It shouldn’t be difficult to prepare new mexico form scd 31015 taking advantage of our PDF editor. This is the way it is possible to successfully prepare your form.

Step 1: To begin the process, click the orange button "Get Form Now".

Step 2: Now it's easy to change the new mexico form scd 31015. The multifunctional toolbar can help you include, delete, adapt, and highlight text as well as conduct many other commands.

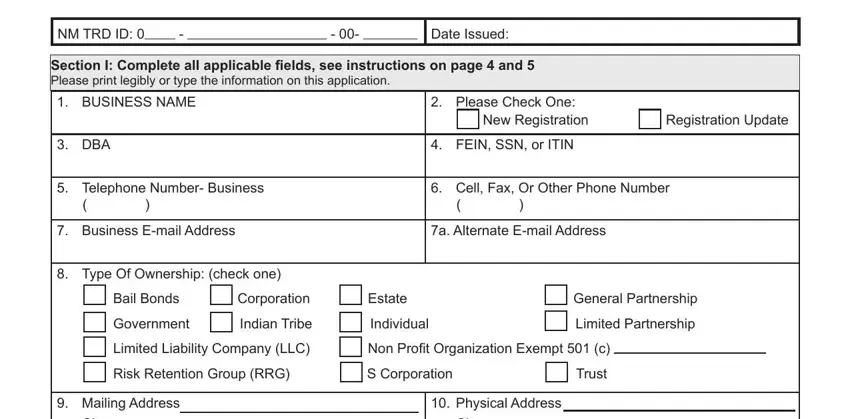

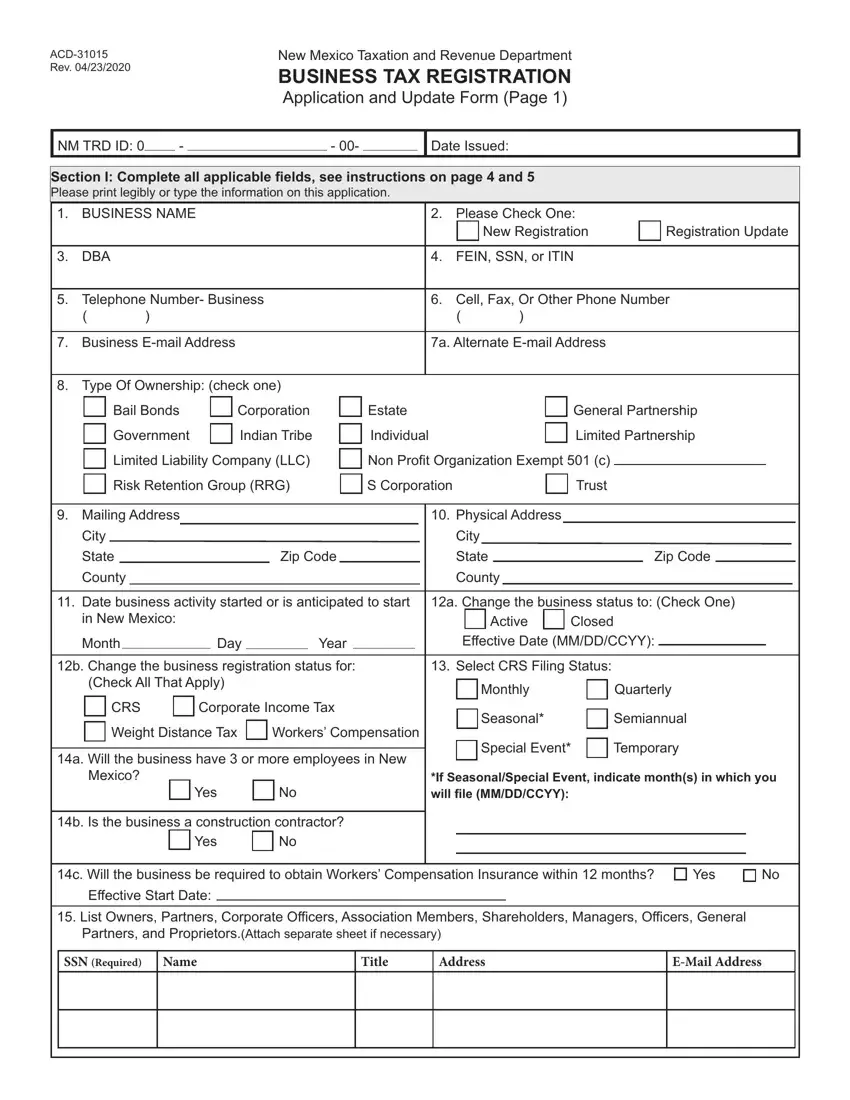

For every single section, prepare the details required by the platform.

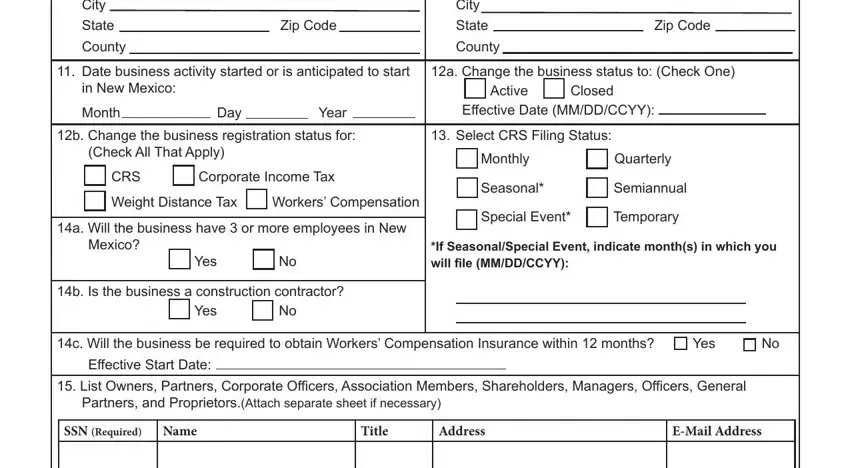

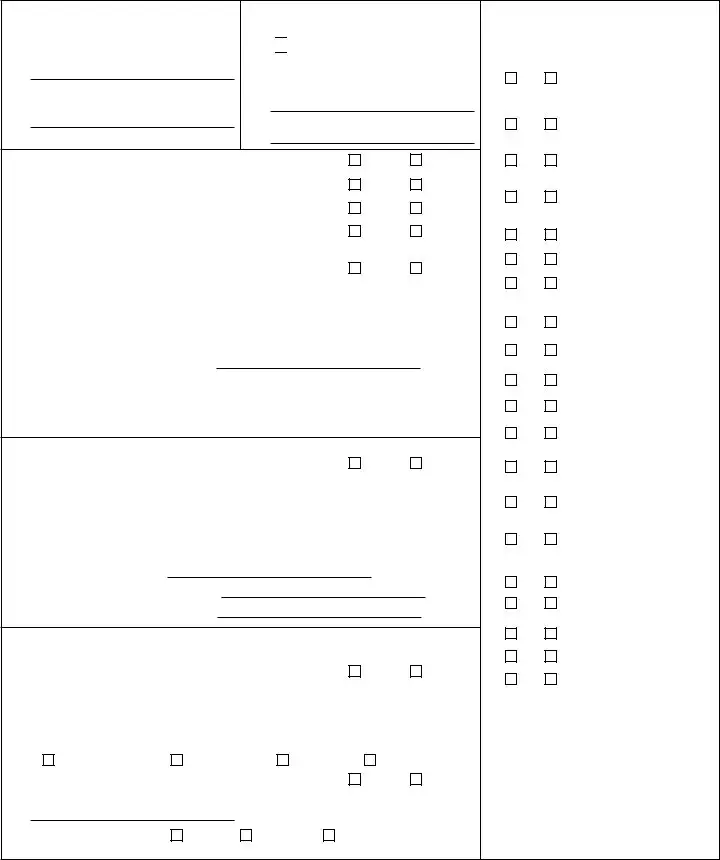

Type in the essential data in the space City, City, State Zip Code, State Zip Code, County, County, Date business activity started or, a Change the business status to, in New Mexico, Active Closed, Month Day Year, Effective Date MMDDCCYY, b Change the business registration, Select CRS Filing Status, and Check All That Apply.

Indicate the important information in field.

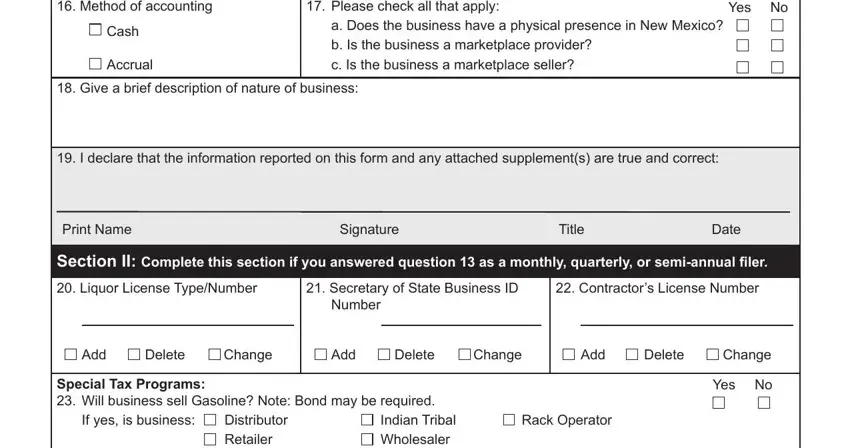

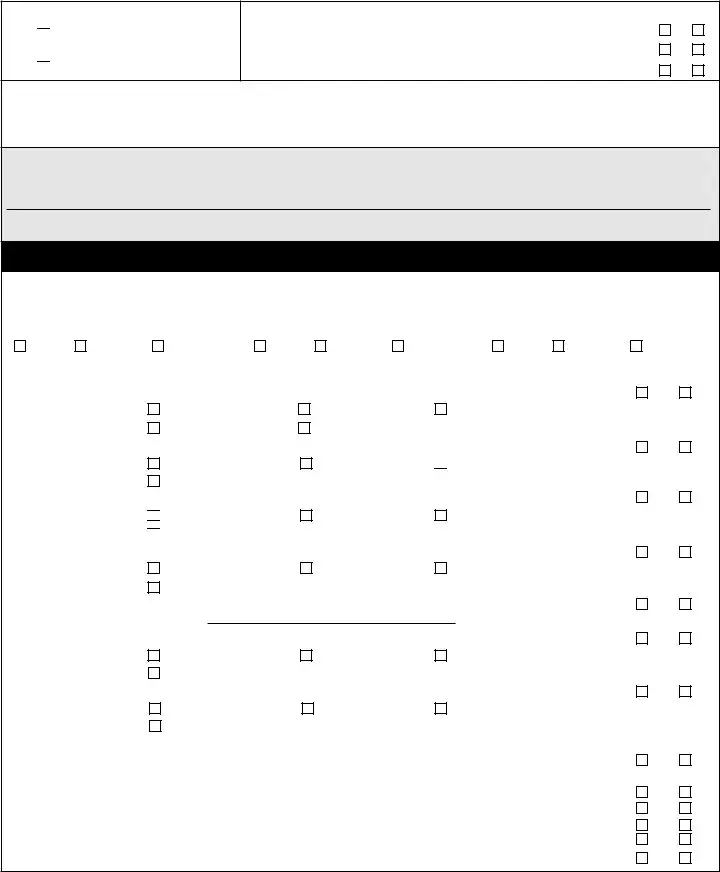

Describe the rights and responsibilities of the parties inside the paragraph Method of accounting, Please check all that apply, Yes No, Cash, Accrual, a Does the business have a, Give a brief description of, I declare that the information, Print Name, Signature, Title, Date, Section II Complete this section, Liquor License TypeNumber, and Number.

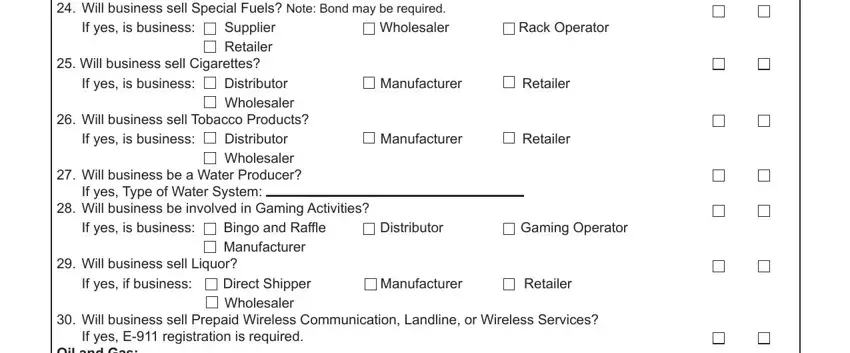

Fill out the form by reading the next sections: If yes is business Distributor, If yes is business Supplier, Will business sell Cigarettes, If yes is business Distributor, Wholesaler Will business sell, If yes is business Distributor, If yes Type of Water System, Will business be involved in, If yes is business Bingo and, Will business sell Liquor, If yes if business Direct Shipper, Will business sell Prepaid, If yes E registration is required, and Oil and Gas Will business engage.

Step 3: As soon as you press the Done button, your ready document can be transferred to any kind of your gadgets or to electronic mail indicated by you.

Step 4: Be sure to avoid possible difficulties by making a minimum of a couple of duplicates of your file.

Cash

Cash

Accrual

Accrual

Rack Operator

Rack Operator

Distributor

Distributor

Wholesaler

Wholesaler

Yes

Yes No

No