It really is super easy to complete the form aoc e 506. Our PDF tool was developed to be assist you to prepare any form easily. These are the basic actions to follow:

Step 1: Initially, press the orange button "Get Form Now".

Step 2: You can now enhance the form aoc e 506. You may use our multifunctional toolbar to include, delete, and transform the content of the form.

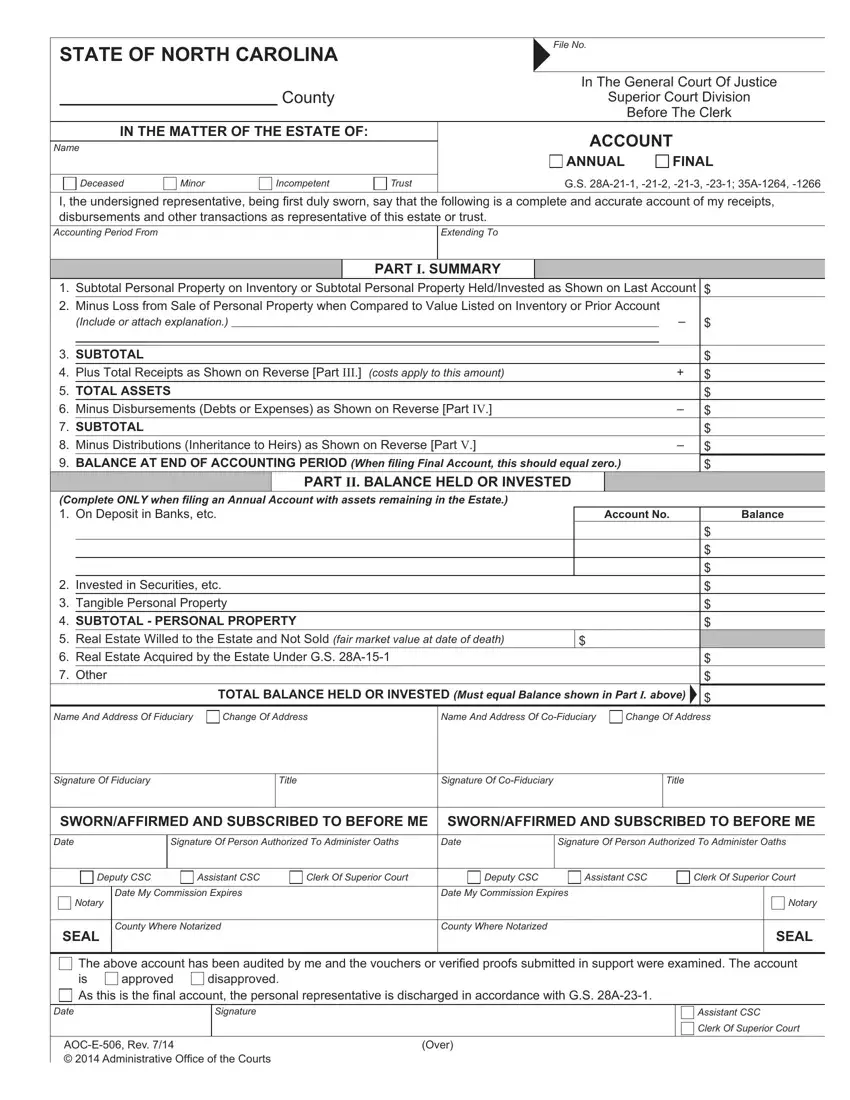

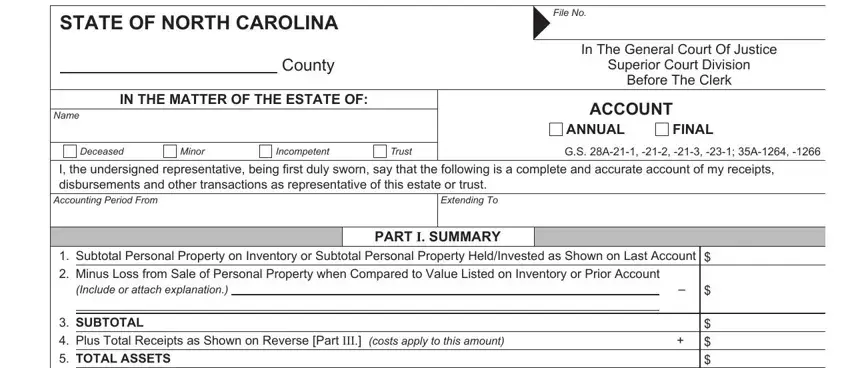

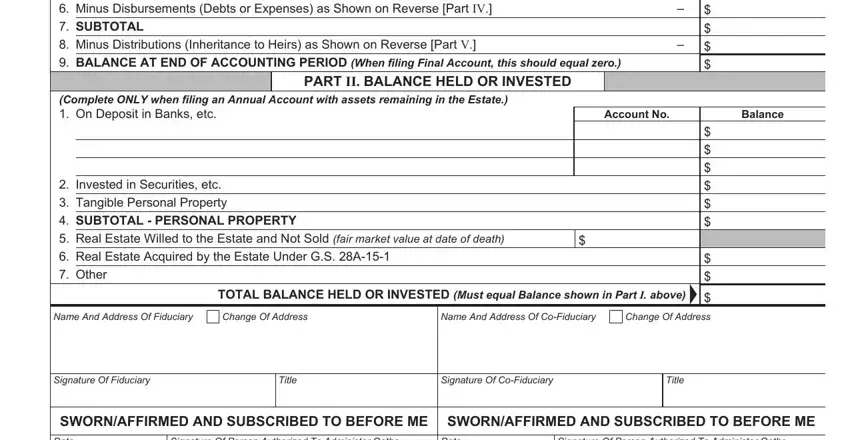

The following areas will constitute the PDF document that you'll be creating:

Complete the SUBTOTAL Plus Total Receipts as, PART II BALANCE HELD OR INVESTED, Complete ONLY when iling an Annual, Account No, Invested in Securities etc, TOTAL BALANCE HELD OR INVESTED, Balance, Name And Address Of Fiduciary, Change Of Address, Name And Address Of CoFiduciary, Change Of Address, Signature Of Fiduciary, Title, Signature Of CoFiduciary, and Title fields with any particulars that may be requested by the platform.

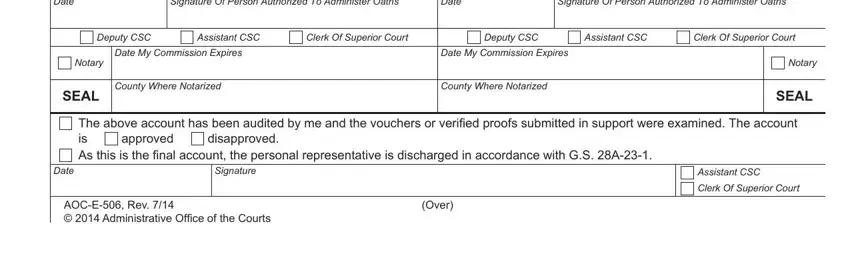

Point out the crucial information on the Date, Signature Of Person Authorized To, Date, Signature Of Person Authorized To, Deputy CSC, Assistant CSC, Clerk Of Superior Court, Deputy CSC, Assistant CSC, Clerk Of Superior Court, Date My Commission Expires, Date My Commission Expires, Notary, SEAL, and County Where Notarized section.

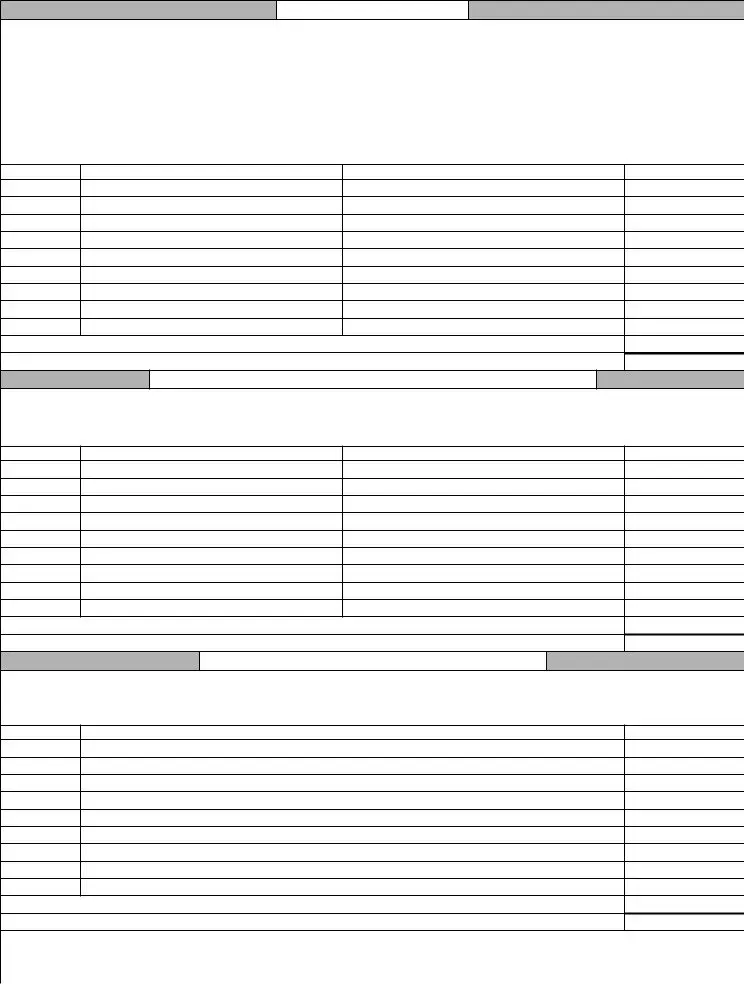

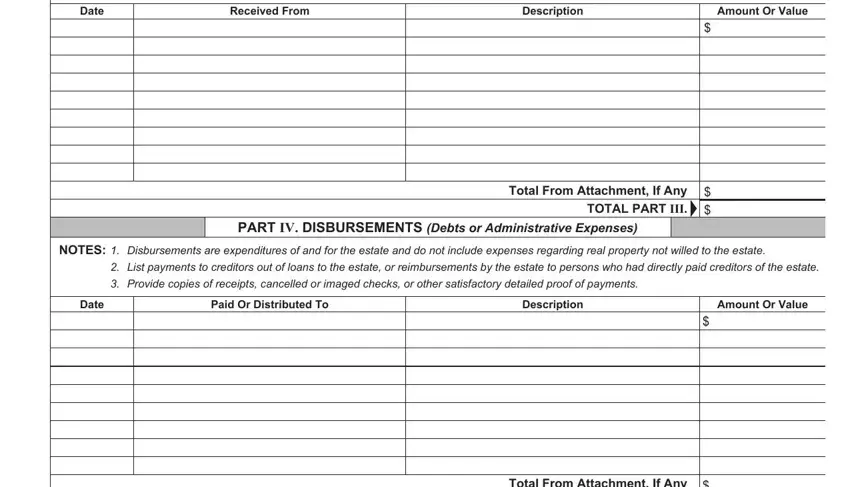

The Date, Received From, Description, Amount Or Value, PART IV DISBURSEMENTS Debts or, Total From Attachment If Any TOTAL, NOTES Disbursements are, List payments to creditors out of, Provide copies of receipts, Date, Paid Or Distributed To, Description, Amount Or Value, and Total From Attachment If Any TOTAL box is going to be place to place the rights and responsibilities of all sides.

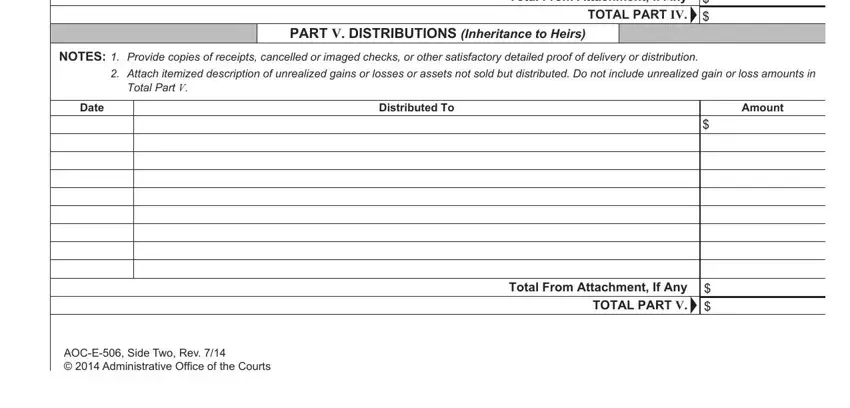

End by looking at the next fields and completing them as needed: PART V DISTRIBUTIONS Inheritance, Total From Attachment If Any TOTAL, NOTES Provide copies of receipts, Attach itemized description of, Total Part V, Date, Distributed To, Amount, AOCE Side Two Rev, and Total From Attachment If Any TOTAL.

Step 3: Click the "Done" button. Next, it is possible to transfer the PDF file - download it to your device or send it through electronic mail.

Step 4: You could make copies of the file torefrain from any type of possible future difficulties. Don't worry, we do not distribute or track your information.