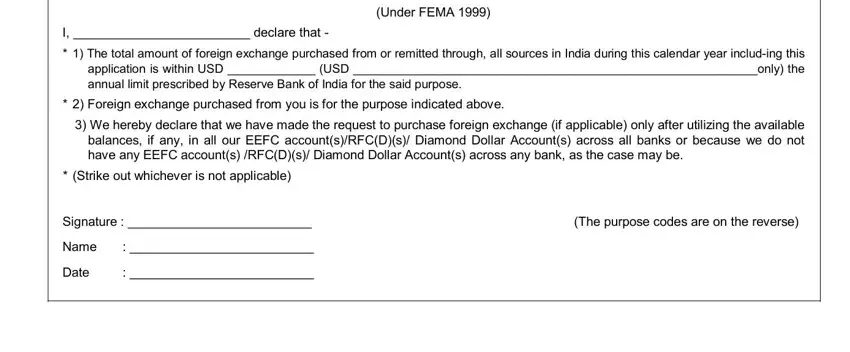

It is important to note particular data inside the area DECLARATION Under FEMA, I declare that The total, Foreign exchange purchased from, We hereby declare that we have, Strike out whichever is not, Signature Name Date, and The purpose codes are on the.

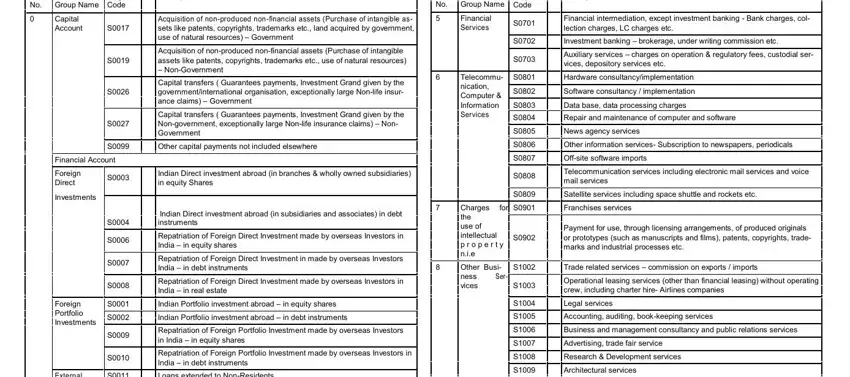

You will need to identify the rights and responsibilities of every party in paragraph GR Purpose No Group Name Capital, Purpose Description Code S, S S, Financial Account Foreign Direct, Foreign Portfolio Investments, External Commercial Borrowings, S S S S S S S S S S S S S S S S S, Acquisition of nonproduced, Indian Direct investment abroad in, Indian Direct investment abroad in, GR Purpose No Group Name Financial, Financial intermediation except, Purpose Description Code S S S, and Ser.

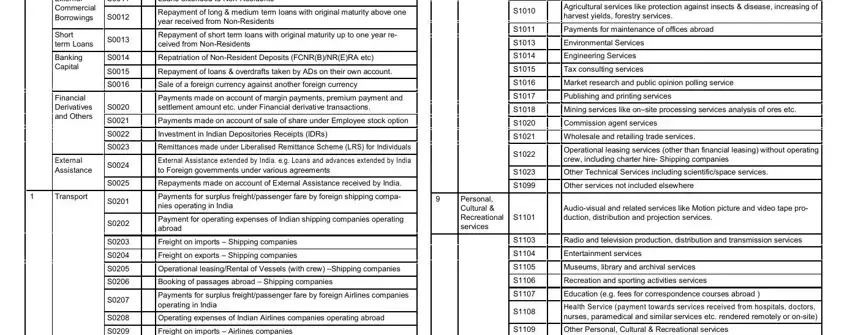

End up by checking the next areas and filling them in as required: External Commercial Borrowings, Financial Derivatives and Others, External Assistance, Transport, S S S S S S S S S S S S S S S S S, Indian Direct investment abroad in, Financial intermediation except, Purpose Description Code S S S, Wholesale and retailing trade, Operational leasing services other, Personal Cultural Recreational, Govt included else where Gnie, and S S S S S S S S not S S S S S S S.

Step 3: In case you are done, choose the "Done" button to transfer your PDF file.

Step 4: You should create as many duplicates of your file as you can to avoid possible problems.